- April 24, 2021

- by:

- in: Blog

Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy. The app industry is as hot as ever, with a record 218 billion downloads and $143 billion in global consumer spend in 2020. Consumers last year also spent 3.5 trillion minutes using apps on Android

Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy. The app industry is as hot as ever, with a record 218 billion downloads and $143 billion in global consumer spend in 2020.

Consumers last year also spent 3.5 trillion minutes using apps on Android devices alone. And in the U.S., app usage surged ahead of the time spent watching live TV. Currently, the average American watches 3.7 hours of live TV per day, but now spends four hours per day on their mobile devices.

Apps aren’t just a way to pass idle hours — they’re also a big business. In 2019, mobile-first companies had a combined $544 billion valuation, 6.5x higher than those without a mobile focus. In 2020, investors poured $73 billion in capital into mobile companies — a figure that’s up 27% year-over-year.

This week we’re diving into the juicy bits from the app store antitrust hearing, rounding up the Apple Spring Loaded event and looking at all the new Clubhouse rivals, including Facebook’s, among other things.

This Week in Apps will soon be a newsletter! Sign up here: techcrunch.com/newsletters

Top Stories

Apple Spring Loaded

Image Credits: Apple / Apple

Apple this week held a big spring event where it announced a number of new products, including a new lineup of colorful M1-powered iMacs and M1-powered iPad Pros, a next-gen Apple TV 4K with a way less terrible Siri remote (buttons, hooray!), a very pretty purple iPhone 12 and 12 mini, its long-awaited UWB lost item finder AirTag, Apple Card Family and a new Podcasts app with a paid subscription option for creators.

The new iPad Pro, which brings a 50% performance increase over the previous Pro model, has a ton of upgrade specs, including Thunderbolt and USB 4 support, up to 2TB of storage and 16GB of RAM, and a “Liquid Retina XDR” display on the 12.9-inch model that will make it ideal for creative pursuits involving photography, video and even AR. But now it’s time for iPadOS to catch up — and that may be in store with iPadOS 15, which will reportedly at least have an upgraded Home Screen but hopefully more.

Apple didn’t bother to offer a real launch date for iOS 14.5, although we know it’s next week thanks to Apple’s reminders about getting ready for ATT.

The launch of AirTag, meanwhile, played right into the other big Apple event this week: a Senate antitrust hearing over App Stores.

Apple and Google defend the app store business model in antitrust hearing

This week’s hearing brought three chief Apple critics to testify: Tile, Match and Spotify. The companies argued that the app stores’ hold on the ecosystem was too tight.

They’re not allowed to tell their customers inside their own app how to purchase a subscription to their services outside the App Store, where they could keep 100% of the revenues, they said. And, they argued, these IAP “taxes” have to be passed along to the consumer, leading to higher prices. In Spotify’s case, this puts them at a disadvantage when having to compete against a direct rival, like Apple Music, which doesn’t have the same impediment.

The companies also argued how little power they had to fight against any changes enacted by the platform makers. Tile’s General Counsel Kirsten Daru noted that her company’s relationship with Apple used to be symbiotic, saying Apple “sold our devices in their retail stores, and they even featured us on stage at their Worldwide Developer conference in 2018. But that all changed when Apple decided that it wanted to take over this category,” she said. “If Apple turned on us, it can turn on anyone.”

Spotify spoke of the times Apple threatened to pull it from the App Store over rule violations. And how Apple told Spotify it couldn’t email customers to tell them how they could upgrade via its website instead of through IAP. Apple, meanwhile, defended its position equating it to coming in a Verizon store to advertise that the new iPhone was available for sale down the street at an Apple Store. “No retailer is going to allow us to do that,” Apple’s Chief Compliance Officer Kyle Andeer argued.

Match talked about app rejections and Apple dictating how it can run its business. It said it wanted to verify IDs for a dating app in Taiwan and Apple wouldn’t allow this. Match also mentioned an app rejection that kept it from releasing its LGBTGQ+ safety update for two months. (But we’ve learned that Apple’s rejection was not related to the LGBTQ+ feature itself.)

