News: Human Capital: Prop 22 puts the ‘future of labor’ at stake

Welcome back to Human Capital, where we look at the latest in tech labor and diversity and inclusion. Because election day is quickly approaching and given that California’s Prop 22 puts the “future of labor” at stake, as Instacart worker and co-organizer at Gig Workers Collective Vanessa Bain told TechCrunch this week, we’re paying close

Welcome back to Human Capital, where we look at the latest in tech labor and diversity and inclusion.

Because election day is quickly approaching and given that California’s Prop 22 puts the “future of labor” at stake, as Instacart worker and co-organizer at Gig Workers Collective Vanessa Bain told TechCrunch this week, we’re paying close attention to this ballot measure. Gig companies like Uber, Lyft, DoorDash and Instacart have put more than $180 million into Prop 22, which seeks to keep their drivers and delivery workers classified as independent contractors.

Before we jump in, friendly reminder that Human Capital will soon be a newsletter…starting next week! Sign up here so you don’t miss it.

Gig Work

Instacart began asking workers to pass out Yes on Prop 22 propaganda to customers

Vanessa Bain, Instacart shopper and co-founder of Gig Workers Collective, tweeted about how she was instructed to pass out Yes on 22 stickers to customers. Many people, including Bain, questioned whether it was legal or not.

Unbelievable. @Instacart is now requiring Shoppers to do the uncompensated work of distributing Prop 22 propaganda to customers —against our own self-interests. Even *if* (big if) this is legal, it is reprehensible and establishes a dangerous precedent for workers. #NOonProp22 pic.twitter.com/NXVblutvsh

— Vanessa Bain

#BlackLivesMatter #NOonProp22 (@hashtagmolotov) October 10, 2020

Instacart, however, told CNN the initiative was allowed under campaign finance rules. Additionally, I reached out to the Fair Political Practices Commission, but was told by Communications Director Jay Wierenga that “only an investigation by FPPC Enforcement (or a DA or the AG’s Office) determines whether someone or group violated the Political Reform Act.”

What is clear, however, is that it goes against what many workers want. We actually caught up with Bain ahead of the relaunch of TechCrunch Mixtape, where she discussed why she’s anti Prop 22. The episode goes live next week, but here’s a bit of a teaser from our conversation:

“The future of labor is at stake,” Bain told us earlier this week. “I would argue the future of our democracy, as well. The reality is that, you know, it establishes a dangerous precedent to allow companies to write their own labor laws…This policy was created to unilaterally benefit companies at the detriment of workers.”

Hundreds took to SF’s streets in protest of Prop 22

In San Francisco, there was a massive protest against Prop 22. While Prop 22 would provide more benefits than workers currently have, many drivers and delivery workers say that’s not enough. For example, Prop 22 would institute healthcare subsidies, but it falls short of complete healthcare.

Y’all there are hundreds of people here, starting our drivers caravan outside Uber’s HQ.

We’re all demanding #NoOnProp22.

Drivers deserve living wages, healthcare, & benefits.

We’re gonna fight to get them. pic.twitter.com/EEVZcVRKqX

— Gig Workers Are Voting No On Prop 22 (@GigWorkersRise) October 15, 2020

Speaking of SF, 76% of app-based workers in the city are people of color

And 39% are immigrants, according to the latest survey of gig workers conducted by the Local Agency Formation Commission and UC Santa Cruz Professor Chris Benner.

This study surveyed 259 workers who drive or deliver for DoorDash, Instacart or Amazon Fresh. Other findings were:

- 71% of workers get at least 3/4 of monthly income from gig work

- 57% of workers completely rely on gig work for their monthly income

- On average, workers make $450 per week. After expenses, that averages drops to $270 per week.

California appeals court heard arguments in the Uber, Lyft gig worker classification case

California 1st District Court of Appeal judges heard arguments from Uber and Lyft about why they should be able to continue classifying their drivers as independent contractors. The hearing was a result of a district judge granting a preliminary injunction that would force Uber and Lyft to immediately reclassify their workers as employees. Uber and Lyft, however, appealed the ruling and now here we are.

As Uber and Lyft have argued drivers would lose flexibility if forced to be employees, an appeals court judge asked what part of AB 5 would require companies to take away that flexibility. Spoiler alert: there’s nothing in AB 5 that requires such a thing.

But a lawyer for Lyft, which has said it would leave California if forced to reclassify its workers, said he doesn’t “want the court to think that if the injunction is affirmed, that these people will continue to have these earnings opportunities because they won’t.”

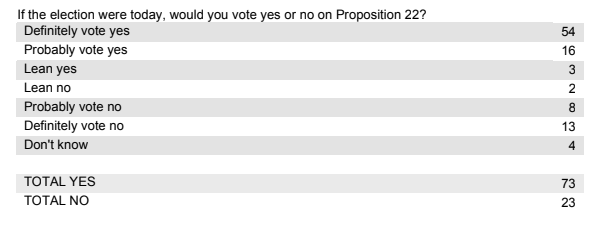

Uber’s survey of workers on Prop 22 shows strong support for the ballot measure

But it’s important to note that of the more than 200,000 Uber drivers in California, only 461 workers participated in the study. Uber conducted this survey from September 23 through October 5 to see how drivers felt about Prop 22 and being an independent contractor. In that survey, 54% of respondents said they would definitely vote yes on 22 if the election were today while 13% said they would definitely vote no.

