News: Labster gets millions from a16z to bring virtual science lab software to the world

Andreessen Horowitz, a venture capital firm with $16.5 billion in assets under management, has poured millions into an edtech startup that sells virtual STEM lab simulations to institutions. Copenhagen-based Labster, which sells virtual science laboratory simulations to schools, announced today that it has raised $60 million in a Series C round led by the prominent

Andreessen Horowitz, a venture capital firm with $16.5 billion in assets under management, has poured millions into an edtech startup that sells virtual STEM lab simulations to institutions.

Copenhagen-based Labster, which sells virtual science laboratory simulations to schools, announced today that it has raised $60 million in a Series C round led by the prominent Silicon Valley firm, including participation from existing investors GGV Capital, Owl Ventures and Balderton Capital. Labster has now raised $100 million in total known venture capital to date.

Like many edtech companies, Labster has found itself centered and validated as the pandemic underscores the need for remote work. In April, Labster signed a contract to bring its services to the entire California Community College network, which includes more than 2.1 million students. Months later, the startup brought on $9 million in equity funding to bring GGV’s Jenny Lee onto the board and expand its Asia operations.

“A16z is very excited about investing in technology companies that have a big impact and potential to become massive global successes’,” CEO and co-founder Michael Bodekaer Jensen said. “The fact that Labster is a platform innovating learning at scale is really what attracted them.”

The new capital will help Labster increase its staff, grow into new regions that include Latin America and Africa, as well as invest in new product development to better support teachers.

Jensen says that today’s raise, which is singularly larger than any capital Labster has raised prior, “dramatically increased” the valuation of the company. Jensen did confirm that Labster has not yet hit the $1 billion mark in terms of valuation, nor did he comment on whether the startup had hit profitability or not.

What Jensen did share, though, is that he thinks Labster’s new capital brings the startup one step closer to two big goals: serve 100 million students in the next few years, and become a platform to “enable anyone in the world to customize and build their own simulations on their platform.”

“We’re not a content company,” the co-founder said. “We’re a platform for immersive learning.”

