News: The Station: The script for Elon Musk’s Loop drivers, Redwood snags $700M and a chat with Kodiak Robotics’ co-founder

The Station is a weekly newsletter dedicated to all things transportation. Sign up here — just click The Station — to receive it every weekend in your inbox. Hello readers: Welcome to The Station, your central hub for all past, present and future means of moving people and packages from Point A to Point B. In

The Station is a weekly newsletter dedicated to all things transportation. Sign up here — just click The Station — to receive it every weekend in your inbox.

Hello readers: Welcome to The Station, your central hub for all past, present and future means of moving people and packages from Point A to Point B.

In case you missed it, our scoop machine Mark Harris was at it again. This time, he found some interesting and entertaining documents related to Elon Musk’s underground Loop system in Las Vegas received via a Freedom of Information Act. Among the treasure is a “ride script” that instructs drivers for the Loop system to bypass passengers’ questions about how long they have been driving for the company, declare ignorance about crashes, and shut down conversations about Musk himself.

The takeaway: the script shows just how serious The Boring Company, which built and operates the system, is about controlling the public image of the new system, its technology and especially Musk.

Importantly, the documents confirm that Autopilot, the advanced driver assistance system in the Tesla vehicles used in the Loop system, must be disabled.

As always, you can email me at kirsten.korosec@techcrunch.com to share thoughts, criticisms, offer up opinions or tips. You can also send a direct message to me at Twitter — @kirstenkorosec.

Micromobbin’

This is a step outside the norm of what I usually think of when I think of micromobility (you’ll see what I did there in a second), but this week I wrote about a new in-shoe navigation system that helps the visually impaired walk around town.

Ashirase, as both the system and the name of the company is called, involves attaching a three-dimensional vibration device, including a motion sensor, inside a pair of shoes. This bit of hardware is connected to a smartphone app that someone with low vision can use to enter their destination. Vibrations in the front part of the shoe give the cue to walk straight, and vibrations on the left and right cue the user to make a left or right turn. The aim is to free up the hands while walking to use a cane and allow the walker to put more of their full attention on audio signals in the environment, thus making their commutes a bit more intuitive and their lives more independent.

It’s a really interesting bit of tech because it uses a similar stack to what we’re seeing in autonomous driving and advanced driver assistance systems. Which makes sense because that’s the founder’s background. Wataru Chino worked in Honda’s EV motor control and automated driving systems departments since 2009. His startup is a product of Honda’s incubator, Ignition, that features original technology, ideas, and designs of Honda associates with the goal of solving social issues and going beyond the existing Honda business.

Accessibility: We love to see it

Cabify recently announced a new feature that makes its rideshare service more accessible to the elderly, people with partial visual impairment and people with cognitive disabilities. The feature provides voice notifications to alert the user when a driver is on their way or has just arrived, when the ride starts, when a stop has been reached, when a message has come into the app’s chat, etc.

The notification makes use of a text-to-speech functionality that Android and iOS phones have.

“Apple and Google operating systems allow us to pronounce sentences with the system’s voice but we have developed the text and established the situations where we inform and draw the user’s attention,” a Cabify spokesperson told me.

Lime’s push for world domination

And we’re back with the latest on Lime’s plans to take over the world, one electric scooter at a time. The micromobility goliath has announced an integration with the Moovit transit planning app. From Monday onwards, Moovit users in 117 cities across 20 countries will see Lime’s electric scooters, bikes and mopeds show up as an option for travel, either as the whole journey or as part of a multi-modal journey. This news follows a trend we’re seeing as cities start to see micromobility companies as less of a public nuisance and more of a public solution, particularly for first- and last-mile travel. Integrating with Moovit, an app that’s solely focused on public transportation, is a move that helps in the long run creating a broader transportation ecosystem.

New whips

Espin released its limited edition fixie style e-bike called the Aero. It’s just the thing for Seattle hipsters, particularly ones with a stick-and-poke bike tattoo. The bike frame is just as sleek as you’d expect from a single gear bike, all clean lines and comes in either a forest green or a smoke gray. The Aero can reach top speeds of 20 mph and can hit 30 miles on a single charge. Best of all, it doesn’t break the bank at $1,399.

