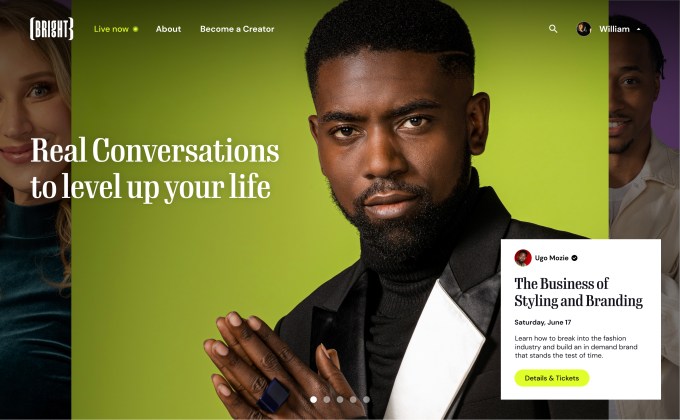

What if you could Zoom with your favorite creator and ask them questions? That’s the promise of Bright, the new live video platform launching today from co-founders Guy Oseary and early YouTube product manager Michael Powers. The service, built on top of Zoom, allows fans to engage in live, face-to-face video sessions with creators, ask

What if you could Zoom with your favorite creator and ask them questions? That’s the promise of Bright, the new live video platform launching today from co-founders Guy Oseary and early YouTube product manager Michael Powers. The service, built on top of Zoom, allows fans to engage in live, face-to-face video sessions with creators, ask questions and even join creators on a virtual stage for a more personal and direct learning experience.

Though the startup has some similarities to voice chat apps like Clubhouse, as it also democratizes access to big-name talent at times, the co-founders explain that Bright’s focus will be very different. Besides being a video-on experience, Bright is solely focused on educational content — that is, learning from people who are sharing their expertise with the community. In addition, the sessions hosted on Bright are ticketed events, where the creator decides how many tickets they want to sell and how much they’re charging.

Image Credits: Bright

“Twenty percent of the content on YouTube was learning. It was the second-biggest area next to music. And that was true the first year of YouTube and it’s true now at scale,” explains Bright CEO Michael Powers, as to why Bright has chosen to focus on learning. Powers knows the creator industry firsthand, having launched the YouTube Channels feature while at YouTube, and later managed YouTube’s first revenue-generating opportunities for creators. More recently, he served as SVP and GM at CBS Interactive.

Powers says he saw how powerful educational and learning content could be, but also how difficult it was for creators earning a rev share off an ad network, like YouTube’s, to become self-sustainable.

“I watched that over the past five years, especially, as the different platforms have scaled up,” Powers says, and became inspired to launch a better way for creators to monetize their expertise. “We’ve got to empower [creators] so they can go beyond just being a personal brand or social brand, and be an actual business,” he adds.

Oseary, meanwhile, was tooling around with a similar concept, having also had direct experience with creators in the music industry and through his investments. The founder of Maverick music management company, Oseary continues to manage Madonna and U2, but these days has his hands in numerous startups as the co-founder of Sound Ventures and A-Grade Investments with actor Ashton Kutcher.

Though Oseary and Powers have yet to meet in person, they connected over the web — much like Bright’s creators will now do — to get the new startup off the ground during a pandemic.

With today’s launch, Bright is promising a lineup of more than 200 prominent creators, many from the arts, including Madonna, Ashton Kutcher, Naomi Campbell, Shawn Mendes, Amy Schumer, D-Nice, the D’Amelio Sisters, Laura Dern, Judd Apatow, Deepak Chopra, Diplo, Kenny Smith, Kane Brown, Drew and Jonathan Scott (Property Brothers), Lindsey Vonn, Rachel Zoe, Diego Boneta, Tal Fishman, Ryan Prunty, Demi Skipper, Charlotte McKinney, Jason Bolden, Yris Palmer, Cat & Nat, Ronnie2K, Chef Ludo Lefebvre and Jonathan Mannion, among others.

And it has another 1,500 creators on a waitlist, ready to begin hosting their own sessions when Bright opens up further.

Image Credits: Bright session example

Although Bright’s lineup implies it’s aiming at a high-profile creator crowd, Oseary insists Bright will be for anyone with an audience of their own — not just famous names.

“This is not elitist…If you’ve got an audience and you have something to offer your audience, we would like you on the platform,” he says.

Today, creators can go to other social networks, like Facebook Live or Instagram Live, if they want to just chat with fans more casually. But people will come to Bright to be educated, Oseary notes. And short of getting a creator to FaceTime you directly, he believes this will be the next best way to reach them — and one people are familiar with using, thanks to the Zoom adoption that grew out of the pandemic’s impact to business culture and remote work.

“The best way to connect is to use a platform that we’ve all learned how to use this last year,” Oseary says, referring to Bright’s Zoom connection. “We all already have the app. We already know how to navigate through it. We’ve added a bunch of features to make it more interesting,” he adds.

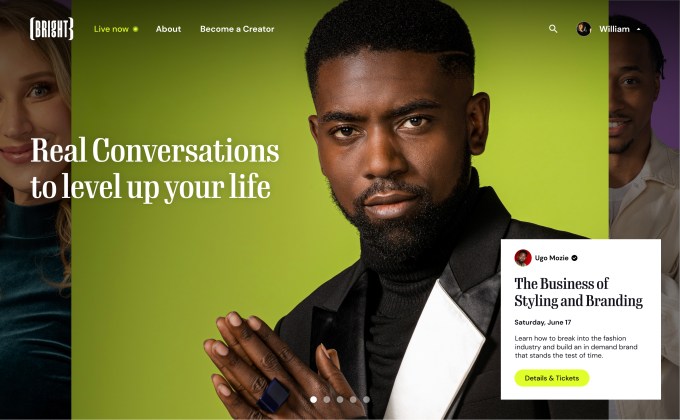

Image Credits: Bright

At launch, fans will be able to visit Bright’s website, view the array of upcoming events and purchase tickets. Some of the first sessions include Laura Dern leading a “Tell Your Story” session about personal growth; Kenny Smith will interview favorite athletes and discuss their mindsets at turning points in their careers; Property Brothers Jonathan & Drew Scott will host “Room by Room,” focused on home improvement; recording artist Kane Brown will host “Record This: Nashville Edition” about the country music industry; and Ronnie2K will host a series about building a career in gaming.

Bright’s model will see it taking a 20% commission on creator revenue, which is lower than the traditional marketplace split of 30/70 (platform/creator), but higher than the commission-free payments on Clubhouse (at least for the time being!). Further down the road, Bright envisions building out more tools to help creators with other aspects of their business — like the sale of physical or digital goods, for example.

Though there are numerous creator platforms to choose from these days, Bright aims to give creators direct access to their own analytics about their biggest fans, their content and fans’ contact information, like names and emails. This allows them to continue their relationship with their community beyond Bright into other areas of their business — whether that’s email newsletters or Shopify stores.

To make all this work, LA-based Bright has recruited a team with deep expertise in both the creator economy and tech.

This includes Bright’s VP of Talent & Partnership, Kaitlyn Powell, former head of Talent at Caffeine; Bright’s lead Creator & Product Strategy, Sadia Harper, formerly a UX Strategist at Instagram; Bright’s director of Creative Programming, Jeben Berg, previously of YouTube & Maker Studios; Design lead Heather Grates, previously of Pinterest; and Bright’s finance lead Jarad Backlund, previously in roles at Apple and Facebook.

The startup has raised an undisclosed amount funding from Oseary’s own Sound Ventures, as well as RIT Capital, Norwest, Globo and other investors.