News: Wrike launches new AI tools to keep your projects on track

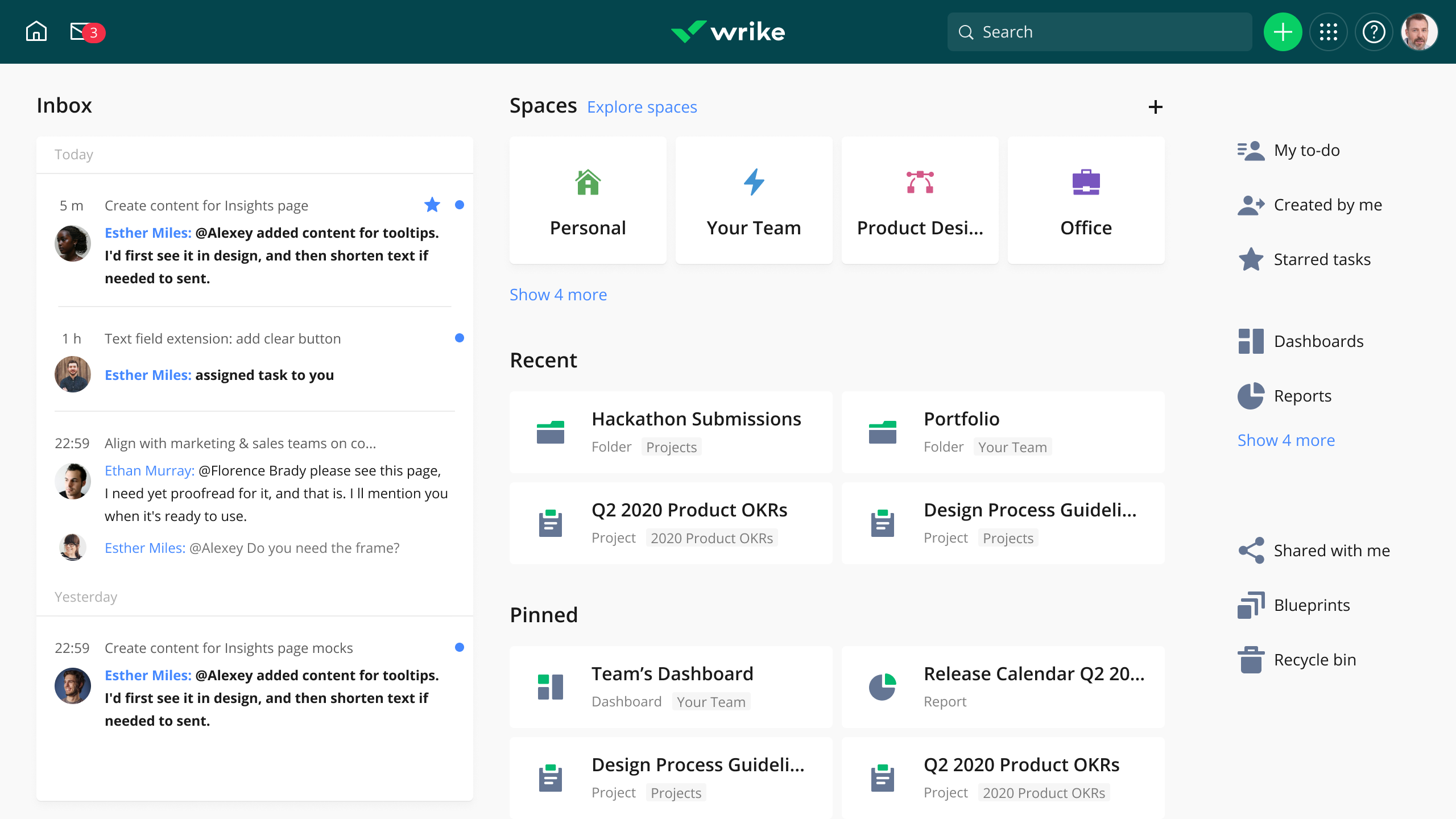

Project management service Wrike today announced a major update to its platform at its user conference that includes a lot of new AI smarts for keeping individual projects on track and on time, as well as new solutions for marketers and project management offices in large corporations. In addition, the company also launched a new

Project management service Wrike today announced a major update to its platform at its user conference that includes a lot of new AI smarts for keeping individual projects on track and on time, as well as new solutions for marketers and project management offices in large corporations. In addition, the company also launched a new budgeting feature and tweaks to the overall user experience.

