- July 16, 2021

- by:

- in: Blog

Switzerland-based privacy startup Nym Technologies has raised $6 million, which is being loosely pegged as a Series A round. Earlier raises included a $2.5M seed round in 2019. The founders also took in grant money from the European Union’s Horizon 2020 research fund during an earlier R&D phase developing the network tech. The latest funding

Switzerland-based privacy startup Nym Technologies has raised $6 million, which is being loosely pegged as a Series A round.

Earlier raises included a $2.5M seed round in 2019. The founders also took in grant money from the European Union’s Horizon 2020 research fund during an earlier R&D phase developing the network tech.

The latest funding will be used to continue commercial development of network infrastructure which combines an old idea for obfuscating the metadata of data packets at the transport network layer (Mixnets) with a crypto inspired reputation and incentive mechanism to drive the required quality of service and support a resilient, decentralized infrastructure.

Nym’s pitch is it’s building “an open-ended anonymous overlay network that works to irreversibly disguise patterns in Internet traffic”.

Unsurprisingly, given its attention to crypto mechanics, investors in the Series A have strong crypto ties — and cryptocurrency-related use-cases are also where Nym expects its first users to come from — with the round led by Polychain Capital, with participation from a number of smaller European investors including Eden Block, Greenfield One, Maven11, Tioga, and 1kx.

Commenting in a statement, Will Wolf of Polychain Capital, said: “We’re incredibly excited to partner with the Nym team to further their mission of bringing robust, sustainable and permissionless privacy infrastructure to all Internet users. We believe the Nym network will provide the strongest privacy guarantees with the highest quality of service of any mixnet and thus may become a very valuable piece of core internet infrastructure.”

The Internet’s ‘original sin’ was that core infrastructure wasn’t designed with privacy in mind. Therefore the level of complicity involved in Mixnets — shuffling and delaying encrypted data packets in order to shield sender-to-recipient metadata from adversaries with a global view of a network — probably seemed like over engineering all the way back when the web’s scaffolding was being pieced together.

But then came Bitcoin and the crypto boom and — also in 2013 — the Snowden revelations which ripped the veil off the NSA’s ‘collect it all’ mantra, as Booz Allen Hamilton sub-contractor Ed risked it all to dump data on his own (and other) governments’ mass surveillance programs. Suddenly network level adversaries were front page news. And so was Internet privacy.

Since Snowden’s big reveal, there’s been a slow burn of momentum for privacy tech — with rising consumer awareness fuelling usage of services like e2e encrypted email and messaging apps. Sometimes in spurts and spikes, related to specific data breaches and scandals. Or indeed privacy-hostile policy changes by mainstream tech giants (hi Facebook!).

Legal clashes between surveillance laws and data protection rights are also causing growing b2b headaches, especially for US-based cloud services. While growth in cryptocurrencies is driving demand for secure infrastructure to support crypto trading.

In short, the opportunity for privacy tech, both b2b and consumer-facing, is growing. And the team behind Nym thinks conditions look ripe for general purpose privacy-focused networking tech to take off too.

Of course there is already a well known anonymous overlay network in existence: Tor, which does onion routing to obfuscate where traffic was sent from and where it ends up.

The node-hopping component of Nym’s network shares a feature with the Tor network. But Tor does not do packet mixing — and Nym’s contention is that a functional mixnet can provide even stronger network-level privacy.

It sets out the case on its website — arguing that “Tor’s anonymity properties can be defeated by an entity that is capable of monitoring the entire network’s ‘entry’ and ‘exit’ nodes” since it does not take the extra step of adding “timing obfuscation” or “decoy traffic” to obfuscate the patterns that could be exploited to deanonymize users.

“Although these kinds of attacks were thought to be unrealistic when Tor was invented, in the era of powerful government agencies and private companies, these kinds of attacks are a real threat,” Nym suggests, further noting another difference in that Tor’s design is “based on a centralized directory authority for routing”, whereas Nym fully decentralizes its infrastructure.

Proving that suggestion will be quite the challenge, of course. And Nym’s CEO is upfront in his admiration for Tor — saying it is the best technology for securing web browsing right now.

“Most VPNs and almost all cryptocurrency projects are not as secure or as private as Tor — Tor is the best we have right now for web browsing,” says Nym founder and CEO Harry Halpin. “We do think Tor made all the right decisions when they built the software — at the time there was no interest from venture capital in privacy, there was only interest from the US government. And the Internet was too slow to do a mixnet. And what’s happened is speed up 20 years, things have transformed.

“The US government is no longer viewed as a defender of privacy. And now — weirdly enough — all of a sudden venture capital is interested in privacy and that’s a really big change.”