Image Credits: Uber

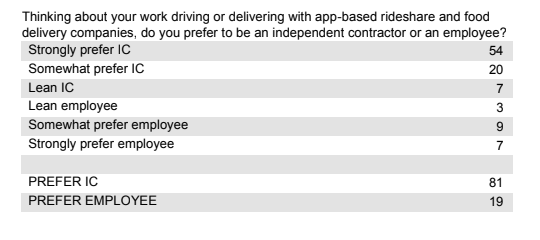

Those surveyed also weighed in on whether they prefer to be independent contractors; 54% of those surveyed said they strongly prefer being an independent contractor while 9% said they strongly prefer being an employee.

Image Credits: Uber

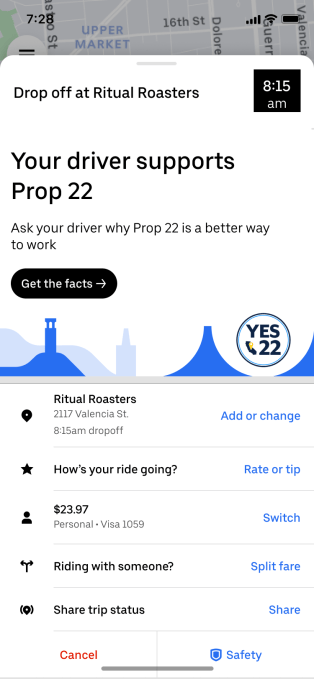

This week, Uber also encouraged riders to talk to their drivers about Prop 22 to see how they feel about it.

“First and foremost, the conversation about Proposition 22 should be about what gig workers actually want,” an Uber spokesperson said in a statement. “That’s why we are encouraging everyone who uses Uber or Uber Eats to ask their driver or delivery person how they really feel about Prop 22.”

Based on the wording of the in-app message, Uber seems confident most drivers do support Prop 22.

Image Credits: Uber

Stay woke

Facebook and Twitter ban Holocaust-denial posts

Both Facebook and Twitter took a step in their ongoing battles against hate this week by removing posts that deny the Holocaust, the systematic and state-sponsored mass murder of around 6 million Jewish people. On Monday, Facebook announced it would block posts that deny the Holocaust. Facebook said its decision was driven by the rise in anti-Semitism and “the alarming level of ignorance about the Holocaust, especially among young people.” On Wednesday, Twitter announced a similar stance.

BLCK VC launches Black Venture Institute

In partnership with Operator Collective, Salesforce Ventures and UC Berkeley Haas School of Business, BLCK VC’s Black Venture Institute wants to help more Black entrepreneurs become angel investors. The goal is to train 300 students over the next three years to be in a position of writing checks.

“It is these closed networks that have helped contribute to the lack of access for the Black community over the years,” BLCK VC co-founder Frederik Groce told TC’s Ron Miller. “Black Venture Institute is a structural attempt to create access for Black operators — from engineers to product marketing managers.”

GV finally has a Black female partner, Terri Burns

Terri Burns recently made partner at GV, formerly known as Google Ventures. Burns is now the only Black female partner at GV, which is wild. But, you know, progress, not perfection.

Throwback to when Burns spoke a bit about racial justice in tech and venture capital.

“Venture capital certainly plays a role,” Burns, then a principal at GV, told TechCrunch about the overall lack of diversity in tech. “VC is a tool that can enable businesses to scale greatly and quickly, and historically, this tool hasn’t been equally distributed. For example, VC has traditionally focused on founders from a small number of institutions and pedigrees that are not particularly diverse (in 2016 we learned from Richard Kerby, general partner at Equal Ventures, that 40% of VCs went to either Harvard or Stanford). With more equal distribution of funds across backgrounds, underrepresented people will have a greater chance at success.”

The Wing co-founder admits her mistakes

Audrey Gelman, the former CEO of The Wing who resigned in June, posted a letter she sent to former employees of The Wing last week. In it, Gelman apologized for not taking action to combat mistreatment of women of color at The Wing. She also acknowledged that her drive for success and scaling quickly “came at the expense of a healthy and sustainable culture that matched our projected values, and workplace practices that made our team feel valued and respected.”

That meant, Gelman said, The Wing “had not subverted the historical oppression and racist roots of the hospitality industry; we had dressed it up as a kindler [sic], gentler version.”

Here are some other highlights from her letter:

- “Members’ needs came first, and those members were often white, and affluent enough to afford The Wing’s membership dues.”

- “White privilege and power trips were rewarded with acquiescence, as opposed to us doubling down on our projected values.”

- “When the realization set in that The Wing wasn’t institutionally different in the ways it had proclaimed, it hurt more because the space we claimed was different reinforced the age-old patterns of women of color and especially Black women being disappointed by white women and our limited feminist values.”

Human Capital launches as a newsletter next Friday. Sign up here to get this delivered straight to your inbox.