The highlight of the launch, though, is, without doubt, the launch of the new AI and machine learning capabilities in Wrike . With more than 20,000 customers and over 2 million users on the platform, Wrike has collected a trove of data about projects that it can use to power these machine learning models.

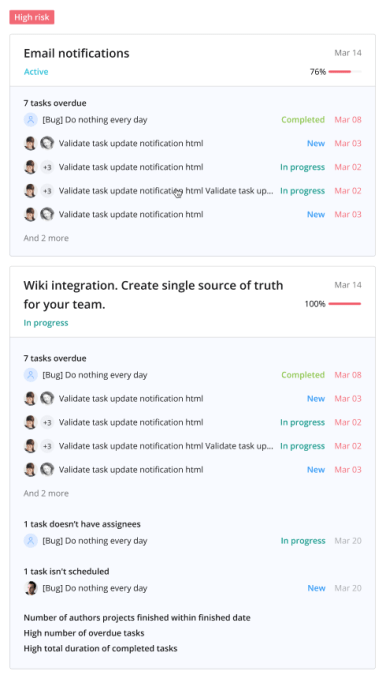

The way Wrike is now using AI falls into three categories: project risk prediction, task prioritization and tools for speeding up the overall project management workflow.

Figuring out the status of a project and knowing where delays could impact the overall project is often half the job. Wrike can now predict potential delays and alert project and team leaders when it sees events that signal potential issues. To do this, it uses basic information like start and end dates, but more importantly, it looks at the prior outcomes of similar projects to assess risks. Those predictions can then be fed into Wrike’s automation engine to trigger actions that could mitigate the risk to the project.

Task prioritization does what you would expect and helps you figure out what you should focus on right now to help a project move forward. No surprises there.

What is maybe more surprising is that the team is also launching voice commands (through Siri on iOS) and Gmail-like smart replies (in English for iOS and Android). Those aren’t exactly core features of a project management tools, but as the company notes, these features help remove the overall friction and reduce latencies. Another new feature that falls into this category is support for optical character recognition to allow you to scan printed and handwritten notes from your phones and attach them to tasks (iOS only).

“With more employees working from home, work and personal life are becoming intertwined,” the company argues. “As workers use AI in their personal lives, team managers and everyday users expect the smarts they’re accustomed to in consumer devices and apps to help them manage their work as well. Wrike Work Intelligence is the most comprehensive machine learning foundation that taps into tens of millions of work-related user engagements to power cross-functional collaboration to help organizations achieve operational efficiency, create new opportunities and accelerate digital transformation. Teams can focus on the work that matters most, predict and minimize delays, and cut communication latencies.”

