- July 1, 2021

- by:

- in: Blog

Hepsiburada — Turkey’s giant online shopping platform considered the Amazon of its country — floats on the Nasdaq today, for a valuation likely to exceed $3.9 billion on current projections, especially with shares being marked up to $14 apiece (up from the previously predicted $12 pricing). Bu this isn’t the end of the journey for this break-out Turkish tech and e-commerce

Hepsiburada — Turkey’s giant online shopping platform considered the Amazon of its country — floats on the Nasdaq today, for a valuation likely to exceed $3.9 billion on current projections, especially with shares being marked up to $14 apiece (up from the previously predicted $12 pricing). Bu this isn’t the end of the journey for this break-out Turkish tech and e-commerce company, for long-time founder and chairwoman Hanzade Doğan Boyner – who started the business in 1998 no less, and still has overall control of the company – considers this closer to a growth round of funding, enabling her ambitious plans to mine Turkey’s fast-developing market even further, as well as expand into Central and Eastern Europe. Doğan Boyner, a scion of the powerful Doğan family in Turkey, continues to hold three-quarters of the voting power in the company, according to the prospectus filed to the SEC.

Hepsiburada’s IPO comes after it more than doubled its revenue during the pandemic, as Turkey’s largely offline population was forced to switch to online shopping in what might well be characterized as a sort of enforced ‘Great Leap Forward’ for the country.

Hepsiburada (which translates as “everything is here”) is also making history as the first-ever Turkish, NASDAQ IPO.

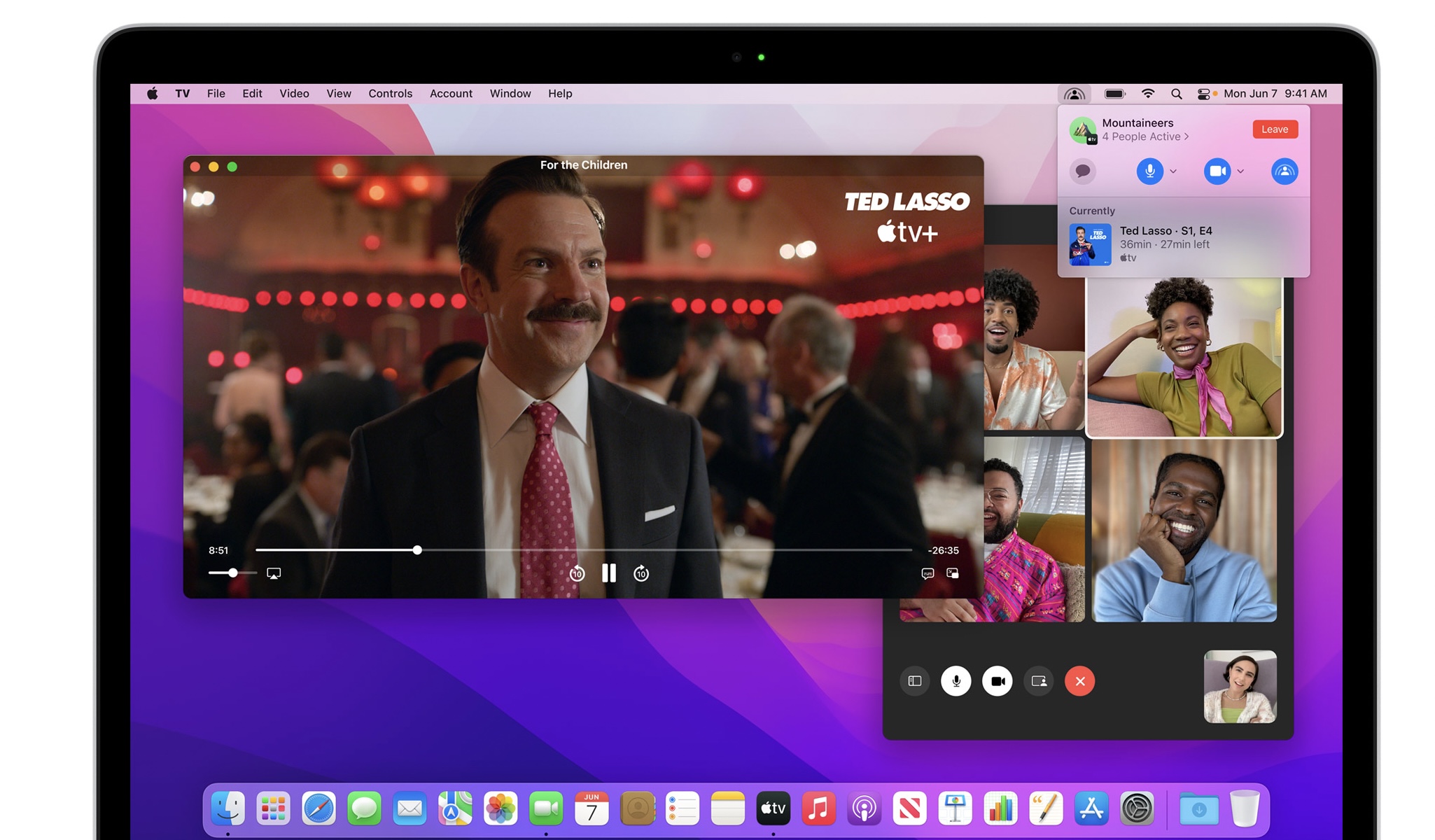

With a massive logistics platform spread across Turkey, the company now offers 2hr deliveries, with around 43 million products available on the platform, available from a more Chinese-like ‘super-app’ which can offer everything from groceries to flights, to payment services, via is ‘Alipay-like’ service called Hepsipay. And in Turkey, many people prefer to buy things on installments, a service Hepsiburada has pre-built into its platform.

