- March 27, 2021

- by:

- in: Blog

Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy. The app industry is as hot as ever, with a record 218 billion downloads and $143 billion in global consumer spend in 2020. Consumers last year also spent 3.5 trillion minutes using apps on Android

Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy. The app industry is as hot as ever, with a record 218 billion downloads and $143 billion in global consumer spend in 2020.

Consumers last year also spent 3.5 trillion minutes using apps on Android devices alone. And in the U.S., app usage surged ahead of the time spent watching live TV. Currently, the average American watches 3.7 hours of live TV per day, but now spends four hours per day on their mobile devices.

Apps aren’t just a way to pass idle hours — they’re also a big business. In 2019, mobile-first companies had a combined $544 billion valuation, 6.5x higher than those without a mobile focus. In 2020, investors poured $73 billion in capital into mobile companies — a figure that’s up 27% year-over-year.

This week we’re looking at the case of the missing Arizona app store bill, the latest on the Dispo drama and Facebook’s new audio efforts, among other things.

This Week in Apps will soon be a newsletter! Sign up here: techcrunch.com/newsletters

Top Stories

So…where did that App Store legislation go?

Arizona’s Senate was supposed to vote on a controversial bill, HB2005, that would make it the first state to regulate the Apple and Google app stores. But though the vote was listed first on the Senate’s livestream agenda on Wednesday, March 24th, the vote never came up.

Basecamp co-founder and Apple critic David Heinemeier Hansson, who submitted testimony in support of HB 2005, basically called the lobbying system corrupt.

Doesn’t mean it’s guaranteed that it’s over in Arizona, but hot diggity damn. Seeing how the corru… I mean.. lobbying works this close and this brazenly is something else. But Apple can’t buy all the legislators in all the states. Refuse to believe that.

— DHH (@dhh) March 24, 2021

It’s true that Apple and Google had hired lobbyists to combat the bill, which would have threatened the companies’ ability to continue collecting their 15% or 30% commissions by allowing app developers to use third-party payment processors for sales and in-app purchases.

Apple had its own lobbyist, Rod Diridon, working on the Arizona bill, and was said to have hired Kirk Adams, a former chief of staff to Arizona Gov. Doug Ducey, to negotiate directly with the bill’s sponsor, Rep. Regina Cobb (R).

However, others countered the narrative being laid out by Hansson, saying that the bill’s existence in the first place was the result of lobbying from Epic Games and others, and many lawmakers didn’t even know what they were voting on. A similar bill was already voted down in North Dakota and HB2005 didn’t seem to have much support either, ahead of the would-be vote.

The Coalition for App Fairness (CAF), a group backing these bills, told us it didn’t know what happened to the bill, but was trying to find out.

Pretty weird that this bill ghosted!

Then again, an App Store bill getting mysteriously rejected without sufficient explanation is …fitting. https://t.co/C7ycLqTILc

— Dieter Bohn (@backlon) March 24, 2021

Dispo loses investor support, Dobrik

Once-hot mobile photos app Dispo is becoming a case study as to why partnering with high-profile influencers and YouTuber-types without due diligence is just a bad idea. When a recent investigation exposed that a member of YouTuber David Dobrik’s “Vlog Squad” sexually assaulted her, Dispo’s early investors have been distancing themselves from the app.

Initially, lead investor Spark Capital said it would “sever all ties” with the company, TechCrunch’s Natasha Mascarenhas reported earlier this week. Dobrik also left the board and the company hours later. Two other investors, Seven Seven Six and Unshackled, said they would donate any potential profits from their Dispo investment into organizations working with survivors of sexual assault. (Cynically, one could argue, the firms don’t expect there to be much left to donate with this much of a stain on Dispo’s public image and the loss of its big-name backer in Dobrik).

Dispo had been valued at $200 million after its $20 million Series A, led by Spark Capital only weeks ago. The company released a statement saying it would continue to work on the platform.

Facebook’s Clubhouse rival looks like Clubhouse

New screenshots of Facebook’s unreleased audio product, still under development, show what appears to be a live audio broadcast experience that’s more of an extension of Facebook’s existing Messenger Rooms, rather than a standalone app experience. Facebook confirmed the images are examples of the company’s “exploratory audio efforts,” but cautioned that they don’t represent a live product at this time. The images show Clubhouse-like audio rooms with rounded profile icons and a listener section led by the speakers’ friends — very much like Clubhouse.

