- May 22, 2021

- by:

- in: Blog

Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy. The app industry continues to grow, with a record 218 billion downloads and $143 billion in global consumer spend in 2020. Consumers last year also spent 3.5 trillion minutes using apps on Android devices

Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy.

The app industry continues to grow, with a record 218 billion downloads and $143 billion in global consumer spend in 2020. Consumers last year also spent 3.5 trillion minutes using apps on Android devices alone. And in the U.S., app usage surged ahead of the time spent watching live TV. Currently, the average American watches 3.7 hours of live TV per day, but now spends four hours per day on their mobile devices.

Apps aren’t just a way to pass idle hours — they’re also a big business. In 2019, mobile-first companies had a combined $544 billion valuation, 6.5x higher than those without a mobile focus. In 2020, investors poured $73 billion in capital into mobile companies — a figure that’s up 27% year-over-year

This week we’re reviewing Google’s I/O developer event, rounding up the latest from Snap’s partner summit and taking a look at how Parler got back on the App Store, among other things.

This Week in Apps will soon be a newsletter! Sign up here: techcrunch.com/newsletters

Top Stories

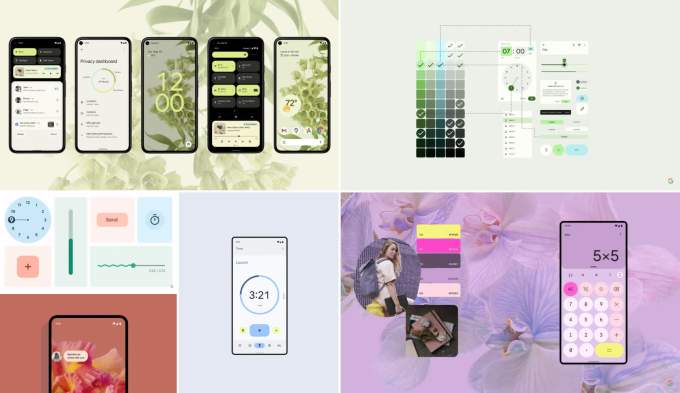

Google I/O was kinda boring this year

Image Credits: Google

Sorry, sorry. But it’s true. Without any new hardware announcements, the software-only event just didn’t feel as big and buzzy as it has in the past — which is kind of a bummer, since I/O was canceled entirely last year due to COVID-19. There was no announcement of an affordable Pixel 5a or 6 smartphone, no rumored Pixel Watch, no news on Pixel chips, no new smart home devices, no update on Google Stadia, and not even the Pixel Buds A-Series, which Google accidentally tweeted about ahead of schedule. What gives? Instead, Google I/O was filled with a lot of product news that could have been announced as blog posts — like Google Workspace improvements or neat Google Maps and Photos features. I mean, sure, a life-size 3D video calling booth is cool, but it’s not exactly going to be in your living room next year.

That’s not to downplay Google’s technical advancements, but if you’re sitting through a long live-ish (??) event, you don’t only want to hear about more conversational AI or less racist cameras (much less from the company that just fired multiple AI ethics researchers). You want to get excited about Google’s next new…thing.

When all was said and done, what stood out was Android 12.

The updated version of Google’s mobile OS with its new personalization features targets a current iPhone weakness: customization.

While iOS finally added support for widgets with iOS 14 and an App Library to clean up home screen clutter, Apple seemed almost caught off guard by the personalization madness that ensued after widgets went live. It had to quickly fix how app shortcuts worked — a workaround people had been using to tediously customize their home screen icons to match their wallpaper and widgets.

Android 12 addresses this demand for its own users and takes things a step further. Now, when Android 12 users set a new wallpaper the system can automatically create a custom palette of colors as the Android theme, including both the dominant and complementary colors. This is applied across the OS, including in the Quick Settings under the Notification Shade, in buttons on the lock screen, widgets and more. Google calls this “Material You,” which is a bit silly but gets the point across. The phone can really start to feel like yours.

Material You also introduces refreshed widgets with interactive controls and easier personalization options, smoother transitions, more animations and a privacy dashboard, where you can check in on which apps are accessing your location, mic and camera, for instance. But what sells it is how all those parts come together to present a new version of Android that actually feels fresh.

