News: CoScreen launches its screen-sharing product, announces $4.6M in fundraising

This morning CoScreen, a startup that helps teams share screens and collaborate in real-time, formally launched its product to market. It also disclosed that it has raised $4.6 million to date. Unusual Ventures led its Seed round. Till Pieper, CoScreen’s co-founder and CEO told TechCrunch in an interview that it raised the bulk of its

This morning CoScreen, a startup that helps teams share screens and collaborate in real-time, formally launched its product to market. It also disclosed that it has raised $4.6 million to date.

Unusual Ventures led its Seed round. Till Pieper, CoScreen’s co-founder and CEO told TechCrunch in an interview that it raised the bulk of its capital pre-pandemic, with the rest coming during 2020 in smaller chunks. A number of angels took part in funding the company, including GitHub CTO Jason Warner.

Why is screen-sharing worth millions in funding, and the time and attention of a whole team? It’s a good question. Happily the CoScreen team have built something that’s could prove more than a bit better than what you currently use in Zoom to share puppy pics with your team during meetings.

What’s CoScreen?

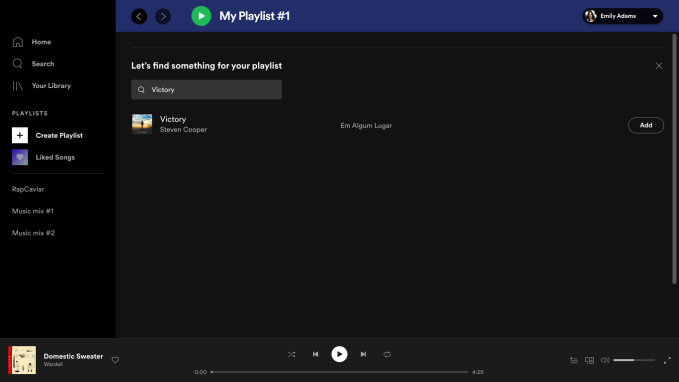

CoScreen provides screen-sharing capabilities, but in a neat manner. Let’s say you are on a Mac at your house, and I’m on a PC at mine. And we need to collab and share some work. I have a document you need to help me edit, and you have an image you want me to view. Using CoScreen, with one click according to Pieper, we can share the two apps across the Internet. Yours will appear on my screen as it was native, and vice versa, and we can both interact with them in real-time.

Or as close to real-time as possible; Pieper told TechCrunch that latency is something that CoScreen will work on forever. Which makes sense, but what the company has built it thinks is good enough to take to market. So, today it’s launching the service after a period of time in beta for both Windows and Mac.

CoScreen also has audio and video-chatting capabilities. With limits. You can’t make video windows too big, for example, helping to keep the mental-load of chatting low. As someone with regular Zoom poisoning, that makes sense.

The startup’s project hits me as one of those things that sounds easy but isn’t. Remember Google Wave? It allowed for instantaneous co-writing. It was amazing. It died. And its successor-of-sorts Google Docs is a laggy mess to this day that feels more quarter-baked than half-done. Real-time tech is not simple.

Is the market too full of apps that allow a version of what CoScreen does for the startup to succeed? Maybe, maybe not. Zoom stormed the already-mature video chat market with a product that actually worked. And so software that I have used has been very good at screen-sharing, let alone sharing and collaborating. So if CoScreen’s tech is good, the company should have a shot at broad adoption.

Which it is banking on. The startup is currently offering its product for free for a few weeks. It will focus on monetization later, Pieper explained. Making money is just not a burning desire for the firm at the moment, which implies both confidence in its product and bank account.

Closing, the startup is targeting engineers and other agile teams, though I suspect that its product will have wider market remit in time.

At this juncture, we’ll have to wait for numbers to see what’s ahead for CoScreen. The company didn’t share much in the way of usage metrics, which was reasonable given its recent beta status. We’ll expect more hard figures the next time we chat.