News: Pinterest rolls out new features that let creators make money from Pins

Pinterest today is increasing its investment in the creator community by introducing new tools that will allow creators to make money from their content. Now, creators will be able to tag products in their Idea Pins — a video-first feature the company first launched this spring — to make their content “shoppable.” They’ll also now

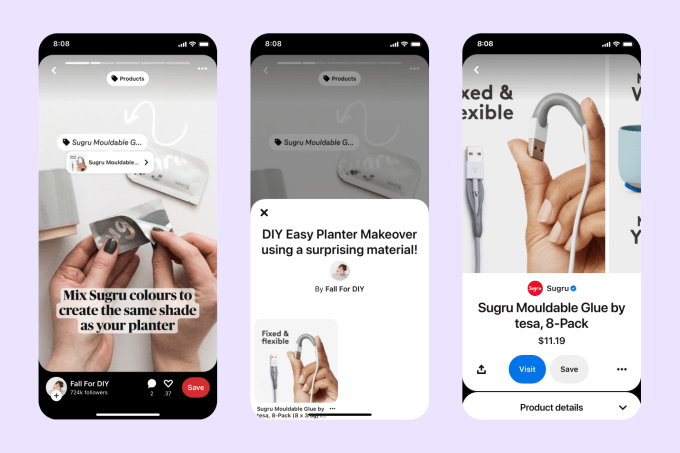

Pinterest today is increasing its investment in the creator community by introducing new tools that will allow creators to make money from their content. Now, creators will be able to tag products in their Idea Pins — a video-first feature the company first launched this spring — to make their content “shoppable.” They’ll also now be able to earn commissions through affiliate links and partner with brands on sponsored content, much like on other social platforms like Instagram, YouTube and TikTok.

Despite its general focus on turning product inspiration into clicks and purchases, Pinterest has been slower to embrace the creator community which today is responsible for driving a significant amount of interest in new products among online shoppers. Over the past several years, brands have increased their influencer marketing budgets from $1.7 billion in 2016 to now $13.8 billion in 2021. However, Pinterest offered few tools for creators to tap into that market on its own site, until its more recent debut of Idea Pins in May.

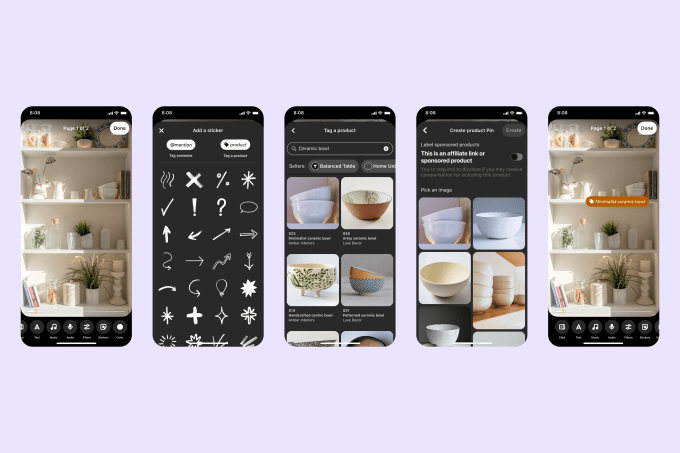

These Pins are somewhat like Pinterest’s take on TikTok, mixed with Stories, as they offer a way for creators to produce content that combines music, video, and other interactive elements. The videos in Idea Pins can be up to 60 seconds per page, with up to 20 total pages per Pin. Creators can also add other features to their Pins, like stickers or music, and tag other creators with their @username.

Image Credits: Pinterest

While similar in some ways to TikTok, the videos can include “detail pages” where viewers can find associated content, like the ingredient list and instructions for a recipe, or a list of how-to instructions for a craft project.

Now, explains Pinterest, creators will be able to tag products in their Pins, as well. That means fans viewing the Pin content can now go from inspiration to purchase from the Pinterest app. However, the path isn’t as straightforward as it is on Instagram, where a tap on a tag leads you to a page where you can then add an item to a shopping cart. Instead, Pinterest’s product tags tend to take you to another Pinterest page for the product in question, and from there you have to click again to visit the retailer’s website to complete your order.

