- June 2, 2021

- by:

- in: Blog

Jeeves, which is building an “all-in-one expense management platform” for global startups, is emerging from stealth today with $131 million in total funding, including $31 million in equity and $100 million in debt financing. The $31 million in equity consists of a new $26 million Series A and a previously unannounced $5 million seed round.

Jeeves, which is building an “all-in-one expense management platform” for global startups, is emerging from stealth today with $131 million in total funding, including $31 million in equity and $100 million in debt financing.

The $31 million in equity consists of a new $26 million Series A and a previously unannounced $5 million seed round.

Andreessen Horowitz (a16z) led the Series A funding, which also included participation from YC Continuity Fund, Jaguar Ventures, Urban Innovation Fund, Uncorrelated Ventures, Clocktower Ventures, Stanford University, 9 Yards Capital and BlockFi Ventures.

A high-profile group of angel investors also put money in the round, including NFL wide receiver Larry Fitzgerald and the founders of five LatAm unicorns — Nubank CEO David Velez, Kavak CEO Carlos Garcia, Rappi co-founder Sebastian Mejia, Bitso CEO Daniel Vogel and Loft CEO Florian Hagenbuch. Justo’s Ricardo Weder also participated in this round and Plaid co-founder William Hockey put money in the $5 million seed funding that closed in 2020 after the company completed the YC Summer 2020 batch.

The “fully remote” Jeeves describes itself as the first “cross country, cross currency” expense management platform. The startup’s offering is currently live in Mexico — its largest market — as well as Colombia, Canada and the U.S., and is currently beta testing in Brazil and Chile.

Dileep Thazhmon and Sherwin Gandhi founded Jeeves last year under the premise that startups have traditionally had to rely on financial infrastructure that is local and country-specific. For example, a company with employees in Mexico and Colombia would require multiple vendors to cover its finance function in each country — a corporate card in Mexico and one in Colombia and another vendor for cross-border payments.

Image Credits: Left to right: Jeeves co-founders Dileep Thazhmon and Sherwin Gandhi

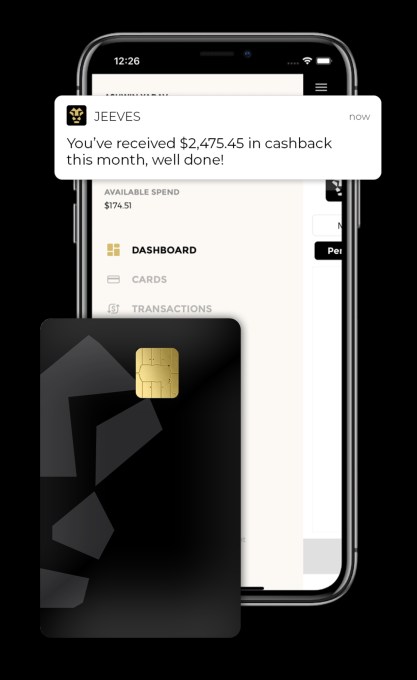

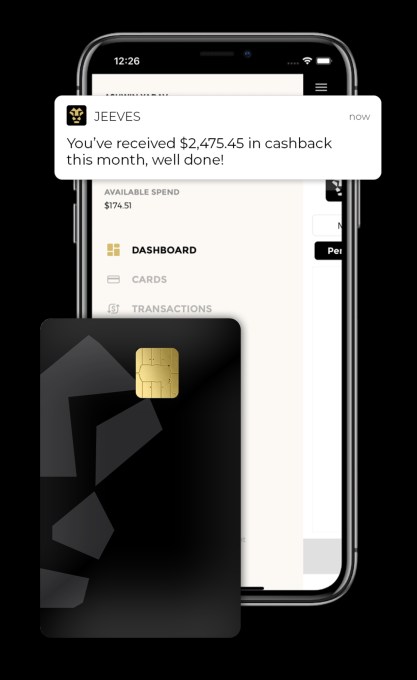

Jeeves claims that by using its platform, any company can spin up their finance function “in minutes” and get access to 30 days of credit on a true corporate card, noncard payment rails, as well as cross-border payments. Customers can also pay back in multiple currencies, reducing FX (foreign transaction) fees.

“We’re building an all-in-one expense management platform for startups in LatAm and global markets — cash, corporate cards, cross-border — all run on our own infrastructure,” Thazhmon said.

“We’re really building two things — an infrastructure layer that sits across banking institutions in different countries. And then on top of that, we’re building the customer-, or end user-facing app,” he added. “What gives us the ability to launch in countries much quicker is that we own part of that stack ourselves, versus what most fintechs would do, which is plug into a third-party provider in that region.”

Image Credits: Jeeves

Indeed, the company has seen rapid early growth. Since launching its private beta last October, Jeeves says it has grown its transaction volume (GTV) by 200x and increased revenue by 900% (albeit from a small base). In May alone, Jeeves says it processed more transaction volume than the entire year to date, and more than doubled its customer base. It says that “hundreds of companies,” including Bitso, Belvo, Justo, Runa, Worky, Zinboe, RobinFood and Muncher, “actively” use Jeeves to manage their local and international spend. On top of that, it says, the startup has a waitlist of more than 5,000 companies — which is part of why the company sought to raise debt and equity.

The shift to remote work globally due to the COVID-19 pandemic has played a large role in why Jeeves has seen so much demand, according to Thazhmon.

“Every company is now becoming a global company, and the service to employees in two different countries requires two different systems,” he said. “And then someone’s got to reconcile that system at the end of the month. This has been a big reason why we’re growing so fast.”

One of Jeeves’ biggest accomplishments so far, Thazhmon said, has been receiving approval to issue cards from its own credit BIN (bank identification number) in Mexico. It can also run SPEI payments directly on its infrastructure. (SPEI is a system developed and operated by Banco de México that allows the general public to make electronic payments.)

“This gives us a lot of flexibility and allows us to offer a truly unique product to our customers,” said Thazhmon, who previously co-founded PowerInbox, a

Battery Ventures-backed MarTech company that he says grew to $40 million in annual revenue in three years.

Jeeves says it will use the fresh capital to onboard new companies to the platform from its waitlist, scale its infrastructure to cover more countries and currencies as well as do some hiring and expand its product line.

A16z General Partner Angela Strange, who is joining Jeeves’ board as part of the investment, is extremely bullish on the startup’s potential.

Strange says she met Thazhmon about a year ago and was immediately intrigued.

“Not only were they working to provide the financial operating system within a country, starting in Mexico, they were designing their software platform to scale across multiple countries,” she said. “Finally — a multicountry/currency expense management & payouts platform, where increasingly companies have employees and operations in multiple countries from the start and can use a single company to manage their financials.”

Strange, who has been investing in Latin America for the past few years, notes that most companies in the region are unable to get a corporate credit card.

“That’s only the tip of the iceberg,” she told TechCrunch. “It’s cumbersome for companies to make bank to bank payouts, handle wires, and they usually also have expenses in the U.S. (and often other countries) so there is also FX. And they manage multiple bank accounts. Not only is paying hard, reconciliation on the backend takes weeks.”

As such, Strange said, with every country having their own bank transfer system, rules around who can issue a credit card, approved payment processors, currencies and bank accounts — payments and expense management across countries can be complex.

Jeeves, according to Strange, “gets as close to the networks/payment rails as possible” since it has its own issuing credit BIN versus needing to connect through legacy players.

Providing an orchestration layer on top of all the rails gives Jeeves the ability “to handle all the payment and reconciliation complexity” so “their customers don’t have to think about it,” she added.