News: Google expands languages push in India to serve non-English speakers

There are over 600 million internet users in India, but only a fraction of this population is fluent in English. Most online services and much of the content on the web currently, however, are available exclusively in English. This language barrier continues to contribute to a digital divide in the world’s second largest internet market

There are over 600 million internet users in India, but only a fraction of this population is fluent in English. Most online services and much of the content on the web currently, however, are available exclusively in English.

This language barrier continues to contribute to a digital divide in the world’s second largest internet market that has limited hundreds of millions of users’ rendition of the world wide web to a select few websites and services.

So it comes as no surprise that American tech giants, which are counting on emerging markets such as India to continue their growth. are increasingly attempting to make the web and their services accessible to more people.

Google, which has so far led this effort, on Thursday announced a range of changes it is rolling out across some of its services to make them speak more local languages and unveiled a whole new approach it’s taking to translate languages.

Additionally, Google said it plans to invest in machine learning and AI efforts at Google’s research center in India and make its AI models accessible to everyone across the ecosystem. The company — which counts India as its biggest market by users, and this year committed to invest more than $10 billion in the country over the coming years — also plans to partner with local startups that are serving users in local languages, and “drastically” improve the experience of Google products and services for Indian language users.

Product changes

Users will now be able to see search results to their queries in Tamil, Telugu, Bangla, and Marathi, in addition to English and Hindi that are currently available. The addition comes four years after Google added the Hindi tab to the search page in India. The company said the volume of search queries in Hindi grew more than 10 times after the introduction of this tab. If someone prefers to see their query in Tamil, for instance, now they will be able to set Tamil tab next to English and quickly toggle between the two.

Getting search results in a local language is helpful, but often people want to make their queries in those languages as well. Google says it has found that typing in non-English language is another challenge users face today. “As a result, many users search in English even if they really would prefer to see results in a local language they understand,” the company said.

To address this challenge, Search will start to show relevant content in supported Indian languages where appropriate even if the local language query is typed in English. The feature, which the company plans to roll out over the next month, supports five Indian languages: Hindi, Bangla, Marathi, Tamil, and Telugu.

Google is also making it easier for users to quickly change the preferred language in which they see results in an app without altering the device’s language settings. The feature, which is currently available in Discover and Google Assistant, will now roll out in Maps. Similarly, Google Lens’s Homework feature, which allows users to take a picture of a math or science problem and then delivers its answer, now supports Hindi language.

MuRIL

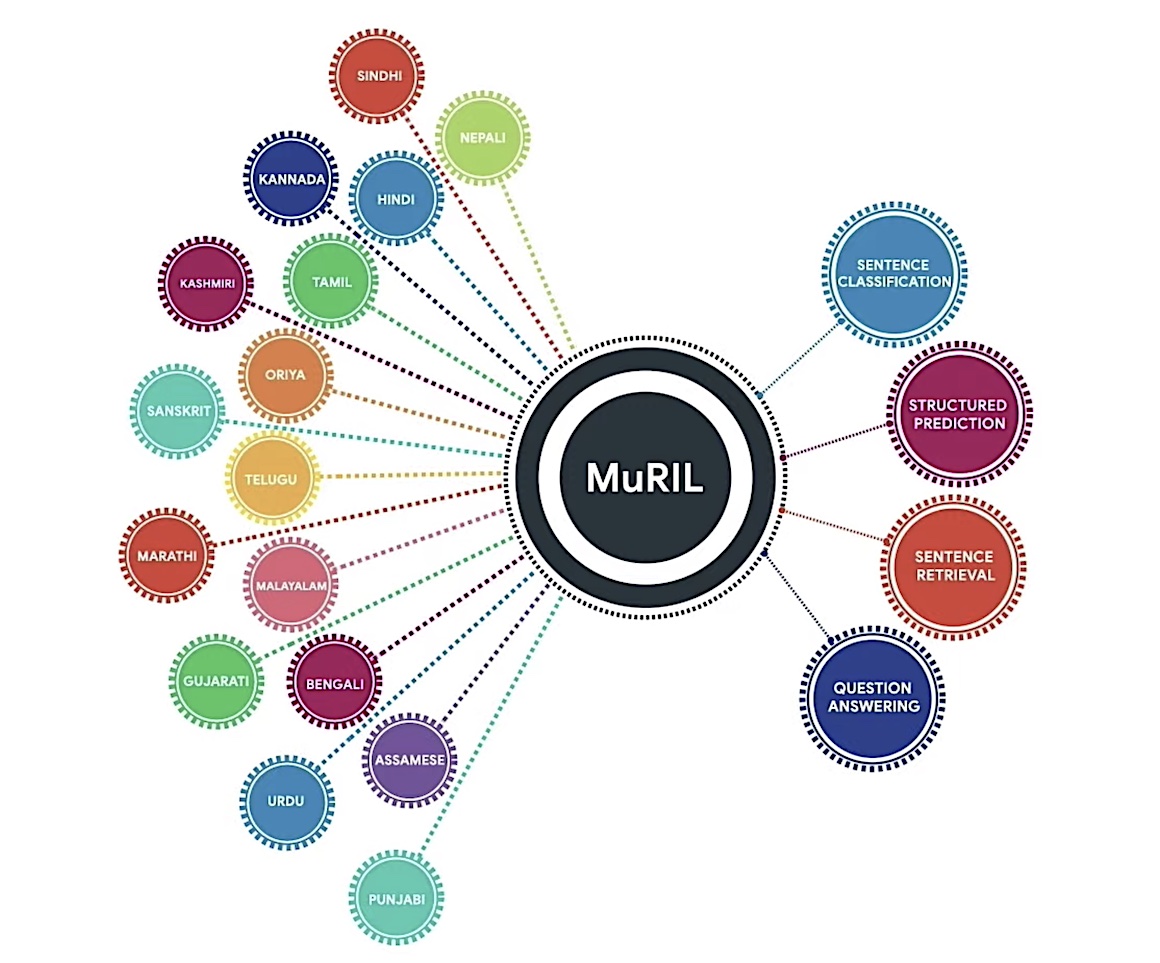

Google executives also detailed a new language AI model, which they are calling Multilingual Representations for Indian Languages (MuRIL), that delivers more efficiency and accuracy in handling transliteration, spelling variations and mixed languages. MuRIL provides support for transliterated text such as when writing Hindi using Roman script, which was something missing from previous models of its kind, said Partha Talukdar, Research Scientist at Google Research India, at a virtual event Thursday.

The company said it trained the new model with articles on Wikipedia and texts from a dataset called Common Crawl. It also trained it on transliterated text from, among other sources, Wikipedia (fed through Google’s existing neural machine translation models). The result is that MuRIL handles Indian languages better than previous, more general language models and can contend with letters and words that have been transliterated — that is, Google is using the closest corresponding letters of a different alphabet or script.

Additionally, the new model allows Google to “transfer knowledge and training from one language to another,” said Talukdar, who noted that the previous model Google relied on proved unscalable. MuRIL significantly outperforms the earlier model — by 10% on native text and 27% on transliterated text. MuRIL, which was developed by executives in India, is open source.

MuRIL supports 16 Indian languages and English.

One of the many tasks MuRIL is good at, is determining the sentiment of the sentence. For example, “Achha hua account bandh nahi hua” would previously be interpreted as having a negative meaning, but MuRIL correctly identifies this as a positive statement. Or take the ability to classify a person versus a place: ‘Shirdi ke sai baba’ would previously be interpreted as a place, which is wrong, but MuRIL correctly interprets it as a person.

More to follow…