ICYMI: An I/O Round-up

- Stats: Android now powers 3 billion devices globally, up from 2.5 billion in May 2019. The figure includes 250 million active tablets as of last year.

- Foldables: Google announced a series of Android 12 updates that add support for foldable screens. (Is a foldable Pixel coming?)

- Design: “Material You” is Android’s new, adaptive design language which fully embraces the home screen personalization trend, allowing users to set themes that apply across the operating system. One of its more clever tricks is that it’s able to build the color palette for the theme based on the wallpaper you choose.

- Wearables: Google and Samsung team up on a unified wearable platform to take on Apple’s watchOS. The goal will be to combine the best of both worlds, Android Wear OS and Samsung’s Tizen, allowing apps to start faster and battery life to last longer, while users will gain more apps and watch faces. Meanwhile, the best of Fitbit — like tracking health progress and on-wrist goal celebrations — will come to Android Wear. Other updates include a Tiles API, watch face designer from Samsung, new consumer experience focused on speed and customization and redesigned Maps, Assistant and Pay.

- Auto: Google is working with BMW and others to allow Android smartphones to unlock and start vehicles, by leveraging support for Ultra Wideband technology (UWB). It’s also making it easier for developers to bring Android apps to the car as they can now create an app that supports both Android OS and Android Auto.

- AR: Google says there are now 850 million ARCore-compatible devices on the market. It also added Raw Depth & Recording/Playback APIs to ARCore to help make more immersive experiences possible.

- Flutter: Google’s cross-platform UI toolkit for building mobile and desktop apps now powers 200K Play Store apps, including those from WeChat, ByteDance, BMW, Grab and Didi. The new version, Flutter 2.2, adds reliability, performance improvements, a payment plugin for IAPs and a more streamlined process for bringing Flutter apps to Windows, macOS and Linux.

- Android Studio: Google announced the next version of its Android Studio IDE, Arctic Fox, which focuses on bringing more of the tooling around building apps directly into the IDE. The marquee feature of the update is Jetpack Compose, the toolkit for building modern UIs for Android.

- Google Play: Google shared details on sharing details (from 30% to 15%) and is adding new resources like an SDK website to help you find the right ones for you, and a dedicated Policy and Programs section in Play Console. Apps will later this year be able to monetize in new ways, including multi-quantity purchases, multi-line subscriptions and prepaid plans (access to content for a fixed amount of time).

- Ads: Google’s App campaigns on Android will expand to the desktop versions of Google.com and the Google Display Network. That means if a user clicks an ad in the desktop browser, they’ll be directed to the Play Store website to install the app to their linked device. Also, the Google Analytics for Firebase SDK now allows event creation and modification without app updates. Plus, Google introduced a deep link validator and impact calculator to make it easier to get started with deep linking.

