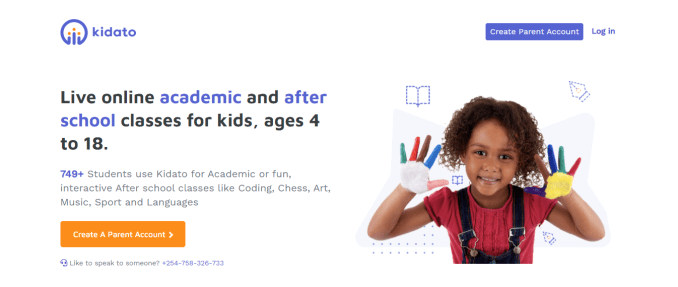

News: YC-backed Kidato raises $1.4M seed to scale its online school for K-12 students in Africa

In public schools across Africa, classrooms are often overcrowded and this affects how teachers and students interact. The large classroom creates too much work for teachers leaving students’ individual problems unattended. Private schools are modeled to fix these issues, but they can be expensive for the average African middle-class professional with kids. Kidato, an online

In public schools across Africa, classrooms are often overcrowded and this affects how teachers and students interact. The large classroom creates too much work for teachers leaving students’ individual problems unattended.

Private schools are modeled to fix these issues, but they can be expensive for the average African middle-class professional with kids. Kidato, an online school for K-12 students in Africa, presents another alternative and is announcing today that it has closed its $1.4 million seed investment.

The investors who participated in the round are Learn Start Capital, Launch Africa Ventures Fund, Graph Ventures and Century Oak Capital, among other notable local and global angel investors.

Kidato was founded by Kenyan serial entrepreneur Sam Gichuru in 2020. As a father of three kids, he encountered similar problems facing the average Kenyan middle-class professional, one of which was struggling to keep up with private school exorbitant tuition fees as high as $8,000 yearly.

“I have three kids. I moved them from private schools to homeschooling because that was the next option to give them the same quality of education but at an affordable price,” Gichuru told TechCrunch. That was when I started noticing the other challenges private schools had.”

First is the overcrowded nature of these schools. Typically, public schools have a teacher-to-student ratio of 1:50 while private schools are at 1:20. “Depending on how much you pay for school fees. The more prestigious the school, the smaller the teacher-to-student ratio. That for me was a big indicator that you want to have a small number of students per teacher,” added Gichuru.

Then there’s the issue of long and tiring commutes for students. Gichuru tells me that kids going to private schools in Nairobi would have to wake up by 5 a.m., prepare to get on the bus at 6 a.m. to get to school at 7 a.m.

Like any homeschooling model, Gichuru had teachers come to his house to teach his kids what they’d ordinarily learn in school. But when the pandemic hit, he had to find another alternative by building a platform around Zoom for these teachers to continue delivering lessons for his kids. By September, the platform had opened up to accommodate 10 more children outside his home. In January, the number of students in its learning-from-home program increased to 30 students.

It is easy to see why the product is catching on with parents. Due to the pandemic, video services like Zoom have become the norm for the middle class in Africa with high internet accessibility. Also, cutting commute time helps to spend more time with family while reducing costs.

Image Credits: Kidato

Building an online school for kids while capitalizing on the advantages of parents’ new remote work culture also got the Kenyan startup accepted into Y Combinator in January. Since then, Kidato has onboarded more than 50 students and claims to be growing at a 100% quarter on quarter.

Gichuru says Kidata wants to ensure better learning outcomes in smaller personalized class sizes. It is also offering the same international curriculum but with an average of 1:5 teacher-student ratio.

The company has also implemented after-school programs like robotics and chess, art, coding, and debate classes. Typically, they are usually found among students from affluent schools; however, they are being democratized by Kidato to the more than 700 registered students using its platform. The students mainly from Canada, Kenya, Malawi, Switzerland, Tanzania, UK, United States, and UAE pay $5 per lesson, the company revealed.

Kidato wants to make learning fun and gratifying. According to Gichuru, the business trains its 740 teachers on how to make classes interactive by using the context of arcade games like Minecraft and Roblox to tailor lessons taught to students in different subjects.

“Drawing from our understanding about how these platforms work and how kids learn from them, we have built-in behavior reward mechanisms such as lesson merits into our teaching methods resulting in interesting and enjoyable virtual classes,” an excerpt from the statement read.

But what happens when Kidato meets a demand and supply problem. While its product seems appealing for students, will Kidato find enough qualified teachers to meet the growing demand? The CEO holds that his company has it figured out.

Most private schools shut down during the lockdowns. Though some are beginning to re-open gradually, they are embarking on a recovery process with increased school fees and reduced teachers’ salaries. This has presented a big opportunity for Kidato as it currently has a waitlist of 3,000 teachers who are being swayed by Kidato’s promise of better pay. In the long run, this number creates a pipeline for 15,000 students.

Besides, Kidato doesn’t incur infrastructural costs like real estate, a feature common with traditional schools. Therefore the revenue made from students doesn’t go into any extreme costs, which means more money for teachers.

“Our teachers are paid at least one and a half times more than the average teacher in a private school, and that has driven a great supply of teachers to us.”

Kidato’s revenue split with teachers is 70/30; teachers take the larger percentage. Gichuru adds that if teachers combine their efforts in both normal and afterschool classes, they can earn an average of $2,000 per month.

Image Credits: Sam Gichuru

One would’ve thought that a challenge Kidato would be facing despite its progress would be internet and power but that’s not the case. It is the skepticism of whether Kidato can offer socialization for the students. To solve that, Kidato is adopting an offline approach by leveraging the connections of corporates and align its after-school classes to include monthly educational field trips.

“We’re trying to show them how well kids socialize on our platform. We are partnering with companies that can make it possible to take these kids to plantations, factories, planetariums,” the CEO added.

Kidato is Gichuru’s second stint at Y Combinator. The entrepreneur who founded one of Kenya’s well-known incubator Nailab, also co-founded recruitment platform, Kuhustle. The company which seems to be in pilot mode at the moment, took part in Y Combinator’s batch in 2015.

Kidato has some high expectations given the CEO’s experience and as the only edtech startup in this current batch. The company will use the seed financing for growth and product development as it hopes to replace brick-and-mortar schools. In Gichuru’s words regarding the company’s future, he said, “in the next couple of years, we want to have the biggest online school for K-12 students.”