News: Amazon announces $250 million venture fund for Indian startups

Amazon on Thursday announced a $250 million venture fund to invest in Indian startups and entrepreneurs focusing on digitization of small and medium-sized businesses (SMBs) in the key overseas market. The announcement comes at a time when the American e-commerce group, which has previously invested over $6.5 billion in its India business, faces heat from

Amazon on Thursday announced a $250 million venture fund to invest in Indian startups and entrepreneurs focusing on digitization of small and medium-sized businesses (SMBs) in the key overseas market.

The announcement comes at a time when the American e-commerce group, which has previously invested over $6.5 billion in its India business, faces heat from government bodies, and the small and medium-sized businesses that it purports to serve.

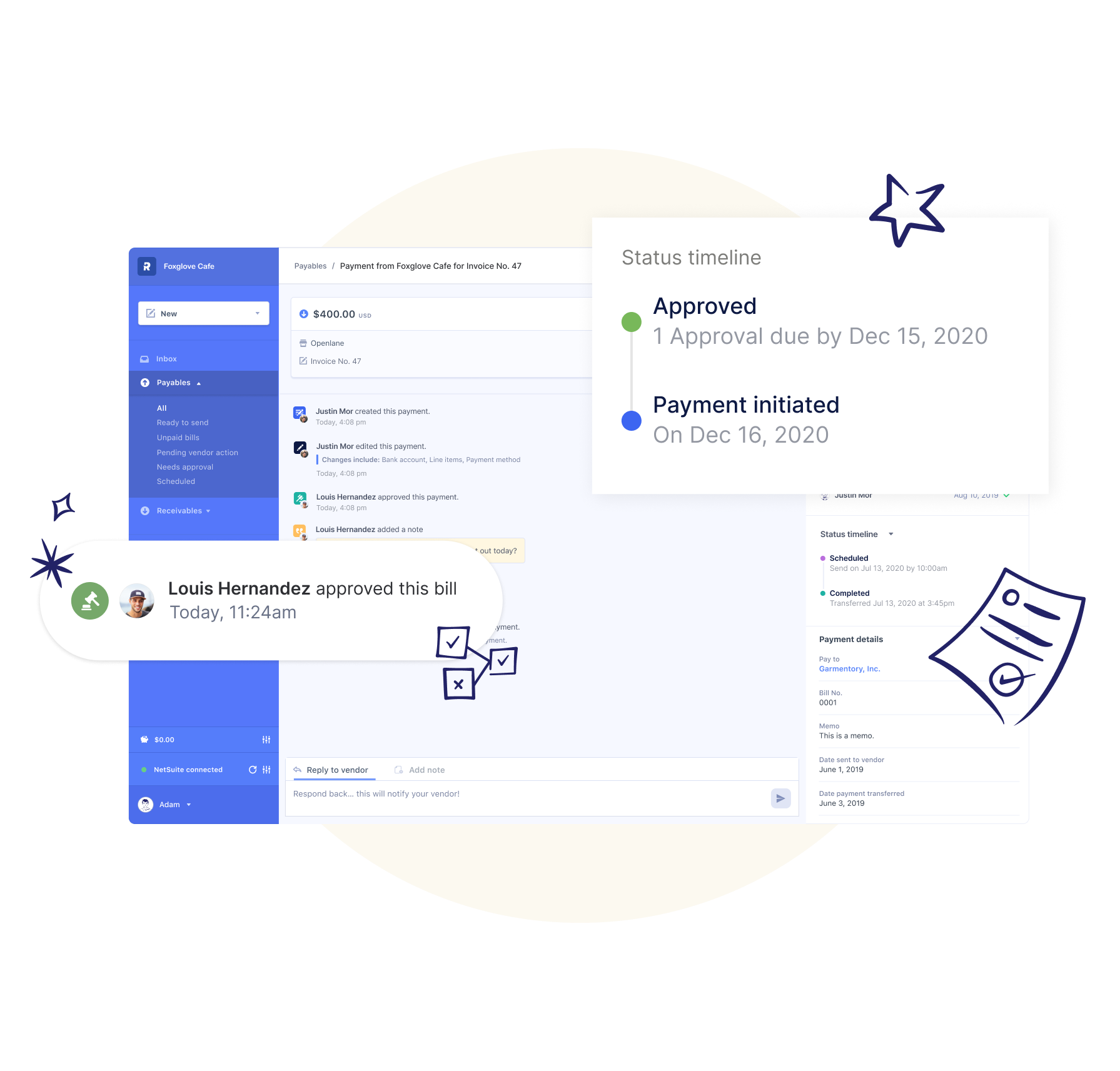

Through the new venture fund, called Amazon Smbhav Venture Fund, Amazon said it wants to invest in startups that focus on helping small businesses come online, sell online, automate and digitize their operations, and expand to customers worldwide.

