News: Daily Crunch: Apple, Google bow to Russian pressure

Hello and welcome to Daily Crunch for Friday, September 17th! What a week, ya’ll. It is now just days before Disrupt, which means the TechCrunch hive is buzzing. I’ll leave it by noting that Reid Hoffman is coming, which is going to be a treat.

Hello and welcome to Daily Crunch for Friday, September 17th! What a week, ya’ll. It is now just days before Disrupt, which means the TechCrunch hive is buzzing. I’ll leave it by noting that Reid Hoffman is coming, which is going to be a treat. See you next week! — Alex

The TechCrunch Top 3

- Profits > Ethics: Apple and Google have removed a “tactical voting app created by the organization of jailed Kremlin critic Alexei Navalny” from their marketplaces, we reported. TechCrunch notes that “the Russian state [is] amping up the pressure on foreign tech giants ahead of federal elections.” So much for standing up for democracy, or whatever.

- Are software valuations stabilizing? After a simply incredible run, the value of software revenues may have reached a plateau. A very high plateau, mind, but still a resting point. This is not bad news for SaaS companies, which are still valued at historically elevated levels.

- Apple “actively monitoring” legal challenges to Texas abortion law: While some tech companies are making their displeasure at the new Texas reproductive care bill very public, Apple is taking a slightly slower, lower-profile approach to the matter. But it’s still good to see an American tech company nearly take a stand on a moral matter. It’s better than whatever is actually less than that. A little.

Startups/VC

- Journey raises $3M for psychedelic therapy: There’s growing market sentiment that some drugs generally associated with recreational activities could have positive impacts for various mental conditions. Journey wants to explore Ketamine-based treatments for anxiety and depression.

- Aurora Propulsion raises €1.7M for satellite propulsion: How do you make a satellite move a little bit and then stop? It’s not an idle question given how many flying objects there are in orbit today. And with more expected to take flight this year than ever, Aurora wants to help our satellites scoot around and avoid one another.

- Aircover raises $3M more for its sales intelligence tool: Integrating with Zoom to provide real-time insights to sales folks during their calls, Aircover is part of a larger trend of sales tech startups building services for the myriad sales people in the market. Defy Partners led the round, which also saw participation from Firebolt Ventures and others.

- Unicorns are taking so long to go public that their former executives are becoming VCs before they reach liquidity: That’s our key takeaway from the news that Instacart’s chief financial officer Sagar Sanghvi has left the on-demand grocery for Accel.

4 ways to leverage ROAS to triple lead generation

In school, it’s highly unethical to copy someone else’s work and pass it off as your own. In business, however, it’s encouraged.

Xiaoyun TU, global director of demand generation at Brightpearl, wrote a comprehensive guide that describes how a better understanding of return on advertising spend (ROAS) can triple your company’s lead generation.

“A ‘good’ ROAS score is different for each company and campaign,” she says.

“If your figure isn’t where you’d like it to be, you can leverage ROAS data to create targeted campaigns and personalized experiences.”

(Extra Crunch is our membership program, which helps founders and startup teams get ahead. You can sign up here.)

Big Tech Inc.

- Elon praises Chinese automakers: As Beijing looks to consolidate its national EV industry, Tesla’s CEO took to a scripted set of comments to praise his Chinese rivals. If you want to understand how different the business climate is between China and America, contrast the mercurial executive’s message to China, and then read his tweets.

- Here’s a headline for you: “Facebook knows Instagram harms teens. Now, its plan to open the app to kids looks worse than ever.” Preach, Taylor. If you are not caught up on the Facebook beat, read the Wall Street Journal’s latest series of articles. They are more than revelatory.

