News: Wise’s Taavet Hinrikus and Teleport’s Sten Tamkivi partner in new investment firm — just don’t call it a VC fund

Taavet Hinrikus, the first employee of Skype and co-founder of fintech giant Wise (formerly TransferWise), is teaming up with Teleport co-founder and current Topia CPO Sten Tamkivi to create a new investment vehicle. Both are already seasoned investors — Hinrikus is one of Europe’s bona fide super angels, with over 100 investments to his name

Taavet Hinrikus, the first employee of Skype and co-founder of fintech giant Wise (formerly TransferWise), is teaming up with Teleport co-founder and current Topia CPO Sten Tamkivi to create a new investment vehicle.

Both are already seasoned investors — Hinrikus is one of Europe’s bona fide super angels, with over 100 investments to his name — and have already done a number of tickets together. The new as yet unnamed venture will see the pair’s investment activities formalised as an equal partnership and be supported by a team of six people based in Estonia, including an investment analyst.

Just don’t call it a VC fund.

“I’m still not setting up a fund, but am partnering to help do more of the same on the investing side,” Hinrikus told me last week in a text message.

For the last few years — perhaps prompted by swapping the role of CEO of Wise for chairperson — there’s been speculation within London’s increasingly chatty venture capital scene that he might raise a fund of his own or join an A-list VC firm as a partner. The Wise founder actually spent about a year as a venture partner at Mosaic Ventures, which ended last summer and went unreported.

“When you say fund, this means other people’s money and a specific mandate (i.e. invest in seed or late, in biotech or fintech, promise to return the money in a certain time, etc.),” Hinrikus said in an email earlier this week. He also explained that the new firm will not be seeking outside LPs and will be “evergreen”, enabling it to make considerably longer-term bets than many VC funds. Instead, Hinrikus and Tamkivi are happy to hold investments for 10-20 years.

“This structure is both liberating and differentiating, because without strict external mandates we can go after the missions we feel passionate about and be really patient about how long we stay involved in our companies,” said Tamkivi in an email.

“[We] will not be the one pushing a founder to sell,” underlines Hinrikus. “Will always stay on the founder’s side as we’ve been in that position ourselves”.

The pair’s combined portfolios focus mostly on Europe but also further afield, including the U.S., Japan and Singapore. Mutual investments (or shareholdings) include Wise, Bolt, Veriff, LHV, Xolo, Oyster HR, Pactum, Starship, Curve, Sunrise and Acapela.

Hinrikus and Tamkivi have also jointly contributed to several “mission driven” nonprofit endeavours such as Jõhvi School of Technology, Good Deed Education Fund or Vabamu Museum of Freedom and Occupations, which they, and the new firm’s back office, will continue to support. Most recently, Hinrikus co-founded Certific, which is building the rails for home health testing.

Hinrikus and Tamkivi say their new investment firm will back tech companies with a €250,000 to €1 million seed investment, but also has the freedom to follow on right up to an IPO. In most instances, it doesn’t expect to lead rounds but hopes to be seen as more collaborative than competitive.

“In short, we will be doing more of the same: give founder-backing to more upcoming founders,” said Hinrikus. “What excites us most is the future ahead and finding positive missions that improve our future. So far it’s been lots of future of work, future of finance, but in the future we’d love to think more about future of health and climate as well”.

“It will take a bit more conscious effort to figure out what our theses and strategy will be for completely new areas,” adds Tamkivi. “As humans, we both care about longevity, health, education, democracy — if we find ways how to move these huge problem spaces along with capital, we are very eager to learn”.

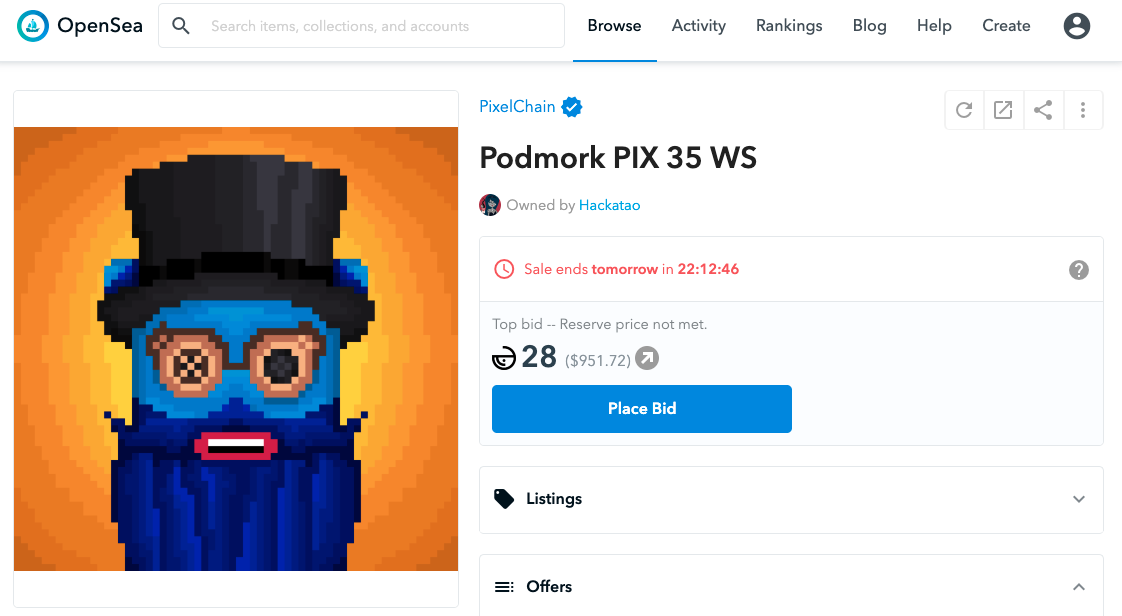

The pair are also willing to take positions in crypto tokens, real assets or any alternative financial instruments.

“On a high level you can think of DeFi as just a natural extension of our broader ‘future of money’ financial freedom thesis,” said Tamkivi. “When it comes to technical execution, we’ve benefited a lot from the freedom to invest not just in equity of established companies, but to also take token positions, use on-chain yield strategies or work with specialized venture funds. Whatever helps our founders”.

To that end, the new investment fund is breaking cover with very little fanfare — and, as mentioned, it doesn’t even have a name yet. “’Have you talked to Taavet and Sten yet?’ should work fine for now,” quipped Hinrikus, in his own deadpan style of humour I’ve become accustomed to over the years.

“More seriously, we are just getting started together,” clarified Tamkivi. “[We’re] still figuring out what kind of structure, processes, new talent and other things, such as additional branding, we’ll need as we scale up the activities from our lives as individual angels to date”.

Early Stage is the premier ‘how-to’ event for startup entrepreneurs and investors. You’ll hear first-hand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company-building: Fundraising, recruiting, sales, product market fit, PR, marketing and brand building. Each session also has audience participation built-in – there’s ample time included for audience questions and discussion. Use code “TCARTICLE at checkout to get 20 percent off tickets right here.