News: Leading a $15 million round, Prosus Ventures makes the challenger bank Klar its first bet in Mexico

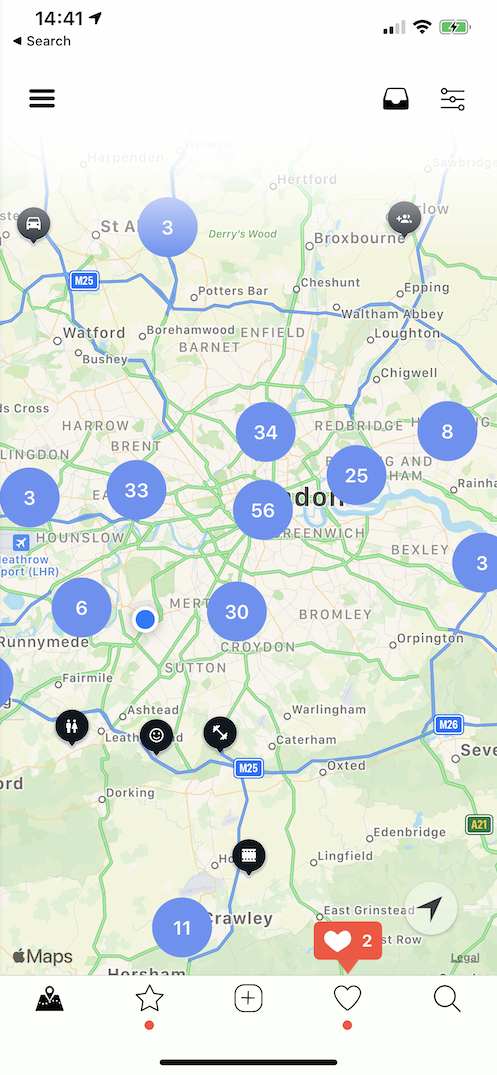

Klar, a new online bank based in Mexico City, has become the first big bet that Prosus Ventures (the firm formerly known as Naspers Ventures) is taking in Latin America outside of Brazil. Founded by Stefan Moller, a former consultant at Bain & Co. who advised large banks, Klar blends Moller’s work experience in Mexico

Klar, a new online bank based in Mexico City, has become the first big bet that Prosus Ventures (the firm formerly known as Naspers Ventures) is taking in Latin America outside of Brazil.

Founded by Stefan Moller, a former consultant at Bain & Co. who advised large banks, Klar blends Moller’s work experience in Mexico with his connections to the German banking world and the tech team at Berlin -based n26, to create a challenger bank offering deposit and credit services for Mexican customers.

The Mexican market is woefully underserved when it comes to the finance industry, according to Moller. Only 10% of Mexican adults have a credit card, something Moller said is the cheapest consumer lending instrument around.

That’s why Klar launched last year with both credit and debit services. The company has 200,000 banking customers and roughly 27,000 of those customers have taken out loans through the bank. A typical loan is roughly $110, according to Moller, and each loan comes with a 68% annual percentage rate.

If that sounds usurious, that’s because it is — at least by U.S. standards. In the U.S. a typical credit card will run somewhere between 16% and 24%, according to data from WalletHub. In Mexico, Moller said the typical interest rate is 70% (no wonder only 10% of adults have credit cards).

Still, the opportunity to expand credit and debit services made sense to Prosus, which led the company’s Series A round alongside investors including the International Finance Corporation and former investors Quona capital, who led Klar´s SEED round, Mouro Capital (formerly Santander Innoventures) and aCrew.

Banafsheh Fathieh, the Prosus Ventures principal who led the investment for the firm, said that the commitment to Klar will likely be the first of many investments that her firm makes in the region — both in fintech and likely in Mexico’s tech ecosystem more broadly.

Prosus is famous for making early bets on emerging technology companies in developing markets. Perhaps most famously the firm’s parent company was an early investor in Tencent — a multi-million dollar bet that has generated billions in returns.

Before this investment, Prosus had confined its work in the Latin American region to investments in Brazilian technology companies like Creditas and Movile .

“Prosus Ventures partners with entrepreneurs that are solving big societal problems with technology, in a uniquely local way. We invest in sectors of the economy where technology can lead to meaningful change in the lives of consumers. Klar has identified a massive need in the Mexican financial market and brings a unique solution through their credit and debit offering,” said Banafsheh Fathieh from Prosus Ventures, in a statement. “In less than a year, the team has shown an ability to build a world-class digital bank for the masses, one focused on financial access and inclusion. We are very excited to partner with them on that mission.”