- July 28, 2021

- by:

- in: Blog

The cohort aims to tackle wide-ranging music industry issues. Some have already laid out commercialization plans, while others came together for the program and haven’t thought that far down the road.

Music rights giant ASCAP said today that a quartet of early-stage startups/university music projects will compete in its Immersive Music Studio Challenge. The 12-week project is a partnership between ASCAP Lab and NY Media Lab (NYCML) that offers the teams grants and access to development resources. They’ll also be showcasing at the upcoming ASCAP Experience.

It’s an interesting little cohort, aiming to tackle some wide-ranging music industry issues. Some have already laid out commercialization plans, while others essentially came together for the program and really haven’t thought that far down the road.

We spoke to the founding teams to get a better sense of the projects.

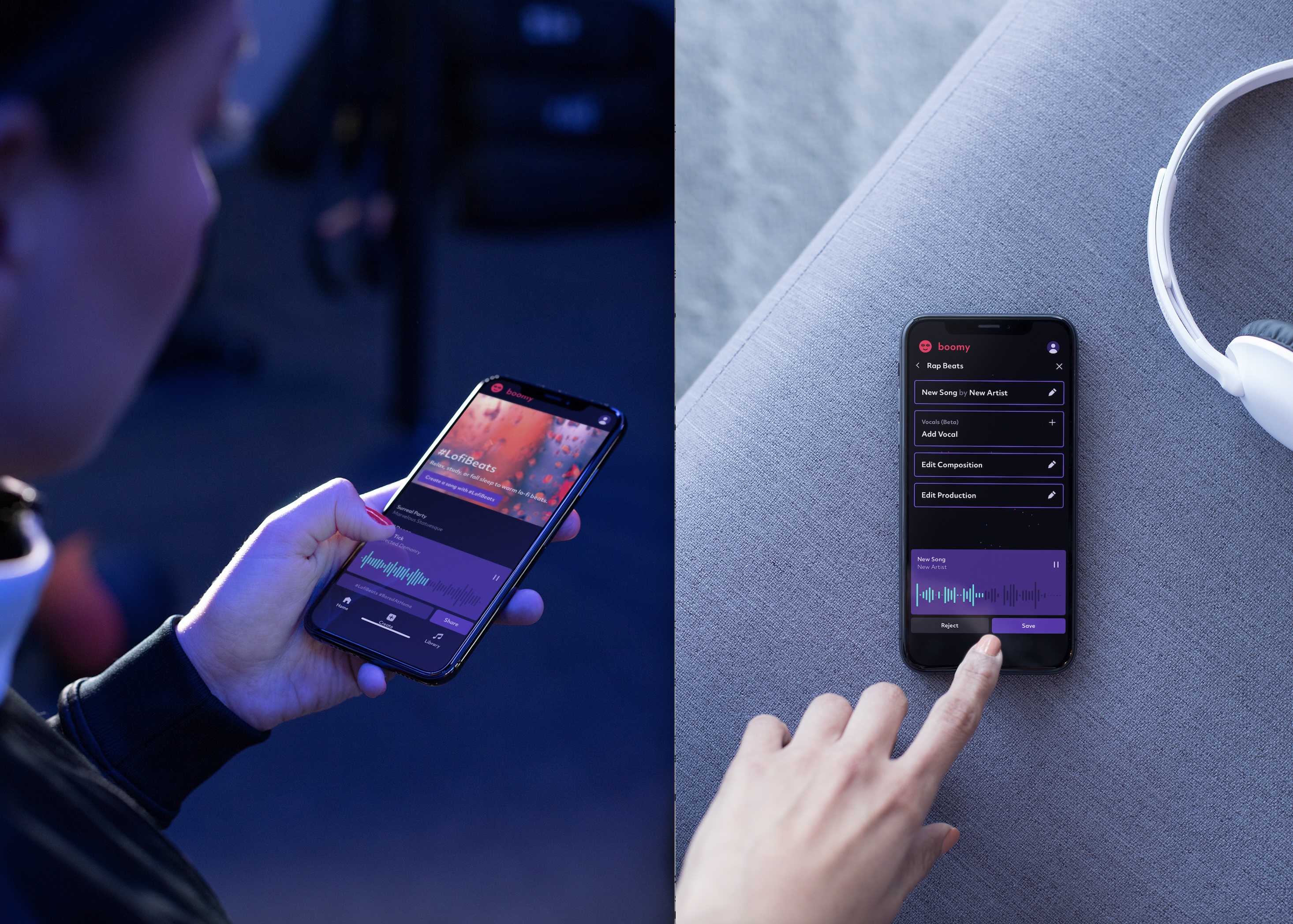

Image Credits: Boomy

Who’s on your founding team?

