News: As edtech evolves, LatAm reskilling platforms raise millions to bring outcomes into the mix

As Latin America attracts record-breaking venture capital totals, education technology startups in the region are given new opportunities to grow. In the past week, Coderhouse, a live cohort-based learning platform, and Crehana, an on-demand skills development service for the enterprise, both announced financing rounds. The back-to-back raises are a reminder that edtech’s relevance in LatAm isn’t

As Latin America attracts record-breaking venture capital totals, education technology startups in the region are given new opportunities to grow. In the past week, Coderhouse, a live cohort-based learning platform, and Crehana, an on-demand skills development service for the enterprise, both announced financing rounds.

The back-to-back raises are a reminder that edtech’s relevance in LatAm isn’t just growing in classrooms, but also within organizations across LatAm. It’s a sign that both consumers and employers believe in the importance of reskilling in today’s new, ever-changing future of work.

Broad but better

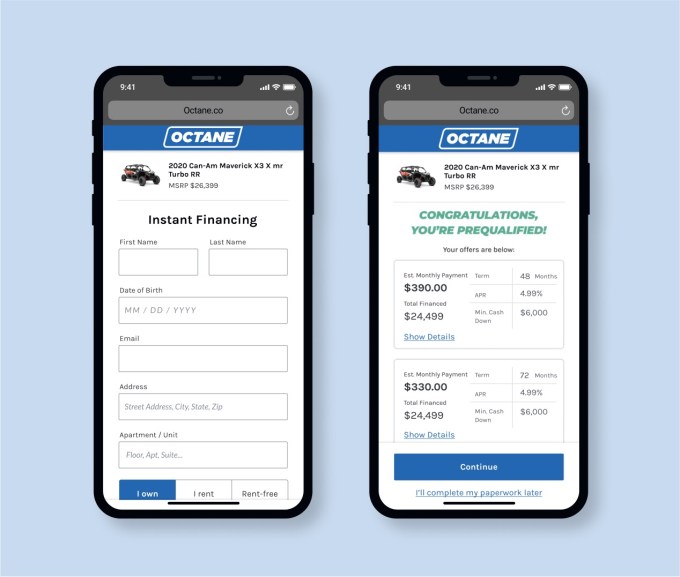

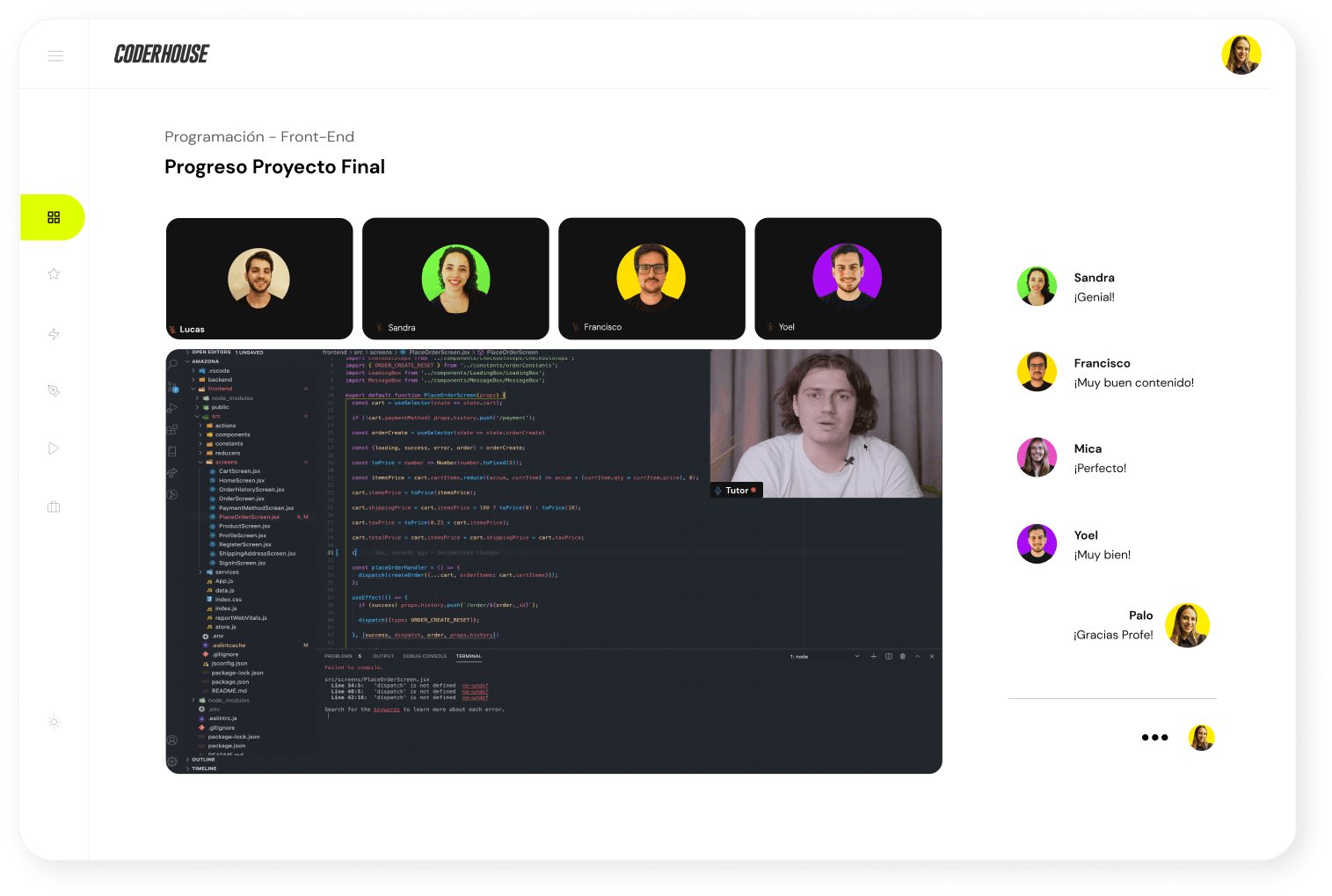

Coderhouse, founded in 2014 by Christian Patiño, is a platform for LatAm professionals to take live, online cohort-based courses in topics such as data, coding, design and marketing.

Patiño explained how the original online education platforms, also known as MOOCs, are “super accessible,” with low completion rates. The response to this then became boot camps, which he deems are “way more effective” but inaccessible due to low acceptance rates and high costs. With both sides of the spectrum in mind, he wants Coderhouse to sit somewhere in the middle, combining the affordability of MOOCs (massive open online course providers) and the engagement of bootcamps.