Splach, which normally makes e-scooters and e-bikes, has come out with something it’s calling the Transformer. I truly don’t know how to categorize it but it looks like a lot of fun to ride. The company is calling the light-duty e-vehicle a “mini-moto Robust scooter specialized for rugged terrains.” It looks like a dirt bike has been sized way down and given a long neck so you can stand on it and still steer it. It also looks like it would indeed do well on rugged terrains, based on videos of people shredding down dirt paths. Splach used Indiegogo to fund the thing, and said it reached its goal within an hour.

Deal of the week

Get ready to hear a lot more about supply chain constraints around batteries with virtually every automaker shouting out pledges to shift their entire portfolio away from internal combustion engines and towards electric powertrains.

Cell producers need access to the raw materials like nickel that are needed to make batteries. Mining those materials is the most common means, but that isn’t sustainable (and I’m not just talking about the environmental toll). JB Straubel, who is best known as the former Tesla co-founder and longtime CTO, is tackling the supply chain issue through his startup Redwood Materials. The battery recycling company is aiming to create a circular supply chain. This closed-loop system, Straubel says, will be essential if the world’s battery cell producers hope to have the supply needed for consumer electronics and the coming wave of electric vehicles.

High-profile investors like Amazon, funds managed by T. Rowe and Bill Gates’ Breakthrough Ventures fund recognize the opportunity and have injected $700M in fresh capital into Redwood Materials. This is comically large compared to the startup’s last raise of $40 million. And sources tell me that this pushes Redwood Material’s valuation to $3.7 billion.

I interviewed Straubel about the raise and what struck me was how aggressively he wants to scale; he is treating this issue as if there is no time to lose — and he’s not wrong.

Other deals that got my attention this week …

Clarios, the maker of low-voltage vehicle batteries, postponed its IPO, citing market volatility, Bloomberg reported. the Milwaukee area-based company backed by Brookfield Asset Management had filed to raise $1.7 billion by offering 88.1 million shares at a price range of $17 to $21.

Fisker, the electric vehicle startup turned publicly traded company via a SPAC, has turned investor to support EV charging company Allego. Fisker said it is investing $10 million in private-investment-in-public equity (PIPE) funding for the merger of Allego and special purpose acquisition company Spartan Acquisition Corp III. The merger puts Allego at a pro forma equity value of $3.14 billion.

Flock, which went from providing drone insurance to commercial vehicle insurance, raised $17 million in a Series A funding led by Social Capital, the investment vehicle run by Chamath Palihapitiya, best known as a SPAC investor and chairman of Virgin Galactic. Flock’s existing investors Anthemis and Dig Ventures also participated. This round brings Flock’s total funding to $22 million. Justin Saslaw (Social Capital’s fintech partner) joins Flock’s board of directors, as does Ross Mason (founder of Dig Ventures and MuleSoft).

HappyFresh, the on-demand grocery app based in Indonesia, raised $65 million in a Series D round led by Naver Financial Corporation and Gafina B.V., with participation from STIC, LB and Mirae Asset Indonesia and Singapore. It also included returning investors Mirae-Asset Naver Asia Growth Fund and Z Venture Capital. The company’s previous round of funding was a $20 million Series C announced in April 2019.

Lordstown Motors got a lifeline from a hedge fund managed by investment firm Yorkville Advisors about five weeks after the automaker issued a warning that it might not have enough funds to bring its electric pickup truck to market. The hedge fund agreed to buy $400 million worth of shares over a three-year period, according to a regulatory filing.

Merqueo, the on-demand delivery service that operates in Latin America, raised $50 million in a Series C round of funding co-led by IDC Ventures, Digital Bridge and IDB Invest. MGM Innova Group, Celtic House Venture Partners, Palm Drive Capital and previous shareholders also participated. The financing brings the Bogota, Colombia-based startup’s total raised to $85 million since its 2017 inception.

Niron Magnetics, a company developing permanent magnets free of rare earths, raised $21.3 million in new financing from the Volvo Cars Tech Fund and Volta Energy Technologies, which joined existing investors Anzu Partners and the University of Minnesota. Niron will use the funding to build its pilot production facility in Minnesota.

Onto, the EV car subscription company raised $175 million in a combined equity and debt Series B round. The equity piece was led by Swedish VC Alfvén & Didrikson. British investment company Pollen Street Capital provided the senior-secured asset-backed debt facility. The company, which has raised a total of $245 million, says it plans to double its fleet size every three to six months and that any new vehicles will be used as collateral. Onto did not disclose how much of the round came from equity versus debt.