Snap’s Partner Summit: AR and e-commerce and more

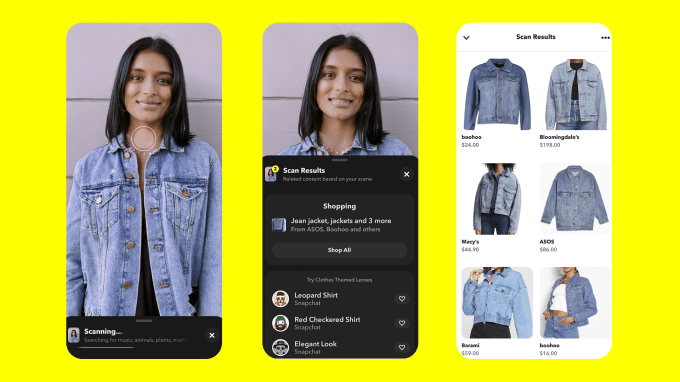

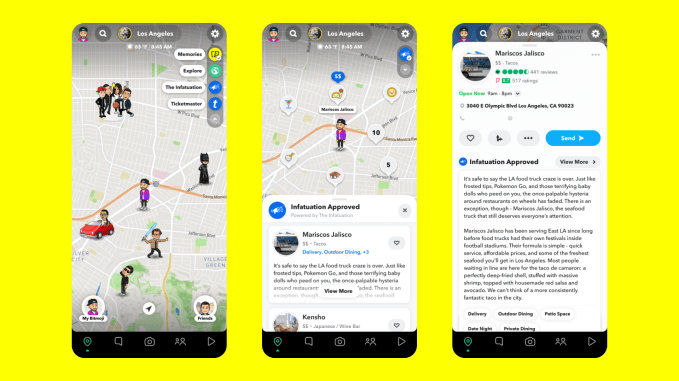

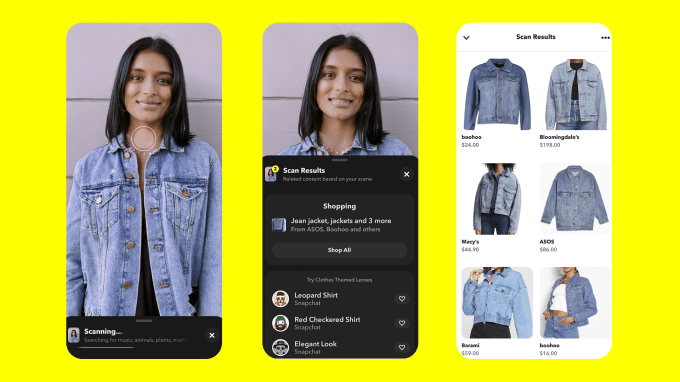

Snap, an app with now with 500 million MAUs, this week hosted an event for its partners, where the company unleashed a host of news about what’s next for its platform, including developer tools, AR updates, shopping features and more.

Among the highlights was Snap’s computer vision-enabled Scan product, which will analyze content in the camera feed to pull up matching products, similar to efforts by Pinterest and Google. Meanwhile, AR updates and partnerships with brands like Farfetch and Prada will make possible virtual try-on of clothes using AR. (Honestly, sometimes it feels like Snap’s tech is being lost in an app that’s mainly used by teenagers and young adults for socializing. Are they really Prada shoppers?)

Image Credits: Snap

Another big news item was Snap’s plans to release a brand-new app, Story Studio, which will give creators access to more powerful editing tools, for precisely trimming shots, adding captions, stickers and other visual elements, accessing licensed music, and more. Creators can then publish to Snapchat Spotlight, which is now available on the web, as well as other platforms.

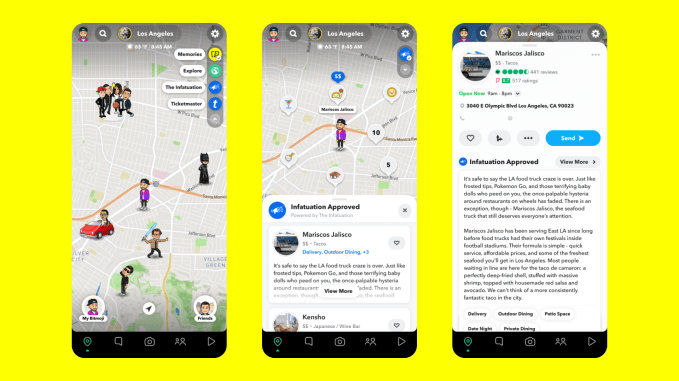

Meanwhile, Snap Map is getting an update with a product called Layers, that allows users to add data from Snap’s developer partners to their map to personalize their experience. For instance, a Ticketmaster Layer will show nearby concert venues.

Image Credits: Snap

The company also gave an update on its creator funding efforts, saying it had doled out more than $130 million to more than 5,400 creators making content for its TikTok rival, Spotlight, since November. It now says it will now longer pay out $1 million per day to encourage creator adoption.

Weekly News

E-commerce

Facebook debuted “Live Shopping Fridays” across the web and Facebook’s mobile apps to encourage consumers to make appointments to shop for beauty, skin care and fashion items from major brands like Abercrombie and Fitch, Bobbi Brown, Clinique, Sephora, Dermalogica and others.

Image Credits: Facebook

Fast fashion e-commerce app Shein took the crown from Amazon this week to become the most downloaded app on iOS and Android in the U.S. The company controls its own production chain, from prototype to manufacturing, allowing it to churn out products tailored to different regions and tastes at a daily rate, giving it the name the “TikTok for e-commerce.”

Africa’s largest carrier, Vodacom, has developed Africa’s first super-app with help from China’s Alibaba. The app will include a range of services, including e-commerce, banking and making mobile payments.