Match Chief Legal Officer & Secretary Jared Sine also threw out a pretty big bomb when it alerted lawmakers to the fact that they received a call the night before their testimony. Google wanted to know why Match’s testimony appeared to differ from what it said during earnings, he said. (On the earnings call, Match said they believed they could work through the issues of Google’s 30% tax.) Google’s Senior Director Public Policy & Government Relations Wilson White said “it sounds as if some business development folks who are working on commercial conversations” called Match and that Google doesn’t “view that as a threat…we would never threaten our partners.”

Tile argues for a level playing field

Immediately after launching its lost item finder AirTag, Apple had to defend its product against antitrust claims made by Tile. From what we’ve seen, there are mixed feelings out there as to whether Tile has a case. Tile carved out a market for lost item finders and has many years’ worth of a head start on Apple. Some say it wouldn’t have to worry about Apple if it had continued to innovate. After all, just look at the AirTag hardware design and the clever way it guides you to a lost item with directional arrows.

But Tile points out there were areas where it believes Apple didn’t level the playing field.

Tile has asked since 2019 for access to the U1 chip for UWB (ultra wideband) access, like AirTag has, so it can roll out its own UWB device. But Apple only this month, April 2021, announced a draft specification for chipset manufacturers that will arrive later this spring (AFTER AirTag debuts) which will allow third-party device makers to take advantage of ultra wideband technology in U1-equipped Apple devices.

And while Apple opened up Find My to third-parties — a move it’s using to fend of antitrust claims — that means Tile wouldn’t be able to continue its direct relationship with its customers through its own iOS app, if it made the switch. As to what other details that Find My agreement forces upon developers, Tile couldn’t say. When pressed by lawmakers in the antitrust hearing this week, Tile’s Daru said she couldn’t talk about it, because Apple makes companies sign an NDA. Apple CCO Andeer declined to allow Daru to answer questions about the nature of the agreement for the purpose of the hearing either.

Tile had several other grievances as well, like how its app had to ask permission to do things like track location or run in the background or use Bluetooth, when Apple’s Find My did not.

They took away one of our critical permissions, which requires our customers to go deep, deep, deep into their settings to turn Tile on. Find my, by contrast, is on by default…when you set up your operating system. And in order to turn it off you have to go deep into your Settings and actually enter a password. Apple also started serving prompts with that same update to our users — once they figured out how to turn Tile on, they started serving these prompts encouraging them to turn Tile off. But they didn’t serve up those prompts for Find My. Our Bluetooth network — of course, people need to opt in to the Bluetooth network; I think that’s great. We are complete supporters of consumer transparency. But the Find my Bluetooth network in the new Find My app is on by default. And then with these AirTags, as I discussed, we have the UWB issue, which I won’t repeat. But there’s something else. It’s called..they call the ‘magic onboarding flow.’ To connect your AirPods or your AirTags with your phone, you don’t even have to open the Find My app. You just put them near. But that magic flow isn’t available to third-parties like Tile.

Apple questioned about the problem with App Store subscription scams

During the hearing, Apple was also specifically pressed on its failure to police app store scams. The tech giant has argued that one of the reasons it requires developers to pay App Store commissions is to help Apple fight marketplace fraud and protect consumers. But developers claim Apple is doing very little to stop obvious scams that are now raking in millions and impacting consumer trust in the overall subscription economy, as well as in their own legitimate, subscription-based businesses.

One developer in particular, Kosta Eleftheriou, has made it his mission to highlight some of the most egregious scams on the App Store. Functioning as a one-man bunco squad, Eleftheriou regularly tweets out examples of apps that are leveraging fake reviews to promote their harmful businesses. Georgia’s Senator Ossoff asked why we had to rely on independent reports (presumably referring to these efforts by Kosta) to route out scams? Apple defended itself by saying security was a cat-and-mouse game and consumers were refunded when scammed.

Apple and Google questioned on use of app store data

Finally, an interesting line of questioning put to Apple and Google asked the companies if they had an internal firewall between sharing data gleaned from their app stores with their own product development teams working on other initiatives. Apple’s answer left room for doubt. Andeer initially responded that Apple has separate teams, which was clearly not what Senator Blumenthal wanted to know. After the Senator clarified what a “data firewall” was, Apple’s response was “we have controls in place.”

