- August 24, 2021

- by:

- in: Blog

Creating single-family homes for the homeless using 3D printing robotics. Developing construction systems to create infrastructure and habitats on the moon, and eventually Mars, with NASA. Delivering what is believed to be the largest 3D-printed structure in North America — a barracks for Texas Military Department. These are just some of the things that Austin,

Creating single-family homes for the homeless using 3D printing robotics. Developing construction systems to create infrastructure and habitats on the moon, and eventually Mars, with NASA. Delivering what is believed to be the largest 3D-printed structure in North America — a barracks for Texas Military Department.

These are just some of the things that Austin, Texas-based construction tech startup ICON has been working on.

And today, the company is adding a massive $207 million Series B raise to its list of accomplishments.

I’ve been covering ICON since its $9 million seed round in October of 2018, so seeing the company reach this milestone less than three years later is kind of cool.

Norwest Venture Partners led the startup’s Series B round, which also included participation from 8VC, Bjarke Ingels Group (BIG), BOND, Citi Crosstimbers, Ensemble, Fifth Wall, LENx, Moderne Ventures and Oakhouse Partners. The financing brings ICON’s total equity raised to $266 million. The company declined to reveal its valuation.

ICON was founded in late 2017 and launched during SXSW in March 2018 with the first permitted 3D-printed home in the U.S. That 350-square-foot house took about 48 hours (at 25% speed) to print. ICON purposely chose concrete as a material because, as co-founder and CEO Jason Ballard put it, “It’s one of the most resilient materials on Earth.”

Since then, the startup says it has delivered more than two dozen 3D-printed homes and structures across the U.S. and Mexico. More than half of those homes have been for the homeless or those in chronic poverty. For example, in 2020, ICON delivered 3D-printed homes in Mexico with nonprofit partner New Story. It also completed a series of homes serving the chronically homeless in Austin, Texas, with nonprofit Mobile Loaves & Fishes.

The startup broke into the mainstream housing market in early 2021 with what it said were the first 3D-printed homes for sale in the U.S. for developer 3Strands in Austin, Texas. Two of the four homes are under contract. The remaining two homes will hit the market on August 31.

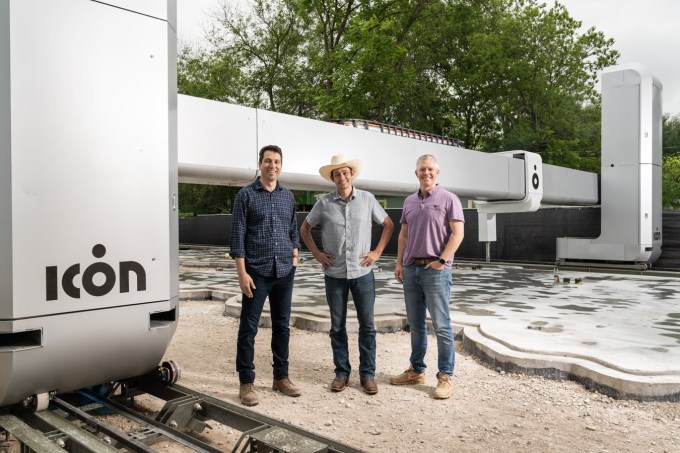

And recently, ICON revealed its “next generation” Vulcan construction system and debuted its new Exploration Series of homes. The first home in the series, “House Zero,” was optimized and designed specifically for 3D printing.

For some context, ICON says its proprietary Vulcan technology produces “resilient, energy-efficient” homes faster than conventional construction methods and with less waste and more design freedom. The company’s new Vulcan construction system, according to Ballard, can 3D print homes and structures up to 3,000 square feet, is 1.5x larger and 2x faster than its previous Vulcan 3D printers.

From the company’s early days, Ballard has maintained ICON is motivated by the global housing crisis and lack of solutions to address it. Using 3D printers, robotics and advanced materials, he believes, is one way to tackle the lack of affordable housing, a problem that is only getting worse across the country and in Austin.

ICON’s list of future plans include the delivery of social, disaster relief and more mainstream housing, Ballard said, in addition to developing construction systems to create infrastructure and habitats on the moon, and eventually Mars, with NASA.

ICON also has two ongoing projects with NASA. Recently, Mars Dune Alpha was just announced by NASA, ICON and BIG – and ICON so far has finished printing the wall system and is onto the roof now. Also, NASA is recruiting for crewed missions to begin nextfFall to live in the first simulated Martian habitat 3D printed by ICON.

Project Olympus represents ICON’s effort to develop a space-based construction system for future exploration of the Moon and “to imagine humanity’s home on another world.”

“Our goal is to have ICON tech on the Moon in the next decade,” Ballard said.

When asked, Ballard said the most significant thing that has happened since the company’s $35 million Series A last August has been the “the radical increase in demand for 3D-printed homes and structures.”

“That single metric represents a lot for us,” Ballard told TechCrunch. “People have to want these houses.”

To tackle the housing shortage, the world needs to increase supply, decrease cost, increase speed, increase resiliency, increase sustainability… all without compromising quality and beauty, he added.

“Perhaps there are a few approaches that can do some of those things, but only construction scale 3D printing holds the potential to do all of those things,” he said.

ICON has seen impressive financial growth, with 400% revenue growth nearly every year since inception, according to Ballard. It’s also tripled its team in the past, year and now has more than 100 employees. It expects to double in size within the next year.

Image Credits: Co-founders with next-gen Vulcan Construction System / ICON

The series B funds will go toward more construction of 3D-printed homes, “rapid scaling and R&D,” further space-based tech advancements and creating “a lasting societal impact on housing issues,” Ballard said.

“We have already stood up early-stage manufacturing and are in the process of upgrading and accelerating those efforts in order to meet demand for more 3D-printed houses even as we close the round,” Ballard said. “In the next five years, we believe we will be delivering thousands of homes per year and on our way to tens of thousands of homes per year.”

Norwest Venture Partners Managing Partner Jeff Crowe, who is joining ICON’s board as part of the financing, said his firm believes that ICON’s 3D printing construction technology will “massively impact the housing shortage in the U.S. and around the globe.”

It is “enormously difficult” to bring together the advanced robotics, materials science and software to develop a robust 3D printing construction technology in the first place, Crowe said.

“It is still harder to develop the technology in a way that can produce hundreds and thousands of beautiful, affordable, comfortable, energy efficient homes in varying geographies with reliability and predictability — not just one or two demonstration units in a controlled setting,” he wrote via e-mail. “ICON has done all that, and…has all the elements to be a breakout, generational success.”