Adtech

Apple’s IDFA change has pushed Android ad spending up by 21%, per Liftoff. The growth comes when as many as 63.5% to 83.2% of iOS users are opting out of being tracked.

Apple released an update, iOS 14.5.1, which fixed the ATT bug that had grayed out the App Tracking Transparency toggle for some users in the Settings.

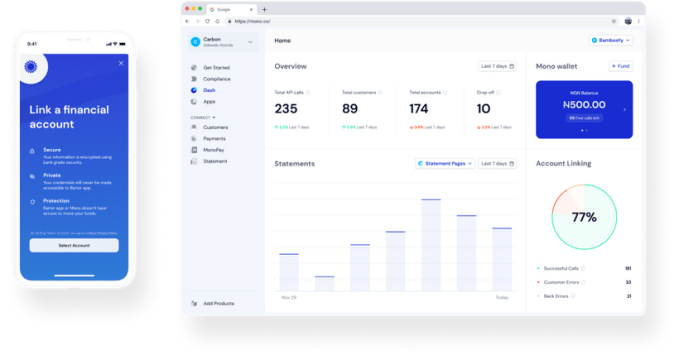

Fintech

Google Pay’s app was redesigned to make it easier for users to find businesses in the U.S., India and Singapore to start, with new discovery features, branded experiences for businesses, money organization tools and spending insights, Google Pay APIs for Web and Android, and a loyalty enrollment and sign-in API.

Social

Image Credits: TechCrunch

Parler’s back. After getting booted from the app stores and from its web host for inciting violence ahead of the January 6 Capitol riots, Parler has returned to the App Store. Now, posts that are labeled hate, (yes, “hate,” — this app doesn’t take down hate speech), won’t be visible on iPhone. The “hate” posts, which may include things like racial slurs, will be visible on other platforms and on the web version.

Parler’s back. After getting booted from the app stores and from its web host for inciting violence ahead of the January 6 Capitol riots, Parler has returned to the App Store. Now, posts that are labeled hate, (yes, “hate,” — this app doesn’t take down hate speech), won’t be visible on iPhone. The “hate” posts, which may include things like racial slurs, will be visible on other platforms and on the web version.

Apple had insisted that Parler must follow Apple’s App Store guidelines in order to return to its app marketplace, which meant Parler had to moderate its content. Parler however, would rather the option to view hate speech be a toggle, not hidden entry, saying it would prefer to put tools in the hands of it users. The company also dismissively referred to the sanitized version of Parler for iOS as “Parler PG.” The app is now No. 10 in the News category on iPhone.

Pinterest introduced Idea Pins, a video-first evolution of its Story Pins feature, aimed at creators. The Pins allow creators to publish videos of up to 60 seconds per page, with a total of 20 pages per Pin. They can also feature stickers, music and detail pages with more info, like recipe ingredients or project instructions.

TikTok rolled out new tools that allow creators to bulk delete and report comments as well as bulk block users. The feature could help someone quickly clean up their comments section when being trolled and keep their account safe from abusers. But it also could help them to create a false persona of being well-liked, as all negative feedback is removed.

Instagram will host its first Creator Week as an invitation-only series of events June 8-10. The virtual event will include 5,000 creators from the U.S. and will discuss topics like how to grow your online following and make money.

