- May 26, 2021

- by:

- in: Blog

Facebook this week will begin to publicly roll out the option to hide Likes on posts across both Facebook and Instagram, following earlier tests beginning in 2019. The project, which puts the decision about Likes in the hands of the company’s global user base, had been in development for years, but was deprioritized due to

Facebook this week will begin to publicly roll out the option to hide Likes on posts across both Facebook and Instagram, following earlier tests beginning in 2019. The project, which puts the decision about Likes in the hands of the company’s global user base, had been in development for years, but was deprioritized due to the COVID-19 pandemic and the response work required on Facebook’s part, the company says.

Originally, the idea to hide Like counts on Facebook’s social networks was focused on depressurizing the experience for users. Often, users faced anxiety and embarrassment around their posts if they didn’t receive enough Likes to be considered “popular.” This problem was particularly difficult for younger users who highly value what peers think of them — so much so that they would take down posts that didn’t receive enough Likes.

Like-chasing on Instagram, especially, also helped create an environment where people posted to gain clout and notoriety, which can be a less authentic experience. On Facebook, gaining Likes or other forms of engagement could also be associated with posting polarizing content that required a reaction.

As a result of this pressure to perform, some users grew hungry for a “Like-free” safer space, where they could engage with friends or the wider public without trying to earn these popularity points. That, in turn, gave rise to a new crop of social networking and photo-sharing apps such as Minutiae, Vero, Dayflash, Oggl and, now, newcomers like Dispo and newly viral Poparazzi.

Though Facebook and Instagram could have chosen to remove Likes entirely and take its social networks in a new direction, the company soon found that the metric was too deeply integrated into the product experience to be fully removed. One key issue was how the influencer community today trades on Likes as a form of currency that allows them to exchange their online popularity for brand deals and job opportunities. Removing Likes, then, is not necessarily an option for these users.

Instagram realized that if it made a decision for its users, it would anger one side or the other — even if the move in either direction didn’t really impact other core metrics, like app usage.

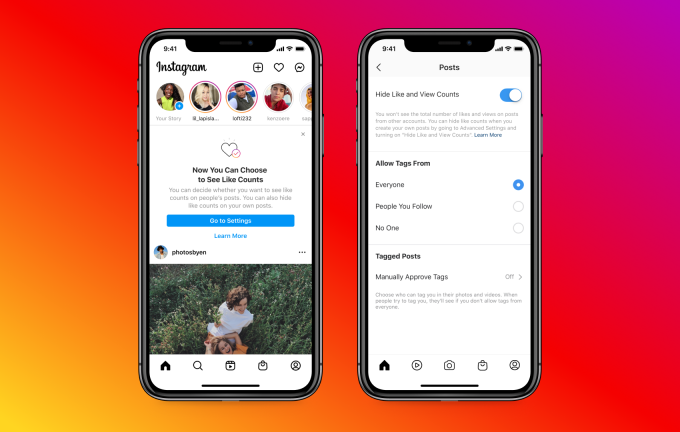

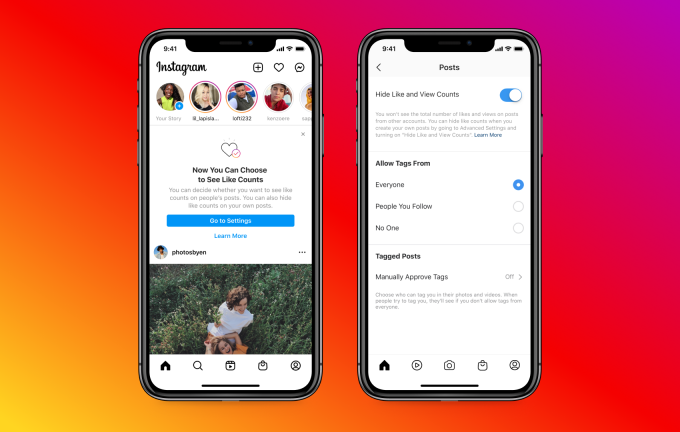

Image Credits: Instagram

“How many likes [users] got, or other people got — it turned out that it didn’t actually change nearly as much about the experience, in terms of how people felt or how much they use experience, as we thought it would. But it did end up being pretty polarizing,” admitted Instagram head, Adam Mosseri. “Some people really liked it and some people really didn’t.”

