News: Frame streamlines finding a therapist and builds a one-stop shop for private practices

Therapy is rapidly becoming a standard part of many people’s lives, but 2020 interrupted that trend by nixing in-person sessions and forcing therapists to migrate their entire practice online — and it turns out that’s not so easy. Frame simplifies it with an all-in-one portal for clients and therapists, unifying the listings, tools and management

Therapy is rapidly becoming a standard part of many people’s lives, but 2020 interrupted that trend by nixing in-person sessions and forcing therapists to migrate their entire practice online — and it turns out that’s not so easy. Frame simplifies it with an all-in-one portal for clients and therapists, unifying the listings, tools and management software that run the countless small businesses making up the industry.

Kendall Bird and Sage Grazer are old friends who happened to be in the right place at the right time — a strange thing to say about anyone anywhere at the start of 2020, but it’s true. The startup’s pitch of bringing your practice entirely online and offering all-online sessions, bookkeeping, scheduling and everything turned out to be exactly what would soon be needed — though as they tell it, it has actually been needed for some time.

Grazer, a therapist herself, experienced firsthand the unexpected difficulties of getting up and running.

“When I started my practice in 2016, I was really passionate about the clinical work, but I was very overwhelmed by setting up a business, marketing, financial stuff,” she said. “So we wanted to help other therapists through that.”

She and Bird happened to reconnect around that time and the two saw an opportunity to improve things.

“We think about therapists as being a one-on-one thing, but they’re really a small business,” said Bird, who formerly worked in marketing at Snapchat, Google and YouTube. “They’re underserved and undersupported as mental health professionals — they don’t have the back-office support that doctors do, and they’re not trained how to run businesses. It just made sense to build a scalable SaaS solution that lets these people work for themselves.”

The therapy industry, like other medical institutions, has two sides: client-facing and practitioner-facing. While there are a handful of services online that combine these, many essentially recruit therapists as contractors. If you want to run your own practice, you’ll likely be using a combination of specialty scheduling, telehealth, billing and other tools made with medical privacy considerations in mind.

“The therapy tools and services landscape is incredibly fragmented — the average therapist is using 5-7 tools, and most of those are not built for therapy,” said Bird.

And then of course there’s Psychology Today: a periodical that straddles the roles of pop psych and industry rag, but whose chief reason for existing for many is its voluminous therapist listings, which dominate search and provide an overwhelming first stop for anyone looking to find one in their area. But for such a personal and consequential decision these brief listings don’t give wary potential clients the impression they’re making an informed choice.

“We wanted an experience that was more approachable, uses language that doesn’t feel overwhelming or pathologizing,” said Grazer. “There are people going to therapy feeling alone and confused, who don’t identify with a disorder or checking a check box.”