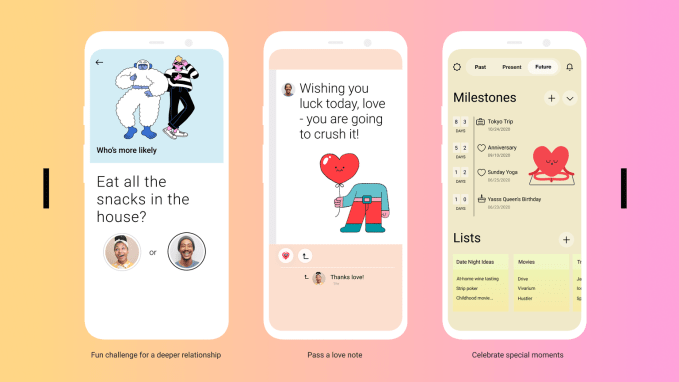

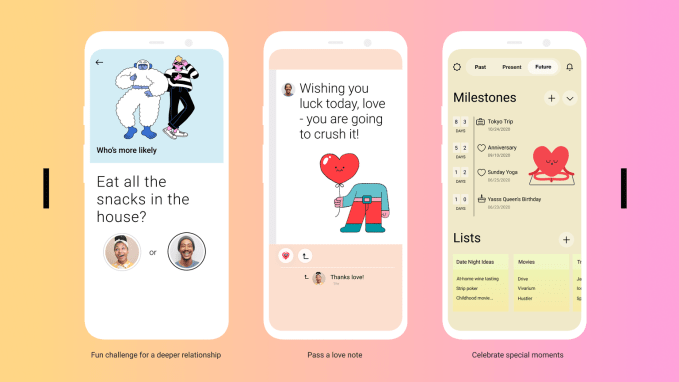

Facebook’s experimental app from its NPE team, Tuned comes to iPhone. The app is designed for users in relationships to stay in touch, messaging and sharing photos, replaying moments and sharing memories, and participating in newly expanded Q&A challenges.

Image Credits: Facebook

Photos

Reface’s buzzy face-swapping app now lets users upload their own source material for face swapping and animations, which rely on GAN algorithms. That means you can face-swap yourself into a famous piece of art, for instance. The app, launched 14 months ago, now has more than 100 million installs.

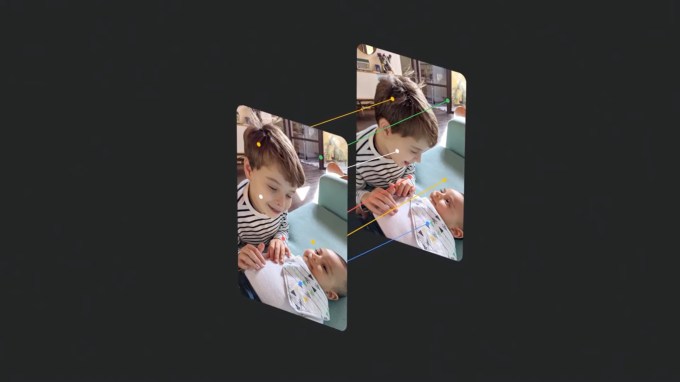

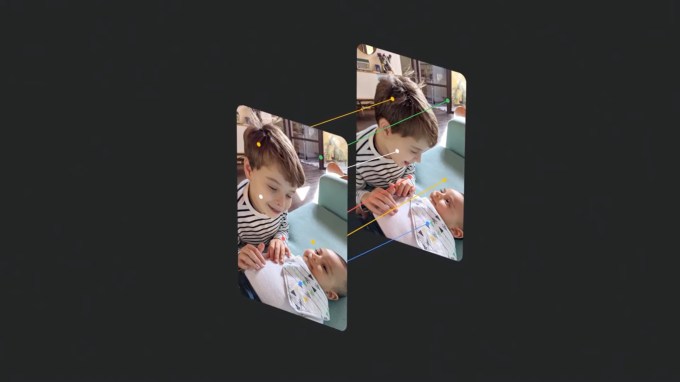

Google Photos update adds new Memories and a Locked Folder and previews Cinematic moments which animate a series of photos.

Image Credits: Google

Utilities

Google Maps is adding a number of updates this year, including new routing updates designed for safety, Live View enhancements, an expansion of detailed street maps to 50 more cities, a new “area busyness” feature, which shows crowded blocks and neighborhoods, and a more personalized Maps experience, which adjusts to your location and time of day.

The Chrome app for Android is bringing back RSS. A new feature for users in the U.S. on Chrome Canary is a “follow” button that will allow you to get the latest content from websites and blogs directly in Chrome. The feature relies on the open RSS web standard, so maybe stop building “blogs” that don’t have an RSS feed, OK?

Messaging

WhatsApp rivals, including Telegram and Signal, saw nearly 1,200% growth ahead of WhatsApp’s privacy policy deadline, Sensor Tower reports.

India told WhatsApp to withdraw its new privacy policy terms, or else the government of India will consider various options available to it under laws in India.

WhatsApp is testing disappearing messages with its TestFlight users. No word on public availability.