Agriculture and healthcare are two additional areas Amazon is focusing on with its new venture fund, but it said it is open to looking at tech startups from other sectors if their work intersects with SMBs.

In the agri-tech sector, Amazon is looking to invest in Indian startups that are using technology to make agri-inputs more accessible to farmers, provide credit and insurance to farmers, reduce food wastage, and improve the quality of produce to consumers. In the healthcare sector, Amazon said it will invest in startups that are enabling healthcare providers to leverage telemedicine, e-diagnosis, AI powered treatment recommendations.

The announcement was made at Amazon’s annual event, called Sambhav, that focuses on India-based SMBs. At the virtual event, Amazon also unveiled ‘Spotlight North East’, an initiative to bring 50,000 artisans, weavers and small businesses online from the eight states in the North East region of India by 2025 and to boost exports of key commodities like tea, spices and honey from the region.

In the first edition of Sambhav last year, Amazon announced it would be investing $1 billion to help digitize 10 million small and medium sized businesses. Amazon said earlier this month that it had created 300,000 jobs in India since January 2020, and enabled exports for Indian-made goods worth $3 billion.

The company said more than 50,000 offline retailers and neighborhood stores — called kirana locally — are using Amazon marketplace and about 250,000 new sellers have also joined the platform. The company said today it aims to onboard 1 million offline retailers and neighbourhood stores by 2025 through the Local Shops on Amazon program.

Not far from Sambhav’s first event last year, which was attended by Amazon chief executive and founder Jeff Bezos, tens of thousands of protesters marched on the street and expressed their concerns about what they alleged was unfair practices employed by Amazon to crush them.

A similar protest was seen today. You can hear some of their stories here. It’s an ongoing challenge for Amazon, which has long struggled to stay out of controversy in India.

An influential India trader group that represents tens of millions of brick-and-mortar retailers called New Delhi to ban Amazon in the country in February this year after a report claimed that the American e-commerce group had given preferential treatment to a small group of sellers in India, publicly misrepresented its ties with those sellers and used them to circumvent foreign investment rules in the country.

The Confederation of All India Traders (CAIT) “demanded” serious action from the Indian government against Amazon following revelations made in a Reuters story. “For years, CAIT has been maintaining that Amazon has been circumventing FDI [Foreign Direct Investment] laws of India to conduct unfair and unethical trade,” it said.

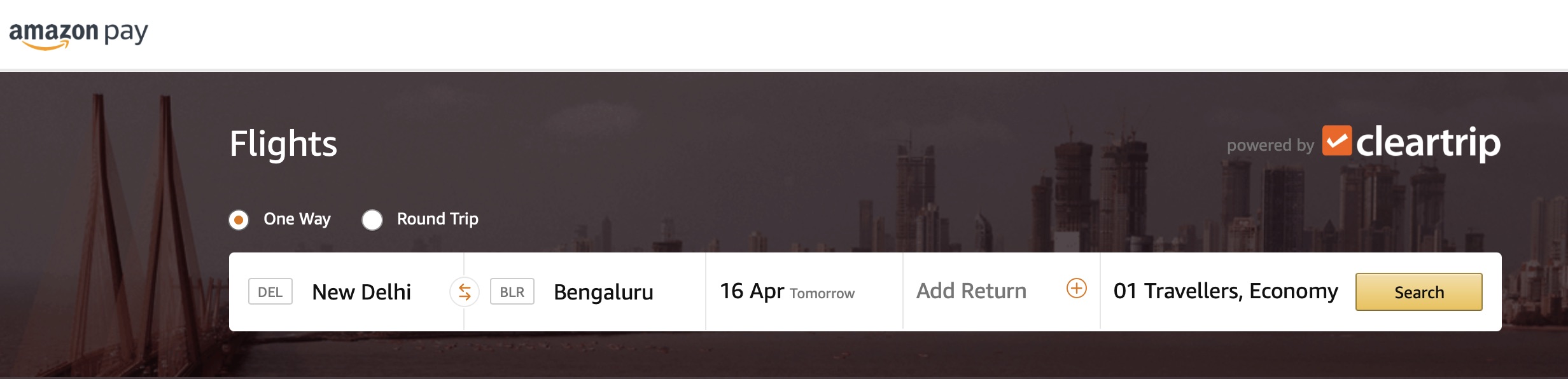

Several international technology giants including Google, Facebook, and Microsoft have invested in Indian startups in recent years. Amazon, too, has backed a number of firms including ride-hailing startup Shuttl, and consumer brand MyGlamm. Last month, it acquired retail startup Perpule for about $20 million.