News: Announcing our TC Sessions: SaaS virtual event happening October 27

Software-as-a-Service (SaaS) is now the default business model for most B2B and B2C software startups. And while it’s been around for a while now, its momentum keeps accelerating and the ecosystem continues to expand as technologists and marketers are getting more sophisticated about how to build and sell SaaS products. For all of them, we’re

Software-as-a-Service (SaaS) is now the default business model for most B2B and B2C software startups. And while it’s been around for a while now, its momentum keeps accelerating and the ecosystem continues to expand as technologists and marketers are getting more sophisticated about how to build and sell SaaS products. For all of them, we’re pleased to announced TechCrunch Sessions: SaaS 2021, a one-day virtual event that will examine the state of SaaS to help startup founders, developers and investors understand the state of play and what’s next.

The single-day event will take place 100% virtually on October 27 and will feature actionable advice, Q&A with some of SaaS’s biggest names, and plenty of networking opportunities. $75 Early Bird Passes are now on sale. Book your passes today to save $100 before prices go up.

We’re not quite ready to disclose our agenda yet, but you can expect a mix of superstars from across the industry, ranging from some of the largest tech companies to up-and-coming startups that are pushing the limits of SaaS.

The plan is to look at a broad spectrum of what’s happening in with B2B startups and give you actionable insights into how to build and/or improve your own product. If you’re just getting started, we want you to come away with new ideas for how to start your company and if you’re already on your way, then our sessions on scaling both your technology and marketing organization will help you to get to that $100 million annual run rate faster.

In addition to other founders, you’ll also hear from enterprise leaders who decide what to buy — and the mistakes they see startups make when they try to sell to them.

But SaaS isn’t only about managing growth — though ideally, that’s a problem founders will face sooner or later. Some of the other specific topics we will look at are how to keep your services safe in an ever-growing threat environment, how to use open source to your advantage and how to smartly raise funding for your company.

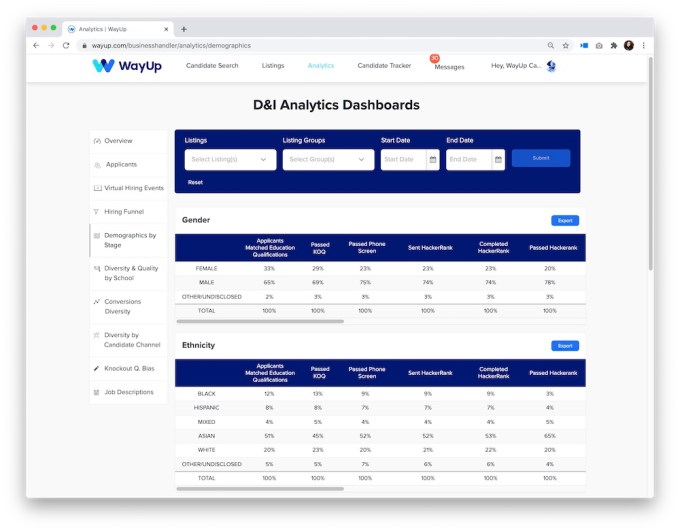

We will also highlight how B2B and B2C companies can handle the glut of data they now produce and use it to build machine learning models in the process. We’ll talk about how SaaS startups can both do so themselves and help others in the process. There’s nary a startup that doesn’t want to use some form of AI these days, after all.

And because this is 2021, chances are we’ll also talk about building remote companies and the lessons SaaS startups can learn from the last year of working through the pandemic.

Don’t miss out. Book your $75 Early Bird pass today and save $100.