Streaming & Entertainment

Image Credits: Getty Images

Spotify launched a virtual concert series with The Black Keys and other artists. The pre-recorded streams are $15 each for the 40-75 minute show. Some unknown portion of that revenue is shared with the artists.

Spotify is adding automatic transcripts to its own Original and Exclusive podcasts, with the goal of rolling out transcripts to all shows over time.

Apple announced it’s bringing lossless audio streaming to Apple Music in June, as a free upgrade. The upgrade will also include support for Dolby Atmos and lossless audio files. The Android version will support lossless but not Dolby Atmos at launch. On Apple devices, lossless does not work on AirPods, AirPods Pro or AirPods Max, even when in wired listening mode. Nor does it work on HomePod devices.

On the same day, Amazon announced its own lossless music streaming service, Amazon Music HD, would also be a free upgrade for Amazon Music Unlimited subscribers.

Deezer technically beat Spotify to offer offline listening on Apple Watch this week, but not by much. Spotify on Friday added support for downloads on the Apple Watch so you can enjoy phone-free listening. Meanwhile Spotify is adding offline listening to Android Wear, too.

Android 12 will add built-in remote control features for controlling the now 80 million monthly active Android TV devices in the world.

HBO Max to add ad-supported streaming at $9.99 per month — a much cheaper option than its $14.99/mo ad-free experience. The option will roll out in June.

Clubhouse goes live globally. Meanwhile, Twitter rival Spaces shows off what Ticketed Spaces look like, and says it’s taking 20% cut of sales.

Dear everyone, everywhere: @Android is officially live across the globe!

— Clubhouse (@Clubhouse) May 21, 2021

Books

Mobile reading app Wattpad expanded its publishing arm with new adult fiction imprint, W by Wattpad Books, shortly after its acquisition by Naver was finalized.

Spotify expands into the audiobooks market by partnering with Storytel. The partnership is the first notable example of what’s possible with Spotify’s recently introduced Open Access Platform (OAP), which aims to give creators and publishers a way to extend their reach. With OAP, Storytel subscribers will be able to connect their account in Spotify, then stream their audiobooks through Spotify’s app.

Gaming

The Epic-Apple trial revealed that Apple generated at least $100 million in revenue and possibly much more from Fortnite’s time on the App Store from 2018 until it was pulled in 2020. Sensor Tower had estimated the figure was around $354 million.

Security & Privacy

Local crime-spotting app Citizen got into trouble for sparking a $30,000 manhunt for the wrong person. The app’s real-time feature, OnAir, broadcast to users that there was a reward for a man suspected of setting an LA area wildfire. But the person described — which was sent to the app’s 860K users — was not the person actually responsible, who was later arrested.

The Epic trial also revealed that there have been 130 types of Mac malware since last May, a level the company doesn’t find acceptable. The point was made as a defense for why the iOS App Store needs to exist — without it, the more than 1 billion iPhones in use would be an attractive target for attackers.

Funding and M&A

Indonesia’s BukuKas raised $50 million in Series B funding for its app helping to digitize small businesses. The startup began as a bookkeeping app but expanded to include online payments and an e-commerce platform that now services 6.3 million businesses.

Indonesia’s BukuKas raised $50 million in Series B funding for its app helping to digitize small businesses. The startup began as a bookkeeping app but expanded to include online payments and an e-commerce platform that now services 6.3 million businesses.

Ethel’s Club founder Naj Austin raised $3.75 million in seed funding for Somewhere Good, a Clubhouse-ish mobile app that connects people across interests, allowing them to post content and have real-time audio conversations.

Ethel’s Club founder Naj Austin raised $3.75 million in seed funding for Somewhere Good, a Clubhouse-ish mobile app that connects people across interests, allowing them to post content and have real-time audio conversations.

Mobile-first car ownership “super app” Jerry raised $57+ million to date, including its new $28 million Series B led by Goodwater Capital. The Palo Alto-based startup launched its car insurance comparison service and now has nearly 1 million U.S. customers.

Mobile-first car ownership “super app” Jerry raised $57+ million to date, including its new $28 million Series B led by Goodwater Capital. The Palo Alto-based startup launched its car insurance comparison service and now has nearly 1 million U.S. customers.