TechCrunch Experts: Growth Marketing

Image Credits: SEAN GLADWELL (opens in a new window) / Getty Images

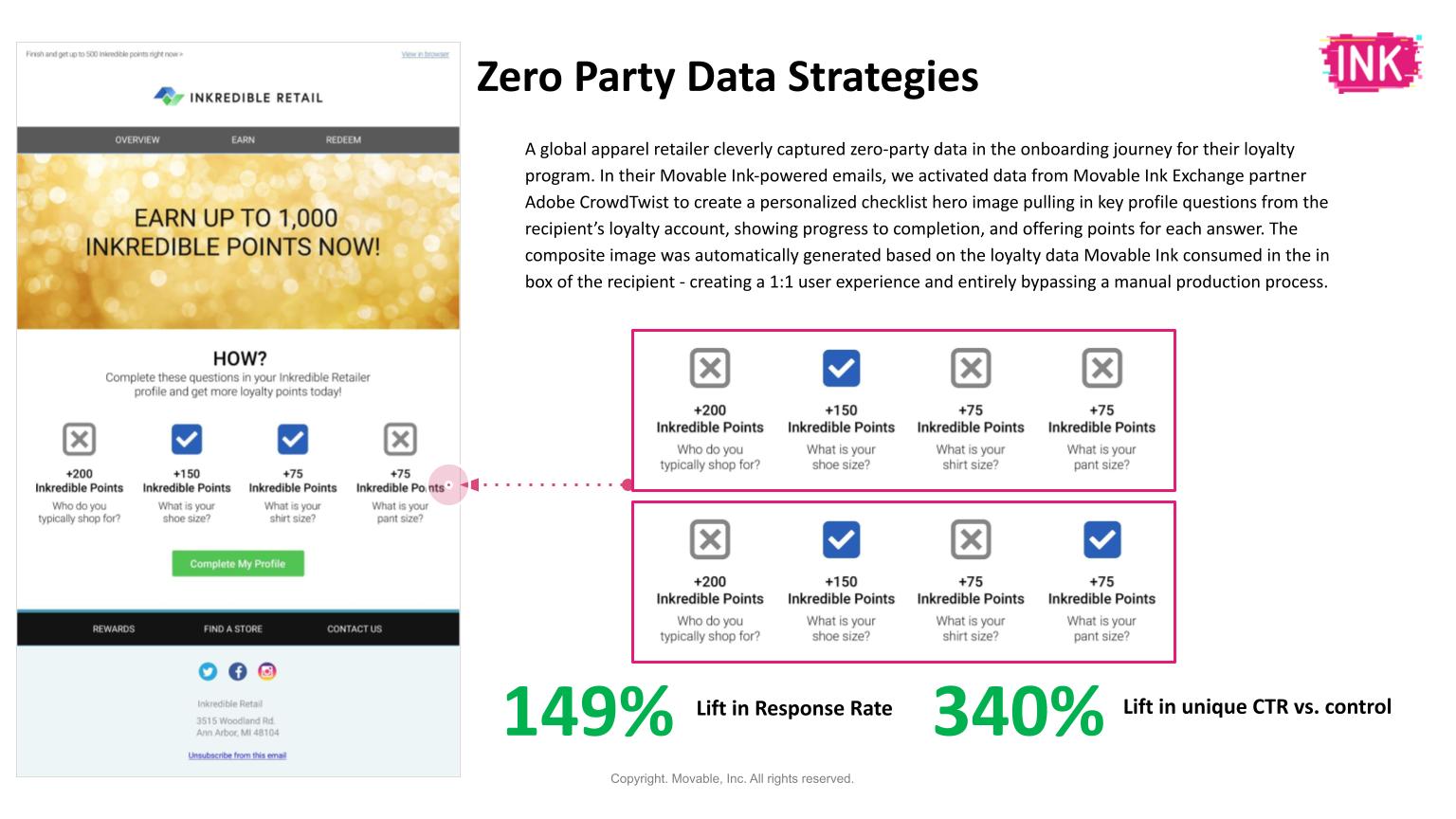

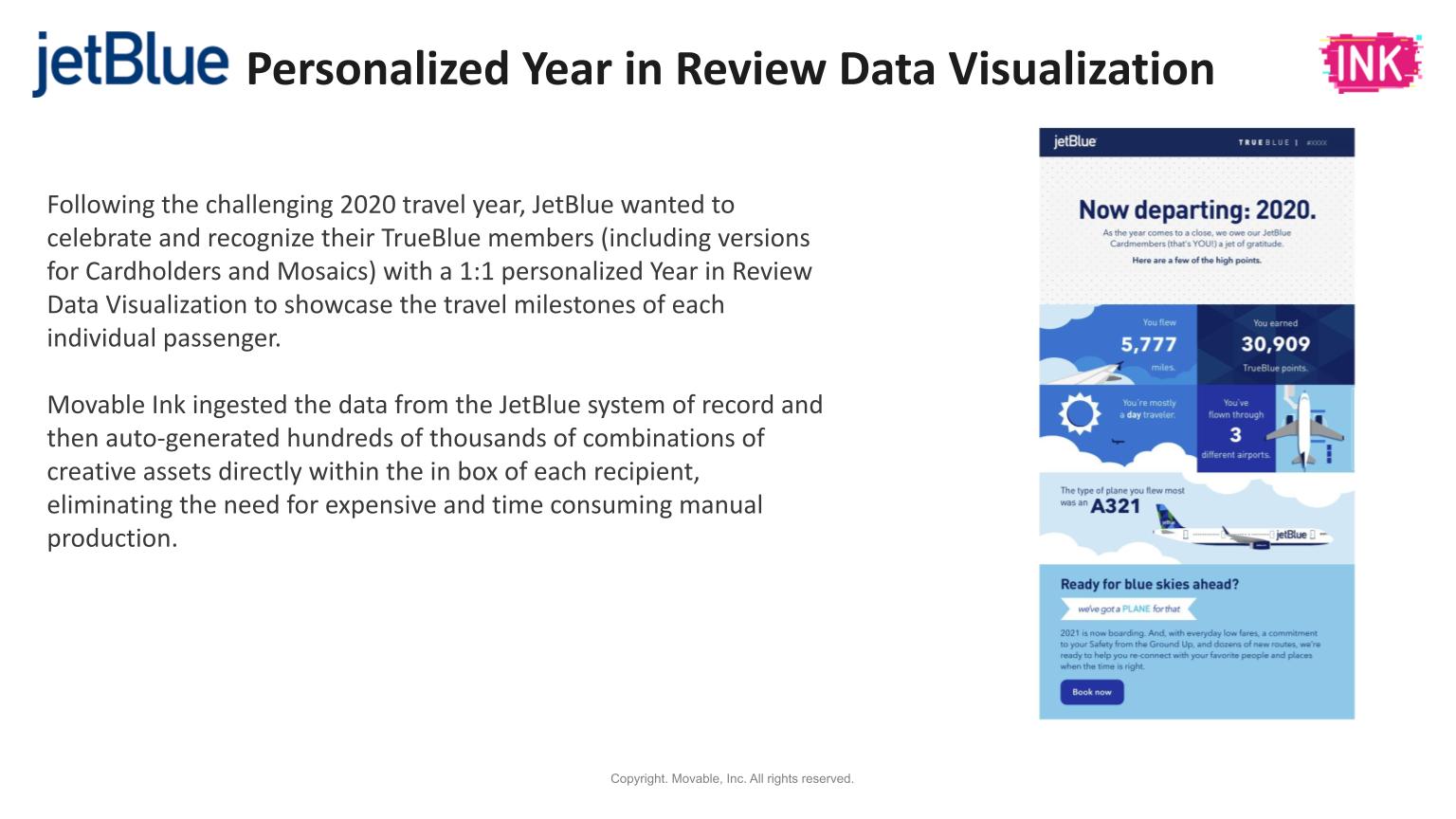

With the release of iOS 15 around the corner, we spoke to Movable Ink CEO Vivek Sharma and got his take on what marketers can do to prepare, “Marketers should plan for more DIY metrics as iOS 15 nears.”

TechCrunch wants you to recommend growth marketers who have expertise in SEO, social, content writing and more! If you’re a growth marketer, pass this survey along to your clients; we’d like to hear about why they loved working with you.