The pandemic has just pushed edtech mainstream, but language-learning startup Duolingo had already spent the past decade figuring out how to build a successful edtech app. In our latest installment of the EC-1 series, Natasha Mascarenhas goes deep with the company to understand how it found product-market fit, then figured out how to grow like

The pandemic has just pushed edtech mainstream, but language-learning startup Duolingo had already spent the past decade figuring out how to build a successful edtech app.

In our latest installment of the EC-1 series, Natasha Mascarenhas goes deep with the company to understand how it found product-market fit, then figured out how to grow like a consumer tech startup and monetize like a SaaS startup. After a record 2020, the Pittsburgh-based company also opened up about its plans for the future, including a focus on speaking a new language (in addition to listening, reading and writing).

Here’s more from Natasha about what’s inside:

Want this kind of coverage on a different company or sector. Check out our ever-growing list of EC-1s, which include recent profiles of Klaviyo, StockX, Tonal and more.

Thanks for reading!

Eric Eldon

Managing Editor, Extra Crunch (subbing in for Walter again)

Amid the IPO gold rush, how should we value fintech startups

If there has ever been a golden age for fintech, it surely must be now.

As of Q1 2021, the number of fintech startups in the U.S. crossed 10,000 for the first time ever — well more than double that if you include EMEA and APAC. There are now three fintech companies worth more than $100 billion (Paypal, Square and Shopify) with another three in the $50 billion-$100 billion club (Stripe, Adyen and Coinbase).

Yet, as fintech companies have begun to go public, there has been a fair amount of uncertainty as to how these companies will be valued on the public markets. This is a result of fintechs being relatively new to the IPO scene compared to their consumer internet or enterprise software counterparts. Furthermore, fintechs employ a wide variety of business models: Some are transactional, while others are recurring or have hybrid business models.

And fintechs now have a multitude of options in terms of how they choose to go public. They can take the traditional IPO route, pursue a direct listing or merge with a SPAC. Given the multitude of variables at play, valuing these companies and then predicting public market performance is anything but straightforward.

How to attract large investors to your direct investing platform

Many fintech startups have tried to become a market-maker between investors and investment opportunities.

However, the challenge with this two-sided market is: How do you get the investors to show up?

It’s hard enough to get retail investors, but family offices and other large check writers are even more challenging to lure.

Analytics as a service: Why more enterprises should consider outsourcing

With an increasing number of enterprise systems, growing teams, a rising proliferation of the web and multiple digital initiatives, companies of all sizes are creating loads of data every day.

This data contains excellent business insights and immense opportunities, but it has become impossible for companies to derive actionable insights from this data consistently due to its sheer volume.

The analytics-as-a-service (AaaS) market is expected to grow to $101.29 billion by 2026. Organizations that have not started on their analytics journey or are spending scarce data engineer resources to resolve issues with analytics implementations are not identifying actionable data insights.

Through AaaS, managed services providers (MSPs) can help organizations get started on their analytics journey immediately without extravagant capital investment.

MSPs can take ownership of the company’s immediate data analytics needs, resolve ongoing challenges, and integrate new data sources to manage dashboard visualizations, reporting and predictive modeling — enabling companies to make data-driven decisions every day.

Will fintech unicorn Flywire’s proposed IPO reach escape velocity?

Flywire, a Boston-based magnet for venture capital, filed to go public Monday.

Flywire is a global payments company that attracted more than $300 million as a startup, according to Crunchbase, most recently raising a $60 million Series F last month. We don’t have its most recent valuation, but PitchBook data indicates that the company’s February 2020, $120 million round valued Flywire at $1 billion on a post-money basis.

So what we’re looking at here is a fintech unicorn IPO. A great way to kick off the week, to be honest, though we thought that Robinhood would be the next such debut.

Fintech venture capital activity has been hot lately, which makes the Flywire IPO interesting. Its success or failure could dictate the pace of fintech exits and fintech startup valuations in general, so we have to care about it.

First, what does Flywire do and with whom does it compete? Then, a closer look at its financial results as we hope to get our hands around its revenue quality, aggregate economics and growth prospects.

After that, we’ll discuss valuations and which venture capital groups are set to do well in its flotation.

As Q2’s lull fades, unicorn IPOs are revving up

If it feels like IPO news slowed for a few weeks at the start of the second quarter, your gut is correct. Investors previously told The Exchange that the first, third and fourth quarters of 2021 would be hot periods for public debuts, but that Q2 would be slower. Their argument revolved around reporting cadences and how long it takes for certain periods of accounting work to be completed.