The company has been testing the feature before today with creators including Olive + Brown, Fall for DIY and UnconventionalSouthernBelle who have already made some of their content shoppable.

The new Idea Pins product tagging tool will roll out to all business accounts in the U.S. and U.K. and will then continue to roll out access over the coming months to international creators.

Image Credits: Pinterest

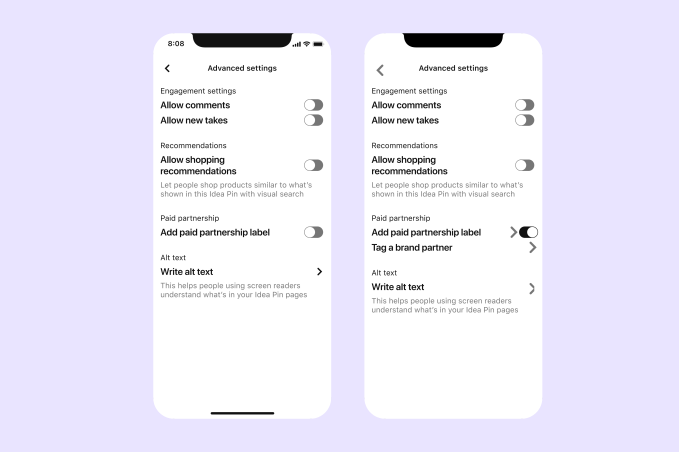

Other new monetization features rolling out now include support for affiliate programs and brand sponsorships.

Creators will now be able to integrate their affiliate programs for Rakuten and ShopStyle to generate additional revenue from their recommendations. Meanwhile, creators who come to the platform with brand partnerships will be able to use a new tool, still in beta, that will let them disclose those partnerships to their followers.

When they then produce branded content on Pinterest and add the brands to their Idea Pins, the brand will then be able to approve the tag, and the Idea Pin will feature a label that reads “Paid Partnership.”

This paid partnerships tool is now live for select Creators in the U.S., U.K., Canada, Australia, Ireland, New Zealand, France, Spain, Italy Germany, Switzerland, Austria, Sweden, Brazil, Argentina, Mexico, Chile, Colombia and Peru.

Image Credits: Pinterest

Most of Pinterest’s new monetization tools are not necessarily all that innovative or unique.

Instead, they represent a company that’s playing catch up to larger social platforms — like Facebook, Instagram, TikTok, an d YouTube — which have been better catering to creators in recent years by allowing them to build their own businesses on their respective platforms and expand their reach. Instagram, in particular, has moved in on Pinterest’s territory to such an extent that many users today start their shopping inspiration searches on its app first.

And Instagram has catered to this growing group of online shoppers by turning its platform into an online shop of sorts, compete with a dedicated Shop button, built-in checkout features, alerts about product drops, and numerous ways for creators to generate profits from their work.

Now that influencer shopping is the norm, the race is on among large platforms and startups alike to bring a similar set of shopping tools to live streamed video.

Given the significant competition, Pinterest’s pitch to the creator community is that its user base is already primed to shop.

By the end of 2020, the company says it saw a 20x increase in product searches on its platform. It also notes that Pinterest users are 89% more likely to exhibit shopping intent on products tagged in creators’ Idea Pins than on its standalone Pins. Plus, the company says that its focus will be more on inspirational content, rather than “influence and entertainment” — a seeming knock at social media and its influencer stars.

“Pinterest is the place where creators with inspiring and actionable ideas get discovered. With this latest update, we’re empowering Creators to reach millions of shoppers on the platform and monetize their work,” said Pinterest Head of Content and Creator Partnerships, Aya Kanai. “Creators deserve to be rewarded for the inspiration they deliver to their followers, and the sales they drive for brands. Creators are central to our mission to bring everyone the inspiration to create a life they love, and we’ll continue working with them to build their businesses and find success on Pinterest,” she added.