News: As the SPAC frenzy continues, questions arise about how much the market can absorb

Another week and the biggest story in a sea of big stories continues to center on SPACs, these blank-check companies that raise capital through IPOs expressly to acquire a privately held company and take it public. But some industry watchers as starting to wonder: Is this party just getting started, with more early guests still

Another week and the biggest story in a sea of big stories continues to center on SPACs, these blank-check companies that raise capital through IPOs expressly to acquire a privately held company and take it public. But some industry watchers as starting to wonder: Is this party just getting started, with more early guests still trickling in? Have we reached the party’s peak, with the music still thumping? Or did someone just quietly barf in the corner, a sure indicator that it’s time to grab one’s coat?

It certainly feels like things are in full swing. Just today, B Capital, the venture firm cofounded by Facebook cofounder Eduardo Saverin, registered plans to raise a $300 million SPAC. Mike Cagney, the fintech entrepreneur who founded SoFI and more recently founded Figure, a fintech company in both the home equity and blockchain space, raised $250 million for his SPAC. Even Michael Dell has made the leap, with his family office registering plans this afternoon to raise a $500 million blank-check company.

Altogether, according to Renaissance Capital, 16 blank-check companies raised $3.4 billion this week, and new filers continue to flood into the IPO pipeline, with 45 SPACs submitting initial filings this week (compared with 10 traditional IPO filings). Perhaps it’s no wonder that we’re starting to see headlines like one in Yahoo News just yesterday titled, “Why some SPAC investors may get burned.”

Interestingly, such headlines could help puncture the SPAC bubble. So argues INSEAD professor Ivana Naumovska in a new Harvard Business Review piece that’s ominously titled, “The SPAC Bubble is About to Burst.”

Naumovska points to research showing that when more people adopt a practice, it will become increasingly widespread due to growing awareness and legitimacy. (See Clubhouse.) But when it comes to something that’s more controversial — which it could be argued that SPACs are — outsider concern and skepticism also grows as the practice becomes more widely used. Thus are born headlines like that one in Yahoo Finance.

Naumovska has studied this phenomenon before, focusing on earlier reverse mergers that, as she notes, “surged in the mid-2000s, outnumbering IPOs in some years, and peaked in 2010, before falling off a cliff in 2011.” She says she and fellow researchers collected a plethora of data on the use of reverse mergers and market responses to them, including how the media evaluated such vehicles. Of the 267 articles published between 2001 and 2012, she says, 6 were positive, 148 were neutral, 113 were negative.

Notably and unsurprisingly, the negative articles grew as the number of reverse merger transactions involving firms with relatively low reputations increased. Then again, the same thing happens whenever the “IPO window” is open. Great companies go public, then good companies, then half-baked companies that think they might just blend in with the others. Except that the media picks up on these companies, as do regulators, and with investors, regulators, and the media feeding off one another’s signals, the party typically comes to a screeching halt.

Anecdotally, much more of the coverage around SPACs right now remains positive to neutral. If business reporters are privately skeptical of SPACs, they are reserving judgment, possibly because save for some highly concerning cases — like when the electric truck startup Nikola was accused of fraud — there isn’t much to criticize yet.

That’s partly because these things appeared so abruptly that public shareholders are still trying to understand them.

The argument that most investors have for creating a SPAC — which is that a lot of so-called unicorn companies are ready to be publicly traded — resonates, too, given how bloated the private market has become.

It’s also impossible to judge many of the SPACs raised over the last six months, as they have yet to announce their targets (they have two years from the time they raise funds from investors to zero in on a company or else have they have give back those IPO proceeds).