Weekly News

Platforms: Apple

The App Store will be adding a second advertising slot in its Suggested Apps section on the Search page, the FT reports. The slot was previously spotted during testing and may arrive by the end of the month. The advantage of this slot is that it will allow developers to advertise to all users who end up on that tab, not just those who have already performed a search.

Tell me you’re launching iOS 14.5 on April 26 without telling me you’re launching iOS 14.5 on April 26. Apple says all apps must use the AppTrackingTransparency framework to request the user’s permission to track them or to access their device’s advertising identifier as of…you guessed it…April 26, 2021. Apple hasn’t officially announced the iOS 14.5 launch date, but this indicates the launch will likely be on April 26 or perhaps the following day.

Apple alerts developers that, starting April 26, iPhone and iPad apps must be built with Xcode 12 and the iOS 14 SDK or later. Watch apps will need to be built with Xcode 12 and the watchOS 7 SDK or later.

A Bloomberg report claims iOS 15 and iPadOS 15 will bring a number of changes, including an updated Lock Screen, a redesigned iPad Home Screen, additional privacy protections, and tools for setting notifications or automatic replies based on their status (driving, working, sleeping, etc.). The update is expected to be announced at this year’s WWDC on June 7.

Apple extended the waiver on IAPs for apps offering paid online group events instead of in-person events due to the pandemic. The waiver now continues through the end of 2021.

Platforms: Google

Google released Android 12’s third developer preview this week — the last one before Android 12 goes live. The highlights in this release included the ability for developers to provide new haptic feedback experiences in their apps and new app launch animations where they can customize the splash screen with their own branding.

Google this week touted its technologies that keep its Play Store safe. It says Google Play Protect scanned over 100 billion installed apps for malware each day in 2020. Its machine-learning detection capabilities and app review process stopped over 962,000 policy-violating apps from being published and it banned 119,000 spammy or malicious apps. It also increased focus on SDK enforcement, which impacts security and privacy violations.

Fintech

PayPal will launch a local wallet in China focused on cross-border payments. The U.S. company in January became the first foreign firm to have 100% ownership of a payments platform in China. The app will not compete with local players like Alipay or WeChat Pay for domestic payments.

Google Pay added its privacy nutrition label to its iOS app. The app’s references to third-party advertising are due to its “Explore” tab where users find merchant offers they can add to their card, which is optional. The app’s personalization features are off by default and, when turned on, are used to surface relevant merchant offers within Google Pay only.

Social Networking

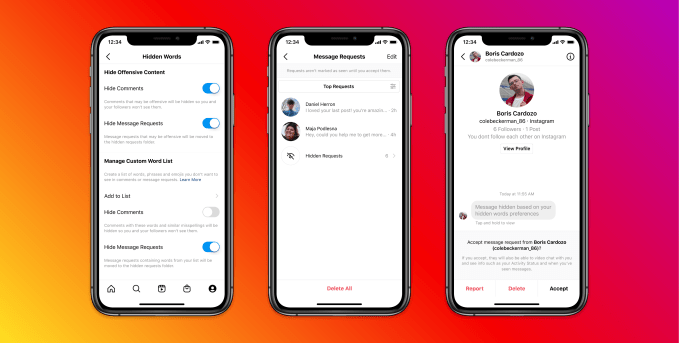

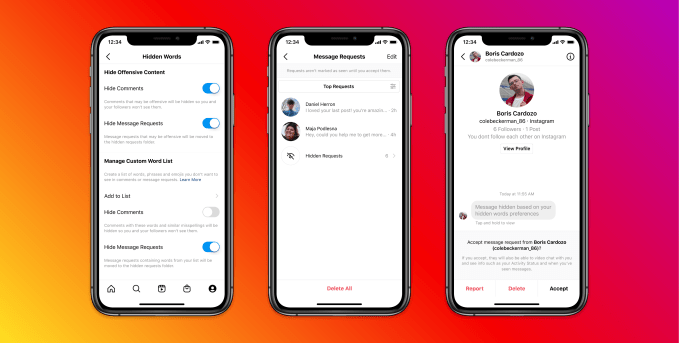

Instagram launched new tools that will filter out abusive DMs based on keywords and emojis used and to proactively block people, even on new accounts. The blocking account feature is going live globally in the next few weeks, and the feature to filter out abusive DMs will start rolling out in the U.K., France, Germany, Ireland, Canada, Australia and New Zealand in a few weeks, with more countries to follow.