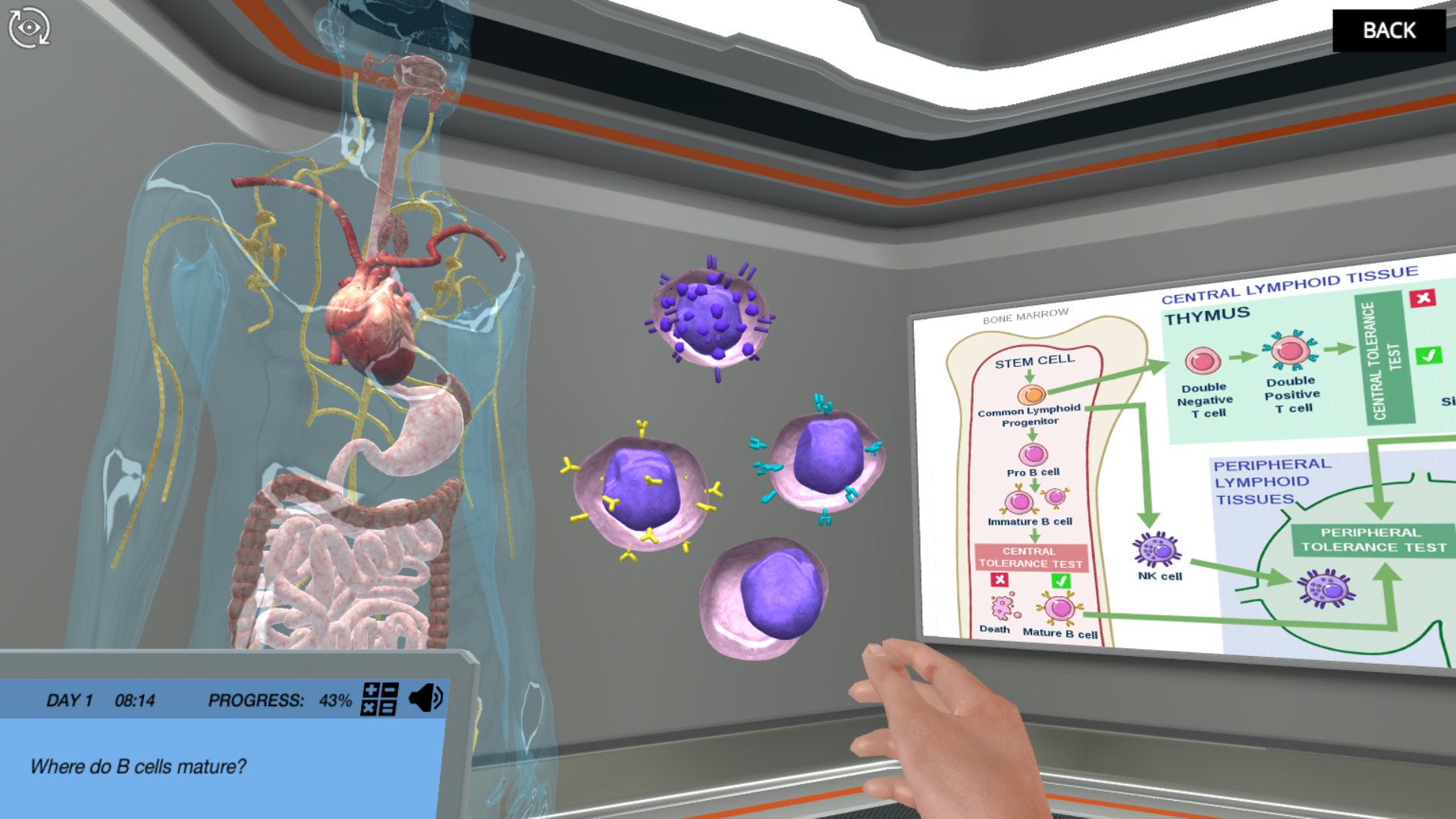

Currently, Labster sells its e-learning solution to support and enhance in-person courses. Based on the subscription an institution chooses, participants can get differing degrees of access to a virtual laboratory. Imagine a range of experiments, from understanding bacterial growth and isolation to exploring the biodiversity of an exoplanet. Along with each simulation, Labster offers 3D animations for certain concepts, re-plays of simulations, quiz questions and a virtual learning assistant.

Image Credits: Labster

Jensen is hinting that the startup might finally be able to move past pre-determined learning tracks and into the world of customizable immersive learning. Other startups, including Inspirit, are also aiming to bring the creativity associated with games such as Minecraft or Roblox to the day-to-day schoolwork of students around the world.

With platform ambition, Labster is pausing its virtual reality efforts, which requires acquiring headsets at scale.

“VR is good for learning, but we need to make sure that we understand and provide services and solutions that work with the hardware that institutions already have and are available,” he said, adding that many institutions have been unable to afford headsets for all students. The fact that Labster is stepping away from virtual reality and framing itself as an immersive learning environment is more than a branding decision, but suggests that the future of scalable edtech might look less like goggles and more like a customizable web page.

“In the early days there was definitely a little naïve entrepreneurial mindset to build it and suddenly all teachers will come,” Jensen said. “[VR] was in no way as revolutionary as we hopped and thought of.”

New investments for the startup include Labster Portal, which is a dashboard for teachers to understand how individual students are using the immersive simulations and what lessons make sense to embed together. The company is also focused on landing partnerships with institutions, on either a country or state-wide level or district-level. Jensen says that the bigger the contract, the bigger the discount because it saves them money on onboarding costs. Labster recently signed a deal to bring its technology to the entire country of Denmark.

Labster currently has more than 2,000 colleges, universities and high schools on its platform.

“Post-COVID, the growth will slow,” Jensen said. “When we have conversations with institutions we are increasingly talking about post-COVID and continuing how we can further use Labster in new and innovative ways.”