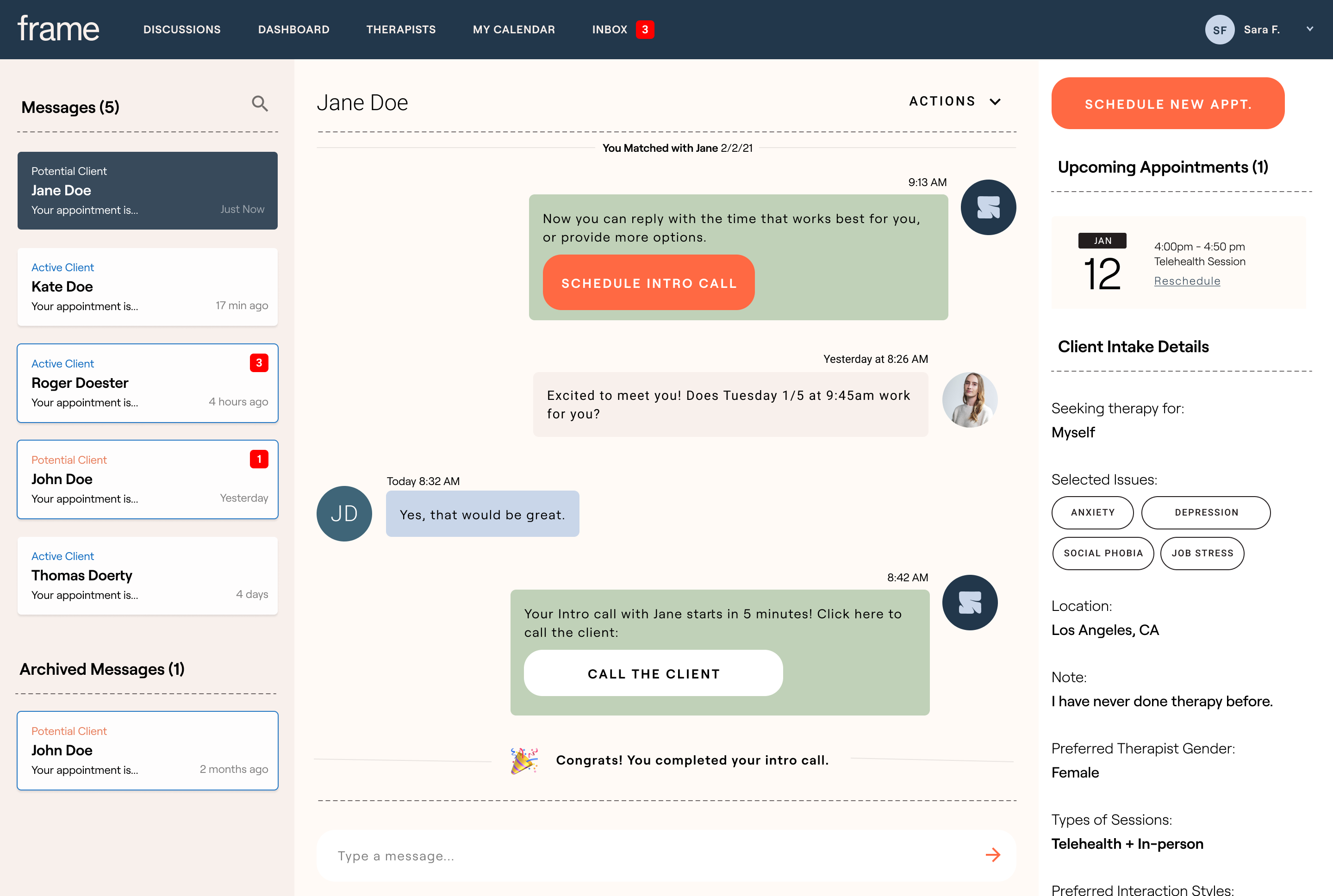

Frame eschews the oversimplified “scroll through therapists near your area code” with a short quiz — not a diagnosis or personality test but just a few basic questions — that winnows down your choices to a handful of local and appropriate therapists, with whom you can instantly set up free introductory video calls. If you find someone you like, the rest of the professional relationship takes place on Frame, though of course soon in-person sessions may return.

For those not quite ready to take the plunge, the company organizes livestreamed sessions between volunteers and therapists to show what a full hour of work might look like. (Whatever courage it may take to confront one’s issues in therapy, it surely takes even more to do so with an audience.)

