News: Dodge Challenges: Can the automaker bring muscle into the electric future?

The term muscle car has always been a euphemism for concessions. Want the most power for the money? Forget about a sports car from Porsche or Lotus. Buy a muscle car and just take corners a bit slower. Today Dodge announced it’s making an electric muscle car and it will be available in 2024. The

The term muscle car has always been a euphemism for concessions. Want the most power for the money? Forget about a sports car from Porsche or Lotus. Buy a muscle car and just take corners a bit slower. Today Dodge announced it’s making an electric muscle car and it will be available in 2024. The first question that comes to mind: well, if it’s a muscle car, what’s missing?

There’s a difference between a muscle car and a sports car, and Dodge is uniquely suited to know the differences. The brand has long been associated with horsepower and going fast in a straight line. The Dodge Viper. The Dodge Challenger. Even the Dodge Durango, a lumbering SUV, is available with a tricked-out V8 capable of putting out 710 hp — more power than most Porches, though no one is about to pit a Durango against a 911 on the track.

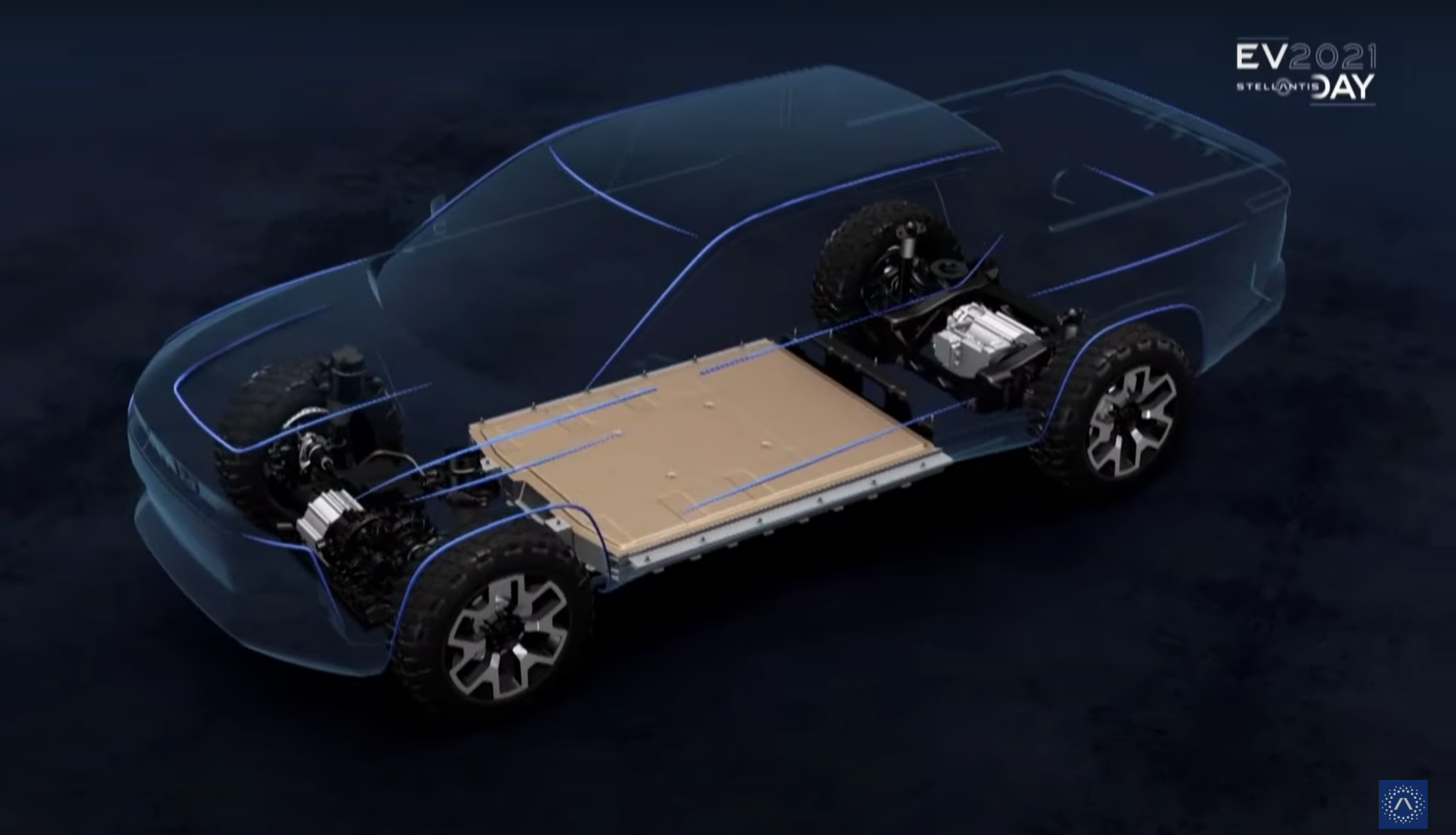

Part of the draw of electric vehicles revolves around their mechanical simplicity. That was the original sales pitch for the muscle car, too. But, instead of offering a sports car with a tuned chassis and remarkable aerodynamics, which adds significant development cost, American car companies just stuffed larger engines in everyday family cars. Bam. Muscle cars, baby.

