News: Japanese VC Samurai Incubate closes $18.6M fund for African startups

Samurai Incubate, a Tokyo-based venture capital firm, announced today it has closed its “Samurai Africa 2nd General Partnership” fund, totalling 2.026 billion yen (~$18.6 million). According to the firm, the fund was oversubscribed as it targeted 2 billion (~$18.4 million) and a total of 54 investors joined as LPs. One notable LP is the Toyota

Samurai Incubate, a Tokyo-based venture capital firm, announced today it has closed its “Samurai Africa 2nd General Partnership” fund, totalling 2.026 billion yen (~$18.6 million).

According to the firm, the fund was oversubscribed as it targeted 2 billion (~$18.4 million) and a total of 54 investors joined as LPs. One notable LP is the Toyota Tsusho Corporation, which has a diverse network across the continent. The firm founded Mobility 54, a corporate venture capital (CVC) looking to invest $45 million into African mobility, logistics, and fintech startups.

Kentaro Sakakibara founded Samurai Incubate, and in 2018, the firm began investing in Africa by establishing a subsidiary called Leapfrog Ventures. From August 2018, Samurai Incubate invested $2.5 million in 20 African startups via the newly established firm. Then in June 2019, renamed itself Samurai Incubate Africa.

“Throughout our journey, we have focused on refining and optimizing our operating approach to maximize our value proposition to founders. However, we might not always have been perfect. We believe that the value we bring should go beyond capital and access to Japanese investors and corporations,” the firm said in a statement.

A sector-agnostic fund, Samurai Incubate Africa has already invested in 26 companies. The six from this second fund include Eden Life, a tech-enabled home service startup; online loan marketplace Evolve Credit; energy startup Shyft Power Solutions; microfinance services for car lenders FMG; freight forwarding company Oneport; and online grocery platform Pricepally.

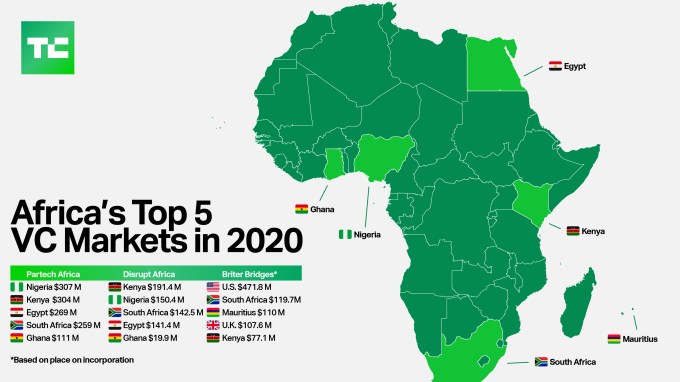

Most of Samurai’s companies are from three African countries — Kenya, Nigeria, and South Africa. However, that will change going forward. According to Rena Yoneyama, the managing partner at the firm, Samurai Incubate Africa is joining Egypt to the list of countries it will target.

Image Credits: Bryce Durbin/TechCrunch

Since 2018, Egypt has been witnessing outstanding ecosystem growth and is producing talent, startups and indigenous investors at a breathtaking pace. For Samurai Incubate Africa, it’s only fair to tap into this growth because Egypt’s inclusion ensures the firm has startups in the Big Four — the continent’s top startup ecosystems.

“Egyptian startup ecosystem and its economy is rapidly expanding and we got to know that there are many talented founders and great investors in the country as well,” Yoneyama said to TechCrunch. “We already decided to make one investment into an Egyptian startup, and we know we’ll never regret it.”

When Samurai first announced this fund back in January 2020, its ticket size was between $50,000 to $500,000. For pre-seed to seed rounds, startups got $200,000 or less. And for pre-Series A and Series A rounds, not more than $500,000. But upon completing the fund, Samurai Incubate is extending the maximum amount of investment to $800,000.

“We would like to support our portfolio companies’ pre-series A and series A raises as an existing investor. To do so, we thought it would be better to increase the ticket size considering the recent round size and valuation of companies,” Yoneyama said of the ticket size increase.

Although sector-agnostic, the firm is particular about companies in fintech, insurtech, logistics, healthtech, consumer and commerce, energy, agritech, mobility and entertainment.

The Japanese VC plans to invest in 30 to 40 new companies at the pre-seed and seed stage as well as follow-up pre-Series A and Series A investments in 7 to 10 existing portfolio companies. Samurai Incubate is part of the growing list of Japanese VC firms like Kepple Africa and Uncovered Fund targeting African startups.