News: GasBuddy tops the App Store for the first time due to Colonial Pipeline attack

The GasBuddy mobile app, which typically helps consumers find the cheapest gas nearby, has now become the No. 1 app on the U.S. App Store for the first time ever, due to the fuel shortages in the U.S. that followed the cyberattack on the Colonial Pipeline. Americans, fearful that gas would become unavailable, began panic-buying

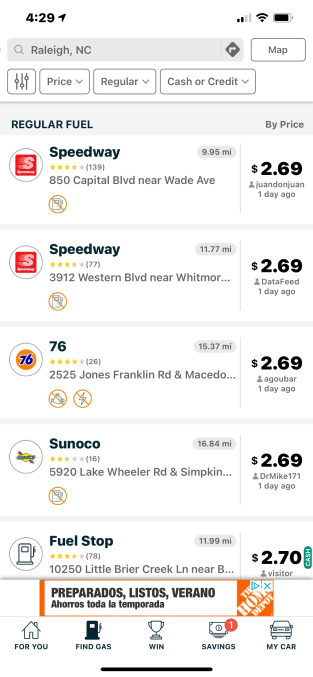

The GasBuddy mobile app, which typically helps consumers find the cheapest gas nearby, has now become the No. 1 app on the U.S. App Store for the first time ever, due to the fuel shortages in the U.S. that followed the cyberattack on the Colonial Pipeline. Americans, fearful that gas would become unavailable, began panic-buying in ways that haven’t been seen since the great toilet paper outage of 2020. As a result, thousands of gas stations ran out of fuel entirely. This dramatic situation has greatly benefitted the GasBuddy app, which includes a crowdsourced feature that helps users locate which local stations still have gas for sale.

As of Wednesday afternoon, GasBuddy says the effects of the Colonial Pipeline shutdown are being felt across 11 U.S. states, largely in the Southeast, and Washington D.C.. North Carolina had the highest number of gas stations with fuel outages, with 65% of stations reportedly out of gas as of 2:48 PM ET on Wednesday. Kentucky has the lowest at only 2%. Because this data is self-reported by GasBuddy users, it may not represent the most current information, we should note.

Image Credits: GasBuddy app screenshot

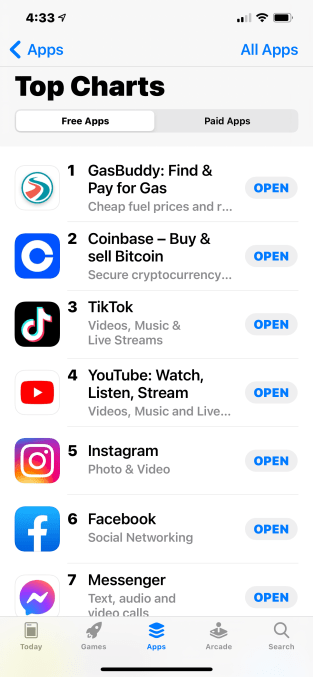

During the week, consumers have been turning to GasBuddy to help them find where they can fill up. Yesterday, the app hit No. 1 in the “Travel” category on the App Store, while it steadily climbed its way up the App Store’s Top Overall charts.

This afternoon, GasBuddy became both the No.1 app in the non-games category as well as the highest-ranked app Overall across the U.S. App Store.

According to data from app store intelligence firm Apptopia, GasBuddy yesterday saw 15,203 new downloads — a 59% increase from its average daily downloads, which were 9,560 for the past 30 days. However, third-party data isn’t always accurate for sudden shots in rank — it catches up in a few days after the fact.

Image Credits: Apptopia

Reached for comment, GasBuddy says its downloads were actually far higher than the third-party estimates. Across all platforms, including both iOS and Google Play, it saw 20x more downloads yesterday compared with an average day in 2021. The company told TechCrunch it counted 313,001 total downloads yesterday, compared with an average daily downloads for the previous 30 days of 15,339.

Broken down by platform, GasBuddy says it saw 104,735 downloads on Android and 208,266 downloads on iOS on Tuesday, May 11, 2021.

Apptopia had also noted that GasBuddy hadn’t been the No. 1 app on the App Store in all the time it’s been recording app store rankings, which goes back to Jan. 1, 2015. However, it noted the app itself launched back in 2010, making it possible (though not likely) that the app had reached No. 1 at some point.

GasBuddy confirmed that’s the not the case. Today is the first time it has ever topped the App Store, though it got close once before when it reached No. 2 behind a walkie-talkie app during Hurricane Irma in September 2017.

Image Credits: App Store screenshot on Wed., May 12, 2021

Consumers can continue to track statewide fuel outages here on GasBuddy’s website as well as where highest prices are being found. In the app, they can report whether gas stations have gas or diesel, as well as current prices.

The Colonial Pipeline, which runs 5,500 miles from the Gulf to the Northeast, shut down on Friday due to a ransomware attack from a criminal hacking network known as DarkSide, which is suspected to be based in Russia or Eastern Europe. The pipeline delivers about 45% of fuel used by the Eastern Seaboard. Reports of the shutdown sent Americans to stock up on gas, worsening the situation further. The U.S. Energy Secretary Jennifer Granholm said the Colonial Pipeline intends to restore operations by the end of the week.