- November 18, 2020

- by:

- in: Blog

Former Yahoo CEO and early Google employee Marissa Mayer’s startup Lumi Labs is today rebranding to Sunshine and releasing its first official product. Its new app, Sunshine Contacts, aims to be a better tool for organizing, updating and sharing contact information with others. In time, the company envisions a portfolio of consumer-facing applications that simplify

Former Yahoo CEO and early Google employee Marissa Mayer’s startup Lumi Labs is today rebranding to Sunshine and releasing its first official product. Its new app, Sunshine Contacts, aims to be a better tool for organizing, updating and sharing contact information with others. In time, the company envisions a portfolio of consumer-facing applications that simplify common tasks in areas like events, organization, family sharing, scheduling and more.

Founded in 2018 by Mayer and fellow Yahoo and Google vet Enrique Muñoz Torres, Lumi Labs has been focused on using sophisticated technologies, like A.I., to improve the common applications people use every day.

Or, as Mayer puts it, “if technology can drive a car, how come it can’t just organize my contacts, make scheduling easier or do some things that seem a lot more straightforward?” She says the goal with Lumi Labs — or now Sunshine, as it’s called — is to make those everyday apps better and more frictionless.

The company last year released a small experiment that hinted at what was to come with Holiday Helper, a desktop app that helped users more easily put together their holiday mailing list.

That product was not fully fleshed out, however, and Mayer today characterizes it as more of an exercise or a warm up for the Sunshine team.

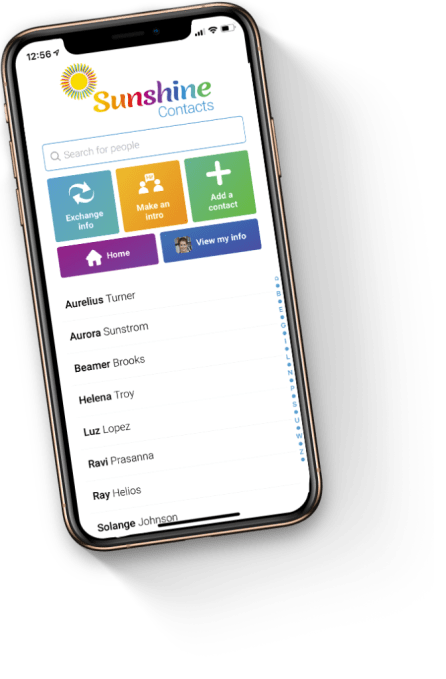

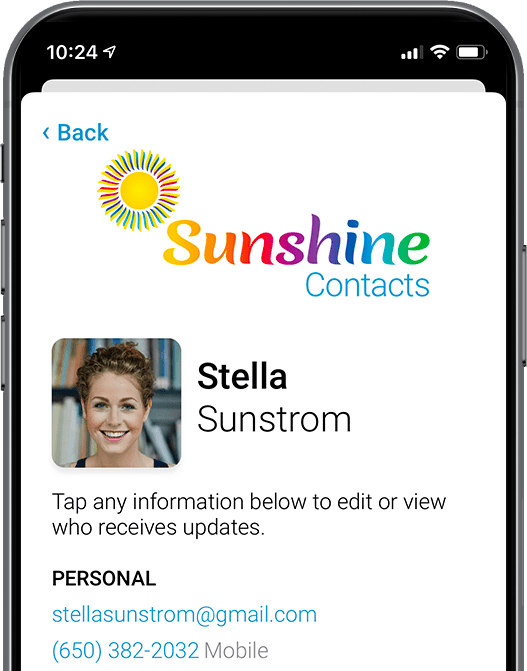

Image Credits: Sunshine

With the launch of Sunshine Contacts, the company is moving closer towards its goal of using modern technologies to improve mundane tasks.

The new app, at first glance, seems not unlike those introduced in years past with the similar goal of better organizing and updating a user’s contacts, like Mingle, Vignette, Humin, FullContact, Bump, CardFlick, Hashable, My Name is E, CardMunch, Brewster, or any of dozens of startups that once aimed to kill the business card or auto-update your address book.

While most of those early efforts are no more, alternative apps like Cardhop from Flexibits, for example, are still able to attract a loyal user base looking for an expanded feature and more improvements over built-in solutions, like Apple or Google’s own address books, for instance.

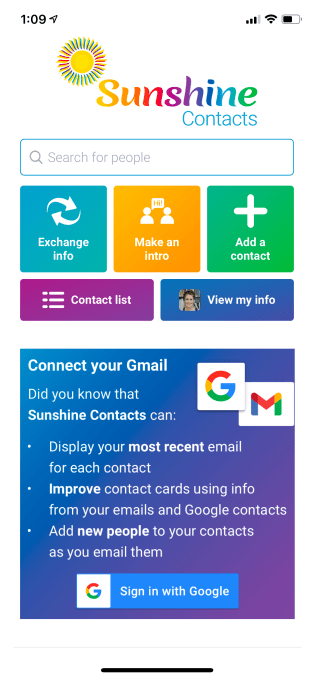

Sunshine Contacts’ approach to the market, meanwhile, isn’t just to attract users interested in improved functionality, but to eventually offer a suite of consumer services under the Sunshine brand.