Boomy was founded by serial music entrepreneur Alex Jae Mitchell and music industry veteran Matthew Cohen Santorelli in 2019.

Please describe your product. What problems in the market are you trying to address?

Music-making is a complex skill requiring time, equipment and resources that most people don’t have. Boomy is an AI-powered music automation platform where people create and release music instantly, effortlessly, and for free — even if they’ve never made music before. Over 200,000 people are already using Boomy to create and release music, 85% of whom are first-time music makers.

Do you have any plans to commercialize? If so, what? Have you identified revenue streams?

Through the Boomy platform, users release albums to 40+ streaming services and digital retailers worldwide, including Spotify, TikTok, YouTube, Apple Music and more — all for free. Users keep an 80% share of the associated royalties, with the remaining 20% used by Boomy to power the free service.

What is your funding to date?

Boomy graduated from the Boost VC accelerator in 2019 and has raised follow-on funding from venture capital firms and music funds, but has not yet made a formal announcement regarding its fundraising.

Image Credits: MiSynth

Who’s on your founding team?

MiSynth began as a fictional business proposal created by Senaida Ng in her freshman year class, “Are Friends Electric?” taught by professor Errol Kolosine. After the class ended, Ng continued with the idea and worked closely with Kolosine to bring the idea to life. She recruited Ph.D. biomedical engineer Sinem Eriksen to lead the R&D alongside the guidance of NYU Music and Audio Research Lab (MARL) researchers Pablo Ripollés and Elena Georgieva.

Please describe your product. What problems in the market are you trying to address?

MiSynth is a revolutionary music software plugin that will allow musicians, songwriters and producers to synthesize any sounds they hear in their heads. They will bridge the gap between your imagination and your music by taking data from brain computer interfaces (BCIs) and turning them into playable MIDI instruments. The team at MiSynth strongly believes that everyone can and should have the tools to be an artist. Rather than spending hours learning about sound design and trying to re-create the perfect synth, MiSynth is making music more accessible and efficient for everyone.

Do you have any plans to commercialize? If so, what? Have you identified revenue streams?

Yes, we plan on continuing to build our prototype and testing it after the ASCAP NYCML Challenge and we hope to launch our software by August 2024. MiSynth will be sold as a software plugin compatible with any digital audio workstation (DAW), including Logic Pro X, Ableton Live, Pro Tools, FL Studio, Cubase and Reason. Customers can buy the license to use the software by paying either a one-time fee or a monthly subscription fee until they pay off the full price of the license.

What is your funding to date?

We are a relatively new company that began only in December 2020, but we plan on continuing to seek funding from investors, research grants and challenges like the ASCAP NYCML Challenge to continue our venture.

The Slashers

Who’s on your founding team?

Devin Kenny – an interdisciplinary artist, writer, musician and independent curator based out of NYC – and William Leon – an AR/VR developer and teaching fellow at Cornell Tech. The founding team met through the Art Fellowship at Cornell Tech in 2020.

Please describe your product. What problems in the market are you trying to address?

Otherwards is a mixed reality album listening experience combining music with interactive 3D objects and geolocation technology, creating an explorative album experience for the listener that melds music, gaming and the world around them.

Do you have any plans to commercialize? If so, what? Have you identified revenue streams?

No plans to commercialize just yet. We are in the process of iterating on the application toolchain and doing customer discovery.

What is your funding to date?

We’ve just started working on this project and have not raised any funds yet.

Image Credits: Dot Dot

Who’s on your founding team?

Kate Stevenson, Elizabeth Perez, Chris White and Jacques Foottit.

Please describe your product. What problems in the market are you trying to address?

Social is a best-in-class online event platform where users can easily meet and chat with other people while exploring virtual spaces with games and live performances. We saw the need to bring serendipitous social moments and ways to spark real-life relationships into the remote, virtual experience, especially at events and live performances.

Every world comes with proximity-activated audio, live-streaming avatars, beautiful customizable visuals and unique brand opportunities. With options to showcase video content, host a social livestream, add entertaining challenges and game packages so attendees and audience members connect through playful exploration and leave wowed by the experience.

Do you have any plans to commercialize? If so, what? Have you identified revenue streams?

Social is being used commercially for product launches, conferences, team-building events, art exhibitions and performances. Revenue streams include monetization through ticketing, donation widgets and sponsorship packages. Our commercial clients include fashion and beauty brands, media, tech and finance.

The COVID-19 pandemic has redefined how we think about virtual communication and experiences. We have seen a level of behavioral change that would typically take more than 10 years happen in just 12 months. There is now a viable market for virtual engagement and therefore an opportunity to consider a hybrid approach for how we can engage audiences as we move out of the pandemic.

What is your funding to date?

We are currently funded through white-labeled development for event companies and brands. Social is growing organically based on user needs, through pilots with physical venues, artists and passionate communities.