With such a high level of complexity involved in what Nym’s doing it will, very evidently, need to demonstrate the robustness of its network protocol and design against attacks and vulnerabilities on an ongoing basis — such as those seeking to spot patterns or identify dummy traffic and be able to relink packets to senders and receivers.

The tech is open source but Nym confirms the plan is to use some of the Series A funding for an independent audit of new code.

It also touts the number of PhDs it’s hired to-date — and plans to hire a bunch more, saying it will be using the new round to more than double its headcount, including hiring cryptographers and developers, as well as marketing specialists in privacy.

The main motivation for the raise, per Halpin, is to spend on more R&D to explore — and (he hopes) — solve some of the more specific use-cases it’s kicking around, beyond the basic one of letting developers use the network to shield user traffic (a la Tor).

Nym’s whitepaper, for example, touts the possibility for the tech being used to enable users to prove they have the right to access a service without having to disclose their actual identity to the service provider.

Another big difference vs Tor is that Tor is a not-for-profit — whereas Nym wants to build a for-profit business around its Mixnet.

It intends to charge users for access to the network — so for the obfuscation-as-a-service of having their data packets mixed into a crowd of shuffled, encrypted and proxy node-hopped others.

But potentially also for some more bespoke services — with Nym’s team eyeing specific use-cases such as whether its network could offer itself as a ‘super VPN’ to the banking sector to shield their transactions; or provide a secure conduit for AI companies to carry out machine learning processing on sensitive data-sets (such as healthcare data) without risking exposing the information itself.

“The main reason we raised this Series A is we need to do more R&D to solve some of these use-cases,” says Halpin. “But what impressed Polychain was they said wow there’s all these people that are actually interested in privacy — that want to run these nodes, that actually want to use the software. So originally when we envisaged this startup we were imagining more b2b use-cases I guess and what I think Polychain was impressed with was there seemed to be demand from b2c; consumer demand that was much higher than expected.”

Halpin says they expect the first use-cases and early users to come from the crypto space — where privacy concerns routinely attach themselves to blockchain transactions.

The plan is to launch the software by the end of the year or early next, he adds.

“We will have at least some sort of chat applications — for example it’s very easy to use our software with Signal… so we do think something like Signal is an ideal use-case for our software — and we would like to launch with both a [crypto] wallet and a chat app,” he says. “Then over the next year or two — because we have this runway — we can work more on kind of higher speed applications. Things like try to find partnerships with browsers, with VPNs.”