While the company said not to jump to any conclusions about what this all means in terms of a final product, it’s interesting to see how Facebook is thinking about social audio experiences and where they could fit in on its platform. In this case, it sees it as a third option in Messenger Rooms — users could start either a private video chat with friends or a private audio chat, or they could go live to the public on audio only.

Mark Zuckerberg (rather boldly) went on Clubhouse to praise Clubhouse for what it had pioneered, saying it would end up “being one of the modalities around live audio broadcast.” It seems Facebook sees Clubhouse as just another networking format to be knocked off, like TikTok’s vertical videos or Snapchat Stories — both of which Facebook later adopted for its own platforms.

Weekly News

Platforms: Apple

People noticed that recently created Shortcuts links broke this week, displaying a message “Shortcut Not Found,” instead of opening the Shortcuts app. The issue impacted everyone who has shared shortcuts. Apple said it was aware of the issue and working on a fix.

Apple rolled out its fifth developer betas for iOS 14.5, iPadOS 14.5 and other platforms, which was then shortly followed by the release of the public betas. These may be the last betas before the public launch, though Apple has gone beyond five betas in the past.

Apple responded to Australian Competition & Consumer Commission (ACCC), which is investigating the potential anti-competitive nature of the App Store, by saying that there were other options for developers to reach iOS users — like using a website. Some developers were not amused.

“[We] face competitive constraints from distribution alternatives within the iOS ecosystem (including developer websites and other outlets through which consumers may obtain third party apps and use them on their iOS devices) and outside iOS.”

This smacks of disingenuousness. https://t.co/spMxnJDGKo

— Dan Masters – OhMDee.com (@OhMDee) March 25, 2021

Apple also defended its App Review process to the ACCC, saying that it reviews 73% of prospective apps within 24 hours of being submitted by a developer, and offers details as to why an app didn’t comply with its guidelines. It also argued that it offers a worldwide support line that facilitates 1,000 calls per week in all 175 countries where the App Store operates.

A tentative initial witness list in Apple’s courtroom battle with Epic Games over Apple’s alleged monopolist practices includes Apple CEO Tim Cook, Software Engineering SVP Craig Federighi and Apple Fellow Phil Schiller (who helped launch and run the App Store). Epic will be calling its CEO Tim Sweeney and VP Mark Rein. Executives from Microsoft, Facebook and Nvidia are also included.

Platforms: Google

Google announced the Android Ready SE Alliance to make sure that new phones will be ready to support digital alternatives to things like car keys, house keys, wallets (think national IDs, mobile driver’s licenses, passports) and more. This requires that phones include tamper-resistant hardware called a Secure Element (SE) and StrongBox, an implementation of the Keymaster HAL that resides in a hardware security module, which launched with the Pixel 3 in 2018.

A bunch of Android apps, including Gmail and Google Pay, began crashing this week due to an issue with Android System WebView. Google addressed the problem by issuing updates for the standalone WebView app and Google Chrome.

E-commerce

H&M was removed from major e-commerce apps and platforms in China, including Alibaba’s Taobao, JD.com and Pinduoduo, Meituan’s shop-listing app Dianping, map apps from Tencent and Baidu, among other major online platforms. The Swedish retailer had decided to stop buying cotton from Xinjiang, where over 1 million members of the Uyghur and other predominantly Muslim ethnic minorities have been confined to detention camps, which are accused of imposing forced labor. Nike, Adidas, Burberry, Uniqlo and Lacoste also criticized China for expressing concern over Xinjiang, leading dozen of celebs to cancel endorsement deals.

NBCU struck a deal with Facebook and Instagram to extend its “shoppable opportunities” to social media platforms. The e-commerce partnership will put pitches from the TV company’s clients on its social handles on Facebook and Instagram.

Fintech

Robinhood, the free trading app and recent home to the GameStop frenzy, confidentially filed for an IPO. The company confirmed the filing in a blog post after several media outlets broke the news.

Social

TikTok belatedly banned some Myanmar accounts that posted violent videos supporting the military’s violent coup, saying that it was aggressively cracking down on accounts promoting violence. The takedowns of the video — some of which threatened protesters with death or spread hate-fueled claims — didn’t start until early March, a month after the coup began.

