- June 1, 2021

- by:

- in: Blog

Online fraud and identity theft is a global problem that has only been exacerbated with increased online transactions amid the COVID-19 pandemic. In particular, it is estimated that Brazilian companies lose over $41 billion due to fraud every year. In an attempt to tackle this problem head on, Lincoln Ando and Raphael Melo started idwall

Online fraud and identity theft is a global problem that has only been exacerbated with increased online transactions amid the COVID-19 pandemic. In particular, it is estimated that Brazilian companies lose over $41 billion due to fraud every year.

In an attempt to tackle this problem head on, Lincoln Ando and Raphael Melo started idwall in mid-2016. São Paulo-based idwall started as an automated background check solution and has since grown into a suite of data and identity validation and risk analysis products. For the consumer market, its “MeuID” app is aimed at users who want to change the way they identify themselves and share their data.

And now the Brazilian regtech has raised $38 million in a Series C round led by Endurance.

GGV Capital, monashees, Canary, Qualcomm Ventures, ONEVC, Peninsula and Norte also participated in the funding, bringing its total raised to nearly $50 million.

The company says it has grown 1,458% between 2017 and 2020, with average growth of 144% per year. Its more than 300 clients include 10 unicorns, two out of the three biggest banks in Brazil and companies such as iFood, Claro, Cielo, Loggi, Ebanx, QuintoAndar and OLX, among others.

Fintechs make up a significant portion of its client base, and in 2020, the company saw its revenue from clients in the financial industry alone climb by 588% compared to 2019.

Idwall uses machine learning and AI to automate the onboarding process via its face match, background check, risk analysis, ID validation and automated optical character recognition (OCR) offerings to help companies avoid fraud.

The company said its APIs verify personal documents and information by searching in public and private databases “quickly and pursuant to the compliance rules.” Idwall does all this by first validating that an ID is authentic. Then it works to ensure the person using it is actually the owner of the ID. And lastly, it runs a full background check. It claims it does all this in less than three minutes.

“We help them do all these onboarding processes in a safer, better and faster way,” said idwall co-founder and CEO Ando.

Over the years, idwall has generated more than 65 million data reports for its clients, a number that it says surged by 5,000 times between 2017 and 2020.Those reports, it claims, have helped its clients scale their operations, register more of their own clients and optimize compliance and KYC processes, as well as reduce fraud.

Image Credits: idwall

In general, the pandemic’s drive to digital led to a massive increase in the number of digital bank accounts, mobile payment services and also of companies adjusting to digital platforms and/or expanding their digital operations — leading to a boom in business for idwall.

“The more digitized companies become, the more client expectations grow — and market competition grows stronger,” Ando said. “Our mission is to always stay ahead of innovation in our market, and that’s why we invest so much in growth and in building the best possible team to develop our products.”

Part of that includes using its new capital to recruit more developers, strengthen its existing products and release new ones. Idwall plans to increase its headcount from its current 200 to about 300 over the next few months. The company is also examining the possibility of expanding outside of Brazil to all of Latin America.

“Many of the identity validation and fraud problems faced in Brazil are seen in other Latin American countries as well,” Ando said. “Besides, places like Mexico and Colombia also have highly innovative companies pushing the envelope when it comes to identity and technology. We still have a lot to achieve in Brazil, but we see a big opportunity for us to take our mission even further.”

Still, in its home country, recent regulatory changes in Brazil in recent years have also led to an increase in demand for idwall’s offerings.

In addition, Brazil’s documentation databases are highly siloed, the company says, with each state having its own model for the most common identity document, the RG (“Registro Geral” or “General Registry”). Plus, each citizen can be issued a different RG document in each state.

“It’s undeniable how much digital onboarding and automated identity validation processes are fundamental for the Latin American market to reach as far as it has the potential to,” Ando said. “It’s extremely difficult to understand and validate identification and personal data in Brazil.”

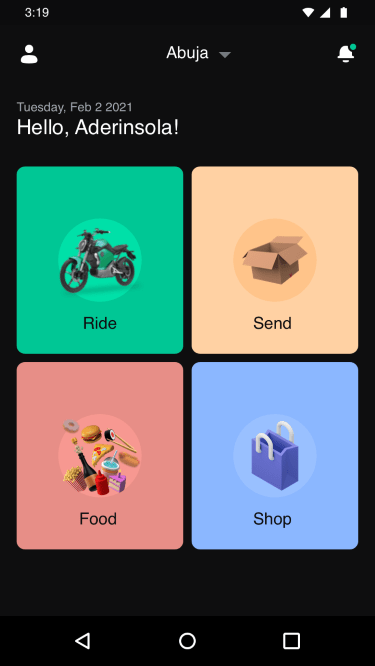

Also, in general, the company has observed how weary Brazilians are of having to show their IDs for routine events. Idwall helps with that via its aforementioned “MeuID” solution, which stores in a single wallet all the documents necessary for the onboarding processes of fintechs, startups, office buildings and other businesses.

Its investors are, naturally, bullish.

Hans Tung, GGV Capital’s managing partner, describes idwall as a “one-of-a-kind” startup.

“idwall is leading the discussions and innovations in Brazil regarding digital onboarding and identity validation,” he said. “And their B2C digital identity app MeuID could be the first true super-app in Latin America.”

GGV aims to invest in category leaders that are using technology to create positive impact for its users and for society, Tung added.

“The idwall founders are tackling a huge yet underserved problem in Brazil, and have led the company through terrific growth,” he said. “They have the ingredients to become the leading personal data platform in LatAm for the enterprise.”

Marcos Toledo, managing partner at Canary, notes that idwall was one of his firm’s first investments.

“Lincoln and Raphael’s abilities to build and scale a business solving a very relevant problem in Brazil have caught our attention,” he told TechCrunch. “Their culture, tech level and agility as a company also are very remarkable in the Brazilian market.”