At $100 per course, Coderhouse offers small-group classes led by instructors and teacher assistants, with curriculum designed through partnerships with top companies.

The company announced this week that it has raised a $13.5 million Series A round led by Monashees, along with Reach Capital, David Velez from Nubank, Guillermo Rauch from Vercel, Hugo Barra (former head of VR at Facebook) and the founders of Loggi, Rappi, Wildlife Studios, Méliuz, MadeiraMadeira, Cornershop, Bitso, Casai, Clara, RunaHR and Belvo.

It’s Coderhouse’s first venture capital check after bootstrapping for years. Since 2019, Coderhouse has grown revenue 10x year over year, and has reached a $12 million run-rate. Now, with formal backing, the founders are focused on growing that total by offering more services in Latin America. Patiño said that 80% of their revenue comes from Argentina, and the capital resources will help them grow their 21,000 student base to other countries.

The startup serves a variety of students, including people who are looking for new jobs, people who want to get promoted within their current companies and entrepreneurs and freelancers who want to master a business-imperative skill such as marketing or copywriting. The broadness in early adopters could make it hard for the company to provide outcomes at scale — someone looking to be promoted has very different needs than someone who is looking for a new job — but for now, it’s helping the early-stage company find its voice.

The round was the first LatAm investment for Reach Capital, a U.S.-based edtech firm. Partner Esteban Sosnik explained how Coderhouse’s strategy is a response to LatAm’s talent bottleneck, as digital momentum in the region continues and roles change. He believes the broadness of Coderhouse’s offering makes it “tough to define one definition for outcomes.”

