News: Forge’s SPAC deal is a bet on unicorn illiquidity

The total addressable market that Forge serves is growing by the day, with more and more unicorns being born and a steady drumbeat of unicorn IPOs doing little to clear the decks.

As Warby Parker, Freshworks, Amplitude and Toast look to list in the coming weeks, we shouldn’t forget the SPAC boom. This week, for example, Forge Global (Forge), a technology startup that operates a market for secondary transactions in private companies, announced that it would go public via a blank-check combination.

And while we’re not unpacking every single SPAC combination that crosses our radar, the Forge deal is a good one to spend time parsing.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Why? Several reasons. First, we’re curious about how the company generates revenue and how diversified its revenue is. We’re also interested in how big the market may prove to be for trading secondary shares in unicorns — late-stage tech startup equity is popular on secondary exchanges. Additionally, we want to know whether the deal feels expensive, because that may help us get a heat-check on the SPAC market more broadly.

First, some details concerning the transaction. Then we get to have fun. To work!

First, some details concerning the transaction. Then we get to have fun. To work!

The Forge SPAC

Forge is merging with Motive Capital, a blank-check company that raised $360 million in December 2020.

Per the company’s calculations, the combined entity will sport a roughly $2 billion valuation on a “fully diluted equity value on a pro forma basis.” The company’s anticipated enterprise value is a smaller $1.60 billion thanks to an expected $435 million in cash after the deal’s completion, though that number will change some before it trades.

Skipping the nuances of the transaction — there’s a PIPE, 90% equity rollover from existing shareholders and more, in case you wanted to get into it — what matters is that Forge will be worth around $2 billion in equity terms and have hundreds of millions of dollars in the bank after the deal.

The resulting valuation is notable not only for making Forge a unicorn, but also for representing a dramatic upward movement in the worth of the company. PitchBook and Crunchbase data agree that Forge was last valued at $700 million (post-money) when raising $150 million earlier this year. So, the company appears set to provide a solid return to more than just its early backers; even the private investors who put capital into the company rather recently should do well in the deal.

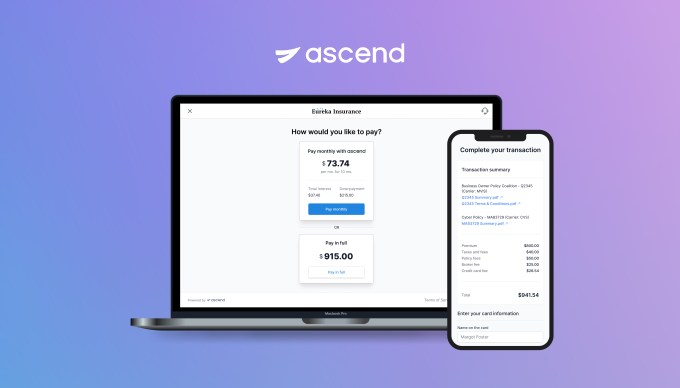

That brings us to the company’s business, and business model. Forge helps pre-IPO companies trade before they float. It’s somewhat ironic that price discovery is something that the company claims its platform can help companies with before they debut, while the company is set to see its private valuation quickly beaten by a public debut.

Regardless, let’s talk unicorns.

A solution to the unicorn traffic jam?

One of my favorite long-term issues with the late-stage startup market is that it is far better at creating value than it is at finding an exit point for that accreted value. More simply, the startup market is excellent at creating unicorns but somewhat poor at taking them public.

That antitrust regulatory concerns have made it harder for wealthy tech companies to snap up promising startups that could challenge them is only part of the matter. There just aren’t enough IPOs, even this year, to counterbalance the growth in the number of global unicorns.

That pressure is a good bit of why Forge is an interesting firm. The more unexited unicorns there are in the world, the more demand, presumably, there is for marketplaces like the one it operates, which allows existing shareholders in valuable private companies to drive liquidity for themselves ahead of eventual public-market debuts.