- April 22, 2021

- by:

- in: Blog

“With the COVID-19 pandemic, it’s easier to land remote jobs and stay in Zagreb, which will positively impact the Croatian startup ecosystem.”

Startups may not spring to mind when speaking about the beautiful country of Croatia. Indeed, the country is most popular as a tourist destination, and given that tourism accounted for about 20% of its GDP in 2018, to an extent, its pre-pandemic focus was mostly on growing its share of the international tourism market.

But Croatia’s entrepreneurs haven’t been quiet: Startups like Infobip and Rimac are significant local hero businesses now, and the region can boast of high-quality talent in the tech, automotive, manufacturing, and agtech spaces. With only two venture capital firms operating in the capital of Zagreb, the startup scene is still young, but the country’s relatively recent EU membership has given it access to a growing set of direct investment instruments.

The current tax framework on capital gains tax (zero if you hold the shares for more than two years) and a new ‘digital nomad’ visa are helping to attract investors and talent to the city, which is also close to some of the best beaches in the world.

Access to fresh, outside capital is always a catalyst for growth, so to get an inside look at Zagreb’s fast-growing startup ecosystem, we spoke with nine local founders, investors and C-level executives.

According to the respondents, Zagreb’s strongest tech areas include HR solutions, automotive, fintech, mobile gaming, IoT, insurtech, and AI. The city’s angel investor scene isn’t very strong yet, but that could be attributed to the ecosystem’s youth.

Use discount code ZAGREB2021 to save 25% off an annual or two-year Extra Crunch membership.

This offer is only available to readers in Europe and expires on May 30, 2021.

The city has an excellent work-life balance, and most of the talent wants to stay there. “Now, with the COVID-19 pandemic, it’s easier to land remote jobs and stay in Zagreb, which will positively impact our ecosystem,” one of the investors said.

However, with competition heating up, startups looking for larger, serious investment will probably have to look beyond the country’s borders while trying to retain their engineering talent. Luckily, an increasing number of international investors are looking at Zagreb for their deal flow pipeline.

Some top Croatian startups include: Agrivi, Amodo, Ascalia, Bellabeat, Cognism, Degordian, Dok-Ing, Infobip, Mindsmiths, OptimoRoute, Oradian, Photomath, Repsly, ReversingLabs, ScoreAlarm, Sportening and AdScanner.

We surveyed:

- Lucija Ilicic, CEO, PlatePay

- Julien Coustaury, partner, Fil Rouge Capital

- Josip Orsolic, CEO, Lilcodelab

- Vedran Tolic, founder & CBO, Q agency

- Bozidar Pavlovic, managing director, airt

- Matej Zelic, COO, Spotsie

- Miroslav Kovac, CEO, Coffee Cloud

- Vedran Blagus, investment manager, South Central Ventures

- Daniel Stefanic, investor

Lucija Ilicic, CEO, PlatePay

Which are the most interesting startups in your city?

Photomath, Sportening, and Mindsmiths.

What are the tech investors like? What is the investment scene like in your city? What’s their focus?

Mostly revenue-oriented.

With the shift to remote working during the COVID-19 pandemic, will people stay in your city, move out, or will others move in?

People would choose to live and move here during the pandemic. Some of them did, especially having in mind that Croatia now has the digital nomad visa.

Who are the key startup people in your city? (e.g. Investors, founders, lawyers, designers, etc)

Investors: Fil Rouge Capital, Feelsgood, Zicer, Bird Incubator; Founders: Ivan Klarić, Damir Sabol, Mislav Malenica, Mate Riimac

Where do you see your city’s tech scene in five years?

The Croatian startup ecosystem really grew during last year and has huge potential. I see it as a perfect place for digital nomads, home of a few new unicorns and a European center for AI solutions development.

Can you recommend any companies that should appear in our global Startup Battlefield competition?

Sportening, Mindsmiths, and of course, PlatePay.

Julien Coustaury, partner, Fil Rouge Capital

Which sectors is your tech ecosystem strong in? What are you most excited by? What is it weak in?

Strong in fintech, automotive, insurtech, and AI. We are excited that the whole ecosystem is growing strong with flagships such as Rimac, Optimoroute, Oradian, Infobeep, Agrivi, Tvbeat, Orqa, and Bellabeat, and our relevant funding partners with us and a new PE fund that have just been creating. There is money, talent and we have unicorns in Croatia. Very few weaknesses in Croatia at the moment, especially with the current tax framework on capital gains (zero if you hold the shares for more than two years) and the digital nomad visa. A giant leap for the region!

Which are the most interesting startups in your city?

Oradian, Lebesgue, Optimoroute, Gideon Brothers, Worcon, TVbeat, Orqa, Ascalia, Epoets Society, Hoss, Jade, Miret, My Valet, Sendbee, She’s Well, Spotsie, Taia, TDA, and Twire.