Zūm, a student transportation startup, was awarded a five-year $150 million contract to modernize San Francisco Unified School District transport service throughout the district. Zūm, which already operates its rideshare-meets-bus service in Oakland, much of Southern California, Seattle, Chicago and Dallas, will be responsible for handling day-to-day operations, transporting 3,500 students across 150 school campuses starting this fall semester.

A little bird

I hear things. But I’m not selfish. Let me share!

You might have missed my article late Friday about Argo AI landing a permit in California that will allow the company to give people free rides in its self-driving vehicles on the state’s public roads.

Tl;dr: The California Public Utilities Commission issued Argo the so-called Drivered AV pilot permit, which is part of the state’s Autonomous Vehicle Passenger Service pilot. This puts Argo in a small and growing group of companies seeking to expand beyond traditional AV testing — a signal that the industry, or at least some companies, are preparing for commercial operations.

Regulatory hurdles remain and don’t expect Argo to be offering and charging for “driverless” rides anytime soon. But progress is being made and I would expect the company to secure the next permit — in a long line of them — later this year.

Argo has never officially indicated what city it is targeting for a robotaxi service in California. The company has been testing its autonomous vehicle technology in Ford vehicles around Palo Alto since 2019. Today, the company’s test fleet in California is about one dozen self-driving test vehicles. It also has autonomous test vehicles in Miami, Austin, Washington D.C., Pittsburgh and Detroit. (In July, Argo and Ford announced plans to launch at least 1,000 self-driving vehicles on Lyft’s ride-hailing network in a number of cities over the next five years, starting with Miami and Austin.)

I’m hearing from some sources familiar with Argo’s strategy for California that we should look south of the Bay Area. Way south.

The city that jumps to mind is San Diego. Some AV companies are already playing around the Irvine area and Los Angeles seems too unwieldy. Plus, Ford already has a footprint in San Diego. The automaker partnered way back in 2017 with AT&T, Nokia and Qualcomm Technologies to test Cellular vehicle-to-everything (CV2X) at the San Diego Regional Proving Ground with the support of the San Diego Association of Governments, Caltrans, the city of Chula Vista, and intelligent transportation solutions provider McCain. The upshot of these trials? To improve traffic efficiency, vehicle safety and “support a path towards autonomous vehicles.”

Policy corner

Hi everyone. Let’s dive into two key pieces of proposed legislation this week: the infrastructure bill and the tailpipe emissions standards.