“For those who liked it, it was mostly what we had hoped — which is that it depressurized the experience. And, for those who didn’t, they used Likes to get a sense for what was trending or was relevant on Instagram and on Facebook. And they were just super annoyed that we took it away,” he added. This latter group sometimes included smaller creators still working on establishing a presence across social media, though larger influencers were sometimes in favor of Like removals. (Mosseri name-checked Katy Perry as being pro Like removals, in fact.)

Ultimately, the company decided to split the difference. Instead of making a hard choice about the future of its online communities, it’s rolling out the “no Likes” option as a user-controlled setting on both platforms.

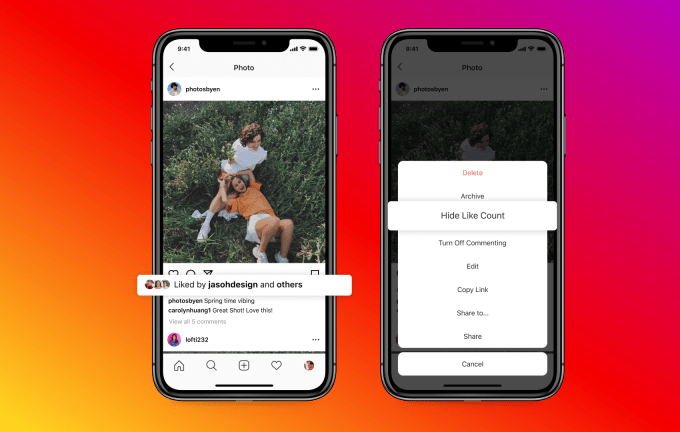

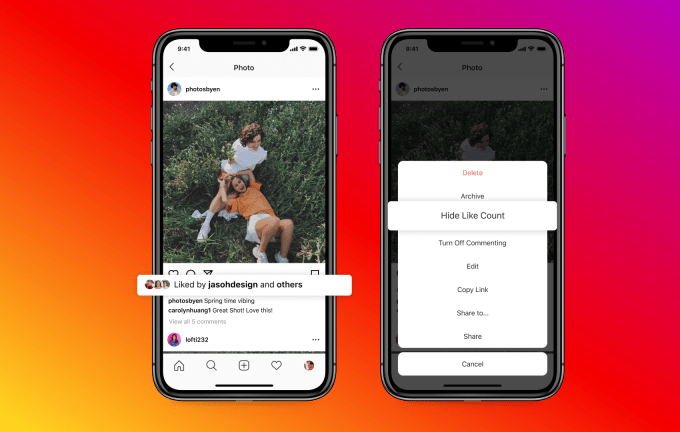

On Instagram, both content consumers and content producers can turn on or off Like and View counts on posts — which means you can choose to not see these metrics when scrolling your own Feed and you can choose whether to allow Likes to be viewed by others when you’re posting. These are configured as two different settings, which provides for more flexibility and control.