Sosnik thinks that graduation rates are a good proxy for impact and student satisfaction. So far, 90% of users who pay for Coderhouse graduate from their course, and of that cohort, 80% of students claim that salaries increase post-graduation. Down the road, he could see Coderhouse offering more data on the long-term economic impact of how taking a course can impact job trajectory two to four years down the line.

Coderhouse UX. Image Credits: Coderhouse

The company has no filters that limit students from taking courses, so it maintains quality by rigorous vetting of teachers. The founder estimates that only 8% of teachers are accepted to teach on Coderhouse’s platform, resulting in nearly 2,000 active teachers with the company today.

A challenge for the startup will be scaling its teacher assistant [TA] to student ratio. Right now, there are 20 students to one TA, and Patiño wants to introduce more peer-to-peer work and grading to limit how labor intensive a class is for instructors.

As Coderhouse figures out how to be an affordable bootcamp for aspiring and current employees, Crehana is finding its stride in going straight to the companies that employ them.

Centralize it all

Crehana is a one-stop shop for employers to retrain their employees. Where it goes niche in clientele focus, it goes broad in services: It wants to do the “entire value chain” of learning, from assessing skill gaps to offering content to address weak spots to tracking progress. Right now, there are more than 400 instructors/mentors that teach over 700 courses across 100,000 techniques and competencies needed for jobs.

Crehana announced today that it has raised a $70 million Series B just months after a $13 million Series A extension round. Per CEO Diego Olcese, the round will lead to “aggressively scaling” an offering that now accounts for half of Crehana’s revenue: Crehana for Business.

Crehana for Business is an enterprise solution packaged for a specific company looking to up-skill a portion of their staff. Crehana will continue to offer individual seats on its learning platform, but Crehana for Business illustrates what Olcese sees as the future: the centralization of education as a focus within companies.

“We’re building this so companies can understand the end-to-end process of employee development in the company, from the onboarding process to when an employee gets promoted in their job,” he said. “We are centralizing that management for HR teams.”

Diego Olcese, founder of Crehana. Image Credits: Crehana

It’s a big bet, one that Udemy has been working on for years. The San Francisco-based platform launched an enterprise product that now has over 7,000 customers, hitting near $200 million in annual recurring revenue. Crehana didn’t disclose specifics around revenue, but did say that it had 10x year over year growth in Crehana for Business, with the overall business hitting 4x year over year growth; both metrics are between 2019 to 2020.

Olcese said that Crehana’s biggest difference from Udemy is in how it handles content. Crehana produces, designs and publishes all content on its site, and selects which teachers will instruct on which topics. Comparatively, Udemy has a more open marketplace that allows anyone to start teaching after their identity is verified.

Crehana’s hands-on content strategy makes sense, but is hard to scale; and content isn’t competitive forever. This tension is why the company thinks its future looks more like Crehana for Business, which uses content as part of a broader infrastructure on how employees are skilled, instead of looking like a content provider.

As it works toward becoming an education infrastructure layer, Crehana is experimenting with technology that would allow companies to create their own content that isn’t just localized to geography, but is tuned into personalities, management structures and more.

As for if it ever wants to become a company that would help Nubank, a LatAm fintech darling valued at $30 billion, create its own mini-university to train and up-skill employees, the founder was clear: “It’ll be better than a university,” he said.

The Venn diagram in between them both

Generally speaking, Crehana and Coderhouse’s pair of financings show that investors see LatAm’s digital transformation having a fundamental, long-tail impact on edtech adoption within regional companies. The question then becomes, which is the best way to serve a newly hungry group of learners, and what is the easiest answer for employers’ biggest stresses: unqualified candidates.

The two companies differ in strategy. Coderhouse, for example, believes in delivering education en masse and through affordable chunks. By using cohort-based methodology, the startup helps consumers work on specific skills that can help in a variety of different scenarios, from promotions to finding new jobs. Meanwhile, Crehana believes that going in-house with institutions could be the sweet spot needed to make true change. It is focusing on localized content as an initial moat, but long-term it thinks that employers need a simple way to track employees as they learn, retain and engage with new skills. The company may look more like a learning infrastructure than a content provider.

While the strategies look different in sales, both build off of current strides in edtech, not limited to but including the ability to learn online, the understanding that lifelong learning is a key competitive advantage for professionals.