- April 27, 2021

- by:

- in: Blog

Spotify today is officially rolling out paid podcast subscriptions, after first unveiling its new subscription platform at the company’s “Stream On” event in February. Through Spotify’s podcast creation tool Anchor, podcasters will be able to mark select episodes as subscriber-only content, then publish them to Spotify and other platforms. The service was initially tested with

Spotify today is officially rolling out paid podcast subscriptions, after first unveiling its new subscription platform at the company’s “Stream On” event in February. Through Spotify’s podcast creation tool Anchor, podcasters will be able to mark select episodes as subscriber-only content, then publish them to Spotify and other platforms. The service was initially tested with a dozen independent creators, and is now expanding to creators who had previously registered for the waitlist.

For the time being, Spotify is only opening up paid subscriptions to creators in the U.S., but it aims to expand internationally in the months ahead, it says.

The launch comes at time when the market for podcasts, and paid podcasts in particular, is heating up. Last week, Apple announced its own plan for paid podcast subscriptions through its Apple Podcasts platform, still a top destination for podcasts today.

But one key difference between Spotify’s efforts and Apple’s plan is how subscription revenue is shared.

Apple said it’s taking a 30% cut of the podcast revenue in year one, dropping to 15% in year two — the same as its cut for streaming services on its App Store. Spotify, meanwhile, says its program will come at no cost to creators for the next two years, which means creators will keep 100% of revenues. Then, in Spring 2023, Spotify plans to introduce only a 5% fee for access to the tool.

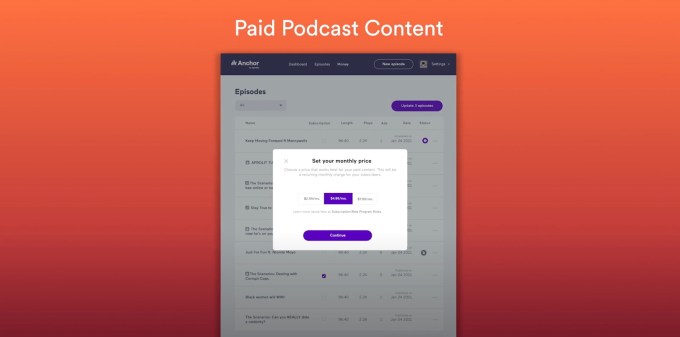

Image Credits: Spotify

The first group of 12 creators will now begin publishing the paid, subscriber-only bonus episodes to their feeds, which will be discoverable and searchable just like any other podcast episode on the platform. These paid episodes will appear in the podcast’s main feed, where they’re marked with a lock icon on the Play button. Early adopters include Wild Thing; Tiny Leap, Big Changes; and The Mindful Minute.

The cost to subscribe is determined by the creator, but will be one of thee tiers: $2.99, $4.99, or $7.99 per month.

While Spotify will allow Anchor creators to mark entire feeds as paid, if they choose, it believes the lure of the free episodes to first attract listeners is a smarter idea. Then you can upsell them bonus content. However, larger podcasts may take a different approach.

For example, Spotify has inked a deal with NPR for paid subscriptions which involves entire paid feeds. NPR will publish five shows — How I Built This with Guy Raz, Short Wave, It’s Been a Minute with Sam Sanders, Code Switch and Planet Money — that will be sponsor-free for paid subscribers starting on May 4. These shows will be branded as “Plus” (e.g. Planet Money Plus) and will live alongside the free feeds. In this case, listeners aren’t getting bonus material, but they’re supporting NPR. More NPR shows will roll out their own Plus versions the weeks ahead.

A Wall St. Journal article on Friday broke the news that Spotify’s paid subscriptions would arrive this week. And it noted that iOS users who wanted to subscribe would be routed to a website to process the transaction, avoiding Apple’s in-app purchase requirements. This could potentially be a tricky line for Spotify to toe. The company has been a chief Apple critic, testifying just last week before Congress about Apple’s anticompetitive behavior when it comes to the App Store.

Now it’s bypassing in-app purchases by directing users to go to a website and buy a subscription. The company, however, says it’s leaving the explanation up to the podcast creators.

“It’s basically up to every creator to educate their their listeners about how and where to subscribe to the podcast, and the actual subscription happens on an Anchor webpage — on the creator’s profile page on Anchor. But once you do that and you authenticate it and you come back to Spotify, it’ll be unlocked,” says Anchor co-founder Michael Mignano. He notes that the Spotify app will not actually open this webpage due to App Store rules. (Also, because Spotify isn’t take a cut of the subscription revenue for the time being, it would be protected via the carve-out for creator donations that Apple established a few years ago even if it had adopted in-app purchases.)

To use the paid podcasts feature, creators will mark their episodes within Anchor after first recording or uploading their episodes. For listeners who want to access the content on a different podcasting app, a private RSS feed will be provided after they subscribe.

Spotify is also announcing, for the first time, the Spotify Open Access Platform (OAP). This will allow creators who already have paid subscribers on other platforms — including competing services or private RSS feeds — to provide that content to current subscribers using their existing logins and billing solutions. Spotify says would help creators retain direct control over the relationship However, Spotify will re-host the content on its servers, which would give it insights into the broader paid podcasts market as a result.

The company isn’t yet ready to announce the complete details on this solution, but says it will have some news in the week ahead.

In addition to the roll out of paid podcasts, Spotify says it’s opening up its audio ads marketplace, the Spotify Audience Network (SPAN), to independent podcasters using Anchor. This is another area where Spotify is differentiated from Apple. On Apple Podcasts, creators are responsible for selling their own ads, so they keep 100% of the revenue.

Spotify, by comparison, has invested in ad technologies with the goal of serving the podcast audience. The company had previously unlocked Megaphone’s inventory (a 2020 acquisition) via the network, but is now making SPAN available to select Anchor creators, as well. The company says it will begin with a group of 50 creators on May 1, then expand over time.