News: France’s competition authority declines to block Apple’s opt-in consent for iOS app tracking

Apple has fended off an attempt by advertisers in France to use a competition complaint route to derail incoming pro-privacy changes in iOS that will require third party apps to obtain users’ consent before they can track them. The French competition authority (FCA) said today it has rejected calls by IAB France, MMAF, SRI and UDECAM

Apple has fended off an attempt by advertisers in France to use a competition complaint route to derail incoming pro-privacy changes in iOS that will require third party apps to obtain users’ consent before they can track them.

The French competition authority (FCA) said today it has rejected calls by IAB France, MMAF, SRI and UDECAM for it to intervene pre-emptively and block Apple’s move, saying it does not currently consider the introduction of the App Tracking Transparency (ATT) feature to be an abuse of a dominant position.

However the regulator said it is continuing to investigate Apple “on the merits” — specifying it will be looking to ensure the tech giant is not applying less restrictive rules for its own apps vs third party developers (aka ‘self preferencing’).

Per Reuters, the competition authority worked closely with France’s privacy watchdog, CNIL, to reject the request to suspend ATT.

The CNIL has been contacted for comment.

An Apple spokesperson told us:

“We’re grateful to the French Competition Authority for recognizing that App Tracking Transparency in iOS 14 is in the best interest of French iOS users. ATT will provide a powerful user privacy benefit by requiring developers to ask users’ permission before sharing their data with other companies for the purposes of advertising, or with data brokers. We firmly believe that users’ data belongs to them, and that they should control when that data is shared, and with whom. We look forward to further engagement with the FCA on this critical matter of user privacy and competition.”

Back in January Apple said the ATT would be applied to iOS in early spring.

Since then a complaint by a French startup lobby, France Digitale, has also been filed with the country’s privacy watchdog — accusing Apple of privacy hypocrisy.

That complaint similarly invoked competition concerns — contrasting the incoming ATT requirement for third party apps to gain consent before tracking iOS users to default iOS setting for Apple’s own apps that the complaint said allow tracking. However Apple called the allegations “patently false”, saying ATT will be “equally applicable to all developers including Apple”.

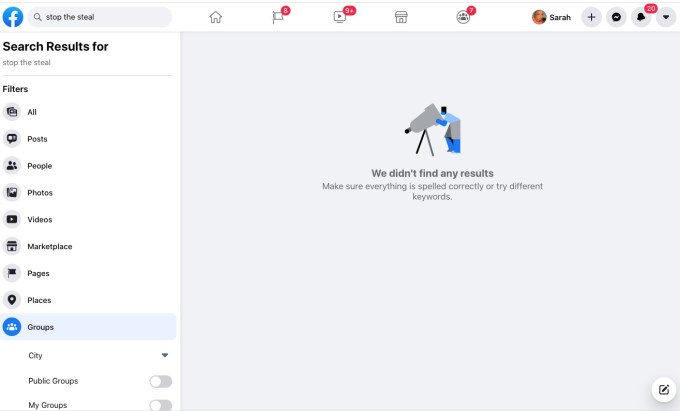

The ATT switch in iOS is certainly wildly unpopular with adtech companies like Facebook, who claim it will harm developers’ ability to monetize their apps. Facebook has also conceded Apple’s move will significantly dent its own revenues.

Apple, meanwhile, has accused the adtech industry of hysteria and false claims — and continued to denounce the “data-industrial complex” for creeping on Internet users to exploit their personal data and try to manipulate people for profit.

While it’s also true that Apple can serve personalized advertising to iOS users of its own apps it argues that it holds itself “to a higher standard” than the adtech data industrial complex because it lets users opt out of what it calls its “limited first-party data use for personalized advertising” — claiming that feature “makes us unique”.

In a similar recent development involving Google, a competition complaint was filed late last year in the UK in an attempt to block changes it intends to make to how users of its Chrome browser can be tracked by third parties.

Google’s so-called ‘Privacy Sandbox‘ plan is also wildly unpopular with advertisers — who accuse the tech giant of abusing a dominant position by shutting down their ability to track users while continuing to do so itself.

Simultaneously, multiple efforts are underway across the adtech industry to devise alternative means of tracking web users’ activity — accelerating by the prospect of Chrome, the dominant browser by marketshare, depreciating support for third party trackers.

The UK’s Competition and Markets Authority announced in January it’s investigating suspected breaches of competition law by Google following a number of complaints about Privacy Sandbox.

That probe continues.