What are the tech investors like? What is the investment scene like in your city? What’s their focus?

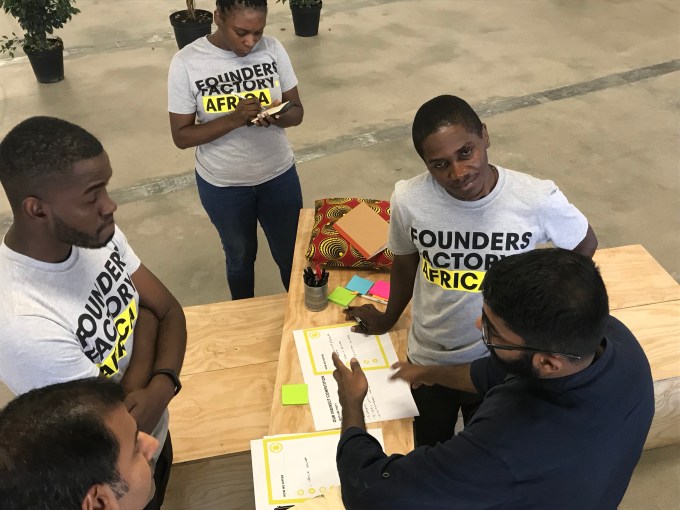

The ecosystem still a bit small to talk about the vertical focus. [We have] two active funds: SC ventures and Fil Rouge Capital. FRC runs an accelerator program along the YC model. The angel scene is a bit disappointing at the moment with not a lot of investments. Funderbeam [is] pretty active here. The quality and quantity is amazing at the moment in Croatia, probably a factor of the ecosystem being rather young.

With the shift to remote working during the COVID-19 pandemic, will people stay in your city, move out, or will others move in?

The current fiscal climate makes it very attractive for people to relocate/stay in Zagreb, no doubt. One million people here; proximity to one of the best seas in the world — all the ingredients are here to make it the beacon of the up and coming startup world!

Who are the key startup people in your city? (e.g. Investors, founders, lawyers, designers, etc)

FRC is definitely the main player in Zagreb; SC ventures, Funderbeam, Novak Law for lawyers, Algebra University, ZICER, Hub 385, Step RI.

Where do you see your city’s tech scene in five years?

No doubt a key hub in Europe on par with Vienna.

Can you recommend any companies that should appear in our global Startup Battlefield competition?

Oradian, Lebesgue, Optimoroute, Gideon Brothers, Worcon, TVbeat, Orqa, Ascalia, Epoets Society, Hoss, Jade, Miret, My Balet, Sendbee, She’s well, Spotsie, Taia, TDA, and Twire.

Josip Orsolic, CEO, Lilcodelab

Which sectors is your tech ecosystem strong in? What are you most excited by? What is it weak in?

IT, automotive, manufacturing, farming (different SaaS and IoT solutions).

Which are the most interesting startups in your city?

Rimac Automobili, Microblink, Five, Nanobit, Agrivi.

What are the tech investors like? What is the investment scene like in your city? What’s their focus?

It’s a small circle of people and not a lot of diversity, although it is getting better. Many new young successful investors emerged in the last few years.

With the shift to remote working during the COVID-19 pandemic, will people stay in your city, move out, or will others move in?

They will stay, maybe go to the suburbs, but just looking at the rental prices for flats/apartments I don’t see any shift in people moving outside of the city.

Who are the key startup people in your city? (e.g. Investors, founders, lawyers, designers, etc)

Mate Rimac, Damir Sabol, Alan Sumina, Tomislav Car, Luka Abrus.

Where do you see your city’s tech scene in five years?

I believe the tech scene is going to grow more and more. Many companies from other countries are opening up engineering hubs in Zagreb. There is a lot of talent, people are drawn to tech jobs; it is heavily covered by the media. Each success is celebrated and covered by the media, so there is a feeling that tech companies are being pushed, even though there are other successful companies from other industries.

Can you recommend any companies that should appear in our global Startup Battlefield competition?

Agrivi, Parklio, Seek and Hit, Electrocoin, TestDome, Include.

Vedran Tolic, founder & CBO, Q agency

Which sectors is your tech ecosystem strong in? What are you most excited by? What is it weak in?

Strongest: Online betting, HR solutions, fintech, mobile gaming, IoT.

Weakest: Gaming for serious platforms; AI solutions are still in their infancy.

Which are the most interesting startups in your city?

PhotoMath, Agrivi, SofaScore, TalentLyft, Jenz, and Bellabeat.

What are the tech investors like? What is the investment scene like in your city? What’s their focus?

The scene is getting stronger, but for any serious investment, startups have to look beyond our borders.

