News: Apple prohibited from blocking outside payment in Epic ruling

A judge this morning issued a ruling in California’s Epic v. Apple case, siding with the Fortnite maker on the topic of third-party payments. Effectively, the judge has ruled that Apple cannot prohibit developers from adding links for alternative payments beyond Apple’s App Store-based monetization. The mobile giant’s control over fees on iOS has long

A judge this morning issued a ruling in California’s Epic v. Apple case, siding with the Fortnite maker on the topic of third-party payments. Effectively, the judge has ruled that Apple cannot prohibit developers from adding links for alternative payments beyond Apple’s App Store-based monetization.

The mobile giant’s control over fees on iOS has long been a sticking point for Epic and the veritable cash cow of its in-gaming micro-transactions.

The ruling notes, in part,

Apple Inc. and its officers, agents, servants, employees, and any person in active concert or participation with them (“Apple”), are hereby permanently restrained and enjoined from prohibiting developers from (i) including in their apps and their metadata buttons, external links, or other calls to action that direct customers to purchasing mechanisms, in addition to In-App Purchasing and (ii) communicating with customers through points of contact obtained voluntarily from customers through account registration within the app.

The decision is the result of a fight that’s been brewing for years between Apple and larger developers, particularly in gaming, whose businesses account for a hefty majority — 70%, the judge noted — of App Store revenue.

After Apple banned Epic Games’ Fortnite app for its implementation of a new payment mechanism that allowed it to bypass Apple’s in-app purchase framework last August, the game maker sued Apple, alleging it was abusing its market power by forcing companies to use Apple’s payment systems. Epic Games also sued Google and joined up with other app developers to form the Coalification for App Fairness, a group that actively lobbied for app store reform, including by involving itself in individual efforts to generate legislation at the state level in the U.S.

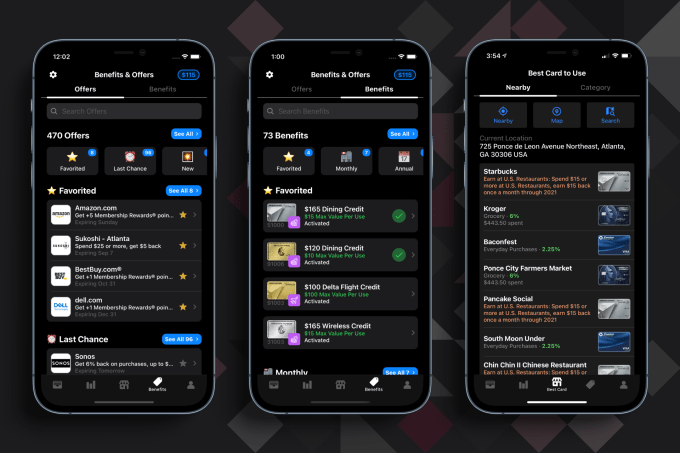

In recent weeks, Apple has made a few minor tweaks to its App Store rules as the result of concessions related to other lawsuits and legislation, which included a settlement with a Japanese regulator that saw the tech giant change its policies for “reader apps”– apps that provide access to purchased content — that would allow them to point users to their own website where users could sign up and manage their accounts. Another settlement gave developers permission to use customer contact information collected inside their app to tell customers about other payment options. And in South Korea, a new law forced Apple and Google to allow developers to use their own third-party payment systems. After the passing of that law, Epic Games asked to reinstate Fortnite to the App Store in that market, but Apple rebuffed that request.

Apple’s ongoing refusal to adapt its App Store rules to the changing environment, it has historically argued, is about consumer protections. In prior statements, allowing alternative means of in-app purchases could put users at risk of fraud and undermine their privacy, the company has said.

While today’s ruling will force Apple to now accommodate developers by allowing them the choice to include buttons or links to other places where they can pay, it still won in the sense that it was not deemed a monopoly. U.S. District Judge Yvonne Gonzalez Rogers had disagreed with how both Apple and Epic Games have framed the relevant market, saying that in digital mobile gaming transactions, Apple did not have a monopoly.

“While the Court finds that Apple enjoys considerable market share of over 55% and extraordinarily high profit margins, these factors alone do not show antitrust conduct,” Rogers wrote. “Success is not illegal.”

“Today the Court has affirmed what we’ve known all along: the App Store is not in violation of antitrust law,” an Apple spokesperson said. “As the Court recognized ‘success is not illegal.’ Apple faces rigorous competition in every segment in which we do business, and we believe customers and developers choose us because our products and services are the best in the world. We remain committed to ensuring the App Store is a safe and trusted marketplace that supports a thriving developer community and more than 2.1 million U.S. jobs, and where the rules apply equally to everyone.”

Today’s ruling may have longer-term implications for the developer community, as Apple will have to adjust its rules to accommodate apps that point to other payment options. It could choose to require apps to include Apple’s own in-app payments option as an option, for example. It could also decide that qualifying “reader apps” as a separate category no longer makes sense, given this new requirement. But those sorts of decisions will roll out in the days ahead.

What Epic Games didn’t win is getting Apple dubbed a monopolist, which is ultimately a much bigger deal with ramifications that could have led to U.S. government regulations. And Apple will not have to allow third-party app stores or sideloading, which could have been far more disruptive to the long-term prospects of its App Store business as a whole. For consumers, however, it means the App Store could get more complicated as they’re forced to exit apps to make purchases or to get better pricing. And when consumers use outside payment systems, they’ll lose the ability to manage all their subscriptions in one place, potentially making cancellations more difficult.

As a result of the lawsuit, Rogers ruled that Epic Games will have to pay Apple the 30% of the $12 million it earned when it introduced its alternative payment system in Fortnite, which was then in breach of its legal contract with Apple.

Following the decision, Epic Games CEO Tim Sweeney tweeted that Fortnite will return to the App Store when and where it can offer in-app payment in “fair competition with Apple in-app payment,” and would pass along the savings to consumers.

“Thanks to everyone who put so much time and effort into the battle over fair competition on digital platforms, and thanks especially to the court for managing a very complex case on a speedy timeline,” he wrote. “We will fight on.”