Let’s assume Dodge uses the muscle car mold and makes a low-cost, high-power, straight-line electric racer — think Dodge Challenger rather than Toyota Supra. This mold has several distinct characteristics.

One, burnouts. Muscle cars are known for their burnouts, which themselves are a byproduct of an overabundance of power, lack of chassis refinement and utter disregard for your tires’ tread. Dodge teased this capability in its announcement tweet, showing a vehicle smoking all four tires. Dodge knows its audience.

Muscle car owners expect to be able to tune, tweak and modify their vehicles at home. That’s one of the main appeals to this type of vehicle. Straight from the factory, muscle cars are capable, but the buyer understands the automaker omitted certain parts to keep the sticker price as low as possible. Want better traction? Swap out the tires. Want better cornering? Add stiffer sway bars. An electric muscle car must be modifiable — something that’s increasingly rare as performance is more often optimized through software tweaks than mechanical upgrades.

Tesla has long been criticized for its aversion to vehicle modifications and at-home repairs. This is an opportunity for Dodge and others. A large swath of car buyers expect to be able to wrench on their vehicles, and I’ll wager this demographic is critical to Dodge’s future growth.

These unique characteristics of muscle cars are what make the segment so appealing for Dodge. The auto brand struggles to keep up with the market with a stable of stale vehicles, and the muscle car’s low-cost formula could allow for cheaper development costs.

And keeping development costs low is what Dodge needs right now.

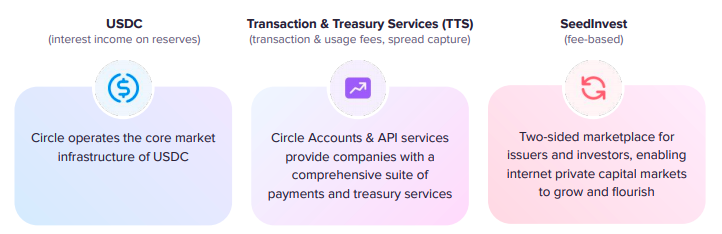

Dodge is owned by Stellantis, a new automobile conglomerate formed when FCA, Dodge’s old owner, merged with the Dutch automaker PSA Group. It gets more confusing when Dodge’s previous owner is mentioned. Once always mentioned along with the giants of GM and Ford, Chrysler previously owned Dodge but is now just another brand in the Stellantis family. Together, Dodge and Chrysler offer only six vehicles, and none have seen significant updates in years.

An electric muscle car could revitalize the brand in the same way the Bronco is revitalizing Ford.

Look at Ford. The 2021 Bronco is a hit because it lines up nicely with consumer’s expectations of a Bronco. People hardly remember the engine and chassis issues that were long associated with the Bronco. Instead, people remember a durable off-roader (and slow car chases), so Ford made a durable off-roader loaded with modern conveniences.

Dodge should do the same with its upcoming electric muscle car. But, of course, calling a vehicle a muscle car sets certain expectations that Dodge would be wise to deliver.

Likewise, Ford is also selling a four-door electric Mustang, and its heavily rumored Chevrolet is preparing a similar electric SUV Corvette. While most people love the electric Mustang (I don’t), they also concede the Mustang naming muddles the branding.

What is it going to be called? Automakers are increasingly turning to their back catalog for new branding. GM revived the Hummer for its first electric truck, and Ford brought back the Bronco and F-150 Lightning. Dodge has a lot of history with muscle cars. There’s the legendary Charger Daytona (perfect if the upcoming car is built on the current Charger or Challenger), the low cost Coronet and its upgraded sibling Coronet Super Bee, the Dodge Stealth, or Dodge Polara — though maybe Polara is too close to the EV maker, Polestar. Or Dodge could turn to names used by Plymouth, another brand previously owned by Chrysler. So there’s the Plymouth Roadrunner, Duster, Fury, and Barracuda, too.

Last question: How will Dodge make the car sound like a muscle car? Hopefully, they won’t. I’m here for feeling performance rather than hearing it — and I drive a big F-150 with a custom exhaust.

#StellantisEVDay2021 | Timothy Kuniskis: “@Dodge will not sell electric cars, it will sell American eMuscle” https://t.co/adpUdnY5hy

— Stellantis (@Stellantis) July 8, 2021