With the shift to remote working during the COVID-19 pandemic, will people stay in your city, move out, or will others move in?

Zagreb has an excellent work-life balance, and most of the talent want to stay here. Now, with the COVID-19 pandemic, it’s easier to land remote jobs and stay in Zagreb, which will positively impact our ecosystem.

Who are the key startup people in your city? (e.g. Investors, founders, lawyers, designers, etc)

Founders: We have many charismatic founders who are raising awareness around startups and entrepreneurship in general. They are reaching large audiences and getting attention from government, the education system and the public.

Where do you see your city’s tech scene in five years?

Shifting from mostly agency work for foreign companies to a more product-oriented scene — especially in AI and ML. Products will revolve around customer and employee engagement, automation and prediction of processes which are today done by a large workforce.

Can you recommend any companies that should appear in our global Startup Battlefield competition?

Photomath, Agrivi, Bellabeat, Jenz

Bozidar Pavlovic, managing director, airt

Which sectors is your tech ecosystem strong in? What are you most excited by? What is it weak in?

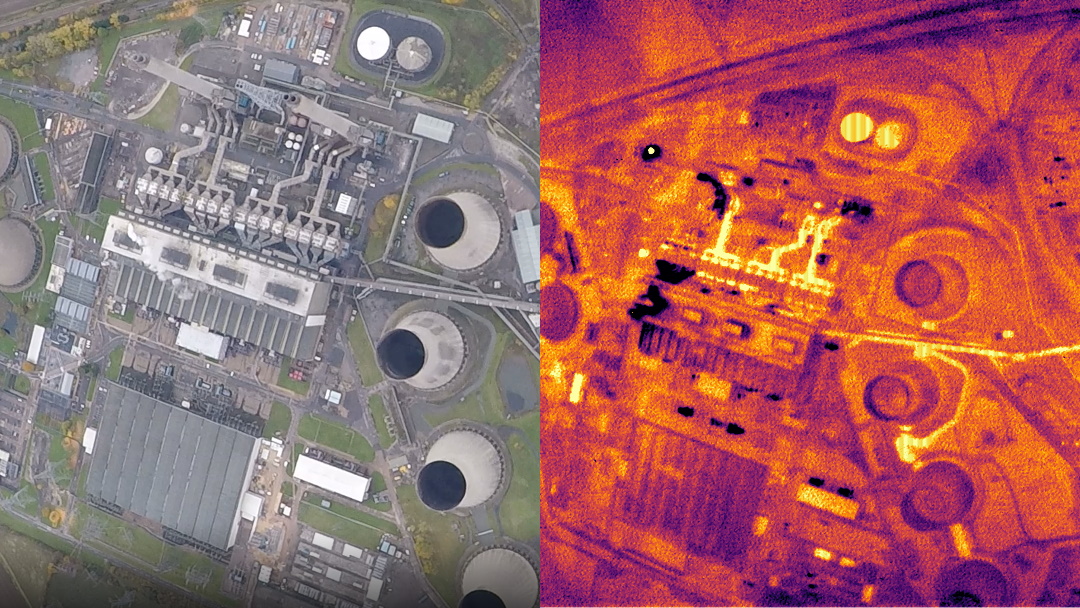

AI, SaaS, electric cars manufacturing, and software development in general.

Which are the most interesting startups in your city?

Rimac Automobili, Nanobit, Infinum, Five, Agrivi, Aircash, Identyum, Airt, Mindsmiths, Electrocoin, Agency 04, Oradian, Microblink, Photomath, Agency Q, Revuto, Optimoroute, Amodo, Lemax, Ampnet, RobotiqAI, and Velebit AI.

What are the tech investors like? What is the investment scene like in your city? What’s their focus?

The scene is growing recently — Zagreb is capital of Croatia, thus attracting capital and people. A recent near-unicorn (Rimac, with heavy investment from Hyundai and Porsche) helped raise visibility for this vibrant ecosystem.

With the shift to remote working during the COVID-19 pandemic, will people stay in your city, move out, or will others move in?

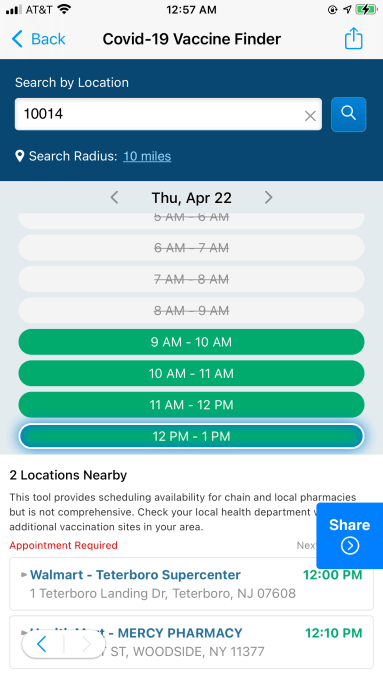

Even before the pandemic, Zagreb was very attractive for tech experts worldwide due to its appealing price of accommodation, security, comfort of living and relatively high salaries. I am expecting to see the masses return after vaccination.