So we weren’t surprised when the second quarter’s IPO cycle began to feel a bit soft compared to the rapid-fire first quarter. And, as we’ve all heard in recent days, the great SPAC rush is slowing.

But that hasn’t stopped a number of firms from defying expectations and going public all the same.

SAP CEO Christian Klein looks back on his first year

Image Credits: SAP

SAP CEO Christian Klein was appointed co-CEO with Jennifer Morgan in October 2019. He became sole CEO just as the pandemic was hitting full force across the world last April.

He was put in charge of a storied company at 39 years old. By October, its stock price was down and revenue projections for the coming years were flat.

That is definitely not the way any CEO wants to start their tenure, but the pandemic forced Klein to make some decisions to move his customers to the cloud faster. That, in turn, had an impact on revenue until the transition was completed. While it makes sense to make this move now, investors weren’t happy with the news.

There was also the decision to spin out Qualtrics, the company his predecessor acquired for $8 billion in 2018. As he looked back on the one-year mark, Klein sat down with TechCrunch to discuss all that has happened and the unique set of challenges he faced.

Forerunner’s Eurie Kim and Oura’s Harpreet Rai discuss betting on consumer hardware

Image Credits: Forerunner Ventures / Oura

Forerunner General Partner Eurie Kim and Oura CEO Harpreet Rai joined us on Extra Crunch Live to discuss the process of taking Oura to the next level — and beyond — as the product found a second (or third) life during the pandemic through partnerships with sports leagues like the NBA.

And as we’re wont to do, we asked the pair to take a look at a handful of user-submitted pitch decks.

How to break into Silicon Valley as an outsider

Domm Holland, co-founder and CEO of e-commerce startup Fast, appears to be living a founder’s dream.

His big idea came from a small moment in his real life. Holland watched as his wife’s grandmother tried to order groceries, but she had forgotten her password and wasn’t able to complete the transaction.

He built a prototype of a passwordless authentication system where users would fill out their information once and would never need to do so again. Within 24 hours, tens of thousands of people had used it.

Shoppers weren’t the only ones on board with this idea. In less than two years, Holland has raised $124 million in three rounds of fundraising, bringing on partners like Index Ventures and Stripe.

Although the success of Fast’s one-click checkout product has been speedy, it hasn’t been effortless.

For one thing, Holland is Australian, which means he started out as a Silicon Valley outsider.

Holland talks about how he built his network, why it’s important — not just for fundraising but for building the entire business — and how to avoid the mistakes he sees new founders make.

Revel’s Frank Reig shares how he built his business and what he’s planning

Image Credits: Bryce Durbin

It’s only been three years since they hit the streets, but Revel’s blue electric mopeds have already become a common sight in New York, San Francisco and a growing number of U.S. cities.

However, Revel founder and CEO Frank Reig set his sights far beyond building a shared moped service.

In fact, since the beginning of 2021, Revel has launched an e-bike subscription service, an EV charging station venture and an all-electric rideshare service driven by a fleet of 50 Teslas.

We caught up with Reig to talk about what he learned from building the company, how Revel’s business strategy has evolved and what lies ahead.

Brex, Ramp tout their view of the future as Divvy is said to consider a sale to Bill.com

Image Credits: KTSDESIGN/SCIENCE PHOTO LIBRARY / Getty Images

Divvy, a Utah-based corporate spend unicorn, is considering selling itself to Bill.com for a price that could top $2 billion. For the fintech sector, it’s big news.

Corporate spend startups including Ramp and Brex are raising rapid-fire rounds at ever-higher valuations and growing at venture-ready cadences. Their growth and the resulting private investment were earned by a popular approach to offering corporate cards, and, increasingly, the group’s ability to build software around those cards that took into account a greater portion of the functionality that companies needed to track expenses, manage spend access and, perhaps, save money.

It makes sense to see Bill.com decide to take on the yet-private corporate spend startups that are playing the field; why not absorb a growing customer base and fend off competition in a single move?

To get a better handle on how the startups that compete with Divvy feel about the deal, TechCrunch reached out to both Ramp CEO Eric Glyman, and Brex CEO Henrique Dubugras.

4 strategies for building a digital health unicorn

It’s an entrepreneur’s market in digital health today, with startups raising record-breaking funding at soaring valuations and debuting on public markets to eager investors.

The massive influx of capital to healthcare should not be surprising; the pandemic has made it starkly clear that digital health is the future of healthcare.