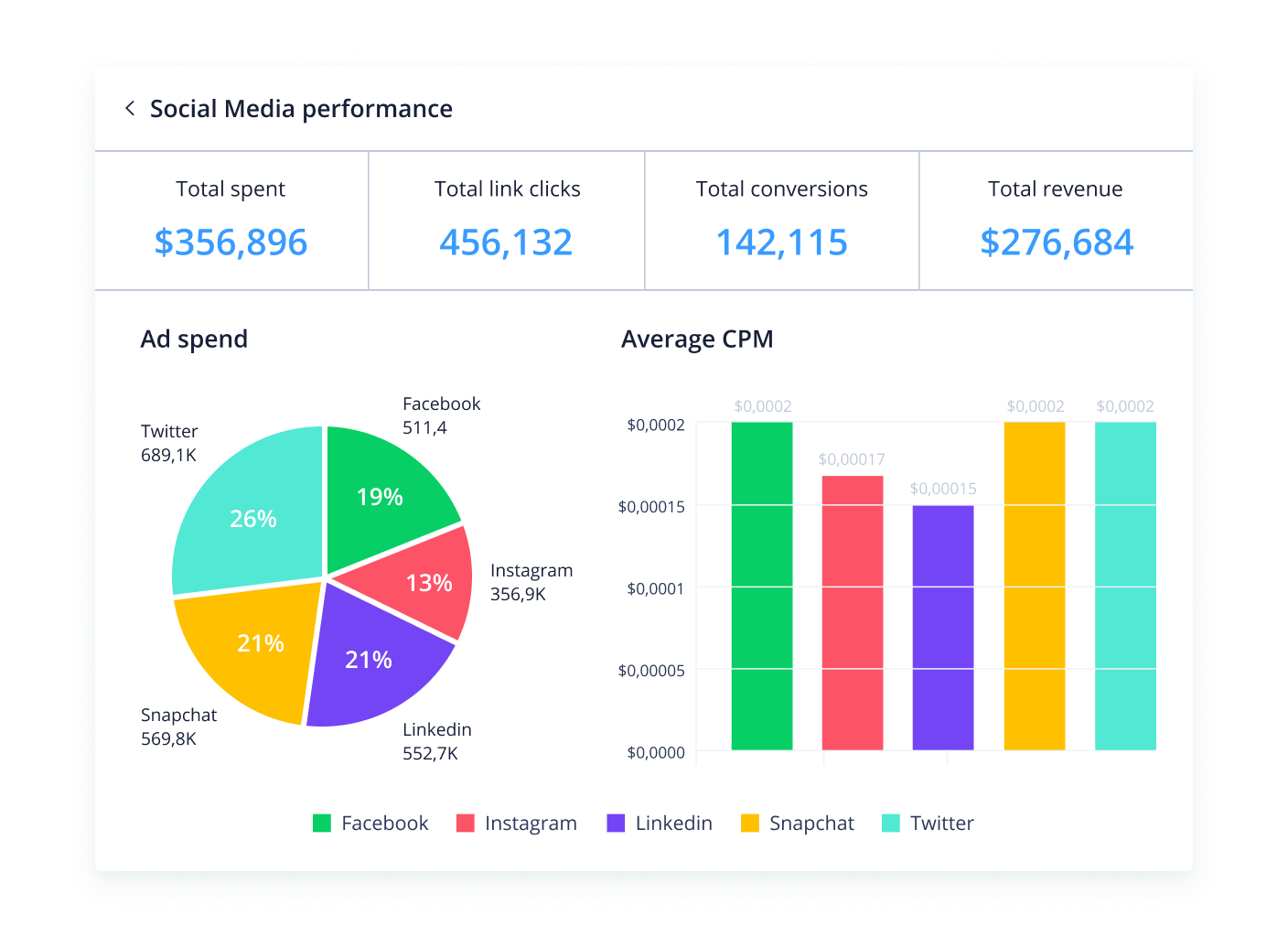

The other major new feature — at least if you’re in digital marketing — is Wrike’s new ability to pull in data about your campaigns from about 50 advertising, marketing automation and social media tools, which is then displayed inside the Wrike experience. In a fast-moving field, having all that data at your fingertips and right inside the tool where you think about how to manage these projects seems like a smart idea.

Somewhat related, Wrike’s new budgeting feature also now makes it easier for teams to keep their projects within budget, using a new built-in rate card to manage project pricing and update their financials.

“We use Wrike for an extensive project management and performance metrics system,” said Shannon Buerk, the CEO of engage2learn, which tested this new budgeting tool. “We have tried other PM systems and have found Wrike to be the best of all worlds: easy to use for everyone and savvy enough to provide valuable reporting to inform our work. Converting all inefficiencies into productive time that moves your mission forward is one of the keys to a culture of engagement and ownership within an organization, even remotely. Wrike has helped us get there.”

The value of quickly-growing and unprofitable software and cloud companies is well known. Snowflake

The value of quickly-growing and unprofitable software and cloud companies is well known. Snowflake