News: Front introduces customer-centric features with deeper CRM integration

Customer communication platform Front is holding an event today to introduce three new features. These new features focus on showing you more information about your customers right from Front’s user interface. If you’re not familiar with Front, the company started as a shared email inbox product so that you can interact with incoming emails as

Customer communication platform Front is holding an event today to introduce three new features. These new features focus on showing you more information about your customers right from Front’s user interface.

If you’re not familiar with Front, the company started as a shared email inbox product so that you can interact with incoming emails as a team. For instance, if your company uses email lists, such as support@companyname.com, sales@companyname.com or jobs@companyname.com, multiple team members can see incoming emails in Front.

Before replying, you can triage conversations by assigning them to specific team members, discuss the current conversation in the comment section or show your email draft before sending it.

Over time, Front has evolved to integrate more communication channels. You can now use Front for SMS conversations, live chat on your website with your customers, Facebook messages, etc. The company has also refined its product with more powerful features.

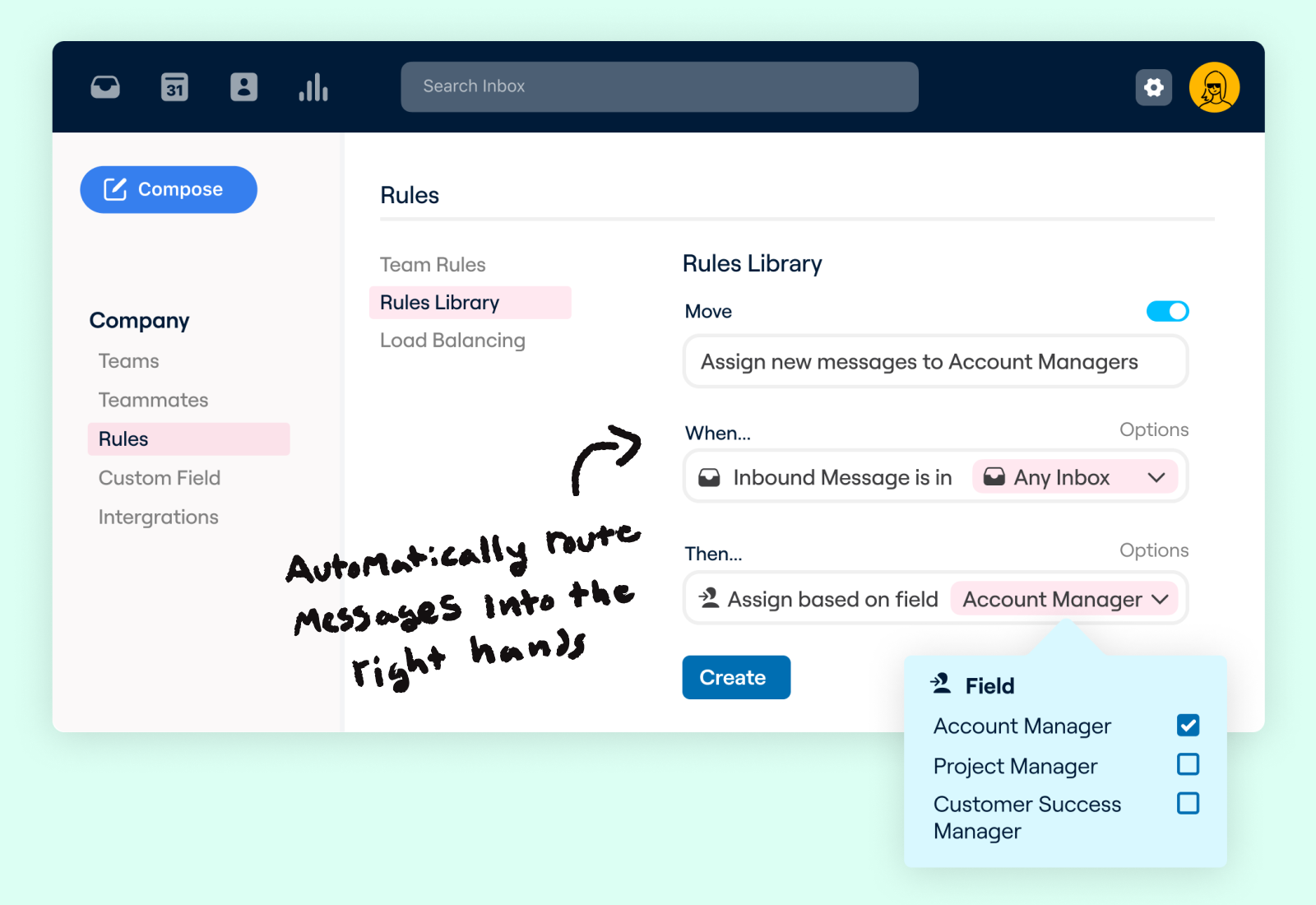

For instance, you can set up rules to automate your workflow with simple ‘if this then that’ rules. It’s a good way to spread out work across multiple team members and make sure the right person sees the incoming message as quickly as possible.