TikTok added an Ad Library tool that allows marketers to view the top performing ad campaigns taking place across the app. The “top ads” feature can also be filtered by vertical and region, then by time (last seven or 30 days), and performance (CTR, impressions, video view rate).

Snapchat is developing its own take on TikTok Duets with the test of a Snap Remix feature. Duets are a core part of what makes TikTok feel like a social network, rather than just a platform for more passive video viewing. Remix — which shares the name with an Instagram Duets-style feature that’s soon to launch publicly — lets users repurpose others’ Snaps for use in their own through a variety of formats.

Facebook is testing an app for prisoners who are re-entering society, Bloomberg reports. The “Re-Entry App” was shared at the top of some users’ Instagram feeds this week, offering early access.

Axios reported that Trump was in talks with no-name app vendors about creating his own social networking app. One of the companies he spoke to was the largely unknown platform called FreeSpace, which claims its network is designed to “reinforce good habits and make the world a better place.” The app includes a news feed, user profiles and group messaging features.

Parler says it sent the FBI over 50 posts about the Capitol riot ahead of January 6, The NYT reports. If accurate, it raises the question of whether or not the FBI took the threats seriously. The FBI has refused to comment on Parler’s statement. Meanwhile, Parler is facing a lawsuit by former CEO John Matze who claims he was forced out by conservative donor Rebekah Mercer.

U.K. watchdog says Facebook’s acquisition of Giphy raises competition concerns. The Competition and Markets Authority launched the first phase of its investigation in January, and notes that Giphy had competed with Facebook outside the U.K. in digital ad deals.

Twitter seems to be working on an audience picker for its upcoming communities feature, reports Jane Manchun Wong. This would be accessible from within the tweet composer screen.

Streaming & Entertainment

Spotify updated its mobile app with several changes to the Home hub. These include a way to rediscover recently played songs as far back as three months ago; a way for Premium users to view new and unfinished podcasts with a blue dot (new) and progress bar (unfinished); and a new section of personalized music recommendations. The company later in the week updated its desktop and web app, as well.

Triller forges licensing agreements with music publishers, Variety reports. The agreement with the National Music Publishers’ Association, which represents most American publishers, follows Universal withdrawing its entire library from the app last month, claiming Triller withheld payments. Triller claimed to have no idea why UMG would do this.

Clubhouse says its Android launch will “take a couple of months.” Before, the company had said it would be “soon” without promising any sort of time frame.

