- August 6, 2021

- by:

- in: Blog

This past decade, Nigeria has seen several companies cater to the development and growth of software engineers and tech talent in general. It’s a space many in the Nigerian ecosystem like to think is budding yet overcrowded. So when Chika Nwobi started Decagon in 2018, the perception was generally “here comes another tech talent accelerator.”

This past decade, Nigeria has seen several companies cater to the development and growth of software engineers and tech talent in general. It’s a space many in the Nigerian ecosystem like to think is budding yet overcrowded.

So when Chika Nwobi started Decagon in 2018, the perception was generally “here comes another tech talent accelerator.” Two years on, the entrepreneur who is a household name has significantly scaled the company to new heights.

Today, Decagon is announcing its $1.5 million seed round and a student loan financing facility of $25 million from Nigerian financial institution Sterling Bank.

As a serial founder, Nwobi ran a couple of tech businesses, most notably mobile internet company MTech in the early 2000s. With Decagon, Nwobi is charting new territory in the fast-paced startup world after years of investing via his seed-stage firm called L5Lab.

Nwobi says Decagon aims to address the underrepresentation of black people in tech globally, starting with Nigeria. The West African country is the most populous on the continent and the most populous black nation globally.

The dire need for tech talent in Nigeria has become more evident these days, where startups are raising venture capital at a ridiculous pace. Youth unemployment in the country is at a staggering 50%, and while tech has presented an avenue to create jobs, supply isn’t catching up with demand. And more worrisome is the fact that the country’s best talents are leaving in droves to foreign companies in the U.S, Canada, the U.K., and Germany.

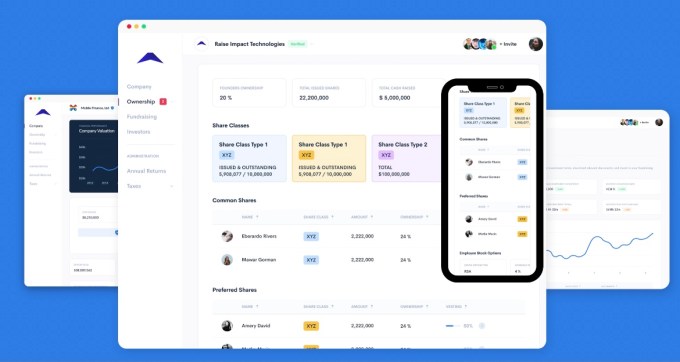

So the issue really is supply. If supply is fixed, everyone is happy. That’s what Decagon hopes for by training and connecting engineers to work remotely with both local and international companies. “Microsoft, Facebook and Google have all invested in building engineering offices in Nigeria, but most other companies can’t afford to do that, so we help them access top talent to work as remote engineers,” Nwobi said.

Decagon runs a six-month software engineering program and selects its candidates based on merit. It’s a paid program, and the software engineers are expected to pay about N2 million (~$4,000) tuition to get in. Then, the company employs an income-sharing model when the engineers find work and start earning upon graduation.

But what if the trainees can not afford the program in the first place? The student loan financing takes care of that, and students who take that option are expected to repay N3 million (~$6,000) in the space of three years.

The company claims to be the first to create such merit-based loan financing for students in Nigeria. The financing is in partnership with the financier Sterling Bank and Nigeria’s apex bank, the Central Bank of Nigeria (CBN). It allows Decagon to offer a Pay-After-Learning plan that provides the trainees with laptops, accommodation, internet, meal allowance and a stipend. No upfront payment is expected, says the company.

Decagon says while more than 80,000 people have applied to partake in its program, it has accepted only 440 candidates. That’s a 0.55% acceptance rate. However, Nwobi discloses three figures to show the company is on the right track: the company has recorded a 100% placement rate for its trainees, a 100% loan repayment rate, and a 410% salary increment made by its software engineers after getting placement.

Global tech talent company Andela employed this model before pivoting, and while it didn’t work for them, it seems to be working for Decagon. The reason is likely because Andela used equity financing to carry out these operations, whereas Decagon uses debt.

Obinna Ukachukwu, the divisional head of Sterling Bank, commenting on the student loan financing, said, “We got involved to support alternative education by providing loans for Nigerian students complemented with financial literacy training. Based on the excellent performance of the current portfolio, it made sense to scale our support to Decagon.”

For its equity financing, Decagon raised money from Kepple Africa and Timon Capital. Some angel investors like Paul Kokoricha, managing partner of the private equity business of ACA, and Tokyo-based UNITED Inc., also took part.

Nwobi says Decagon operates at the intersection of edtech, fintech and the future of work, and the funds will be used to scale its efforts on the three fronts. The company will also be looking to deepen gender inclusion by increasing female participation in its cohorts from 25% (its current stats) to 50% in the next three years.

The CEO adds that the company which he refers to as a “tech talent catalyst” is profitable and growing at 500% per annum. “We see this capital as fuel to accelerate our mission to transform exceptional people, often from under-represented backgrounds, into world-class engineers by connecting them with financing, in-demand skills and their dream jobs.”

“We’re thrilled to work with Decagon to build up the top 0.5% of vetted engineering talent in Africa and help connect them to global tech opportunities. The frequency of engineering leaders from US and European companies in our network ask about sourcing African and Nigerian technical talent has increased at a rapid clip, and we’re excited to lean into that and help Decagon on their mission,” partner at Timon Capital, Chris Muscarella, said in a statement.

Decagon’s raise comes when there is general skepticism about the viability of tech talent accelerators on the continent despite their apparent need.

Before Andela changed its model, it was a clear market leader with over $180 million in its arsenal. Since it’s pivot, funding has relatively stalled for most of these companies. Maybe Decagon’s student loan financing method will be the new trendsetter in a space that desperately needs investment to solve Africa’s talent problem.