To that end, we should anticipate additional healthcare exits worth more than $1 billion in the near term. Which again, is great for entrepreneurs — as long as they understand how hard it is to build a unicorn in healthcare. Today, becoming a unicorn requires founders who are long on vision and operational experience.

During the pandemic, lots of investors jumped in to invest in digital health for the first time. But we’ve been investing for more than a decade.

Here are four instrumental strategies to building a unicorn in digital health that we know work.

One CMO’s honest take on the modern chief marketing role

Image Credits: Matthias Kulka / Getty Images

There’s no shortage of commentary around the chief marketing officer title these days, and certainly no lack of opinions about the role’s responsibilities and meaning within a company.

There’s a reason for that. CMO is the shortest tenured C-suite role — the average tenure of a CMO is the lowest of all C-suite titles at 3.5 years.

That’s because the chief marketing officer’s role is increasingly complex. Qualifications require broad, strategic thinking while also maintaining tactical acumen across several functions. There’s a big disparity in what companies expect from CMOs. Some want a strategist with an eye for go-to-market planning, while others want a focus on close alignment with sales in addition to brand awareness, content strategy and lead generation.

Other companies want their CMO to emphasize product marketing and management. Ask 10 CMOs how they define their role and you’ll get 10 different answers.

Here, a tenured CMO shares his honest take on what the role actually means, plus the key attributes of today’s modern CMO.

Despite gains, gender diversity in VC funding struggled in 2020

People have been discussing the importance of expanding opportunities for women in venture capital and startup entrepreneurship for decades. And for some time it appeared that progress was being made in building a more diverse and equitable environment.

The prospect of more women writing checks was viewed as a positive for female founders, a cohort that has struggled to attract more than a fraction of the funds that their male peers manage. All-female teams have an especially tough time raising capital compared to all-male teams, underscoring the disparity.

Then COVID-19 arrived and scrambled the venture and startup scene, creating a risk-off environment during the end of Q1 and the start of Q2 2020. Following that, the venture world went into overdrive as software sales became a safe harbor in the business world during uncertain economic times. And when it became clear that the vaunted digital transformation of businesses large and small was accelerating, more capital appeared.

But data indicate that the torrent of new capital has not been distributed equally — indeed, some of the progress that female founders made in recent years may have eroded.

How to make sure your legal team is M&A ready

When it comes to acquiring or merging a business with another, it’s imperative that decision-makers know why they’re pursuing a deal and its potential impact on the company, good and bad.

Mergers and acquisitions (M&A) may indeed be the best route to success, but there’s a lot of room for problems, and many leaders underestimate the role in-house legal teams can play in mitigating these problems and facilitating progress until they’re locked into a deal.

And that’s when issues become much more difficult to resolve and plans unravel.

While a CEO and board might fully appreciate in-house counsel, it’s equally important the team is supported across a company — from marketing to product development — in order to ensure an efficient closing and successful integration. The best way to do that is by bringing in-house counsel into the process early and often.

Beyond the fanfare and SEC warnings, SPACs are here to stay

Image Credits: erhui1979 / Getty Images

The number of SPACs in the deep tech sector was skyrocketing, but a combination of increased SEC scrutiny and market forces over the past few weeks has slowed the pace of new SPAC transactions.

The correction is an inevitable step on the path to mainstreaming SPACs as an alternative to IPOs, but it won’t cause them to go away.

Instead, blank-check vehicles will evolve and will occupy a small and specialized — but important — part of the startup financing landscape.

Uber’s mixed Q1 earnings portray an evolving business

Image Credits: Matthew Horwood/Getty Images / Getty Images

Uber followed Lyft in reporting its Q1 2021 earnings this week. And like its rival, its results take a little bit of work to understand.

We parsed them as a pair so that we understand what’s going on at the ride-hailing and food-delivery giant.

Let’s start with the big numbers: Uber’s revenue missed sharply, while its profitability beat expectations.

How did investors vet Uber’s performance? The company’s stock is off around 4% in after-hours trading.

Surprised by the revenue miss? Shocked by the profit beat? Startled by the sharp drop in the value of Uber’s stock? Let’s unpack the numbers.

How much product room will fintech giants leave for startups?

Let’s examine the buy now, pay later (BNPL) market, mostly through the lens of PayPal’s first-quarter results.

PayPal’s BNPL results are impressive — and not just to your humble servant, but to other fintech watchers as well — which begs the question: Can the platform effect that the PayPals of the world bring to bear suffocate a growing slice of the startup market?