Gaming

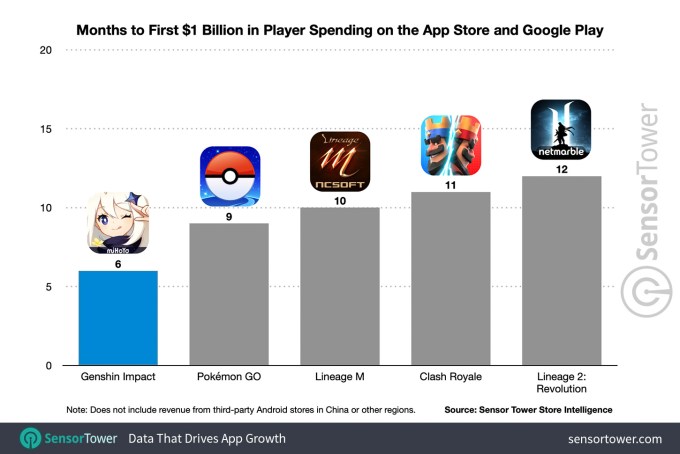

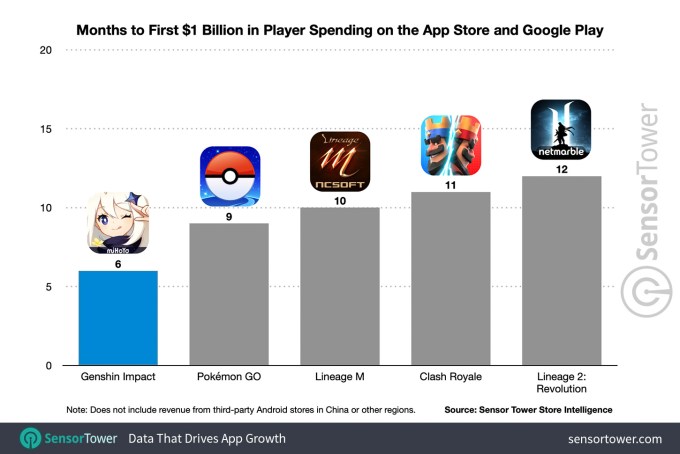

Image Credits: Sensor Tower

Genshin Impact tops $1 billion on mobile in less than six months following its September 2020 launch, says Sensor Tower. During the last 30 days, the game ranked No. 3 on the App Store and Google Play combined, behind Tencent’s PUBG Mobile and Honor of Kings.

Gaming voice and text chat service Discord, which has expanded into other forms of social networking, is said to be exploring a sale that could be worth over $10 billion. Bloomberg reported Microsoft was in talks to buy the service for more than $10 billion but no deal was imminent and Discord may choose to go public instead.

PUBG Mobile has grossed $5 billion in revenue after generating an average of $7.4 million per day in 2020, Sensor Tower reports. Like many games, PUBG Mobile’s revenue soared during the height of the pandemic with record spending of $300 million last March, during lockdowns.

Google Stadia may soon get touchscreen controls on Android, 9to5Google found by digging into the Android app’s code. The controls would allow users to use gestures like tapping, swiping and pinching.

Education

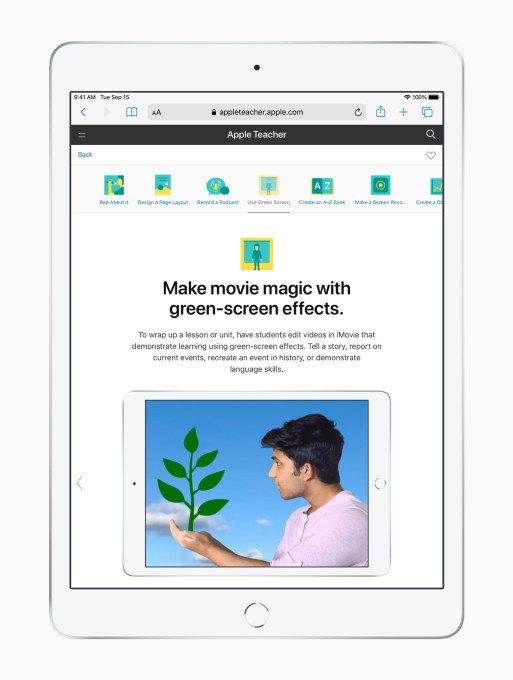

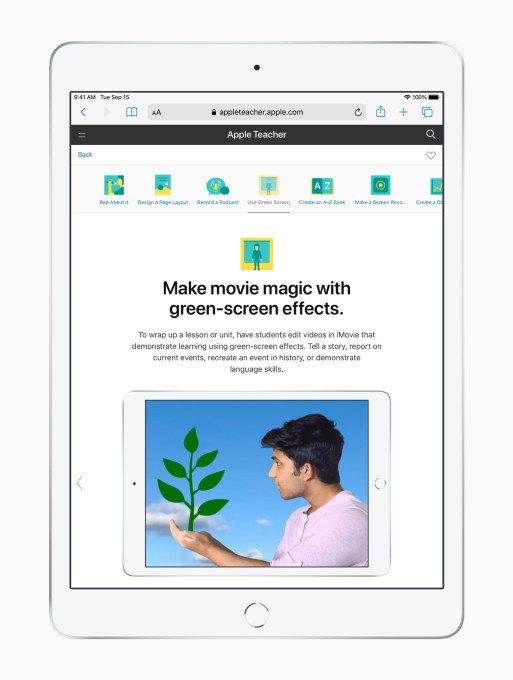

Image Credits: Apple

Apple updated its Schoolwork and Classroom apps with a few more features aimed at making it easier to share projects and support remote learning, among other things. The company also announced a Teacher Portfolio badge that would be awarded to teachers who completed a series of lessons focused on learning foundational skills on iPad and Mac.