Instagram is now testing ads in its TikTok rival, Reels. The ads can be up to 30 seconds long and may resemble Story ads. But you’ll be able to like and comment on Reels ads, just like you can on TikTok. Parent company Facebook also rolled out “sticker ads” for Stories.

Apple confirmed that Parler will be allowed to return to the App Store, after Parler proposed updates to its app, content and moderation practices that would adhere to Apple’s guidelines. The companies have been in talks following Parler’s ban from the App Store after the Capitol attack. Parler Interim CEO Mark Meckler, on Fox News, referred to the changes it had to make as “censorship.” He said Google had also reached out but the company is less concerned with making amends there as the app can be sideloaded on Android devices.

Twitter began testing “Professional Profiles” for businesses. The new profiles let businesses showcase their website, address, hours, map and more, in a new “About” section under the Following/Followers count on their profiles.

Professional Profiles are a new tool that will allow businesses, non-profits, publishers, and creators — anyone who uses Twitter for work — to display specific information about their business directly on their profile.

— Twitter Business (@TwitterBusiness) April 21, 2021

Twitter also rolled out the ability to tweet 4K pictures on iOS and Android to all users. The feature was previously in testing.

Time to Tweet those high res pics –– the option to upload and view 4K images on Android and iOS is now available for everyone.

To start uploading and viewing images in 4K, update your high-quality image preferences in “Data usage” settings. https://t.co/XDnWOji3nx

— Twitter Support (@TwitterSupport) April 21, 2021

A former children’s commissioner for England, Anne Longfield, has filed a case against TikTok over its collection of children’s data. The suit alleges TikTok is violating EU and U.K. children’s data protection laws by processing the information gathered from children without parental consent.

Nextdoor launched a new feature that will alert users if it appears they’re about to post something racist. The feature works by examining words and phrases, like “all lives matter,” that are hurtful to people of color. The app doesn’t prevent users from posting, but will slow them down and ask them to reconsider.

Facebook reminds developers that Apple’s ATT (App Tracking Transparency) will be rolling out next week with the new version of iOS, and shared its resources on how to “minimize disruptions to your business and clients.”

Wattpad social reading community announced it has now paid authors over $1 million as part of its now two-year old Paid Stories program. Today, over 550 writers and 750 stories are a part of the program. Users have also spent more than half a billion minutes reading Wattpad Paid Stories.

Design

Alongside the launch of its whiteboarding tool, Figma released a more fully featured version of its mobile app into beta testing.

Messaging

A Bloomberg report claims that Apple will be working to add more social features to iMessage in an upcoming release of iOS to better compete with WhatsApp. The report didn’t offer any indication about what those features may be.

Facebook partnered with the Academy of Motion Picture Arts and Sciences for the 93rd Oscars to give fans a way to engage in real-time, interactive experiences across its platforms. One of these will include a live Messenger Room which will stream the broadcast and exclusive live interviews with winners, engage in activities like trivia, and more. The room will be live starting at 8 PM ET on Sunday April 25. Messenger will also include AR backgrounds for the event.