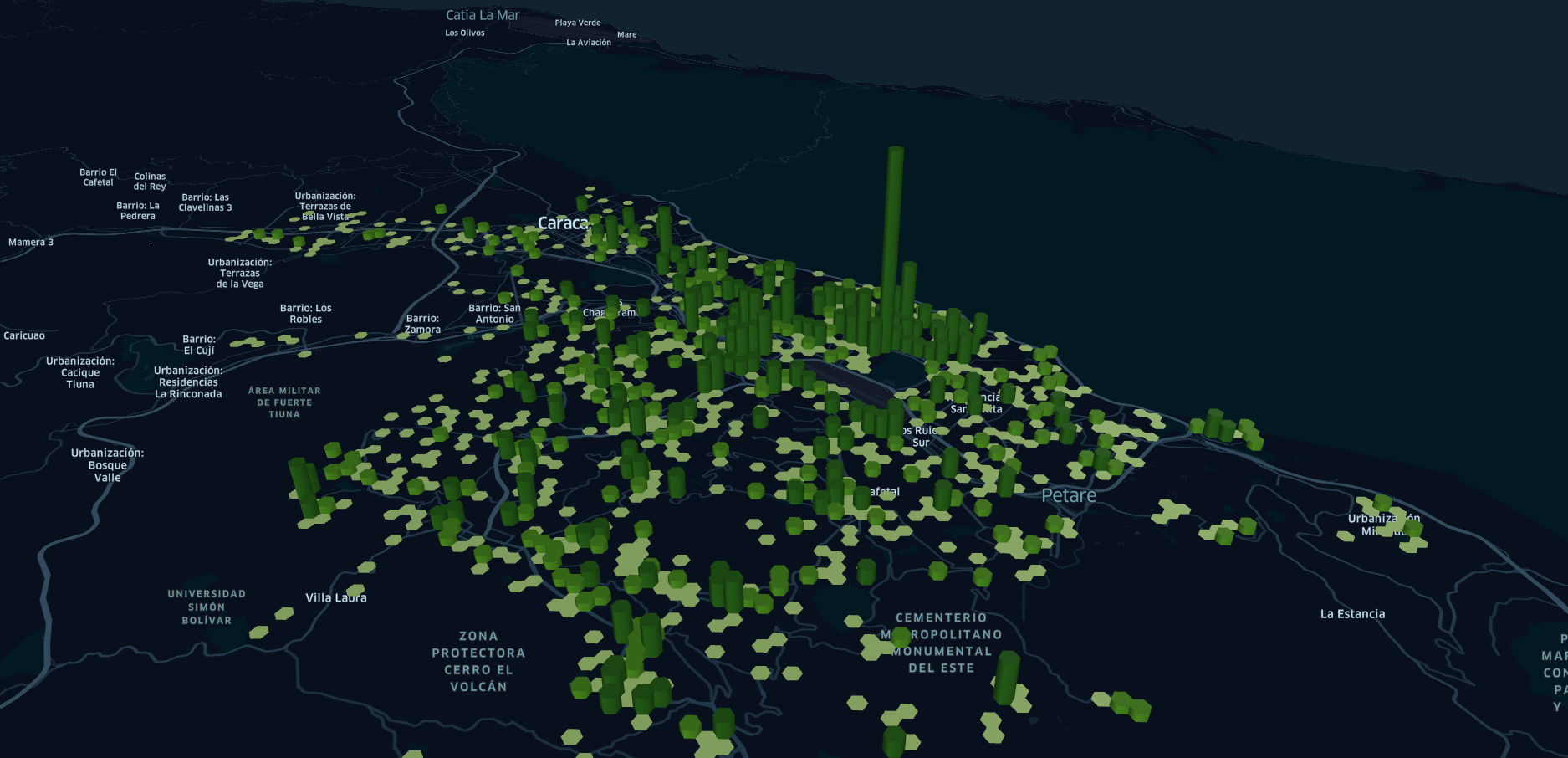

At this (still fairly early) stage of the network’s development — an initial testnet was launched in 2019 — Nym’s eponymous network has amassed over 9,000 nodes. These distributed, crowdsourced providers are only earning a NYM reputation token for now, and it remains to be seen how much exchangeable crypto value they might earn in the future as suppliers of key infrastructure if/when usage takes off.

Why didn’t Mixnets as a technology take off before, though? After all the idea dates back to the 1980s. There’s a range of reasons, according to Halpin — issues with scalability being one of them one. And a key design “innovation” he points to vis-a-vis its implementation of Mixnet technology is the ability to keep adding nodes so the network is able to scale to meet demand.

Another key addition is that the Nym protocol injects dummy traffic packets into the shuffle to make it harder for adversaries to decode the path of any particular message — aiming to bolster the packet mixing process against vulnerabilities like correlation attacks.

While the Nym network’s crypto-style reputation and incentive mechanism — which works to ensure the quality of mixing (“via a novel proof of mixing scheme”, as its whitepaper puts it) — is another differentiating component Halpin flags.

“One of our core innovations is we scale by adding servers. And the question is how do we add servers? To be honest we added servers by looking at what everyone had learned about reputation and incentives from cryptocurrency systems,” he tells TechCrunch. “We copied that — those insights — and attached them to mix networks. So the combination of the two things ends up being pretty powerful.

“The technology does essentially three things… We mix packets. You want to think about an unencrypted packet like a card, an encrypted packet you flip over so you don’t know what the card says, you collect a bunch of cards and you shuffle them. That’s all that mixing is — it just randomly permutates the packets… Then you hand them to the next person, they shuffle them. You hand them to the third person, they shuffle them. And then they had the cards to whoever is at the end. And as long as different people gave you cards at the beginning you can’t distinguish those people.”

More generally, Nym also argues it’s an advantage to be developing mixnet technology that’s independent and general purpose — folding all sorts and types of traffic into a shuffled pack — suggesting it can achieve greater privacy for users’ packets in this pooled crowd vs similar tech offered by a single provider to only their own users (such as the ‘privacy relay’ network recently announced by Apple).

In the latter case, an attacker already knows that the relayed traffic is being sent by Apple users who are accessing iCloud services. Whereas — as a general purpose overlay layer — Nym can, in theory, provide contextual coverage to users as part of its privacy mix. So another key point is that the level of privacy available to Nym users scales as usage does.

Historical performance issues with bandwidth and latency are other reasons Halpin cites for Mixnets being largely left on the academic shelf. (There have been some other deployments, such as Loopix — which Nym’s whitepaper says its design builds on by extending it into a “general purpose incentivized mixnet architecture” — but it’s fair to say the technology hasn’t exactly gone mainstream.)

Nonetheless, Nym’s contention is the tech’s time is finally coming; firstly because technical challenges associated with Mixnets can be overcome — because of gains in Internet bandwidth and compute power; as well as through incorporating crypto-style incentives and other design tweaks it’s introducing (e.g. dummy traffic) — but also, and perhaps most importantly, because privacy concerns aren’t simply going to disappear.

Indeed, Halpin suggests governments in certain countries may ultimately decide their exposure to certain mainstream tech providers which are subject to state mass surveillance regimes — whether that’s the US version or China’s flavor or elsewhere — simply isn’t tenable over the longer run and that trusting sensitive data to corporate VPNs based in countries subject to intelligence agency snooping is a fool’s game.