Who are the key startup people in your city? (e.g. Investors, founders, lawyers, designers, etc)

Davor Runje, Nikola Pavesic, Drazen Orescanin, Frane Sesnic, Tin Tezak, Ante Magzan, and Luka Sucic.

Where do you see your city’s tech scene in five years?

I see it blooming, mostly due to upcoming adoption of EUR as a local currency.

Can you recommend any companies that should appear in our global Startup Battlefield competition?

Amodo, Agrivi, Photomath, Identyum.

Matej Zelic, COO, Spotsie

What industry sectors is your tech ecosystem strong in? What are you most excited by? What is it weak in?

Oil and energy, Industry 4.0. Most excited to be a part of digital transformation in the old-fashioned industries.

Which are the most interesting startups in your city?

Rimac, Agrivi, Oradian, Miret, SofaScore.

What are the tech investors like? What is the investment scene like in your city? What’s their focus?

The startup ecosystem in Croatia is still in early stages of development. The investment scene (except a few business angels) started a few years ago backed by EU with just two VCs (FRC and SVC) without a strategic plan and focus.

With the shift to remote working during the COVID-19 pandemic, will people stay in your city, move out, or will others move in?

People will stay here.

Who are the key startup people in your city? (e.g. Investors, founders, lawyers, designers, etc)

Fil Rouge Capital, South Central Ventures. Mate Rimac, Damir Sabol, Frane Sesnic

Where do you see your city’s tech scene in five years?

Because of micro-location, the digital nomad program, and IT talent pool, Zagreb is on the way to becoming the No. 1 tech location in CEE and Europe.

Can you recommend any companies that should appear in our global Startup Battlefield competition?

Gideon Brothers, Spotsie.

Miroslav Kovac, CEO, Coffee Cloud

Which sectors is your tech ecosystem strong in? What are you most excited by? What is it weak in?

IoT, software analytics, big data, coffee industry.

Which are the most interesting startups in your city?

Agrivi, Repsly.

What are the tech investors like? What is the investment scene like in your city? What’s their focus?

Very poor startup ecosystem.

With the shift to remote working during the COVID-19 pandemic, will people stay in your city, move out, or will others move in?

Most of the last year was in partial lockdown.

Who are the key startup people in your city? (e.g. Investors, founders, lawyers, designers, etc.)

Sasa Cvetojecic, Hrvoje Prpic, Fil Rouge Capital, Bird Incubator.

Where do you see your city’s tech scene in five years?

At the same place.

Vedran Blagus, investment manager, South Central Ventures

Which sectors is your tech ecosystem strong in? What are you most excited by? What is it weak in?

Industry is very agnostic. Most of them work in B2B or the enterprise space. They lack B2C knowledge, growth/expansion plan and investor relations.

Which are the most interesting startups in your city?

AdScanner, Agrivi, ReversingLabs, TalentLyft, Sportening, Codemap, Gideon Brothers.

What are the tech investors like? What is the investment scene like in your city? What’s their focus?

Two VCs operating – Fil Rouge Capital (Pre-Seed, Seed, Series A – industry agnostic; B2C and B2B) and South Central Ventures (Seed, Series A, B2B). In the past six to twelve months, C-level executives from corporates started investing in startups in early stages (up to EUR 200k), but keep their investments below the radar.

With the shift to remote working during the COVID-19 pandemic, will people stay in your city, move out, or will others move in?

I believe that it will stay the same as it is. Development/operations in Zagreb, expansion to other European cities by opening offices there.

Who are the key startup people in your city? (e.g. investors, founders, lawyers, designers, etc)

Founders – Matija Zulj, Marin Curkovic, Mate Rimac, Marin Saric, Alan Sumina, Matija Kopic.

Investors – Luka Sucic, Stevica Kuharski, Vedran Blagus.

Lawyers – Marijana Sarolic Robic.

Media – Ivan Brezak Brkan, Bernard Ivezic.

Where do you see your city’s tech scene in five years?

Founders who exited companies they’ve been building for the past 10 years will found new companies and/or invest in early stage startups. More international investors looking at Zagreb for pipeline/investments.

Daniel Stefanic, investor

Which are the most interesting startups in your city?

Infobip, Rimac seem to be hottest ones in Croatia.

Where do you see your city’s tech scene in five years?

There’s some incredibly smart people involved in STEM in Croatia – world class. They just need better pathways to commercialisation and access to capital.