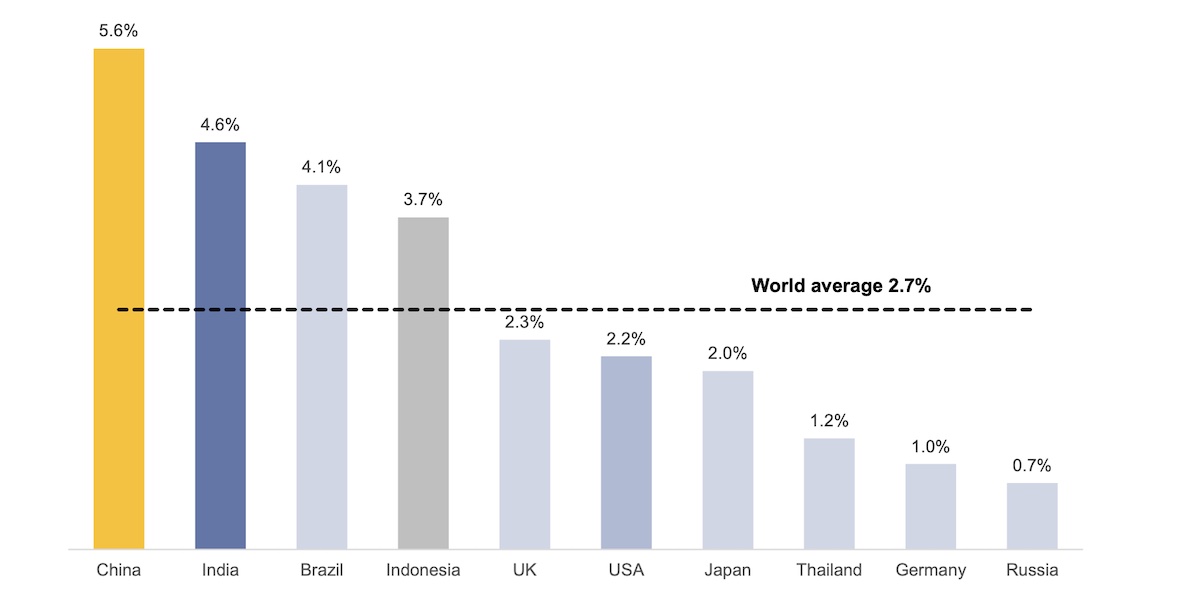

After months of negotiations, U.S. senators have finally settled on a $550 billion infrastructure package that includes investments in roads, bridges, broadband and more. The bill would provide $7.5 billion to electrify buses and ferries, including school buses, and $7.5 billion to build out a national network of public EV charging stations. Subsequent statements on the bill from the White House say directly that the EV investments are intended to keep the U.S. competitive on the world stage: “U.S. market share of plug-in electric vehicle (EV) sales is only one-third the size of the Chinese EV market. The President believes that must change.”

The budget is just a fraction of the $2.25 trillion bill President Joe Biden originally introduced in March. That version of the bill earmarked billions more for transportation electrification, especially in rebates and incentives to get consumers buying more EVs. The bill is still with the Senate for final approval. Then it will head to the House before finally ending up on Biden’s desk.

The Environmental Protection Agency and the Department of Transportation have proposed rules that would beef up tailpipe emissions standards, which had been rolled back under President Donald Trump. The rules would be identical to the agreement the state of California reached with Ford, VW, Honda, BMW and Volvo in 2019, the AP reported. If approved, the rules would apply starting with model year 2023 vehicles.

The aim is to cut carbon emissions from transportation and encourage more people to buy hybrid and electric. But many environmental groups like the Sierra Club — plus some EV automakers — don’t think they go far enough.

“This draft proposal would drive us in the right direction after several years in reverse–but slowly getting back on track is not enough,” Chris Nevers, senior director of environmental policy at Rivian, told TechCrunch. EPA and NHTSA must maximize the stringency of the program beyond the voluntary deal and account for current and future developments in vehicle electrification.

One more thing that caught my eye this week…The Washington Post reported that Biden and a group of automakers are negotiating for the latter group to make a “formal pledge” to have at least 40% of all vehicles sold in 2030 to be electric. The article doesn’t specify which OEMs are part of the talks. However, it’s hard to imagine automakers signing onto anything — even a “voluntary pledge” — without some hefty federal spending to go along with it. We’ll have to see if the provisions in the infrastructure bill are enough.

— Aria Alamalhodaei

Notable reads and other tidbits

As per ushe, there was a ton of transportation news this week. Let’s dig in.

ADAS

Yep, ADAS gets its own section now in an effort to make it abundantly clear that advanced driver assistance systems are not self-driving cars. Never. Never ever.

New York Times’ Greg Bensinger weighs in on beta testing and Tesla in this opinion column.

Autonomous vehicles

Aurora co-founder and chief product officer Sterling Anderson put out a blog and a bunch of tweets to layout a blueprint for an autonomous ride-hailing business that will launch in late 2024 with partners Toyota and Uber. Aurora has spent the past year or so pushing its messaging on self-driving trucks, which the company says is its best and most viable first commercial product. Aurora never entirely ditched the robotaxi idea, but it was pretty quiet on the topic. Until now.

The blog comes about a week after competitor Argo AI and Ford announced a partnership with Lyft. While the timing might not be related, it does show that competition is heating up in both areas — robotaxis and self-driving trucks — with every AV company keen to show progress and deep partnerships.

TuSimple, the self-driving truck company that went public earlier this year, has partnered with Ryder as part of its plan to build out a freight network that will support its autonomous trucking operations. Ryder’s fleet maintenance facilities will act as terminals for TuSimple’s so-called AFN, or autonomous freight network.

Electric vehicles

Ford released Wednesday its second quarter earnings for 2021, which besides containing a surprise profit despite the ongoing chip shortage, revealed that its F-150 Lightning electric pickup has generated 120,000 preorders since its unveiling in May. Ford reported revenue of $26.8 billion, slightly below expectations, and net income of $561 million in the second quarter.