(And it’s interesting to note, for example, that the European Data Protection Supervisor is currently conducting a review of EU bodies use of mainstream US cloud services from AWS and Microsoft to check whether they are in compliance with last summer’s Schrems II ruling by the CJEU, which struck down the EU-US Privacy Shield deal, after again finding US surveillance law to be essentially incompatible with EU privacy rights… )

Nym is betting that some governments will — eventually — come looking for alternative technology solutions to the spying problem. Although government procurement cycles make that play a longer game.

In the near term, Halpin says they expect interest and usage for the metadata-obscuring tech to come from the crypto world where there’s a need to shield transactions from view of potential hackers.

“The websites that [crypto] people use — these exchanges — have also expressed interest,” he notes, flagging that Nym also took in some funding from Binance Labs, the VC arm of the cryptocurrency exchange, after it was chosen to go through the Lab’s incubator program in 2018.

The issue for crypto users is their networks are (relatively) small, per Halpin — which makes them vulnerable to deanonymization attacks.

“The thing with a small network is it’s easy for random people to observe this. For example people who want to hack your exchange wallet — which happens all the time. So what cryptocurrency exchanges and companies that deal with cryptocurrency are concerned about is typically they do not want the IP address of their wallet revealed for certain kinds of transactions,” he adds. “This is a real problem for cryptocurrency exchanges — and it’s not that their enemy is the NSA; their enemy could be — and almost always is — an unknown, often lone individual but highly skilled hacker. And these kinds of people can do network observations, on smaller networks like cryptocurrency networks, that are essentially are as powerful as what the NSA could do to the entire Internet.”

There are now a range of startups seeking to decentralize various aspects of Internet or common computing infrastructure — from file storage to decentralized DNS. And while some of these tout increased security and privacy as core benefits of decentralization — suggesting they can ‘fix’ the problem of mass surveillance by having an architecture that massively distributes data, Halpin argues that a privacy claim being routinely attached to decentralized infrastructure is misplaced. (He points to a paper he co-authored on this topic, entitled Systematizing Decentralization and Privacy: Lessons from 15 Years of Research and Deployments.)

“Almost all of those projects gain decentralization at the cost of privacy,” he argues. “Because any decentralized system is easier to observe because the crowd has been spread out… than a centralized system — to a large extent. If the adversary is sufficiently powerful enough all the participants in the system. And historically we believe that most people who are interested in decentralization are not expects in privacy and underestimate how easy it is to observe decentalized systems — because most of these systems are actually pretty small.”

He points out there are “only” 10,000 full nodes in Bitcoin, for example, and a similar amount in Ethereum — while other, newer and more nascent decentralized services are likely to have fewer nodes, maybe even just a few hundred or thousand.

And while the Nym network has a similar amount of nodes to Bitcoin, the difference is it’s a mixnet too — so it’s not just decentralized but it’s also using multiple layers of encryption and traffic mixing and the various other obfuscation steps which he says “none of these other people do”.

“We assume the enemy is observing everything in our software,” he adds. “We are not what we call ‘security through obscurity’ — security through obscurity means you assume the enemy just can’t see everything; isn’t looking at your software too carefully; doesn’t know where all your servers are. But — realistically — in an age of mass surveillance, the enemy will know where all your services are and they can observe all the packets coming in, all the packets coming out. And that’s a real problem for decentralized networks.”

Post-Snowden, there’s certainly been growing interest in privacy by design — and a handful of startups and companies have been able to build momentum for services that promise to shield users’ data, such as DuckDuckGo (non-tracking search); Protonmail (e2e encrypted email); and Brave (privacy-safe browsing). Apple has also, of course, very successfully markets its premium hardware under a ‘privacy respecting’ banner.

Halpin says he wants Nym to be part of that movement; building privacy tech that can touch the mainstream.

“Because there’s so much venture capital floating into the market right now I think we have a once in a generation chance — just as everyone was excited about p2p in 2000 — we have a once in a generation chance to build privacy technology and we should build companies which natively support privacy, rather than just trying to bolt it on, in a half hearted manner, onto non-privacy respecting business models.

“Now I think the real question — which is why we didn’t raise more money — is, is there enough consumer and business demand that we can actually discover what the cost of privacy actually is? How much are people willing to pay for it and how much does it cost? And what we do is we do privacy on such a fundamental level is we say what is the cost of a privacy-enhanced byte or packet? So that’s what we’re trying to figure out: How much would people pay just for a privacy-enhanced byte and how much does just a privacy enhanced byte cost? And is this a small enough marginal cost that it can be added to all sorts of systems — just as we added TLS to all sorts of systems and encryption.”

”

”