News: An Oracle EVP took a brass-knuckled approach with a reporter today; now he’s suspended from Twitter

Companies and the reporters who cover them routinely find themselves at odds, particularly when the stories being chased are unflattering or bring unwanted attention to a business’s dealings, or, in the company’s estimation, simply inaccurate. Many companies fight back, which is why crisis communications is a very big and lucrative business. Still, how a company

Companies and the reporters who cover them routinely find themselves at odds, particularly when the stories being chased are unflattering or bring unwanted attention to a business’s dealings, or, in the company’s estimation, simply inaccurate.

Many companies fight back, which is why crisis communications is a very big and lucrative business. Still, how a company fights back matters. And according to crisis communications pros who TechCrunch spoke with this afternoon, a new post on Oracle’s corporate blog misses the mark, as did the company’s related follow-up on social media.

In fact, the author of the post, an Oracle executive named Ken Glueck, a 25-year-long veteran of the company, has been temporarily suspended by Twitter, the company told Gizmodo this afternoon. Yet that might be the least of his concerns right now.

The trouble ties to a series of pieces by the news site The Intercept about how a “network of local resellers helps funnel Oracle technology to the police and military in China,” and Oracle’s response to the pieces. While it isn’t uncommon for companies to post responses to media stories on their own platforms (as well as to take out ads in mainstream media outlets), the crisis execs with whom we spoke — and who asked not to be named, given that they work with companies like Oracle — had a few observations that might be helpful to Oracle in the future.

Rule number one: don’t draw attention unnecessarily to work that you might prefer didn’t exist. Oracle’s newest post doesn’t link back to the new Intercept story that Glueck works to dismantle, but in an earlier post about the first Intercept story that ran in February, Glueck hyperlinks to the story on Oracle’s blog. It’s hard to know what Oracle wants its audience to read more — Glueck’s blog post or that Intercept story, particularly given its intriguing title (“How Oracle Sells Repression in China.”). “How many of Oracle’s customers or employees saw [The Intercept piece] and didn’t give a damn and now he’s drawing attention to it?” noted one exec we’d interviewed today.

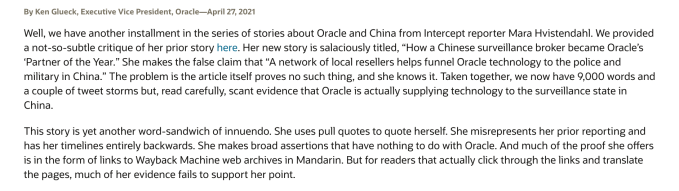

Rule number two: Don’t attack reporters; attack (if you must) the outlet. In Glueck’s first diatribe against The Intercept over its February piece, he mentions the outlet 26 times and the author of the piece once. In Glueck’s newest salvo against The Intercept, he refers to its author, reporter Mara Hvistendahl, 22 times — mostly by her first name — and even invites readers of Oracle’s blog to reach out to him, writing in boldface: “If you have any information about Mara or her reporting, write me securely at kglueck AT protonmail.com.”

Though Glueck has since said the call-out was a tongue-in-cheek gesture, it was subsequently removed from the post, presumably owing to its “sinister tone” as observed by one of our experts. “No one likes a bully,” notes this comms pro, adding that “bullying conveys weakness.”

Before

After

Rule number four: Know your purpose. By lashing out in what is a plainly derisive tone to The Intercept’s piece, as well as continuing to doubling down on its attack against Hvistendahl on social media afterward, Oracle’s strategy became less and less clear, says one of the crisis specialists we spoke with.

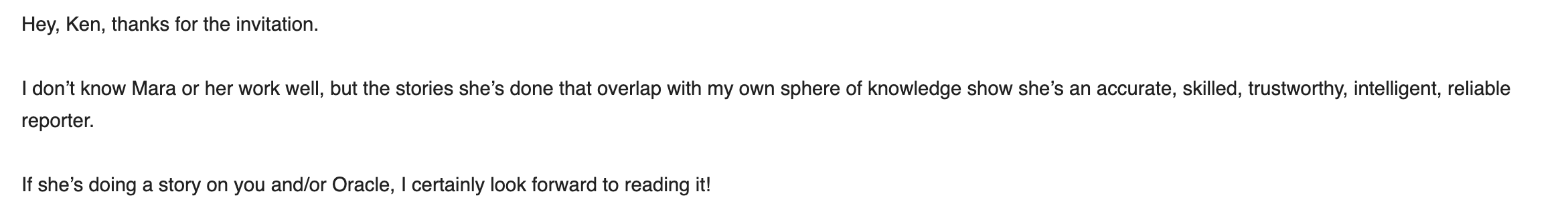

“You can do what Ken did and mock” the reporter, says this person, “but is that going to stop The Intercept from continuing to do stories about Oracle? And what is the reaction of other media? Are they scared off by [what happened today] or are they going to circle the wagons?” (Below: a note from an L.A. Times reporter to Glueck today in response to his call for information about Hvistendahl.)

Rule five: Keep it short. Two of the pros we spoke with today applauded Glueck’s writing style, remarking that it’s both fluid and funny. Both also observed that his response is far too long. “I couldn’t get through it,” said one.

Rule six: Find another way if possible. The crisis experts we spoke with said it’s ideal to first work with a reporter, then the reporter’s editor if necessary, and if it comes to it, involve lawyers, of which Oracle surely has plenty. “That’s the chain of appeal if a reporter has gotten a story blatantly wrong,” said one source.

Very possibly, Glueck decided to throw out this rulebook by design. Oracle tends to do things its own way, and Glueck is very much a product of that culture. (The WSJ wrote a 1,300-word profile about Glueck last year, calling him a “potent weapon” for Oracle.)

As for Hvistendahl, she suggests there is another reason Oracle took the route that it did.

In a statement sent to us earlier, she writes that “Ken Glueck has published two lengthy blog posts attacking me and my editor, Ryan Tate. But Oracle has not refuted my central finding, which is that the company marketed its analytics software for use by police in China. Oracle also hasn’t refuted our reporting on Oracle’s sale and marketing of its analytics software to police elsewhere in the world. We found evidence of Oracle selling or marketing analytics software to police in Mexico, Pakistan, Turkey, and the UAE. In Brazil, my colleague Tatiana Dias uncovered police contracts between Oracle and Rio de Janeiro’s notoriously corrupt Civil Police.”