- September 16, 2021

- by:

- in: Blog

Concreit, a company that wants to open real estate investing to a broader group of people, announced today that it has closed $6 million in a seed funding round led by Matrix Partners. Hyphen Capital also participated in the round, in addition to individual investors such as Betterment founder and CEO Jon Stein; Andy Liu,

Concreit, a company that wants to open real estate investing to a broader group of people, announced today that it has closed $6 million in a seed funding round led by Matrix Partners.

Hyphen Capital also participated in the round, in addition to individual investors such as Betterment founder and CEO Jon Stein; Andy Liu, partner at Unlock Venture Partners; and investor and advisor Ben Elowitz. Concreit raised the capital at a $22.5 million post-money valuation.

The Seattle-based startup also today launched its app, which it claims allows “anyone” to invest in the global private real estate market for as little as $1.

It’s a lofty claim. But first let’s start with some background.

Concreit is not the first time that co-founders Sean Hsieh and Jordan Levy have worked together. The pair previously founded and bootstrapped VoIP communications platform Flowroute before selling it to West Corp. in 2018. Upon the sale of that company, Hsieh and Levy set out to build a company that, in their words, “could help everyday people become more financially secure.”

Hsieh, a second-generation immigrant, worked in his family’s restaurant where they shared the dream of achieving financial freedom through real estate. Similarly, Levy says he grew up watching his parents build a small construction business from scratch. He was intrigued by the idea of passive income through single-family rental homes but became disillusioned with the overhead, risk and hassle of managing one’s own single-family rental investments.

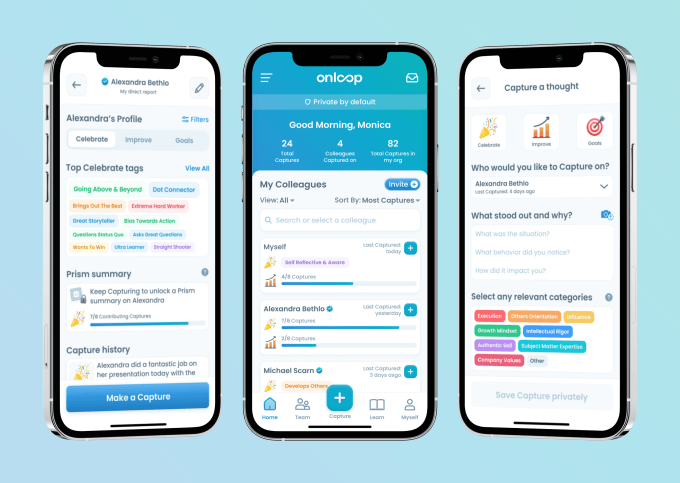

So the duo worked together to design a mobile-first offering that could enable small investors to benefit from real estate “without the burden of making repairs at 2 a.m. on a Saturday.” Enter Concreit.

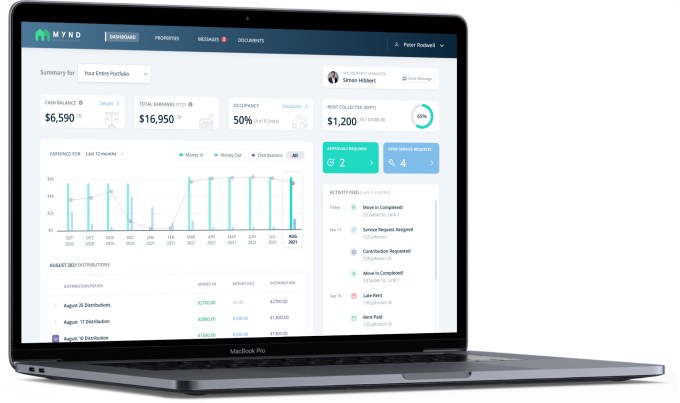

Today, most investors can open a Concreit account and make their first investment in just minutes on their mobile device, the company claims. The company’s free mobile app allows consumers to invest as little as $1 into a fund managed by a team of investment professionals. Withdrawals can be requested at any time through the app and sent upon approval.

The platform facilitates weekly earned payouts, automated investments and on-demand withdrawals while compounding earned payouts weekly.

After selling Flowroute, Hsieh says he “saw the opportunity to earn a great APR through private real estate investing while gaining less correlation with traditional public stocks or bonds markets,” Hsieh said. “But they were only for the already wealthy or required multiyear commitments of capital. Concreit gives everyone access to a real estate portfolio and the ability to have access to withdrawals when they need them.”

Put simply, the startup wants to make it easy for anyone — not just the wealthy — to invest in real estate.

Concreit, Hsieh said, offers “regular people” the ability to access real estate strategies typically used by large hedge funds and private equity.

“We’re seeing a surge of retail demand for alternatives and other ways to invest outside of the public markets and the crypto space for those that value diversification,” Hsieh told TechCrunch. “Most other competitors are focused on marketing and selling securities, but we knew in order to be an innovator in this space we had to produce a truly unique experience for our investors.”

Concreit’s platform is designed to be a more connected investment experience.

“We knew early on that digital natives deserved a whole new real estate investing experience and that it had to be 100x better than just taking traditional real estate investment opportunities and offering them digitally,” Hsieh said.

So on the platform side, Concreit has built a cloud-based proprietary securities accounting engine that allows the company to process fractional calculations and pull in a lot of mutual fund practices, applying them toward the “more labor-intensive” private equity markets, with a focus on real estate.

“We’ve taken a lot of the cloud-architectural work that we’ve pioneered in the telecommunications space and applied it towards a back-office accounting solution that gives us a competitive edge around what we offer to our investors,” Hsieh said. “This affords the ability to run accounting at a higher frequency, which is how we are able to run weekly dividends, process fractional redemptions and ultimately a more real-time experience for our users.”

Concreit’s first private REIT fund, focused on passive income, consists of lower-risk fixed-income private market residential and commercial real estate first-lien mortgages. The fund, which the company says has an annualized return of 5.47%, is managed by a team of industry professionals. The startup has added over 18,000 customers to its platform since it was qualified by the SEC (slightly over a year ago), and doubled its user base in the month of August.

“Our current users can invest with any dollar amount, no lock-ups, weekly payouts, and an experience that’s as easy & familiar as a savings account,” Hsieh said.

Matrix’s Dana Stalder, who joined Concreit’s board as part of the financing, believes Concreit has leveled the playing field for real estate investing by making it more accessible.

“What Concreit has built is incredibly hard to do from both a technology and regulatory standpoint,” he told TechCrunch. “Alternative asset classes, in particular, have been notoriously closed off to the average consumer, leaving high yield returns exclusively to wealthy investors. “