News: 5 Reasons to need to go to TC Sessions: SaaS 2021

We’re thrilled that TC Sessions: SaaS 2021 is just slightly more than a month away on October 27. You have purchased your event ticket, right? No? Well then, it’s time to get your rhymes-with-SaaS in gear. Bonus: You’ll save $100 if you buy your pass before October 1 at 11:59 pm (PT). What’s that? You

We’re thrilled that TC Sessions: SaaS 2021 is just slightly more than a month away on October 27. You have purchased your event ticket, right? No? Well then, it’s time to get your rhymes-with-SaaS in gear.

Bonus: You’ll save $100 if you buy your pass before October 1 at 11:59 pm (PT). What’s that? You need a bit more convincing? Fair enough and listen up.

TC Sessions are a special kind of TechCrunch event. We take one topic and devote an entire day (or sometimes two) and explore the latest trends, challenges and possibilities. And we always focus on the early-stage founders hard at work building or reinventing the sector.

So, what can TC Sessions: SasS do for you? Here are five reasons why attending isn’t just essential — it’s imperative.

- Expand your knowledge base

The defacto software for the B2B and B2C crowd, SaaS is rapidly expanding and constantly evolving to meet ever-increasing demand. How do you scale effectively? What’s your plan to keep company and customer data safe at a time where security threats proliferate faster than bacteria?

You’ll hear from and engage with the leading voices in SaaS on these and other topics like Data, Data Everywhere and Automation’s Moment Is Now. Take a look at our still-growing event agenda.

“Attending TC Sessions helps us keep an eye on what’s coming around the corner. It uncovers crucial trends so we can identify what we should be thinking about before anyone else.” — Jeff Johnson, vice president of enterprise sales and solutions at FlashParking.

2. Network for opportunity

Thousands of SaaS-y people from around the world will attend, and that means infinite possibilities for collaboration and opportunities. The following real-world example comes out of TC Sessions: Mobility, provided courtesy of Karin Maake, senior director of communications at FlashParking.

“TC Sessions isn’t just an educational opportunity, it’s a real networking opportunity. Everyone was passionate and open to creating pilot programs or other partnerships. That was the most exciting part. And now — thanks to a conference connection — we’re talking with Goodyear’s Innovation Lab.”

3. Connect with founders or investors

Early-stage founders in search of funding and VCs in search of promising startups — it is ever thus, and you’ll find each other at TC Sessions: SasS. Take advantage of CrunchMatch, our AI-powered platform that makes finding and connecting with the people you most want to meet simple and efficient.

Start a conversation and see where it leads. It’s one big reason why Rachael Wilcox, creative producer, Volvo Cars makes it a point to attend TC Session events.

“I go TC Sessions to find new and interesting companies, make new business connections and look for startups with investment potential. It’s an opportunity to expand my knowledge and inform my work.”

4. Connect with community

Building a startup can be a lonely pursuit, even without a pandemic. Spend a day with your people — explore the startups in the demo area, talk shop with other founders and engineers, learn the latest trends, hear SaaS icons share their journey and insight. In short, get inspired to keep at the Sisyphean task of building your empire.

“TC Sessions is definitely worth your time, especially if you’re an early-stage founder. You get to connect to people in your field and learn from founders who are literally a year into your same journey. Plus, you can meet and talk to the movers and shakers — the people who are making it happen.” — Jens Lehmann, technical lead and product manager, SAP.

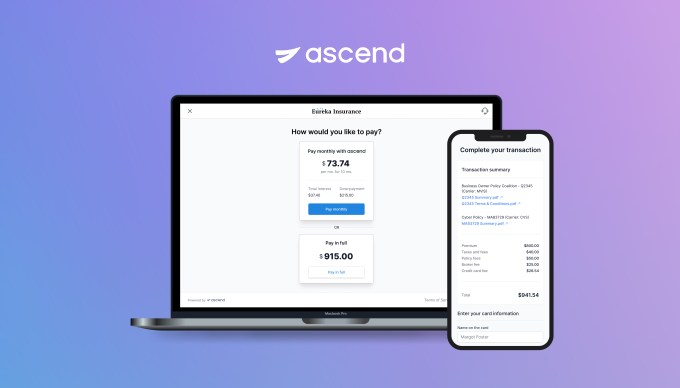

5. Discover new and exciting startups

Speaking of that demo area, we’ve got 10 outstanding early-stage startups ready to show you their latest and greatest. Marvel at your colleagues’ ingenuity, start a conversation, schedule a product demo. Who knows, you might join forces and create a little SaaS magic.

TC Sessions: SaaS 2021 takes place on October 27. Whether you pick one of our reasons, all five or come up with your own, buy your pass before October 1 at 11:59 pm (PT), and you’ll save $100.

Is your company interested in sponsoring or exhibiting at TC Sessions: SaaS 2021? Contact our sponsorship sales team by filling out this form.