Health & Fitness

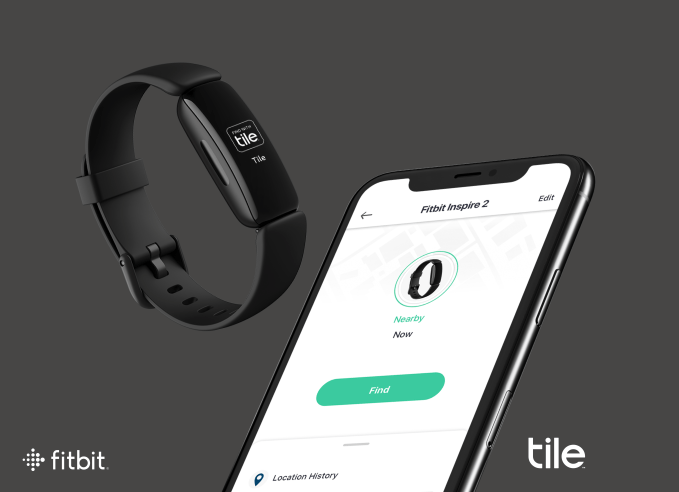

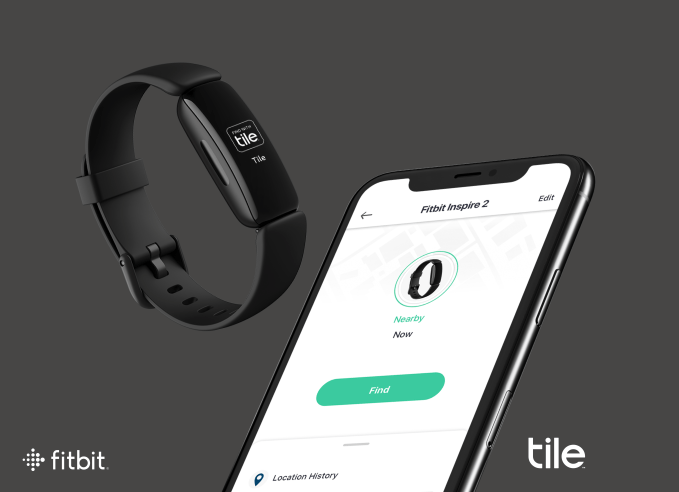

Image Credits: Tile

Tile’s lost item-tracking service arrived on wearables for the first time thanks to a new partnership with Google’s Fitbit. Through a Fitbit app update, new and existing Fitbit Inspire 2 owners will gain access to Tile’s Bluetooth-based finding network to locate their misplaced Fitbit.

Health and fitness apps’ downloads increased 20% in 2020 due to the pandemic and users shifting to at-home workouts, says App Annie. In the IoT and fitness-tracking app space, Mi Fit, Strava, MyFitnessPal, Google Fit, Fitbit, BetterMe, Runtastic, Nike Training Club, Step Tracker by Leap Fitness and Samsung Health saw the most downloads last year.

Data shared by Uswitch notes that demand for sleep apps increased by 104% during the pandemic, while demand for wellness apps grew 26% since March 2020.

Productivity

Slack CEO Stewart Butterfield teased new Slack features were in beta testing: an asynchronous audio messages feature, a Clubhouse-like drop-in voice chat and Slack Stories. The exec announced the news in the PressClub show on Clubhouse, adding “good artists copy, great artists steal.”

Slack also this week launched a new universal DM system called Connect DMs, which allows any Slack user to direct message any other Slack user. The system was immediately called out for potentially enabling harassment and abuse, leading the company to pull the ability to customize the invite message.

Cortana has begun to warn its iOS and Android users that it will be shut down on March 31st. Microsoft pulled back on Cortana last year, but Cortana is still accessible on Windows. The company is also discontinuing Cortana support on the Harman Kardon Invoke speaker, as well.

Opera’s Touch iOS web browser app, now rebranded just Opera, released a major update that modernized the UI with a more flat look, a new color palette, reworked text and new icons in the bottom bar and in the “Fast Action” button, which lets you get to favorite destinations quickly. It also adds a built-in Ethereum wallet.

Privacy & Security

China defined new rules over information apps can collect, saying that users of short video, news, browser and utility apps can access basic services on these platforms without providing their personal info. The new regulation goes into effect May 1 and covers 39 app categories — including also messaging, online shopping, payments, ride hailing, short video, livestream and mobile games — where it specifies what information is necessary to use the app (e.g. if e-commerce, a user’s phone number, name, address, and payment info).