Image Credits: Instagram

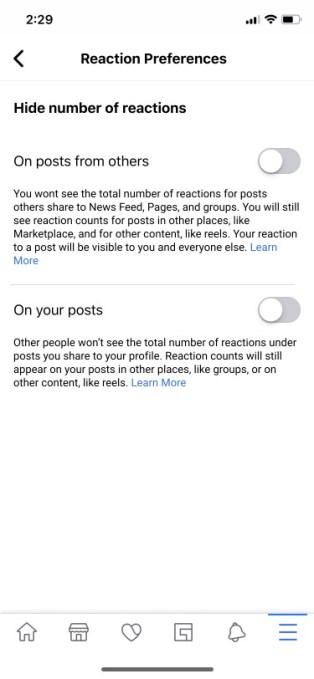

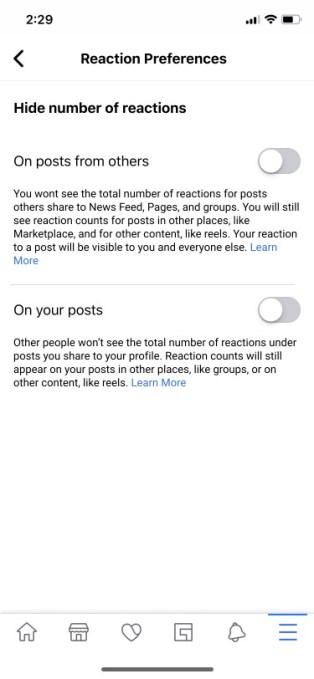

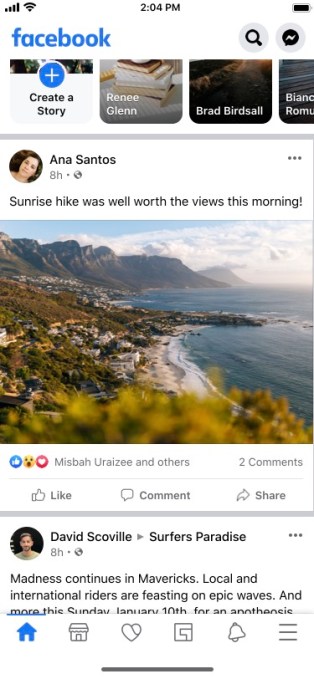

On Facebook, meanwhile, users access the new setting from the “Settings & Privacy” area under News Feed Settings (or News Feed Preferences on desktop). From here, you’ll find an option to “Hide number of reactions” to turn this setting off for both your own posts and for posts from others in News Feed, groups and Pages.

The feature will be made available to both public and private profiles, Facebook tells us, and will include posts you’ve published previously.

Image Credits: Facebook

Instagram last month restarted its tests on this feature in order to work out any final bugs before making the new settings live for global users, and said a Facebook test would come soon. But it’s now forging ahead with making the feature available publicly. When asked why such a short test, Instagram told TechCrunch it had been testing various iterations on this experience since 2019, so it felt it had enough data to proceed with a global launch.

Mosseri also pushed back at the idea that a decision on Likes would have majorly impacted the network. While removal of Likes on Instagram had some impact on user behavior, he said, it was not enough to be concerning. In some groups, users posted more — signaling that they felt less pressure to perform, perhaps. But others engaged less, Mosseri said.

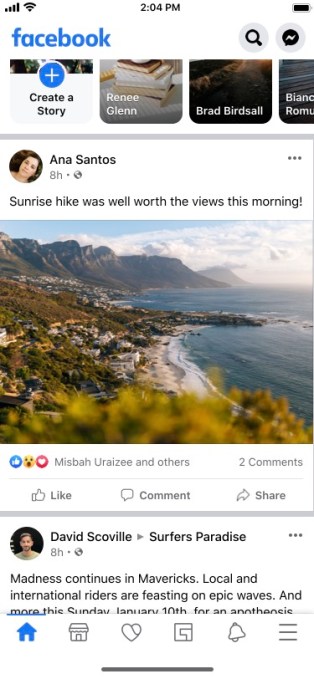

Image Credits: Facebook

“Often people say, ‘oh, this has a bunch of Likes. I’m gonna go check it out,’ ” the exec explained. “Then they read the comments, or go deeper, or swipe to the carousel. There’s been some small effects — some positive, some negative — but they’ve all been small,” he noted. Instagram also believes users may toggle on and off the feature at various times, based on how they’re feeling.

In addition, Mosseri pointed out, “there’s no rigorous research that suggests Likes are bad for people’s well-being” — a statement that pushes back over the growing concerns that a gamified social media space is bad for users’ mental health. Instead, he argued that Instagram is still a small part of people’s day, so how Likes function doesn’t affect people’s overall well-being.

“As big as we are, we have to be careful not to overestimate our influence,” Mosseri said.

He also dismissed some of the current research pointing to negative impacts of social media use as being overly reliant on methodologies that ask users to self-report their use, rather than measure it directly.

In other words, this is not a company that feels motivated to remove Likes entirely due to the negative mental health outcomes attributed to its popularity metrics.

It’s worth mentioning that another factor that could have come into play here is Instagram’s plan to make a version of its app available to children under the age of 13, as competitor TikTok did following its FTC settlement. In that case, hiding Likes by default — or perhaps adding a parental control option — would necessitate such a setting. Instagram tells TechCrunch that, while it’s too soon to know what it would do with a kids app, it will “definitely explore” a no Likes by default option.

Facebook and Instagram both told TechCrunch the feature will roll out starting on Wednesday but will reach global users over time. On Instagram, that may take a matter of days.

Facebook, meanwhile, says a small percentage of users will have the feature Wednesday — notified through an alert on News Feed — but it will reach Facebook’s global audience “over the next few weeks.”