Clubhouse & Clones

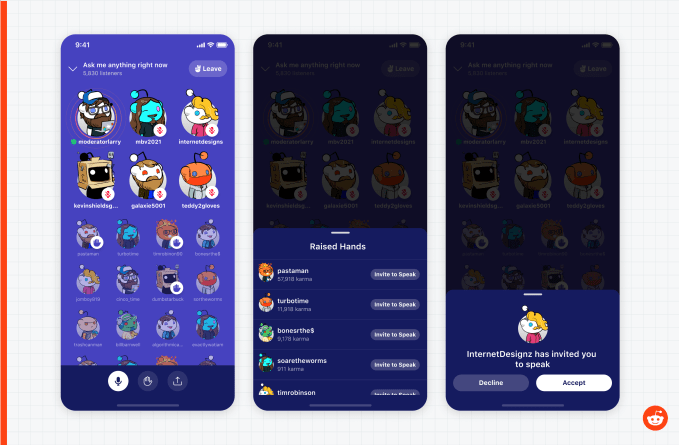

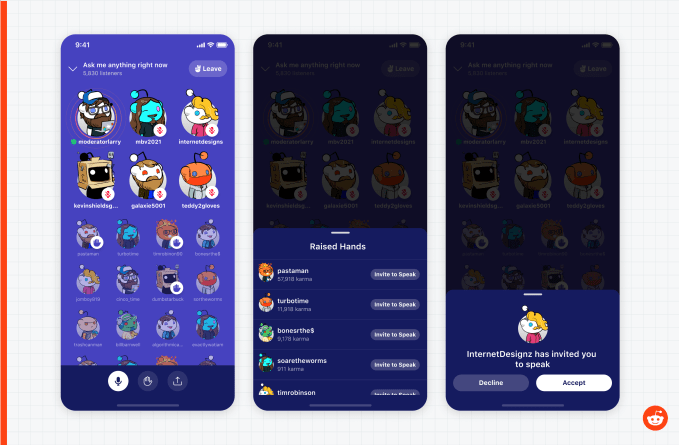

Reddit this week unveiled its Clubhouse Rival, Reddit Talk. The design hasn’t deviated much from Clubhouse’s experience — where speakers sit at the top of the screen in a stage area of sorts, and listeners appear below — all with rounded profile icons, as well as tools to react or raise a hand to ask to speak. However, Reddit Talk will initially live within subreddits, where a community’s moderators will be the only ones able to start a talk for the time being.

Image Credits: Reddit

Clubhouse downloads dropped 72% last month, going from 9.6 million in February to 2.7 million in March, an indication the app, now valued at $4 billion thanks to its fundraise this week, could be losing some momentum as competitors arrive and the world begins to re-open.

A Clubhouse bug let people lurk in rooms invisibly, Wired reports. The “ghosts” could hide in rooms and even disrupt them, while moderators were unable to mute them. Clubhouse said it has fixed the problem.

Facebook announced its suite of audio products this week, including its Clubhouse clone featuring Live Audio Rooms across Facebook and Messenger. The Live Audio Rooms will initially be available in Groups and to public figures and experts. The company also unveiled Spotify integrations for music and podcasts and an audio-only TikTok rival Soundbites, which seems a lot like the startup Cappuccino’s app, its CTO noticed.

Gaming

Discord and Microsoft are no longer having takeover talks. Bloomberg and The WSJ reported. Discord rejected a $12 billion bid for its service that allows gamers (and others) to communicate via text, video and voice. Other companies have been talking to Discord, too, including Twitter, with some discussions valuing Discord between $15 billion-$18 billion.

The Xbox Cloud Gaming beta began rolling out to iOS and PC this week to Game Pass Ultimate users, sending out invites to a limited number of users in the 22 supported countries, and scaling it up over time. Although Apple announced a carve-out that would allow cloud gaming platforms to offer their games through its App Store by making each game an individual app, linked to a main app with IAP, Microsoft has instead chosen to operate its experience through the Safari web browser.