Freemium isn’t a trend — it’s the future of SaaS

As the COVID-19 lockdowns cascaded around the world last spring, companies large and small saw demand slow to a halt seemingly overnight. Enterprises weren’t comfortable making big, long-term commitments when they had no clue what the future would hold.

Innovative SaaS companies responded quickly by making their products available for free or at a steep discount to boost demand.

But these free offerings didn’t go away as lockdowns loosened up. SaaS companies instead doubled down on freemium because they realized that doing so had a real and positive impact on their business. In doing so, they busted the outdated myths that have held 82% of SaaS companies back from offering their own free plan.

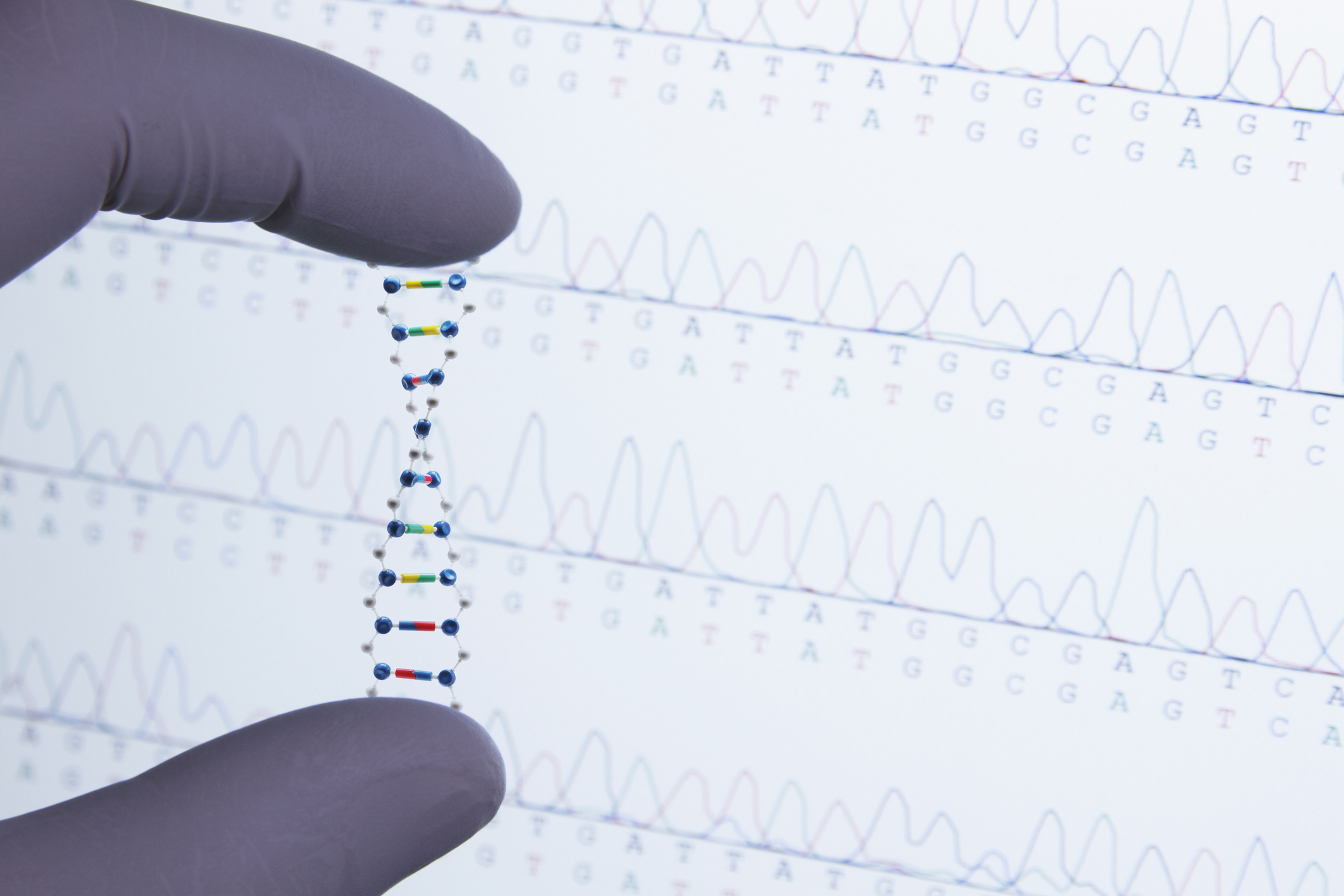

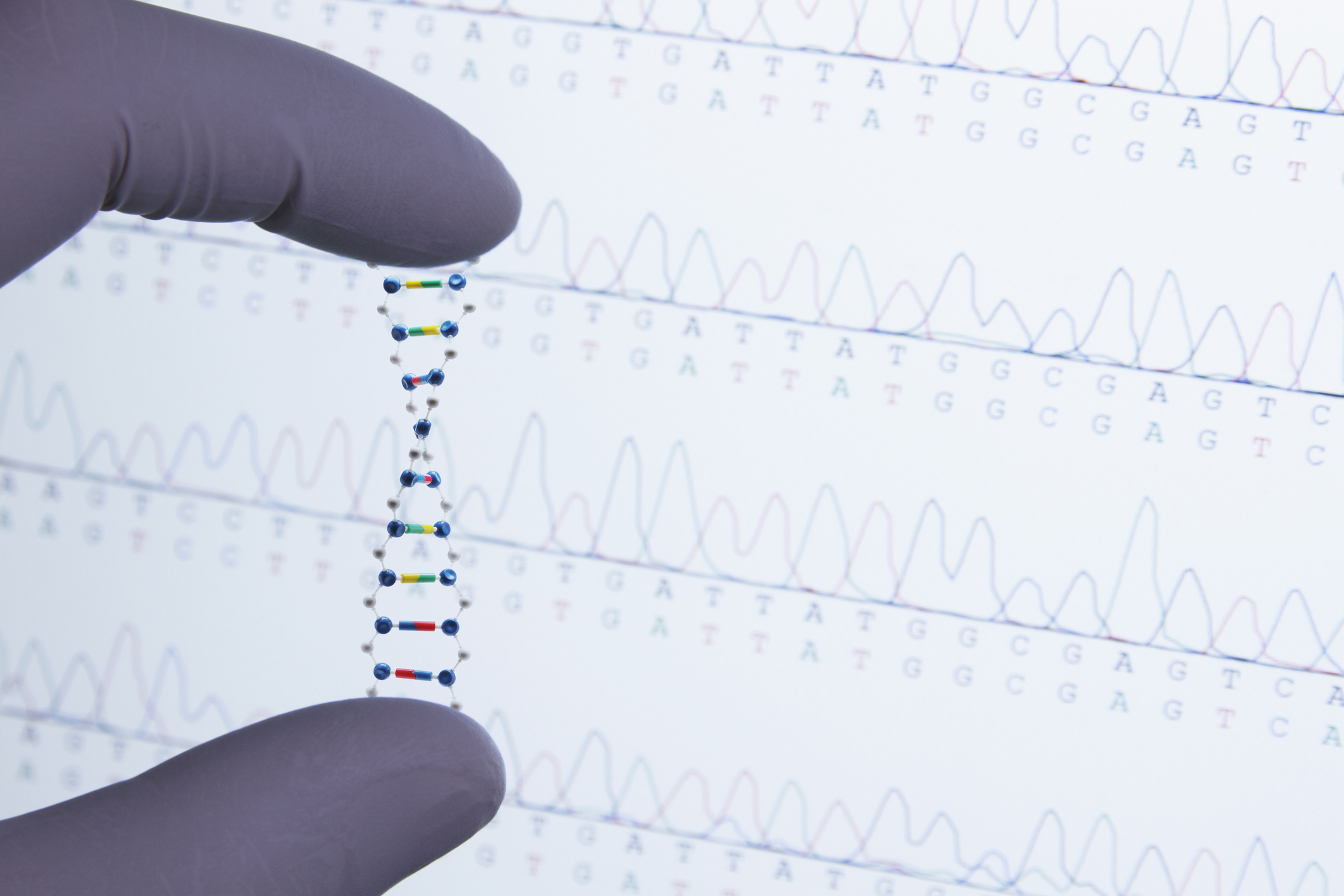

AI is ready to take on a massive healthcare challenge

Image Credits: GIPhotoStock / Getty Images

Shortening the diagnostic odyssey of rare diseases and reducing the associated costs was, until recently, a moonshot challenge, but is now within reach.

About 80% of rare diseases are genetic, and technology and AI advances are combining to make genetic testing widely accessible.

Whole-genome sequencing, an advanced genetic test that allows us to examine the entire human DNA, now costs under $1,000, and market leader Illumina is targeting a $100 genome in the near future.

Why did Bill.com pay $2.5B for Divvy?

