News: Square launches business bank accounts

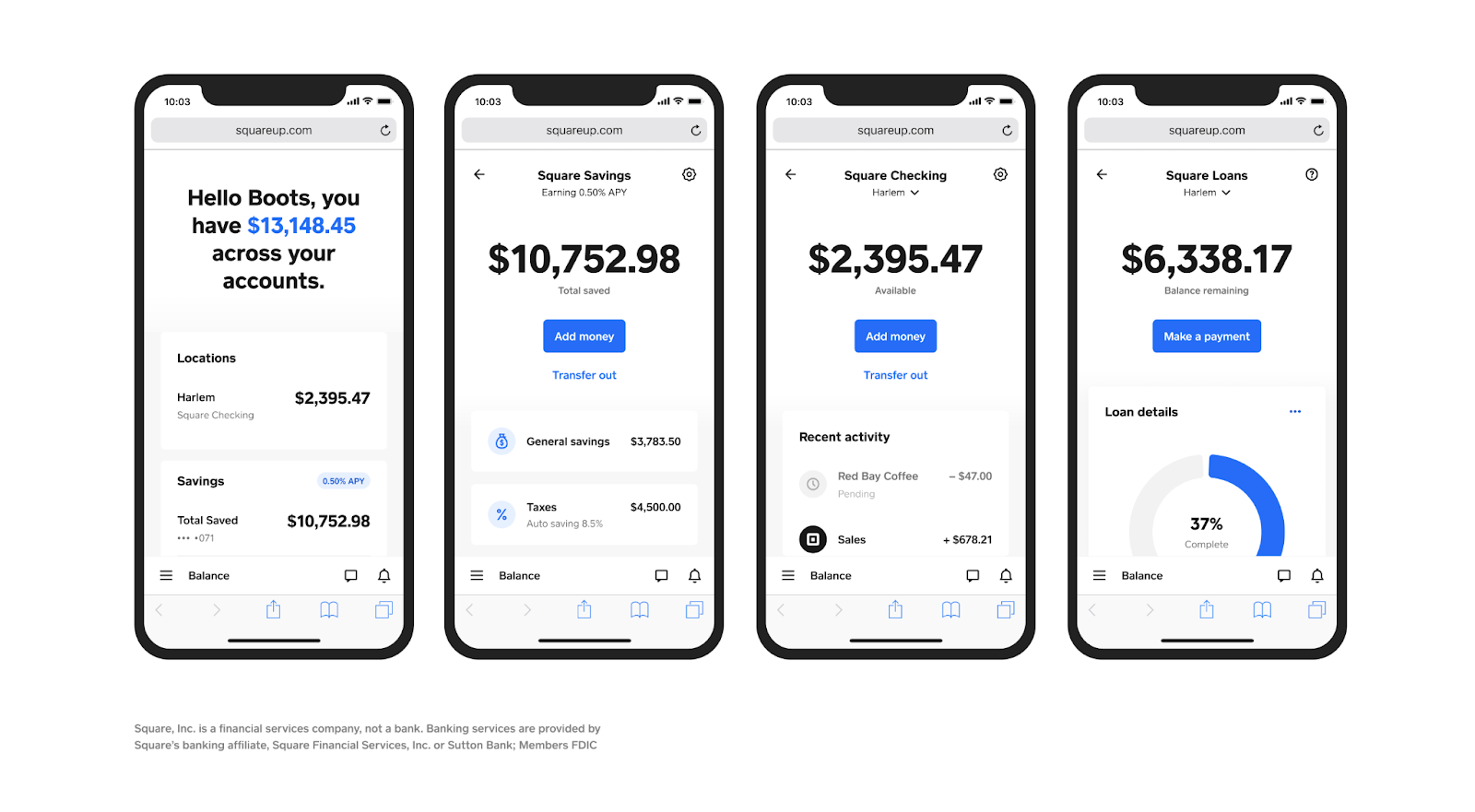

One step at a time, Square is creating a new bank from scratch. Today, the company is launching a new product called Square Banking that combines a checking account, savings accounts, debit cards and loans under a single roof. With Square Banking, the company wants to convince small businesses that it’s just easier to manage

One step at a time, Square is creating a new bank from scratch. Today, the company is launching a new product called Square Banking that combines a checking account, savings accounts, debit cards and loans under a single roof. With Square Banking, the company wants to convince small businesses that it’s just easier to manage all their money needs through Square.

Originally focused on payments processing, Square launched a debit card for its business customers in 2019. This way, business owners can start spending the money they’re bringing in through Square payments without having to transfer the money to a separate bank account first.

With today’s launch, the company is expanding beyond its debit card offering by adding checking and savings accounts. Every time you make a sale, you can access the funds from your new Square checking account. There are no monthly fees, no credit checks and no minimum balance.

And because it’s a traditional checking account, you get your own account and routing numbers — you can receive and send money from your account directly. Behind the scenes, checking accounts are currently provided by Sutton Bank — your funds are FDIC-insured.

Square now also lets you open savings accounts. The company is taking advantage of the fact that it also manages your sales through its payments products. You can choose a percentage of your Square sales revenue so that you can save money every day without having to think about it. Users can also create different folders for different business needs — sales taxes, new machine, etc.

Right now, Square offers an annuel percentage yield (APY) of 0.50% but that rate is only guaranteed through the end of 2021. Transfers between your savings accounts and your Square checking account are free and instant. Once again, your savings accounts are FDIC-insured.

Image Credits: Square

Finally, Square is integrating its business loans with the rest of its banking products. Instead of calling it Square Capital, the product is simply called ‘Loans’. The company recently completed the charter approval process for Square Financial Services, proving that its lending products are a key part of the company’s strategy going forward.

Compared to traditional business loans, Square has simplified repayments. It takes a percentage of your daily card transactions, which means that you pay more when you have more sales and you pay less when you have fewer sales. Of couse, if you’re temporarily shutting down your business, you have to pay a minimum payment every 60 days.

Square Banking will be particularly interesting for small businesses already using Square to process payments for in-person and online sales. Chances are these customers also have a business bank account that isn’t managed by Square. But they could realize that they use those separate accounts less and less as Square keeps adding features to its banking products.