Health & Fitness

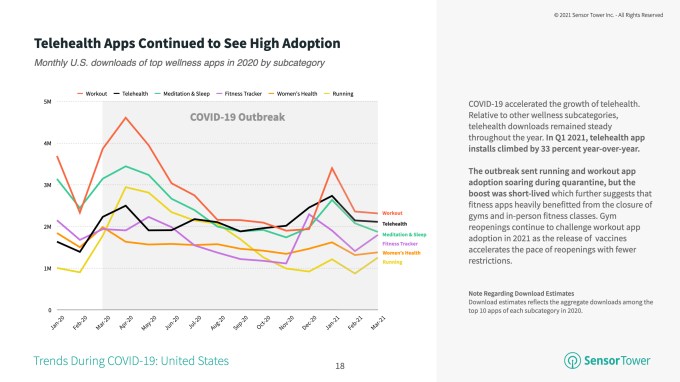

Image Credits: Sensor Tower

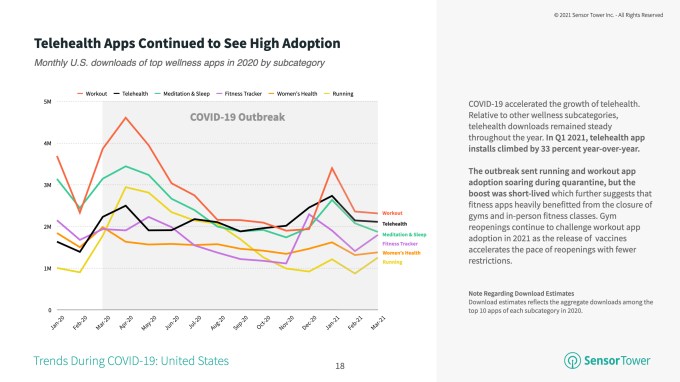

The top 10 telehealth apps in the U.S. saw their first-time installs climb 33% Y/Y to 7 million in Q1 2021, reported Sensor Tower. MyChart led the subcategory, reaching a record 1.1 million downloads in January — likely thanks to it becoming a tool for booking vaccine appointments.

Travel & Transportation

TripAdvisor is preparing to launch a subscription service in advance of a post-pandemic return to travel. The company expects the new product, TripAdvisor Plus, will grow to generate more than $1 billion per year for the service that will offer consumers discounts on hotels, experiences and more. The service is expected to arrive in the U.S. in June.

Ride-hailing app Gett inked a deal with Curb Mobility to integrate the latter’s some 50,000 yellow taxis into Gett’s app, which will now cover some 65 cities across the U.S. The deal does not involve any investment between Gett and Curb.

Utilities

Apple Maps looks to be adding user reviews and photos in the U.S., after first launching the feature in select markets, including the U.K. A brief shot from Apple’s event this week showed the feature in action.

Security

Secure messaging app Signal reverse engineered Cellebrite’s hacking kit after the cell phone hacking company said it had figured out how to access the Signal app. In the process of doing so, Signal found several vulnerabilities in Cellebrite’s kit. It also implied the team would make changes to Signal to make it more difficult to hack.

Facebook said it took action against two separate groups of hackers in Palestine — a network linked to the Preventive Security Service (PSS) and a threat actor known as Arid Viper. The groups were engaged in cyber espionage activities in Palestine and other nations.

Researchers found that popular running apps — including Strava, Runkeeper, MapMyRun, Nike Run Club and Runtastic — don’t use basic security measures to prevent hackers from breaking in or health and fitness data spilling out.

Developer Kosta Eleftheriou has been hunting down App Store scam apps, after his own app became a victim to Apple’s failures to police misleading apps with fake reviews. One of his more recent discoveries was particularly interesting: he found a crypto casino hidden inside what otherwise looked like a silly kids’ game. The app was removed from the App Store shortly after he tweeted about it.

Funding and M&A

Clubhouse closed an undisclosed round of Series C funding, valuing the business at $4 billion, or triple its earlier valuation. The round was led by Andrew Chen of Andreessen Horowitz, with participation from DST Global, Tiger Global and Elad Gil.

Kandji raised $60 million in a Series B for its solution that helps onboard and update Apple devices to support remote workforces. Felicis Ventures led the round. The company now has 100 employees.

Amsterdam-based Bux raised $80 million for its European Robinhood rival that lets people invest in shares and ETFs without paying commissions. The startup now has around 500,000 users across part of Europe using its main app and two others, including a Bux Crypto app. The round was co-led by Prosus Ventures and Tencent.

Leo AR raised $3 million in seed funding led by Great Oaks Ventures for its app that capitalizes on ARKit to create 3D AR objects. The startup claims its users have now created more than 8 million videos with AR objects to date.