The Indian government is trying to stop WhatsApp’s controversial privacy policy update with an antitrust investigation into the policy changes, in order to determine the full extent of the app’s data-sharing practices enabled through the “involuntary consent” of WhatsApp users.

An investigation by The NYT found that Britain’s top gambling app, Sky Bet, was compiling extensive records about users. Either the app or one of the data providers it hires to collect info on users had access to users’ banking records, mortgage details, location and gambling habits.

Apple responded to ProtonVPN’s claims that Apple was standing in the way of human rights by rejecting one of its app updates. The VPN maker attempted to tie the rejection to the coup in Myanmar, saying that people in the country use its app to bypass internet crackdowns and share information about the ongoing “crimes against humanity” taking place in the country. Apple responded to the attack by noting that it had only asked the developer to reword its description so it doesn’t read like it’s encouraging users to bypass geo-restrictions or content limitations (you know, which would be illegal). And it pointed out that all Proton’s apps have remained available in Myanmar this whole time.

Facebook caught Chinese hackers using fake personas to target Uyghurs abroad. The social network caught the network of China-based hackers using fake Facebook accounts where they posed as activists, journalists and other sympathetic figures to send the targets to compromised websites. The hacking groups are aiming to gain access to the targets’ devices by getting them to install malicious apps for surveillance purposes.

A cybersecurity review of TikTok by the University of Toronto’s Citizen Lab says it’s not worse than Facebook in either data privacy or security. This, however, may be a low bar.

Scam apps have stolen more than $400 million from users across the App Store and Google, according to a study by Avast. The company reported 204 so-called “fleeceware apps” with over a billion combined downloads that trick users into free trials but then overcharge them with subscriptions that are as high as $3,432 per year.

“Apart from the financial harm… users affected by such scams will be less inclined to download apps or engage with app stores in general. Therefore, these fleeceware appls have a negative impact on legitimate developers that use the subscription model in an ethical manner.” https://t.co/4ec5AtF0s3

“Apart from the financial harm… users affected by such scams will be less inclined to download apps or engage with app stores in general. Therefore, these fleeceware appls have a negative impact on legitimate developers that use the subscription model in an ethical manner.” https://t.co/4ec5AtF0s3

— David Barnard (@drbarnard) March 25, 2021

Funding and M&A

Messaging app Telegram raised over $1 billion through bond sales to multiple investors, including a combined $150 million investment by Mubadala Investment Co. and Abu Dhabi Catalyst Partners, which is part-owned by the Abu Dhabi state fund. Last week, this column noted that the app had owed its creditors around $700 million by the end of April, per The WSJ’s report.

Messaging app Telegram raised over $1 billion through bond sales to multiple investors, including a combined $150 million investment by Mubadala Investment Co. and Abu Dhabi Catalyst Partners, which is part-owned by the Abu Dhabi state fund. Last week, this column noted that the app had owed its creditors around $700 million by the end of April, per The WSJ’s report.

Fortnite and Houseparty owner Epic Games is reportedly closing on $1 billion in new funding that will value its business at $28 billion.

Fortnite and Houseparty owner Epic Games is reportedly closing on $1 billion in new funding that will value its business at $28 billion.

Twitter acqui-hired the team from API integration platform Reshuffle to work on its own developer API platform. The team of seven, including two co-founders, will immediately begin work on building tools for Twitter developers while Reshuffle’s business is wound down.

Twitter acqui-hired the team from API integration platform Reshuffle to work on its own developer API platform. The team of seven, including two co-founders, will immediately begin work on building tools for Twitter developers while Reshuffle’s business is wound down.

Link-in-bio company Linktree, whose mini websites get linked to by creators in your favorite social apps, raised $45 million to develop new social commerce tools. The company says a third of its 12 million users have signed up within the last four months — a trend partially driven by the pandemic.

Link-in-bio company Linktree, whose mini websites get linked to by creators in your favorite social apps, raised $45 million to develop new social commerce tools. The company says a third of its 12 million users have signed up within the last four months — a trend partially driven by the pandemic.

