News: Facebook launches BARS, a TikTok-like app for creating and sharing raps

Facebook’s internal R&D group, NPE Team, is today launching its next experimental app, called BARS. The app makes it possible for rappers to create and share their raps using professionally created beats, and is the NPE Team’s second launch in the music space following its recent public debut of music video app Collab. While Collab

Facebook’s internal R&D group, NPE Team, is today launching its next experimental app, called BARS. The app makes it possible for rappers to create and share their raps using professionally created beats, and is the NPE Team’s second launch in the music space following its recent public debut of music video app Collab.

While Collab focuses on making music with others online, BARS is instead aimed at would-be rappers looking to create and share their own videos. In the app, users will select from any of the hundreds of professionally created beats, then write their own lyrics and record a video. BARS can also automatically suggest rhymes as you’re writing out lyrics, and offers different audio and visual filters to accompany videos as well as an autotune feature.

There’s also a “Challenge mode” available, where you can freestyle with auto-suggested word cues, which has more of a game-like element to it. The experience is designed to be accommodating to people who just want to have fun with rap, similar to something like Smule’s AutoRap, perhaps, which also offers beats for users’ own recordings.

Image Credits: Facebook

The videos themselves can be up to 60 seconds in length and can then be saved to your Camera Roll or shared out on other social media platforms.

Like NPE’s Collab, the pandemic played a role in BARS’ creation. The pandemic shut down access to live music and places where rappers could experiment, explains NPE Team member DJ Iyler, who also ghostwrites hip-hop songs under the alias “D-Lucks.”

“I know access to high-priced recording studios and production equipment can be limited for aspiring rappers. On top of that, the global pandemic shut down live performances where we often create and share our work,” he says.

BARS was built with a team of aspiring rappers, and today launched into a closed beta.

Image Credits: Facebook

Despite the focus on music, and rap in particular, the new app in a way can be seen as yet another attempt by Facebook to develop a TikTok competitor — at least in this content category.

TikTok has already become a launchpad for up-and-coming musicians, including rappers; it has helped rappers test their verses, is favored by many beatmakers and is even influencing what sort of music is being made. Diss tracks have also become a hugely popular format on TikTok, mainly as a way for influencers to stir up drama and chase views. In other words, there’s already a large social community around rap on TikTok, and Facebook wants to shift some of that attention back its way.

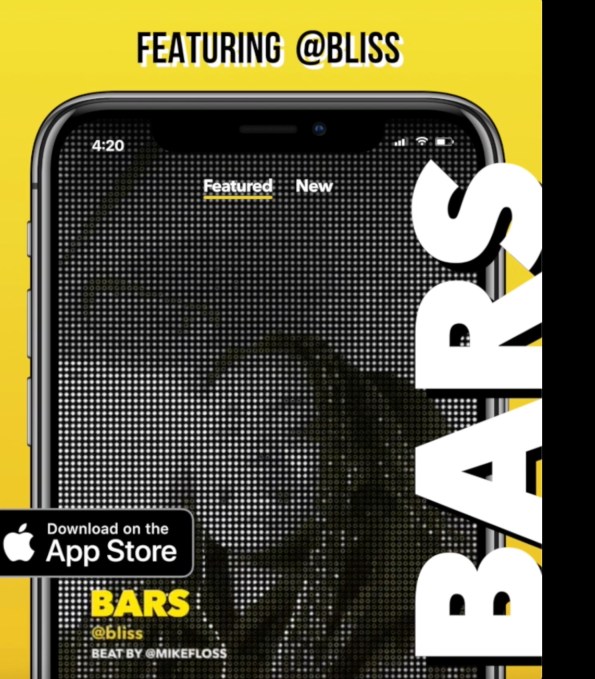

The app also resembles TikTok in terms of its user interface. It’s a two-tabbed vertical video interface — in its case, it has “Featured” and “New” feeds instead of TikTok’s “Following” and “For You.” And BARS places the engagement buttons on the lower-right corner of the screen with the creator name on the lower-left, just like TikTok.

However, in place of hearts for favoriting videos, your taps on a video give it “Fire” — a fire emoji keeps track. You can tap “Fire” as many times as you want, too. But because there’s (annoyingly) no tap-to-pause feature, you may accidentally “fire” a video when you were looking for a way to stop its playback. To advance in BARS, you swipe vertically, but the interface is lacking an obvious “Follow” button to track your favorite creators. It’s hidden under the top-right three-dot menu.

The app is seeded with content from NPE Team members, which includes other aspiring rappers, former music producers and publishers.

Currently, the BARS beta is live on the iOS App Store in the U.S., and is opening its waitlist. Facebook says it will open access to BARS invites in batches, starting in the U.S. Updates and news about invites, meanwhile, will be announced on Instagram.

Facebook’s recent launches from its experimental apps division include Collab and collage maker E.gg, among others. Not all apps stick around. If they fail to gain traction, Facebook shuts them down — as it did last year with the Pinterest-like video app Hobbi.