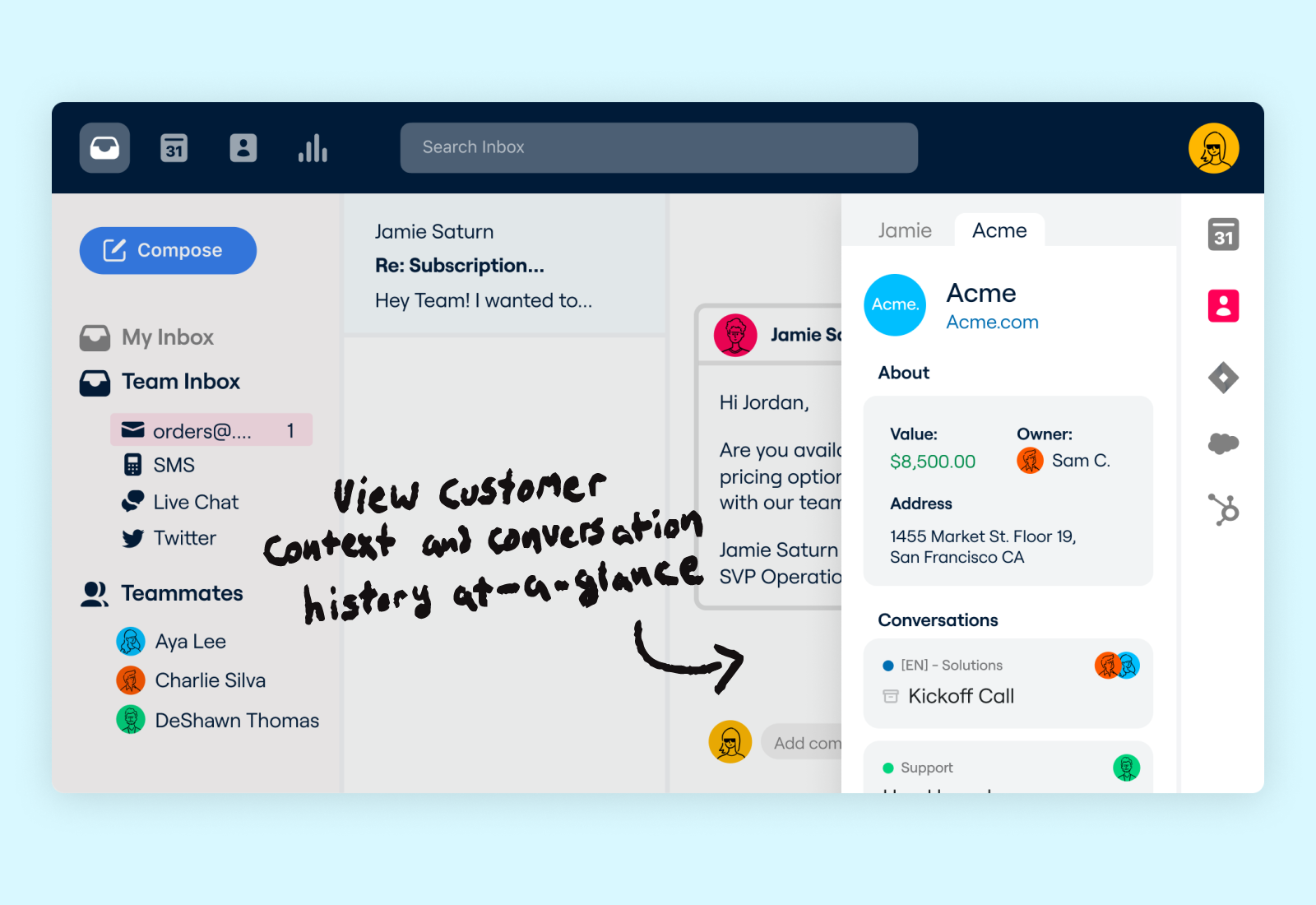

Today, the company is showcasing features that will be particularly useful for teams that interact with bigger customers, such as sales, support and customer success teams. First, Front users will be able to learn more about the customer they’re interacting with directly from their inbox.

The refreshed context panel works better if the team is interacting with multiple people working for your client. Instead of viewing past conversations with someone in particular, you can view past conversations with everyone working for this client.

Front already integrates with your CRM, such as Salesforce or HubSpot. You can now more easily pull data into the context panel. You can see the name of the account owner, the customer segment and the SLA (service-level agreement) commitment with this customer.