Egyptian digital banking app Telda raised $5 million pre-seed funding to help grow its business focused on helping Egyptians save, send and spend money.

Egyptian digital banking app Telda raised $5 million pre-seed funding to help grow its business focused on helping Egyptians save, send and spend money.

Spot Meetings raised $5 million from Kleiner Perkins to modernize remote meetings for mobile. The app includes an assistant “Spot” that can transcribe meeting notes, and offers a scratch pad for copying / pasting snippets of important info, among other things.

Spot Meetings raised $5 million from Kleiner Perkins to modernize remote meetings for mobile. The app includes an assistant “Spot” that can transcribe meeting notes, and offers a scratch pad for copying / pasting snippets of important info, among other things.

PhonePe is in talks to acquire the Samsung-backed Indus OS, an Indian startup that operates an eponymous third-party Android app store.

PhonePe is in talks to acquire the Samsung-backed Indus OS, an Indian startup that operates an eponymous third-party Android app store.

U.K.-based Robinhood rival Stake raised $30 million from Tiger Global and London-based DST Global to expand into Europe. The app has grown 6x since its U.K. launch in early 2020 and now has over 330K customers.

U.K.-based Robinhood rival Stake raised $30 million from Tiger Global and London-based DST Global to expand into Europe. The app has grown 6x since its U.K. launch in early 2020 and now has over 330K customers.

Snap acquired AR startup WaveOptics for over $500 million. The company, which represents Snap’s biggest acquisition to date, provides the waveguides and projectors used in Snap’s AR glasses, Spectacles.

Snap acquired AR startup WaveOptics for over $500 million. The company, which represents Snap’s biggest acquisition to date, provides the waveguides and projectors used in Snap’s AR glasses, Spectacles.

Jam City has filed to go public via a SPAC at $1.2 billion value. Th Harry Potter: Hogwarts Mystery publisher will use some of the money to acquire mobile game publisher Ludia for $175 million.

Jam City has filed to go public via a SPAC at $1.2 billion value. Th Harry Potter: Hogwarts Mystery publisher will use some of the money to acquire mobile game publisher Ludia for $175 million.

Downloads

Halide for iPad

Image Credits: Lux

The popular third-party camera app Halide made its way to the iPad this week, with an interface designed from scratch for the iPad with controls placed within reach near the edge of the big screen, special features for composition and iPad shooting (yes, really), custom icons to match either your Silver or Space Gray iPad Pro and support for either right or left handed users. The app is free with in-app purchases for iPad.

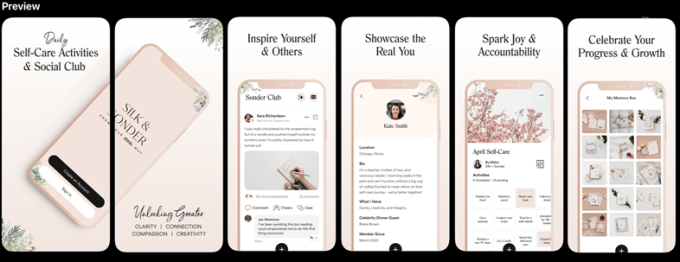

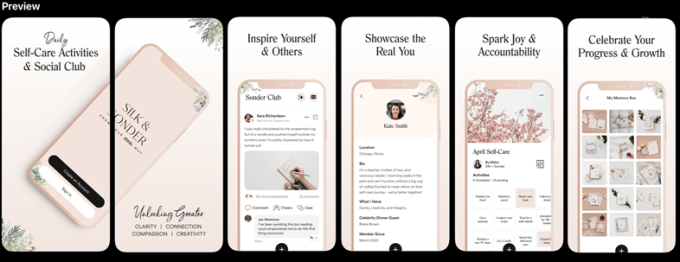

Silk + Sonder (Soft Launch)

Image Credits: Silk + Sonder

AAPI, female-founded Silk + Sonder was created by Meha Agrawal, a software engineer and PM for companies including Goldman Sachs, Stitch Fix, The Muse, and others to take an analog-first approach to mental wellness. Now, the company is launching its first mobile app after growing its me business to tens of thousands of subscribers and raising $4+ million in seed funding.