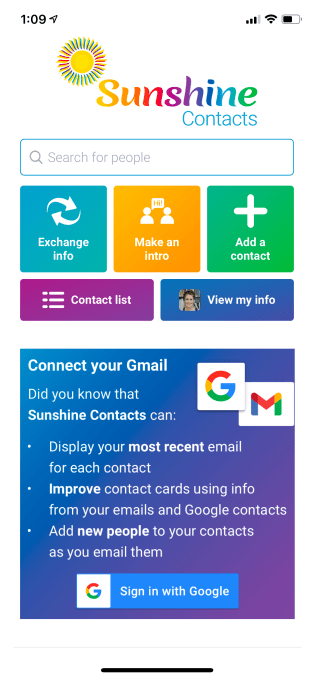

Image Credits: Sunshine

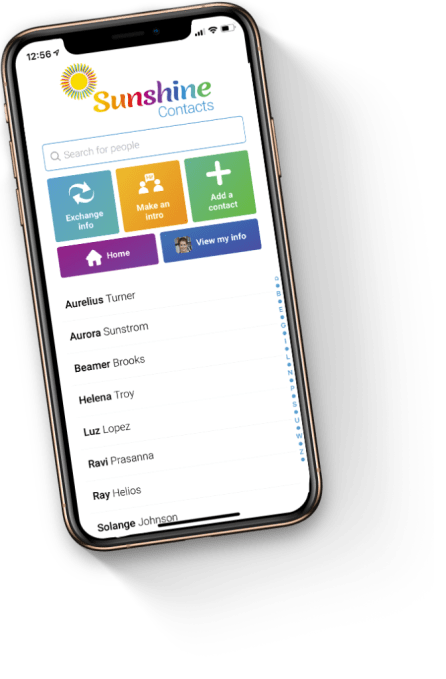

The app itself seems a little underwhelming in terms of its design, a callback perhaps to the Google aesthetic of things that work, but aren’t very pretty.

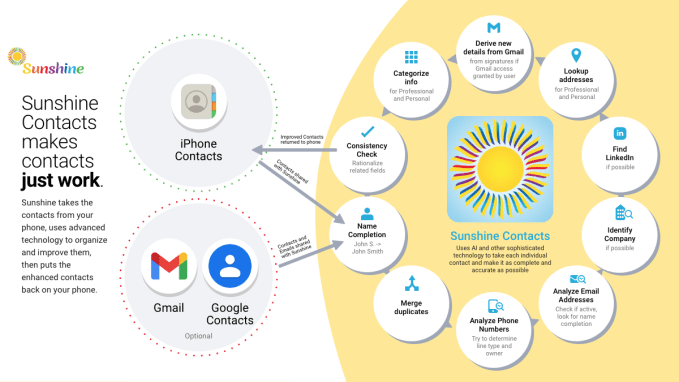

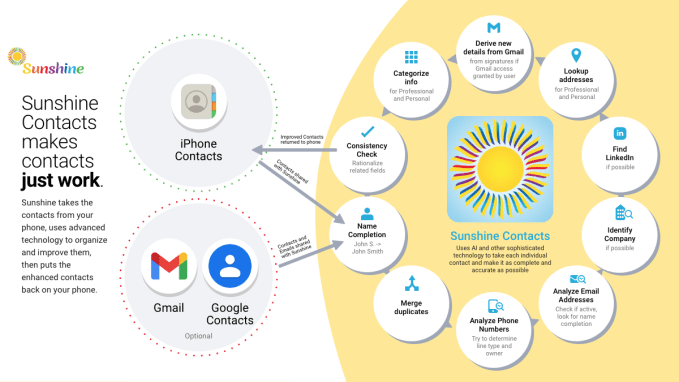

Sunshine Contacts works by pulling in data, with permission, from your iPhone contacts and from Google Contacts. In then tries to expand upon the basic information these imports offer by identifying your contact’s place of business, if not available, finding their LinkedIn profile, autocompleting missing information, looking up addresses, adding profile pictures, analyzing phone numbers to label them as work or cell, for example, and more. The app can also help to deduplicate address with merges.

Image Credits: Sunshine

If you additionally give Sunshine Contacts access to your Gmail, it can scan the email signature lines in your inbox to further complete the address fields.

This, of course, isn’t a new concept. FullContact did this in years past, as did smaller startups. Services like Evercontact or SigParser offer similar solutions today. Meanwhile, apps like Rapportive popularized the idea of pulling in external data found on the web to present a more detailed view of your email contacts. (The founder has since moved on to expand upon that original concept with Superhuman, a full email client with tons of other bells and whistles.)

