- February 23, 2021

- by:

- in: Blog

Not everyone has Type 2 diabetes, the disease that causes chronically high blood sugar levels, but many do. Around 9% of Americans are afflicted, and another 30% are at risk of developing it. Enter software by January AI, a four-year-old, subscription-based startup that in November began providing personalized nutritional and activity-related suggestions to its customers

Not everyone has Type 2 diabetes, the disease that causes chronically high blood sugar levels, but many do. Around 9% of Americans are afflicted, and another 30% are at risk of developing it.

Enter software by January AI, a four-year-old, subscription-based startup that in November began providing personalized nutritional and activity-related suggestions to its customers based on a combination of food-related data the company has quietly amassed over three years, and each person’s unique profile, which is gleaned over that individuals’s first four days of using the software.

Why the need for personalization? Because believe it or not, people can react very differently to every single food, from rice to salad dressing.

The tech may sound mundane but it’s eye-opening and potentially live-saving, promises cofounder and CEO Nosheen Hashemi and her cofounder, Michael Snyder, a genetics professor at Stanford who has focused on diabetes and pre-diabetes for years.

Investors like the idea, too. Felicis Ventures just led a $21 million Series A investment in the company, joined by HAND Capital and Salesforce founder Marc Benioff. (Earlier investors include Ame Cloud Ventures, SignalFire, YouTube cofounder Steve Chen, and Sunshine cofounder Marissa Mayer, among others.) Says Felicis founder Aydin Senkut, “While other companies have made headway in understanding biometric sensor data—from heart rate and glucose monitors, for example—January AI has made progress in analyzing and predicting the effects of food consumption itself [which is] key to addressing chronic disease.”

We talked with Hashemi and Snyder this afternoon to learn more. Below is part of our chat, edited for length and clarity.

TC: What have you built?

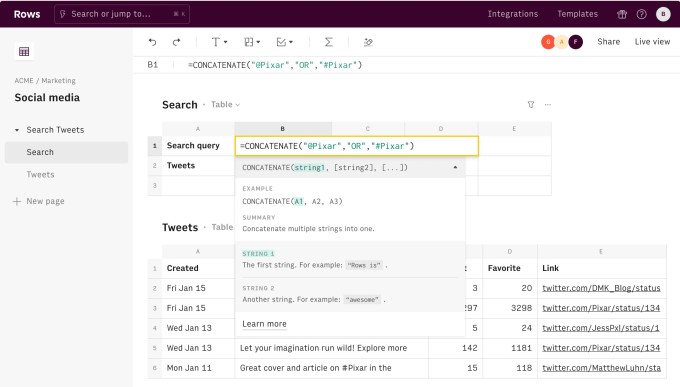

NH: We’ve built a multiomic platform where we take data from different sources and predict people’s glycemic response, allowing them to consider their choices before they make them. We pull in data from heart rate monitors and continuous glucose monitors and a 1,000-person clinical study and an atlas of 16 million foods for which, using machine learning, we have derived nutritional values and created nutritional labeling [that didn’t exist previously].

[The idea is to] predict for [customers] what their glycemic response is going to be to any food in our database after just four days of training. They don’t actually have to eat the food to know whether they should eat it or not; our product tells them what their response is going to be.

TC: So glucose monitoring existed previously, but this is predictive. Why is this important?

NH: We want to bring the joy back to eating and remove the guilt. We can predict, for example, how long you’d have to walk after eating any food in our database in order to keep your blood sugar at the right level. Knowing what “is” isn’t enough; we want to tell you what to do about it. If you’re thinking about fried chicken and a shake, we can tell you: you’re going to have to walk 46 minutes afterward to maintain a healthy [blood sugar] range. Would you like to do the uptime for that? No? Then maybe [eat the chicken and shake] on a Saturday.

TC: This is subscription software that works with other wearables and that costs $488 for three months.

NH: That’s retail price, but we have an introductory offer of $288.

TC: Are you at all concerned that people will use the product, get a sense of what they could be doing differently, then end their subscription?

NH: No. Pregnancy changes [one’s profile], age changes it. People travel and they aren’t always eating the same things. . .

MS: I’ve been wearing [continuous glucose monitoring] wearables for seven years and I still learn stuff. You suddenly realize that every time you eat white rice, you spike through the roof, for example. That’s true for many people. But we are also offering a year-long subscription soon because we do know that people slip sometimes [only to be reminded] later that these boosters are very valuable.

TC: How does it work practically? Say I’m at a restaurant and I’m in the mood for pizza but I don’t know which one to order.

NH: You can compare curve over curve to see which is healthier. You can see how much you’ll have to walk [depending on the toppings].

TC: Do I need to speak all of these toppings into my smart phone?

NH: January scans barcodes, it also understands photos. It also has manual entry, and it takes voice [commands].

TC: Are you doing anything else with this massive food database that you’ve aggregated and that you’re enriching with your own data?

NH: We will definitely not sell personal information.

TC: Not even aggregated data? Because it does sound like a useful database . . .

MS: We’re not 23andMe; that’s really not the goal.

TC: You mentioned that rice can cause someone’s blood sugar to soar, which is surprising. What are some of the things that might surprise people about what your software can show them?

NH: The way people’s glycemic response is so different, not just between by Connie and Mike, but also for Connie and Connie. If you eat nine days in a row, your glycemic response could be different each of those nine days because of how much you slept or how much thinking you did the day before or how much fiber was in your body and whether you ate before bedtime.

Activity before eating and activity after eating is important. Fiber is important. It’s the most under overlooked intervention in the American diet. Our ancestral diets featured 150 grams of fiber a day; the average American diet today includes 15 grams of fiber. A lot of health issues can be traced to a lack of fiber.

TC: It seems like coaching would be helpful in concert with your app. Is there a coaching component?

NH: We don’t offer a coaching component today, but we’re in talks with several coaching solutions as we speak, to be the AI partner to them.

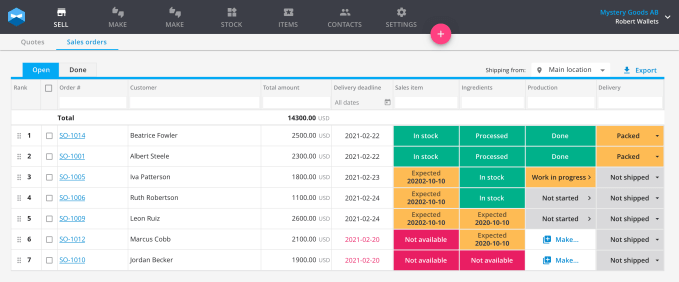

TC: Who else are you partnering with? Healthcare companies? Employers that can offer this as a benefit?

NH: We are selling to direct to consumers, but we’ve already had a pharma customer for two years. Pharma companies are very interested in working with us because we are able to use lifestyle as a biomarker. We essentially give them [anonymized] visibility into someone’s lifestyle for a period of two weeks or however long they want to run the program for so they can gain insights as to whether the therapeutic is working because of the person’s lifestyle or in spite of a person’s lifestyle. Pharma companies are very interested in working with us because they can potentially get answers in a trial phase faster and even reduce the number of subjects they need.

So we’re excited about pharma. We are also very interested in working with employers, with coaching solutions, and ultimately, with payers [like insurance companies].