- July 15, 2021

- by:

- in: Blog

Alt-Bionics made waves back in late 2019 when the brand new startup competed at the University of Texas at San Antonio (UTSA) Tech Symposium. The company finished second to 3BM’s infrared paint-curing system, but Alt went on to capture national and international headlines on the strength of promising technology and a great story. A writeup

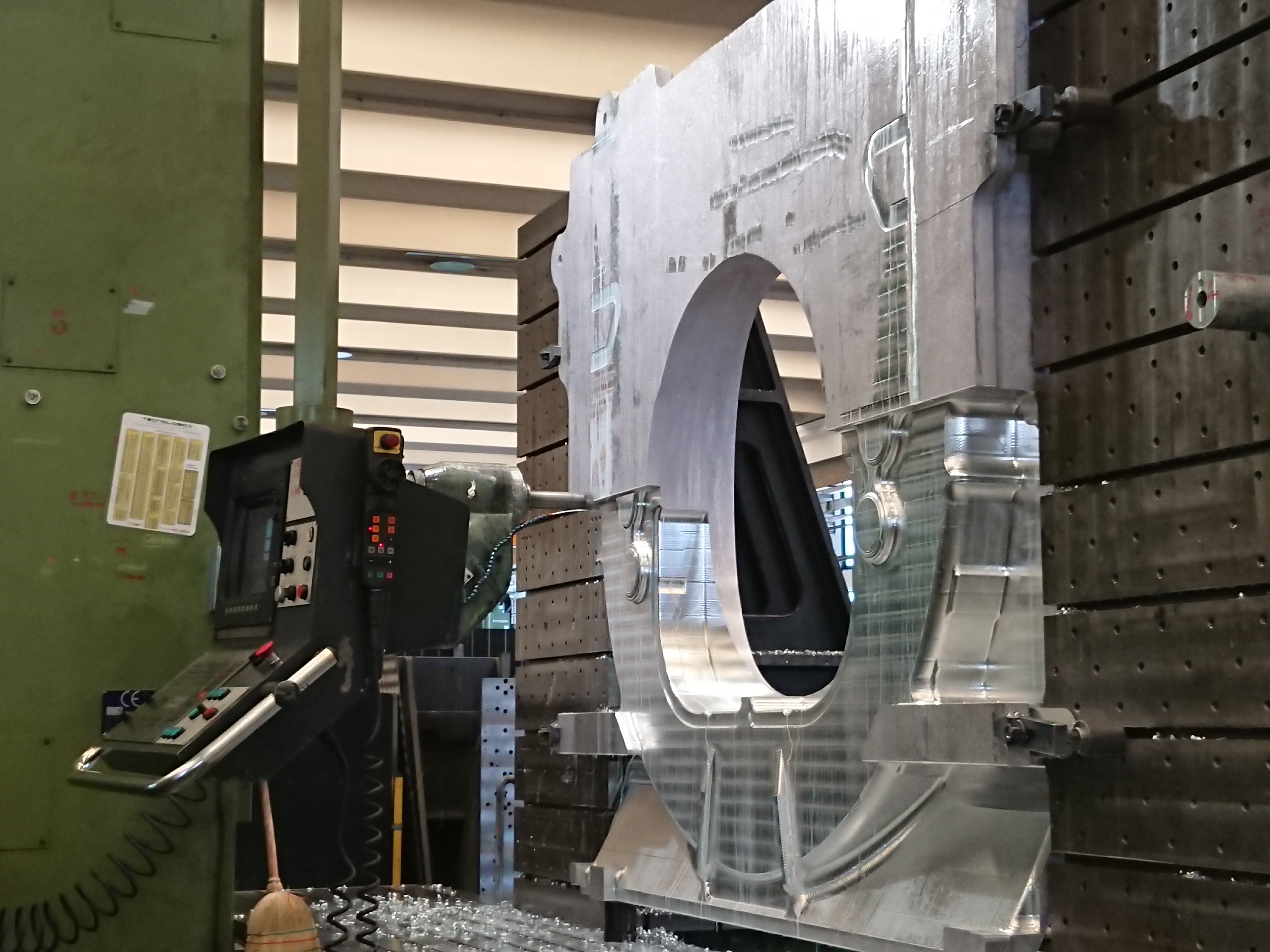

Alt-Bionics made waves back in late 2019 when the brand new startup competed at the University of Texas at San Antonio (UTSA) Tech Symposium. The company finished second to 3BM’s infrared paint-curing system, but Alt went on to capture national and international headlines on the strength of promising technology and a great story.