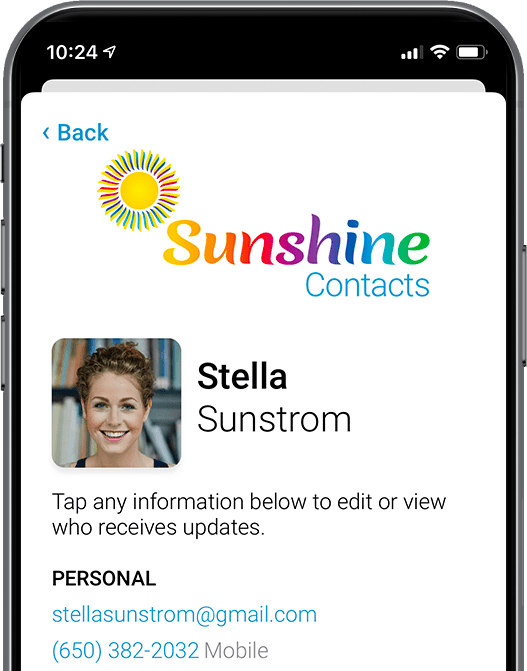

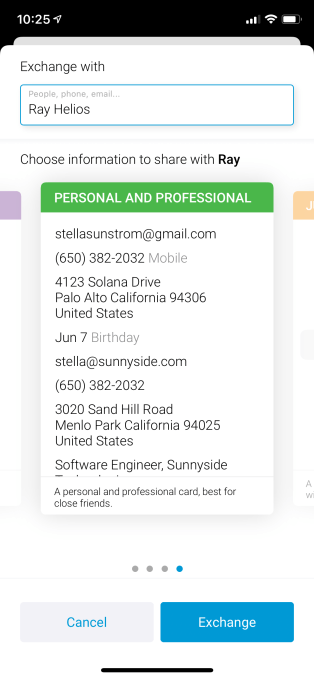

When reaching out to a contact, Sunshine Contacts works a little like a personal CRM, by offering you useful context about your relationship, including your most recent email correspondence. You can also share your contact information easily with other Sunshine users by way of its proximity detection data, but this would only be useful if the app got critical mass.

Image Credits: Sunshine

Given that Sunshine Contact’s feature set is not exactly breaking new ground, Sunshine Contacts will need to try to impress on how well it’s able to perform the tasks at hand.

“I think that the artificial intelligence that we’ve deployed in the app really comes through when you look at the quality,” explains Mayer. For example, she says, other apps’ approach to deduplicating contacts is often fairly basic — only recognizing that there were two “Adam Smiths,” but not digging into the details to realize they were different people.

“They don’t take a confidence interval and signal and evidence-based approach,” Mayer says. “So I think you’ll see the A.I. in the in the quality of the merges, the quality of things like name completion, and nickname identification. We’ve done a bunch of things that I think are quite smart and are better than some of the other things that we’ve seen. I also think that our integration with location is particularly innovative,” she adds.

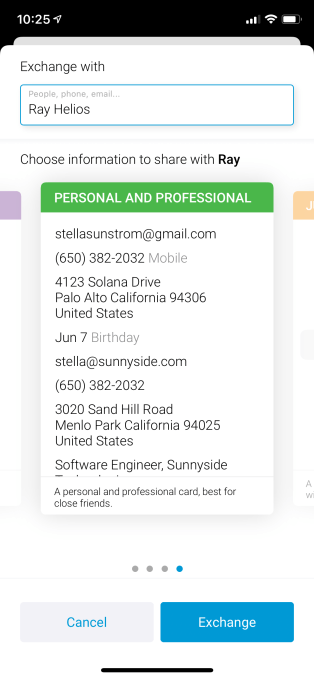

That is, Sunshine Contacts can access a user’s location — again, with permission — to make further inferences about who a user is spending time with more frequently or to make exchanging contacts between two Sunshine Contacts users easier when they’re meeting in person.

Image Credits: Sunshine

But with all the app’s requests for user data — address books, email integration, location data — Sunshine has an uphill battle in terms of gaining user trust after years of being burned by tech companies that promised conveniences only to gather large data stores of personal data for more nefarious purposes than just making life easier.

To address this issue, Sunshine is offering a privacy pledge where it commits to data security practices and promises to never sell user data.

“We take a very strong stance that this data is not and will never be for sale in any shape or form, says Torres. “So, you’re giving us the data for the purpose of making your product experience essentially better and that is the only purpose that we’re going to be using it for,” he continues. “We don’t sell it in aggregate form and individual forum we don’t target advertising based on it. In fact we don’t have any advertising as part of the app,” Torres notes.

Users can also opt in only to the features they want to use. If they don’t want to share location, for instance, they can simply deny the permission.

Instead, Sunshine’s business model will be a direct-to-consumer freemium model, though for now the Sunshine Contacts app is fully free. As the company rolls out additional offerings in the suite, it will opt to monetize each app in the way that’s most suitable — for instance, by making some basic functionality free, then offering paid upgrades to a larger set of features.

The startup raised a $20M seed round in May 2020 from inside and outside investors, including Felicis Ventures, Unusual Ventures, WIN Ventures, as well as numerous angel investors.

The app is launching first on iOS (iOS 11 or higher) on an invite-only basis in the U.S. A web version will later follow as will support for international markets.

pic.twitter.com/fQZ2nEmSQO