Lucid Group (formerly Lucid Motors) will be expanding its factory in Casa Grande, Arizona, by 2.7 million square feet, CEO Pete Rawlinson said just hours after the company officially went public with a $4.5 billion injection of capital. The company also said it has 11,000 paid reservations for its flagship luxury electric sedan, the Lucid Air.

Polestar said it plans to launch in nine more markets this year, doubling its global presence as it seeks to sell more of its electric sedans. The company, which is the electric performance vehicle brand under Volvo Car Group, also wants to double the number of retail stores to 100 locations and add more service centers by the end of the year. The Swedish automaker has more than 650 so-called “service points” in Polestar markets and wants to exceed 780 by the end of 2021.

REE Automotive has picked Austin for its U.S. headquarters. The company said the headquarters will help it address the growing U.S. market demand for mission-specific EVs from delivery and logistics companies, Mobility-as-a-Service and new technology players.

Tesla reported its second-quarter earnings and it was packed with news, including that the company generated $1.14 billion in net income, marking the first time the company’s quarterly profit (on a GAAP basis) has passed the three-comma threshold. And they hit that profitability metric without completely relying on the sale of zero-emissions credits to other automakers.

Tesla CEO Elon Musk weighed in on the company’s battery strategy and disclosed that the company is pushing the launch of its electric Semi truck program to 2022 due to supply chain challenges and the limited availability of battery cells. And everything is pointing to the Cybertruck also being delayed until next year.

And finally, Tesla’s latest quarterly earnings report showed growth in its energy storage and solar business. The company reported $801 million in revenue from its energy generation and storage business — which includes three main products: solar, its Powerwall storage device for homes and businesses, and its utility storage unit Megapack. More importantly, the cost of revenue for its solar and energy storage business was $781 million, meaning that for the first time the total cost of producing and distributing these energy storage products was lower than the revenue it generated. That’s good news.

eVTOLs and other flying things

Joby Aviation completed the longest test flight of an eVTOL to date: Its unnamed full-sized prototype aircraft concluded a trip of over 150 miles on a single charge. The test was completed at Joby’s Electric Flight Base in Big Sur, California, earlier this month. It’s the latest in a succession of secretive tests the company’s been conducting, all part of its goal to achieve certification with the Federal Aviation Administration and start commercial operations.

Lilium, the electric air taxi startup, has tapped German manufacturer Customcells to supply batteries for its flagship seven-seater Lilium Jet.

People stuff

AEye, a lidar company, has been adding to its executive team in the past few months. The most recent is the hiring of automotive veteran and former Valeo executive Bernd Reichert as senior vice president of ADAS. the company has also hired Velodyne’s former COO Rick Tewell, Bob Brown from Cepton and Hod Finkelstein as chief research and design officer from Sense Photonics.

Cruise is also on a bit of an executive and engineering hiring spree. The company sent me a list of recent folks who have joined including former Southwest Airlines employee Anthony Gregory as VP of market development, Phil Maher, the former Virgin Atlantic COO, as VP of central operations and Bhavini Soneji as VP of product engineering. Soneji was most recently VP of engineering at Headspace, and was at Microsoft and Snapchat before that.

Cruise also hired Vinoj Kumar, who oversaw Google’s cloud infrastructure and software systems, as VP of Infrastructure and Yuning Chai, former lead perception researcher at Waymo, as head of AI Research. In all, Cruise now employs more than 1,900 people.

Don Burnette, the co-founder and CEO of self-driving trucks company Kodiak Robotics, sat down with TechCrunch as part of our ongoing Q&A series with the founders of transportation startups. The interview covers a lot of ground, including Burnette’s views on the company’s strategy, current funding conditions in the industry and what he learned at Otto. the self-driving trucks startup he co-founded and that was acquired by Uber.

Trevor Milton, the fast-talking showman founder of Nikola and the electric truck startup’s former CEO and executive chairman, was charged with three counts of fraud. He is free on $100 million bail.

Milton “engaged in a fraudulent scheme to deceive retail investors” for his own personal benefit, according to the federal indictment unsealed by U.S. Attorney’s Office in Manhattan. Milton was charged with two counts of securities fraud and wire fraud by a federal grand jury.