News: Outer, D2C outdoor furniture brand, secures $50M Series B funding to spur expansion and materials development

Americans spend more than 90% of each day indoors on average. However, approximately 82% of American homeowners are more interested in renovating their outdoor living spaces than they were prior to the pandemic, based on a recent survey, Outer co-founder and CEO Jiake Liu told TechCrunch. On top of that, about 54% of homeowners have

Americans spend more than 90% of each day indoors on average. However, approximately 82% of American homeowners are more interested in renovating their outdoor living spaces than they were prior to the pandemic, based on a recent survey, Outer co-founder and CEO Jiake Liu told TechCrunch.

On top of that, about 54% of homeowners have made at least one home improvement in the backyard since the outbreak of COVID-19, while millennials, the largest house-buying group now, are willing to take less square feet inside, or even give up a bedroom, to get a little bit of outdoor space, Liu said.

COVID-19 caused a “flight from density” across the U.S., meaning millions of Americans fled from big cities to suburbs to escape the coronavirus pandemic. This trend has led to more market opportunities in the outdoor entertainment industry.

A Santa Monica-based direct-to-consumers (D2C) outdoor furniture startup company, Outer, announced today its $50 million Series B funding to help more people around the globe to bring their lives back outside. The company was founded by CEO Liu and Chief Design Officer Terry Lin in 2019.

The Series B round was led by Capital Today’s founder Kathy Xu, with participation from Tribe Capital, C Ventures and Upfront Ventures. Existing investors, including Sequoia Capital China, Mucker Capital, Mantis VC and Reimagined Ventures, also joined in the round.

This fundraising, which comes about eight months after Outer’s $10.5 million Series A round in January, brings its total funding to $65 million.

The fresh funding will be used to cement its position in the outdoor living industry as they develop new sustainable materials, build an eco-friendly supply chain and expand their product offering and community, Liu said. Outer is currently hiring a variety of roles to enter global market this year and will announce a strategic international launch in October, Liu told TechCrunch.

“We are working on new, eco-friendly fabrics, plastics and concrete to replace the industry standards that currently pollute our environment,” Liu said. The company’s effort in sustainable materials isn’t stopping at recycled plastics but working towards carbon neutrality, and has set its goal of becoming carbon negative in the future, he explained.

“Since the beginning, the Outer team has insisted on prioritizing sustainability. Terry and his team have pioneered new fabrics and eco-friendly designs to ensure durability doesn’t come at the expense of environmental responsibility. The team is developing sustainable fabrics, plastics and concrete that will become the new industry gold standard,” said Capital Today’s founder Kathy Xu.

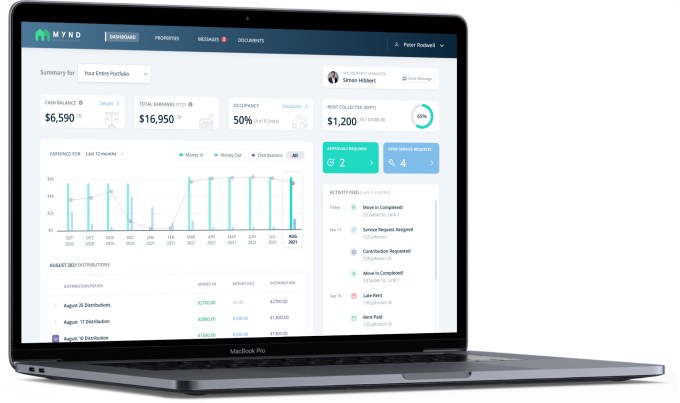

Its unique feature is its Neighborhood Showroom program, allowing shoppers to visit the homes of nearby Outer customers to experience Outer products in more than 1,000 locations in 49 states as of today, which has grown from 50 locations in 13 states in 2019. Outer’s direct-to-consumers (D2C) business does not require middlemen like distributors, retailers or brick-and-mortar showrooms.

The global furniture market was approximately $17.8 billion in 2018 and is projected to grow to $26.6 billion 2027, Liu said. The U.S. outdoor living market is estimated at $33.4 billion in 2021, based on a report by Freedonia.

Outer recently launched the Teak Collection, Aluminum Collection and Bug Shield Blankets.

“Outdoor products have long been an afterthought and their poor design has been a serious barrier to time spent outside. Outer’s thoughtful and sustainable products are already changing the way consumers interact with their outdoor spaces,” Xu said, adding that Outer is tackling real consumer problems, from dirty, wet outdoor cushions to pesky mosquito bites, with its solutions.

“Jiake and his team have taken a product-focused approach to establish Outer as a go-to premium furniture brand — driving rapid growth and attractive unit economics,” said Tribe Capital partner Sri Pangulur.