Image Credits: Bryce Durbin / TechCrunch

As expected, Bill.com is buying Divvy, the Utah-based corporate spend management startup that competes with Brex, Ramp and Airbase. The total purchase price of around $2.5 billion is substantially above the company’s roughly $1.6 billion post-money valuation that Divvy set during its $165 million, January 2021 funding round.

Per Bill.com, the transaction includes $625 million in cash, with the rest of the consideration coming in the form of stock in Divvy’s new parent company.

Bill.com also reported its quarterly results: Its Q1 included revenues of $59.7 million, above expectations of $54.63 million. The company’s adjusted loss per share of $0.02 also exceeded expectations, with the street expecting a sharper $0.07 per share deficit.

The better-than-anticipated results and the acquisition news combined to boost the value of Bill.com by more than 13% in after-hours trading.

Luckily for us, Bill.com released a deck that provides a number of financial metrics relating to its purchase of Divvy. This will not only allow us to better understand the value of the unicorn at exit, but also its competitors, against which we now have a set of metrics to bring to bear.

Let’s unpack the deal to gain a better understanding of the huge exit and the value of Divvy’s richly funded competitors.

5 investors discuss the future of RPA after UiPath’s IPO

Image Credits: NicoElNino / Getty Images

Robotic process automation (RPA) has certainly been getting a lot of attention in the last year, with startups, acquisitions and IPOs all coming together in a flurry of market activity. It all seemed to culminate with UiPath’s IPO last month. The company that appeared to come out of nowhere in 2017 eventually had a final private valuation of $35 billion. It then had the audacity to match that at its IPO. A few weeks later, it still has a market cap of over $38 billion in spite of the stock price fluctuating at points.

Was this some kind of peak for the technology or a flash in the pan? Probably not. While it all seemed to come together in the last year with a big increase in attention to automation in general during the pandemic, it’s a market category that has been around for some time.

RPA allows companies to automate a group of highly mundane tasks and have a machine do the work instead of a human. Think of finding an invoice amount in an email, placing the figure in a spreadsheet and sending a Slack message to Accounts Payable. You could have humans do that, or you could do it more quickly and efficiently with a machine. We’re talking mind-numbing work that is well suited to automation.

Twitch UX teardown: The Anchor Effect and de-risking decisions

Built for Mars CEO Peter Ramsey tears down Twitch’s UX, asking how Twitch rakes in cash and the psychology used within its app to encourage users to keep spending.

Ramsey describes Twitch’s protocol of asking users if they want to subscribe to a streamer before seeing their stream “unnecessarily boolean,” which would be a great band name.

But that’s neither here nor there. Ramsey notes: “Often it’s at the point of clicking, not the final stage of a process, meaning the user decides to buy the item when they click ‘check out now,’ not when they’ve entered their card details and click ‘complete purchase.’

Ramsey argues Twitch shouldn’t make users choose between doing nothing and subscribing: “Instead, if they changed the text to, say, “learn more,” the user could click it without having to internalize the decision.”

To buy time for a failing startup, recreate the engineering process

In non-aerobatic fixed-wing aviation, spins are an emergency. If you don’t have spin recovery training, you can easily make things worse, dramatically increasing your chances of crashing. Despite the life-and-death consequences, licensed amateur pilots in the United States are not required to train for this. Uncontrolled spins don’t happen often enough to warrant the training.

Startups can enter the equivalent of a spin as well. My startup, Kolide, entered a dangerous spin in early 2018, only a year after our Series A fundraise. We had little traction and we were quickly burning through our sizable cash reserves. We were spinning out of control, certain to hit the ground in no time.

All spins start with a stall — a reduction in lift when either the aircraft is flying too slowly or the nose is pointed too high. In Kolide’s case, we were doing both.

Kolide had a lot going for it that enabled me to recover the company, but by far the most important was that we recognized we were in a spin very early, and we had enough cash remaining (and therefore sufficient time) to execute a recovery plan.

What Square’s smashing earnings tell us about consumer bitcoin demand

Shares of Square are up more than 6% after the American fintech company reported a staggering $5.06 billion in revenue in its Q1 2021 earnings report, far ahead of an expected tally of $3.36 billion.

By posting the huge revenue beat, Square grew 266% compared to its year-ago Q1. Because that’s the sort of growth that we generally expect to see from early-stage startups instead of maturing public companies, some exploration is in order. In short, bitcoin revenues from Square, and how they fit into its accounting, are responsible for much of its outsized growth.

And that’s something we need to talk about.