Turkish people have also enjoyed its frictionless returns, where goods can be returned for free, involving a super-efficient logistics network.

After growing at about 50% year on year for the last five years, the company says it doubled in size last year, taking advantage of the exponential growth in Turkey’s e-commerce penetration into its 82 million-strong population.

The IPO comes after a mere $100m was invested in the platform over the last 20 years, and a profit-making period until 2018 when Doğan Boyner started investing more in the platform, prior to this moment.

TC: What brought you to this moment in time in terms of the IPO?

Doğan Boyner: “Almost 20 years ago I started with e-commerce and from day one we built it with new features, new services, and today we manage a fully integrated ecosystem, from last-mile delivery to payment to groceries. Hepsiburada is the super app that makes our customer’s lives easier. They can get their groceries or their toys for next-day delivery or flight tickets. Why are we listing now? Because the Turkish e-commerce market is at 10% penetration, and we believe that its penetration will double by 2025. It’s an inflection point. It’s a large market, and as Hepsiburada we are a pioneering platform reaching maturity towards becoming a public company. With the funds raised through the IPO, we will accelerate our growth and continue to execute our vision.”

TC: “Are you satisfied with the $3.9 billion valuation?”

Doğan Boyner: “Today’s valuation is not very important for me. It’s not where you start, it’s where you go. I’m not selling any shares, and this is primarily for growth funding. This is just the beginning. You know, the market is still low penetration, and we have an exciting journey ahead of us. I want the stock to perform well for my investors, but what the value today is irrelevant for me.”

TC: “You’re going to use some of this funding to add on new products onto the platform like booking flights or money transfers and other kinds of new products, what are some of the other kinds of expansion plans you have?”

Doğan Boyner: “One is to continue building our infrastructure, such as frictionless returns, which gives such peace of mind to our consumers. The second is Hepsi Express. It’s still only at 4% penetration. This will change the consumer’s grocery shopping habit because we have such a strong model where we partner with a lot of national chains, regional chains, Mom-and-Pop shops, so we turn those stores into our ‘dark stores’. Plus we sometimes do our own picking from the stores or sometimes the retailer does the picking. So the customer offering is very strong. You can get something in half an hour, or you can schedule it for next day, whenever you want. You can do the weekly shopping, or just get something for that night. Express is an area that we will scale. Payment is another focus. We are the only platform with a payments license. Soon it will be an open wallet and our Fintech capabilities will increase post IPO.”

TC: Are you following a sort of Alibaba / Alipay strategy?

Doğan Boyner: “We will leverage our current customers and marketplace, and we will turn them into our wallet customers. Super apps don’t really exist in Europe or the US. So it’s our vision to digitalize commerce. We are in our customer’s pocket. We want to make life easier for them.”

TC: “How did you shift operations during the pandemic?”

Doğan Boyner: “We almost became a lifeline, not just for consumers but for our merchants as well. So we rose to the occasion to not only scale operationally. We had to onboard 1000s of drivers and employees, very, very fast, but we also had to secure the well-being of our employees. While all of us were isolating we had to ask our employees to work, which, which I think we’ve done a very, very good job of, in terms of providing PPE, and providing health coverage. It was a chance to live up to our values. Our consumers experimented with us as new consumers, and they’re happy with the service so they will stay with us and our merchants appreciated us as well, because in a time when their shops were closed, they could generate revenues through us.”

TC: You’ve been a big advocate of women in your company and also in your country, you’ve created many programs for women and girls and engaged in a great deal of advocacy. Where do you feel you are on that journey?

Doğan Boyner: “Half far our workforce is female, 33% of our management is female – which should be 50%! Our woman entrepreneur program has been very impactful. We tell women entrepreneurs to come, we will teach you ecommerce, we will onboard your products, we will give you free shipping, we will prioritize your products or listing pages, we will give you real estate on our home page. Some 19,000 women have benefitted from this. Women have sent me their inspiring stories. They start small and hire two people, and then they create their own brands. Having said that, when I look at where we are in terms of gender equality globally, the needle doesn’t move much. You look at the number of CEOs in the FTSE 500, the number doesn’t change. So, I will keep doing whatever I can, because every ‘small drop’ counts. And hopefully, it will. I also think there should be a new conversation, a global conversation about gender equality in general. The 19,000 women who benefited from our program became economically more empowered. They gained skills and tools and confidence to trade on a platform like Hepsiburada, which is very meaningful.”

TC: Are you concerned that perhaps your success may attract the attention of government regulation in Turkey, in the future?

Doğan Boyner: “We are considered a national champion. Turkey has different dynamics. I think it’s an inspiration that national champions can come out and be successful.”

TC: You’ve been very hugely successful, you’re a big advocate for women in your country, do you have any political aspirations?

Doğan Boyner: “No.”