Image Credits: Front

Second, Front is adding new capabilities for its automated routing feature with deeper integrations with your CRM. For instance, you can find the name of the account owner in your CRM and assign incoming emails to the account owner directly.

If the account owner changes in Salesforce, rules will be automatically updated in Front. You can also fetch annual revenue data from your CRM and set a VIP tag if you’re receiving a message from an important customer.

Image Credits: Front

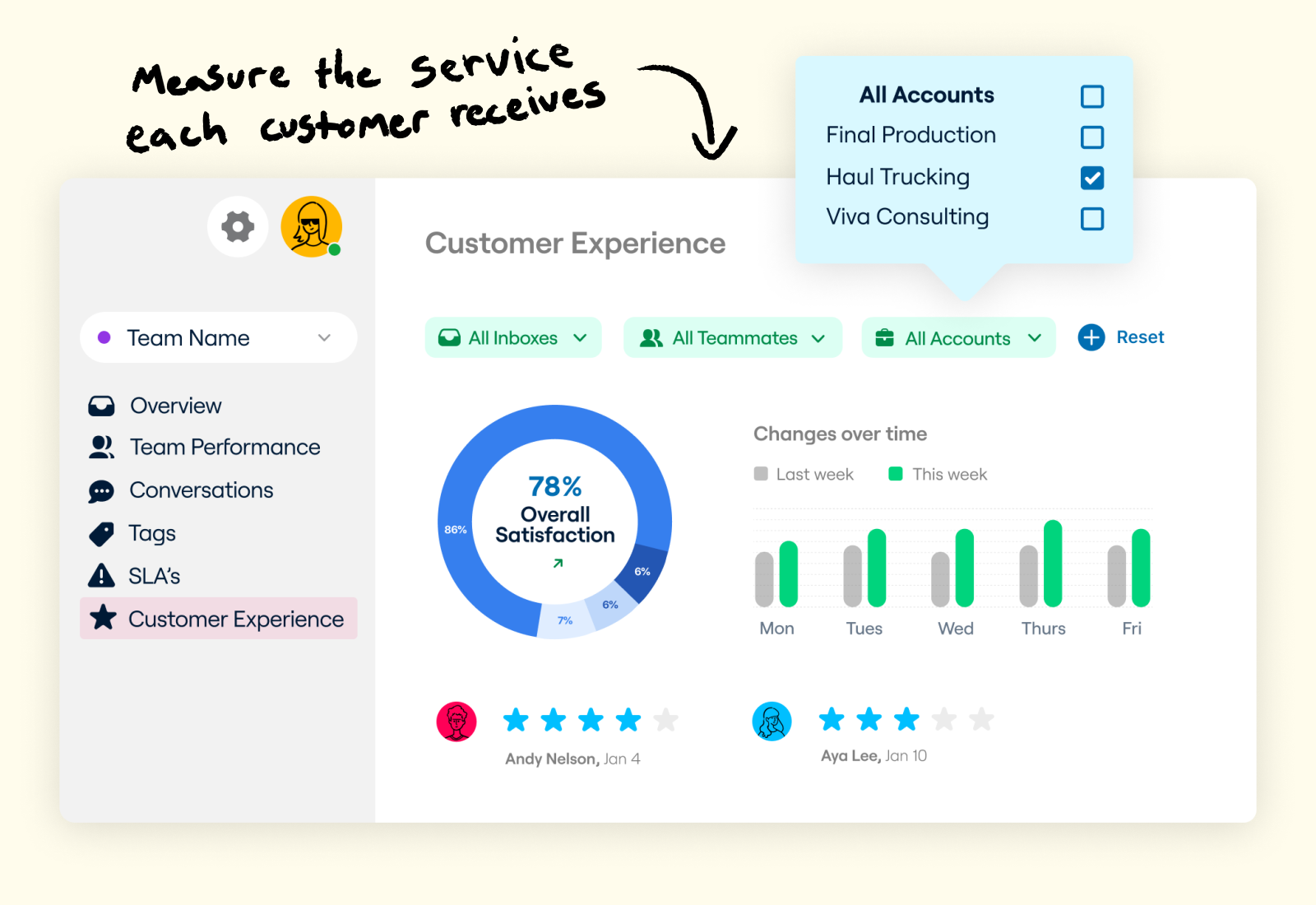

Finally, Front will soon upgrade the analytics pages. For instance, you can track the team’s performance for a specific account and compare that to the SLA.

These updates position Front as a tool that works better for bigger enterprise clients with expensive B2B contracts. Current Front customers include Shopify, Dropbox, Flexport, Checkout.com, Lydia and Airbnb.

Image Credits: Front