South Korea’s largest travel app Yanolja is in talks with banks to go public through a dual listing in Seoul and overseas. The company is aiming for a $4 billion valuation.

South Korea’s largest travel app Yanolja is in talks with banks to go public through a dual listing in Seoul and overseas. The company is aiming for a $4 billion valuation.

ironSource, a business platform for the app economy, reached an agreement with Thoma Bravo’s blank-check firm to go public via a SPAC at a $11.1 billion valuation.

ironSource, a business platform for the app economy, reached an agreement with Thoma Bravo’s blank-check firm to go public via a SPAC at a $11.1 billion valuation.

Ryu Games raised a seed round of $2.3 million for its service that helps developers add cash tournaments to their mobile games. The company is aiming to be present on a few dozen games this year.

Ryu Games raised a seed round of $2.3 million for its service that helps developers add cash tournaments to their mobile games. The company is aiming to be present on a few dozen games this year.

Nigerian fintech Bankly raised $2 million for its app that digitizes cash for the unbanked, in a round led by led by Vault.

Nigerian fintech Bankly raised $2 million for its app that digitizes cash for the unbanked, in a round led by led by Vault.

Mumbai-headquartered Indian fantasy sports app Dream11’s parent firm, Dream Sports, raised $400 million in a round led by TCV, D1 Capital Partners and Falcon Edge, valuing the business at nearly $5 billion.

Mumbai-headquartered Indian fantasy sports app Dream11’s parent firm, Dream Sports, raised $400 million in a round led by TCV, D1 Capital Partners and Falcon Edge, valuing the business at nearly $5 billion.

Indian social network Public App raised $41 million just six months after its $35 fundraise, valuing the business at over $250 million — or more than double the valuation since the prior fundraise. The app now has over 50 million users, including over 50,000 elected officials, government authorities and citizen journalists.

Indian social network Public App raised $41 million just six months after its $35 fundraise, valuing the business at over $250 million — or more than double the valuation since the prior fundraise. The app now has over 50 million users, including over 50,000 elected officials, government authorities and citizen journalists.

U.K.-based stock trading app Freetrade raised a $69 million Series B from Left Lane Capital. The Robinhood-like app offers free trades and the ability to buy fractional shares. The company is now valued at $366 million.

U.K.-based stock trading app Freetrade raised a $69 million Series B from Left Lane Capital. The Robinhood-like app offers free trades and the ability to buy fractional shares. The company is now valued at $366 million.

Indonesian savings and investment app Pluang raised $20 million in pre-Series B funding led by Openspace Ventures. The company offers savings and investments products that allow users to make contributions starting at 50 cents (USD).

Indonesian savings and investment app Pluang raised $20 million in pre-Series B funding led by Openspace Ventures. The company offers savings and investments products that allow users to make contributions starting at 50 cents (USD).

AR pioneer Blippar returns with $5 million in funding after 18 months of repositioning as a B2B company in the AR space. Blippar’s AR Studio can help brands with AR on the web and inside their apps or Blippar’s own app.

AR pioneer Blippar returns with $5 million in funding after 18 months of repositioning as a B2B company in the AR space. Blippar’s AR Studio can help brands with AR on the web and inside their apps or Blippar’s own app.