A writeup on the school’s site noted that, at $700, its prosthetic hand cost a mere fraction of the cost of standard systems. Most of the subsequent coverage has focused on the story of the team’s journey from good idea to marketable product, with CEO/co-founder (and USTA engineering grad) Ryan Saavedra noting that these sorts of products can range from $10,000-$150,000 a pop. The company is working to a price point around $3,500.

In the meantime, the Alt-Bionics team has been chronicling product development on social media. Before we get this roundup stared in earnest, we wanted to check in with Saavedra about how the past three years have gone and what the future holds for the company. And bonus: We’ve got a couple of unreleased renderings that Alt notes are “not indicative of our final product. Just merely a celebratory rendering our team put together to announce the completion of our patent” — so take that as you will.

Image Credits: Alt-Bionics

TechCrunch: Why are prosthetics prohibitively expensive?

I’ll start by saying that they aren’t expensive to manufacture and they do not need to be so expensive to the user. At all. There is no one answer for this, but I will do my best to summarize the multiple reasons behind the exorbitant prices surrounding bionic hands. We have found that there are two parts to the end price/cost of prosthetic devices. A third (but secondary reason) will also be discussed.

The manufacturer. The manufacturer develops and creates these bionic devices and then sells them to prosthetic and orthotic clinics (one of the few places you can be fitted for and purchase these devices). The most affordable bionic prosthetic hand sold to P&O clinics starts at about $10,000 and can go up to hundreds of thousands of dollars. Oddly enough, this cost doesn’t always reflect the functionality or performance of the devices. These manufacturers ultimately determine the prices of their devices. The larger among them cite overhead costs as the primary reason they cannot lower their price tags.

The prosthetic & orthotic clinic. We are still learning more about the specifics, but these clinics handle the medical insurance side of things. This means that they submit LCodes (insurance codes for bionic hands, suggested by the manufacturer) to the medical insurance company for reimbursement. These LCodes have floor and ceiling reimbursement amounts that the prosthetist can select. The reimbursement amount is commonly more than what they paid for the hand, and covers the time and effort the clinic and clinician put into procurement, fitting, testing, assembly and patient care. While normally a reasonable margin is obtained (through reimbursement amounts closer to the floor), we have seen reimbursement amounts exceed $124,000 for a $10,000 hand (from a 2018 patient receipt).

Technological stagnation. The technology for bionic hands has been stagnant for almost 15 years, with companies only just now emerging as competitors in this space. Larger companies in this space are tackling more than the one area of transradial (below elbow) bionic prosthetic devices. This means that their attention is not solely focused on the development and affordability aspects of upper extremity prostheses. The stagnation has meant that there are no external factors or forces being pressed on the existing devices and their manufacturers. Essentially, they have no reason to lower the prices, so they remain the same. This is more of an affirmation that reason No. 1 is a larger problem.

TechCrunch: How has the reception been from the broader medical community?

Wonderful! Clinics, clinicians, patients, potential users and other competing companies have all been incredibly supportive of our mission. The space and companies, while competitive, are all aiming for the same thing: using technological advancements to give people a better quality of life.

There is obviously some skepticism at first at how we are able to achieve our much lower price point ($3,500), but it is quickly assuaged when we talk with them about our technologies and processes. We are currently discussing partnerships with prosthetic and orthotic clinics to help develop devices that not only help patients, but also lessen the burden of prosthetists in the repair and maintenance of these devices.

TechCrunch: How far along is the project? What’s the current timeline for bringing it to market?