Per Diem raised $2.3 million in seed funding led by Two Sigma Ventures for its service that lets anyone build their own subscription business with shipping and delivery — like Amazon Prime.

Social app IRL is reportedly in talks to raise more than $50 million at a $1 billion valuation, or 10x the size of its last round, according to The Information. The app quickly pivoted from “in real life” events to digital ones during the pandemic.

French startup Alan raised $220 million in funding led by Coatue at a $1.67 billion valuation for its health insurance and healthcare superapp available across web, iOS and Android.

Mobile gaming company AppLovin, which holds about a 1% share of the $189 billion global mobile gaming market, closed down 18.5% on its first day of trading on the Nasdaq. Shares were at $65.20, with a market cap of around $23 billion. The firm also owns app distribution and marketing company Adjust.

French startup BlaBlaCar raised $115 million to build an all-in-one travel app. The round was led by existing investor VNV Global. The company also added a bus marketplace with the acquisition of Ouibus and an online bus ticketing platform with the acquisition of Busfor.

Till Financial raised $5 million from a range of investors, including Melinda Gates’ fund, for its kids’ finance app meant to help them learn how to save and invest.

San Francisco-based Oath Care raised $2 million in seed funding for its subscription-based mobile app focused on improving the lives of new mothers by pairing them with healthcare specialists and moderators who can guide them in chats and video calls.

Downloads

Popl

Image Credits: Popl

This combination NFC tag (available as a phone sticker, wristband or keychain dongle) works alongside a mobile app to help you quickly share your contact info with people you meet in real life. When phone are close, the NFC enables the handoff the data as quickly as an Apple Pay transaction. In the Popl app, meanwhile, you can customize which data you want to share with others — including your contact info, social profiles, website links, etc. — all via an easy-to-use interface. Like some business card apps in the past, you can flip between a personal profile and a business profile in Popl in order to share the appropriate information when out networking.

Yak Tack

Image Credits: YakTack

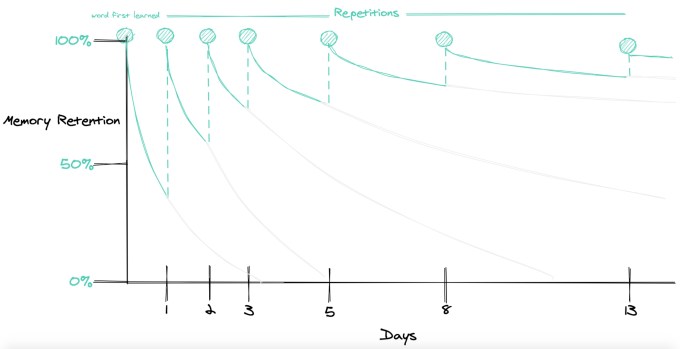

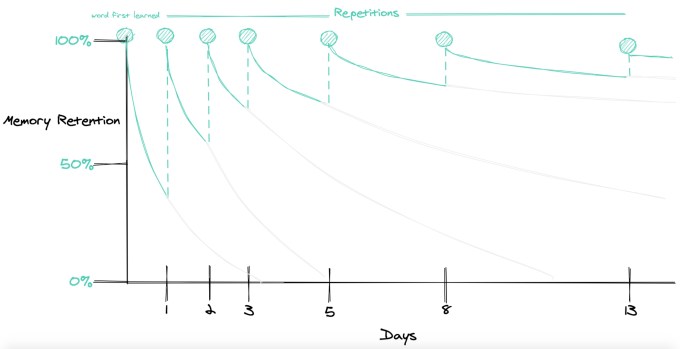

Wordsmiths will like Yak Tack’s simple app, reviewed here by TechCrunch, that help users remember new words using a system it calls “tacking.” When you find a word you want to remember, you use the app to look it up then “tack” it to start the system of repetition that helps combat forgetting. The words are sent via push notifications at a specific intervals so you can read their definitions again.

Manager haseł PasswordState został zhackowany a komputery klientów zainfekowane.

Manager haseł PasswordState został zhackowany a komputery klientów zainfekowane.