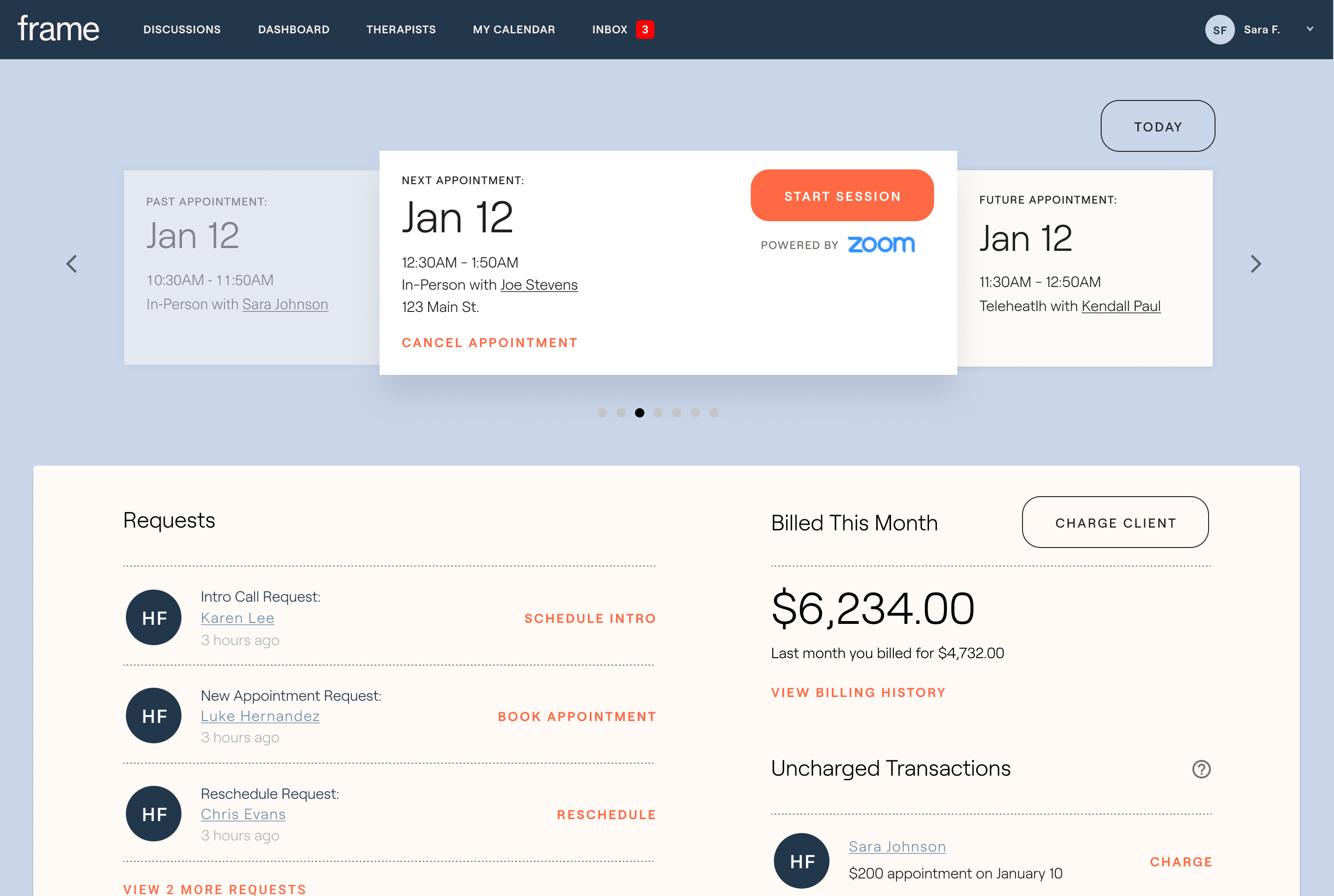

On the therapist’s side, Frame is meant to be a one-stop shop. Marketing and telehealth sessions are on there, as noted above, but so are things like scheduling, notes, billing, notifications, and so on, all tailored specifically to the needs of the industry. And while the shift to online services has been a long time coming, the company just happened to drop in just as the need went into overdrive.

“We built it before COVID ever existed — launched in March 2020 and had telehealth as an option, thinking ‘oh, well maybe some people will do this.’ The majority of therapists in America weren’t doing sessions online at the time… but after COVID they all are,” Bird said. “And they’re looking for these tools now because they’re seeing the rewards of running a lot of their business through telehealth.”

Many therapists are finding that after resisting the transition for years, they are encountering all kinds of benefits, explained Grazer. Like other industries, the flexibility inherent to shifting in-person meetings to virtual ones has been freeing and in some cases profitable. The change is here to stay.

The site is in a closed beta limited to a part of California at present, since therapists are limited to operating in-state and there are other regulations to consider, not to mention all the usual struggles of putting together a sprawling professional service. But the $3 million funding round, led by Maven Ventures, will help fill out the product and move the company toward a larger audience. Sugar Capital, Struck Capital, Alpha Edison and January Ventures participated in the raise.

The money is “almost exclusively going to engineering.” The goal is to open up the beta, expand to the rest of California, then move out to other states once they have the infrastructure to do so and have responded to feedback from the initial rollout.

“Sage and I are really aligned in the belief that the best way to make therapy more accessible to America is to support therapists,” said Bird.