The new app offers curated self-care experiences, daily affirmations, a community club, a private memories feature and others meant to complement the company’s analog journal/planners that are shipped to member’s doorstep monthly. In calming shades of pinks and whites, the app guides users through their wellness journey and helps them stay accountable to their goals.

Since the app’s soft launch this month, it’s added thousands of users, more than 50% of whom engage regularly.

The new app is initially available only to active subscribers, but other users will be able to join a waitlist.

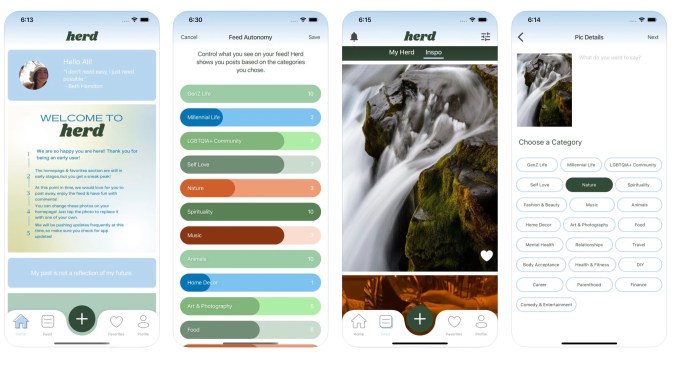

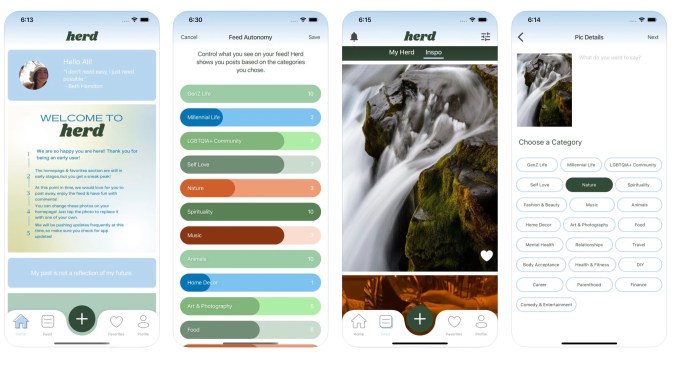

Herd (Beta)

Image Credits: Herd

Female-founded Herd has been building demand for its non-toxic Instagram alternative via TikTok. Now the app is live on iOS as a beta.

The goal of Herd is to give users a safer, social space focused on community, not influence, clout-chasing or data collection.

Users can customize their home feed by interest and use sliders to control what they want to see more of less of, while also posting their own photos, saving favorites, and staying private, if they choose. At present, Herd offers a basic photo-sharing experience. There are no Stories or photo filters or videos or much of anything that could lure users away from more advanced, feature-rich social apps. But what it does have is a mission that users feel connected with — and that pushed the app to No. 18 in the Social category on the App Store on launch day, May 18. It’s now still sitting in the top 50 a few days later.

But ultimately, all the marketing and social buzz can’t prop up an app forever. Herd needs to capitalize on the goodwill it’s built by leaning into quickly upgrading the UI/UX so the app itself feels as fresh as the ideas it espouses.

Reading Rec’s

Tweets

Apple and Epic Games can agree on one thing: The app economy is worth fighting over. Here’s a look at the explosive growth that turned app marketplaces into multibillion-dollar businesses. https://t.co/0279yhUS0I

— The Wall Street Journal (@WSJ) May 16, 2021

Schiller says in 2019 App Store drove $400 billion+ in transactions of physical goods, so food delivery, Amazon, Uber/Lyft, etc.

Judge interjects. “Billion with a b?” It’s a big number, and Schiller confirms Apple doesn’t take a cut of that.

— Nick Statt (@nickstatt) May 17, 2021

tim cook having to utter the words “I’m not a gamer” on record is why the epic v apple trial is good

— Megan Farokhmanesh (@Megan_Nicolett) May 21, 2021

Parler’s back. After getting booted from the app stores and from its web host for inciting violence ahead of the January 6 Capitol riots, Parler

Parler’s back. After getting booted from the app stores and from its web host for inciting violence ahead of the January 6 Capitol riots, Parler

Indonesia’s BukuKas

Indonesia’s BukuKas PhonePe

PhonePe  Jam City has

Jam City has