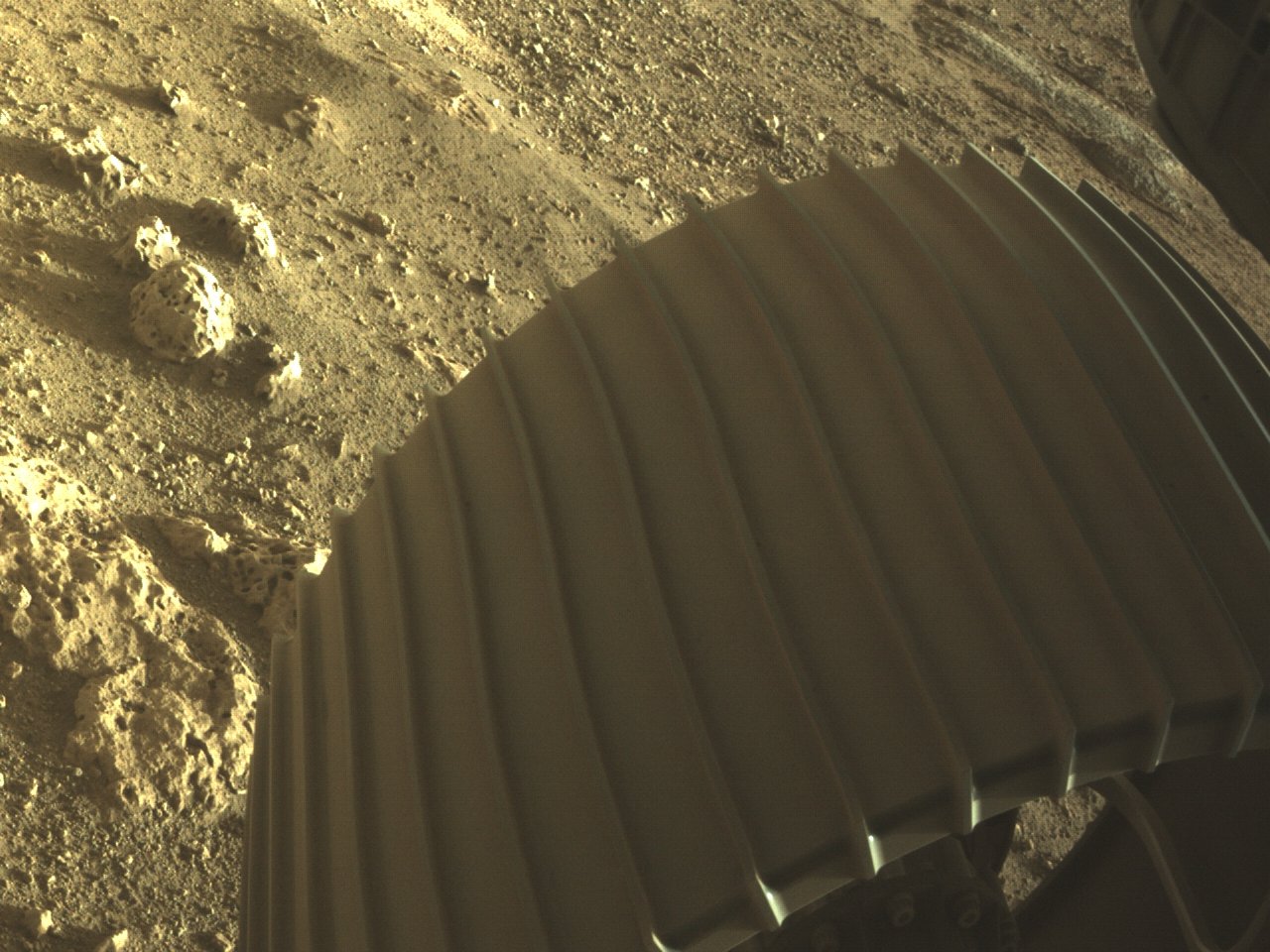

In the meantime, some of the merger deals that critics have long expected would begin to unravel have not, like Virgin Galactic, the space tourism company that kicked off SPAC mania when it went public in the fall of 2019.

Sir Richard Branson founded the company in 2004 in order to fly passengers on suborbital trips to space, but even after putting off plans yet again to attempt a rocket-powered flight to suborbital space last week, its shares — which have more than doubled since January– remain in the figurative stratosphere. (The company, which reported almost no revenue last year, is currently valued at $12 billion.)

Other offerings haven’t gone quite as smoothly. Clover Health, a health insurance company that, like Virgin Galactic, was taken public via a SPAC organized by famed investor Chamath Palihapitiya, is “facing a confluence of existential threats” to its business, as observed in a deep dive by Forbes.

Among others that are “digging into Clover’s business practices, including how the company incentivizes doctors and patients to buy its insurance and use its technology,” are the The Department of Justice, the Securities and Exchange Commission and influential short-sellers. (Clover has rebutted the allegations, but it is reportedly still facing at least three class-action lawsuits that have been filed over the company’s failure to disclose ahead of its IPO that the DOJ was investigating the company.)

“I don’t get it,” said skeptic Steve Jurvetson last month in conversation with this editor of the SPAC frenzy. The veteran venture capitalist, who sits on the board of SpaceX, said there are “some good companies [being taken public]. Don’t get me wrong; they aren’t all fraudulent.” But many are “early-stage venture companies,” he noted, “and they don’t need to meet the forecasting requirements that the SEC normally requires of an IPO, so [SPAC sponsors are] specifically looking for companies that don’t have any operating numbers to show [because they] can make any forecasts they want . . .That’s the whole racket.”

If others agree with Jurvetson, they hesitate to say so publicly. For one thing, plenty of VCs would be happy to see their portfolio companies taken public however possible; others who haven’t formed SPACs of their own are reserving the right to consider them down the road.

Ed Sim of Boldstart Ventures in New York is one of few VCs in recent months to say outright, when asked, that his firm isn’t considering raising a SPAC at any point. “I have zero interest in that honestly,” says Sim. “You can come back to me if you see my name or Boldstart [affiliated] with a SPAC two years from now,” he adds, laughing.

Many more investors stress that it’s all about who is sponsoring what. Among these is Kevin Mayer, the former Disney exec and, briefly, the CEO of the social network TikTok. In a call yesterday, he noted that there are “many fewer public companies now than there were 10 years ago, so there is a need for supplying another way to go public.”

Mayer has a vested interest in promoting the benefits of SPACs. Just yesterday, along with former Disney colleague Tom Staggs, he registered plans for a second a SPAC, after it was announced earlier this month that their first SPAC will be used to take public the digital fitness specialist Beachbody Company.

But Mayer also argues that not every SPAC should be judged by the same yardstick. “Do I think it’s overdone? Sure, everyone and their brother is now getting to a SPAC, so yeah, that does seem a bit ridiculous. But I think . . . the wheat will be separated from the chaff very, very soon.”

It had better if SPACs are to endure. Working against SPAC sponsors already are numbers that are starting to trickle in and that don’t look so great.

Late last week, Bloomberg Law reported that based on its analysis of the companies that went public as a result of a merger with a SPAC dating back to Jan. 1, 2019, and for which at least one month of post-merger performance data is available, 14 out of 24 (or 60%) reported a depreciation in value as of one month following the completion of the merger, and one-third of the companies reported a year-to-date depreciation in value.

The number of securities lawsuits filed by SPAC stockholders post-merger is also on the rise, noted the outlet.

Certainly, SPACs — more recently heralded as a lasting fix for a broken IPO market — could still prove durable.

But given the accelerating rate at which SPACs are being formed, as well as the some of the companies in their sights — some of them still in the prototype phase — the question of whether the phenomenon is sustainable is one that more are beginning to ask.

(@Katemooooon)

(@Katemooooon)

Craig Inzana (@craiginzana)

Craig Inzana (@craiginzana)