Downloads

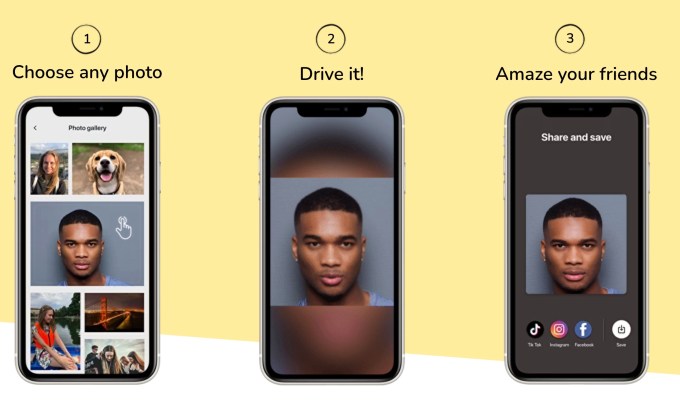

Avatarify

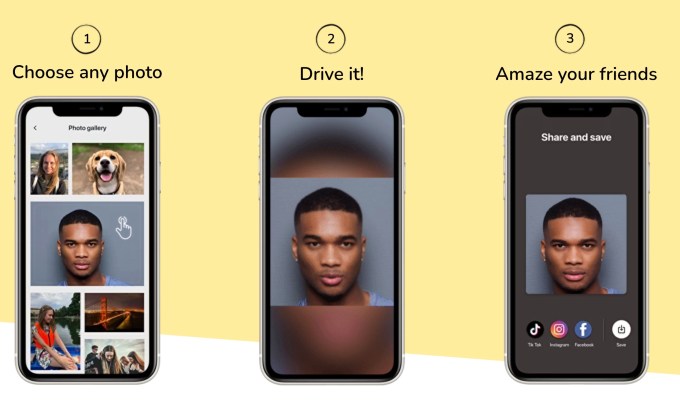

Image Credits: Avatarify

Avatarify is another app benefitting from the current interest in bringing photos to life. We’ve already seen apps like MyHeritage, TokkingHeads, Wombo and Piñata Farms introduce their own ideas in this space — whether it’s recalling long-lost relatives or just making a celeb lip sync to Michael Jackson. Avatarify, meanwhile, will let you record a short video which it then uses to animate any photo of your choice — even photos of art, babies or pets. The app is moving up the charts to now No. 28 on the App Store.

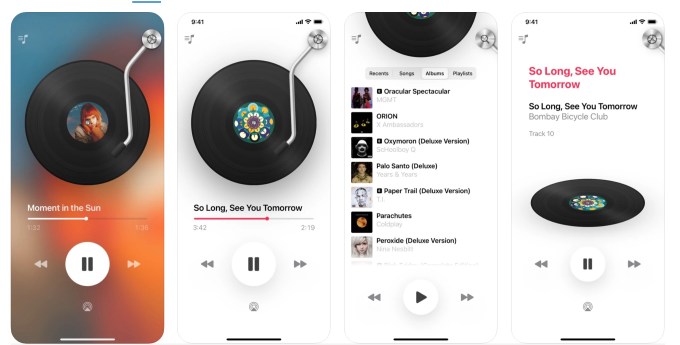

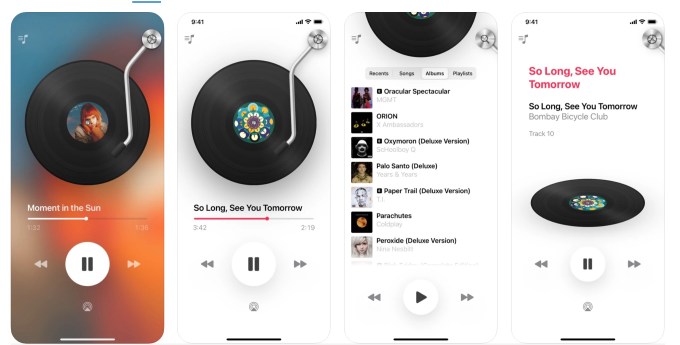

Vinyls

Image Credits: Vinyls

Vinyls, reviewed this week by iMore and recently by 9to5Mac as well, is a minimalist music player for Apple Music subscribers. The app was built by the developer behind the Twitter client Aviary, and displays a spinning vinyl record when music is playing. The app also animates a tonearm that aligns itself with the current playback time and moves in and out when playing and pausing the music. You can also “scrub” the vinyl to seek forwards and backwards. Vinyls is available on Mac, iPhone and iPad.

“Apart from the financial harm… users affected by such scams will be less inclined to download apps or engage with app stores in general. Therefore, these fleeceware appls have a negative impact on legitimate developers that use the subscription model in an ethical manner.”

“Apart from the financial harm… users affected by such scams will be less inclined to download apps or engage with app stores in general. Therefore, these fleeceware appls have a negative impact on legitimate developers that use the subscription model in an ethical manner.”  Messaging app Telegram

Messaging app Telegram  Twitter

Twitter  South Korea’s largest travel app Yanolja is in talks with banks to go public through a dual listing in Seoul and overseas. The company is aiming for

South Korea’s largest travel app Yanolja is in talks with banks to go public through a dual listing in Seoul and overseas. The company is aiming for