The project is just emerging from its infancy and is about 42% complete. Some notable achievements are as follows:

- Successful proof of concept with Army Ranger, Ryan Davis. December, 2019.

- Alt-Bionics was formed. May 2020.

- $42,000 SolidWorks grant from D’Assault Systems. July, 2020.

- Provisional patent filed. June, 2021.

- $50,000 investment from the city of San Antonio’s SAMMI Fund. July 2021.

The current timeline to bring our device to market is one year from the closing of our seed round of financing. We have, to date, raised $142,000 of our $200,000 goal and are looking to close out this round by September.

TechCrunch: What have the biggest challenges been so far?

Navigating the FDA regulatory space and raising capital. It is no secret that the FDA regulatory process is a fearsome beast. There are even companies dedicated to assisting those looking to bring medical devices to market, navigate the process and all its intricacies. Alt-Bionics was recently accepted into a biomedical accelerator program based out of San Antonio, Texas, and will be working with regulatory experts to ensure we have a smooth rest of the ride to market. While our mission is noble and our business plan sound, COVID has brought about many worries and fears from investors. The inability to pitch to a live audience has hindered us from being able to appear in front of investors and has made raising capital a little more difficult than it normally is for a company like ours.

TechCrunch: What is your funding status? How much have you raised thus far and are you looking to raise more?

To date, Alt-Bionics has raised a total of $142,000 from a handful of investors and has received a $50,000 investment from the city of San Antonio’s SAMMI fund. We are looking for an additional $58,000 from accredited investors to help fill out our seed round. From there our timeline of one year to market begins (though we have a hefty head start) and Alt-Bionics will push into its Series A, which will allow us to bring on additional engineers, develop the technology further and expand into international markets.

TechCrunch: Are developing markets going to be a key target?

Developing countries will be a key market for Alt-Bionics, particularly through NGOs, and will play an important part in our international expansion. We see a large opportunity to provide our medical devices to these markets. Affordability is critical to our mission to provide access to these devices and therefore we believe we will be successful with this expansion.

And now back to your regularly scheduled roundup.

Image Credits: Berkshire Grey

I’ll cop to the fact that when Berkshire Grey announced a “$23+” million deal for grocery picking robots, I had one name in mind: Walmart. After talking a bit about Walmart’s mixed robotics play in this panel a couple of weeks back, I’d heard rumblings the company was getting set for a big new play in the category.

Granted, the Symbotic deal doesn’t necessarily mean BG isn’t teaming with Walmart on this one, but it’s worth noting that the mega-retailer loves talking about its big spending on automation. From the outside, looking in, at least, it seems like these deals are often as much about the PR of looking like it’s ready to compete with Amazon as they are about actually competing with Amazon (win-win, I guess).

Image Credits: Walmart

The deal will bring Symbotic’s tech to 25 additional Walmart distribution centers (the two have been running pilots since 2017) in a rollout that will take “several years,” per Walmart. I’ve speculated before (and will happily continue to do so) that one or several of these robotic fulfillment companies are a no-brainer acquisition for Walmart, though Symbotic is probably a bit tougher, given existing ties with competitors like Target.

Berkshire Grey, meanwhile, continues to go the public route. Revolution Acceleration Acquisition Corp. (RAAC) shareholders are set to vote on the SPAC deal on July 20. Newly soon to be acquired Fetch, meanwhile, announced a deal with supply chain logistics company Korber for a new pallet robot designed to replace forklifts.

Image Credits: Facebook AI

A pair of cool research projects this week. Devin wrote about a team from Facebook AI, UC Berkeley and Carnegie Mellon University that is exploring Rapid Motor Adaptation, a method that allows quadrupedal robots to adapt to uneven terrain on the fly. This quote from one of the Berkley researchers gets to the heart of the matter: “We do not learn about sand, we learn about feet sinking.”

Image Credits: MIT CSAIL

Meanwhile, I wrote about research at MIT’s CSAIL that involves using robotic arms to get people dressed. It’s a promising bit of functionality for eldercare robotics and technology that could assist people with mobility issues.