News: Sennheiser partners with Formlabs for customized headphones

3D printing has come a long way over the course of the last decade, but questions about mainstream adoption still linger around the technology. Medical devices have been a pretty compelling use case — they’re not really mass produced and require a high level of personalization. Clear orthodontics are a great example of something that

3D printing has come a long way over the course of the last decade, but questions about mainstream adoption still linger around the technology. Medical devices have been a pretty compelling use case — they’re not really mass produced and require a high level of personalization. Clear orthodontics are a great example of something that falls in that sweet spot — in fact, dental in general has been a big application.

Audio, too, holds a lot of potential. Imagine, for example, a set of headphones custom designed for your ears. The technology has been available on high-end models for a while, courtesy of molding, but 3D printing could unlock a more easily scalable version of that kind of luxury.

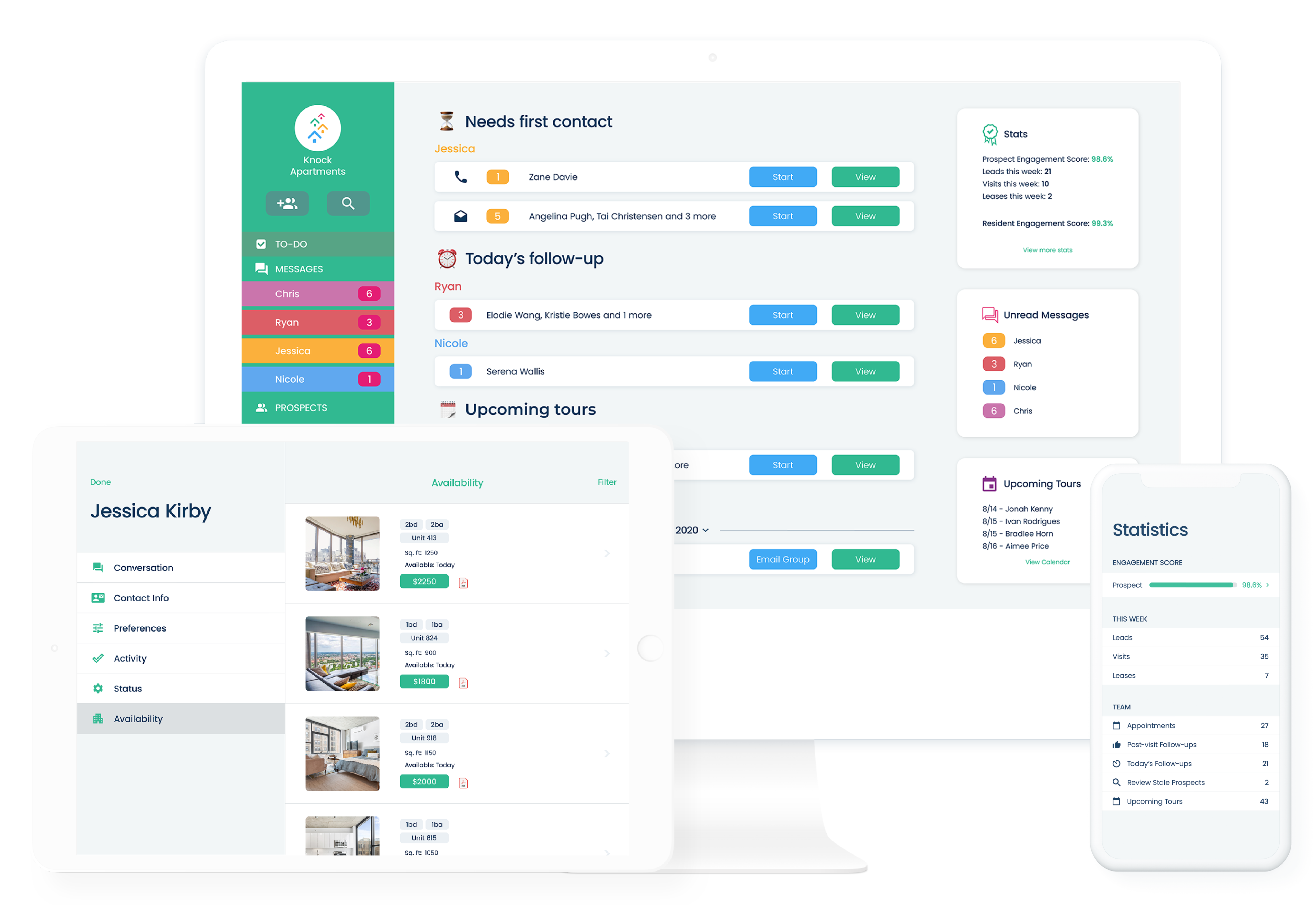

This week, Sennheiser announced a partnership that will utilize Formlabs technology to print custom earphones. Specifically, the headphone maker will be using the Form 3B, a printer design for use with biocompatible material that has largely been utilized for dental applications. Product specifics haven’t been revealed, but the audio company’s Ambeo division will be using the tech to create custom headphone eartips. Users would be able to scan their ears with a smartphone and send that to the company to get a tip printed.

Image Credits: Sennheiser

“Our technology collaboration with Sennheiser seeks to change the way customers interact with the brands they love by enabling a more customized, user-centric approach to product development,” Formlabs audio head Iain McLeod said in a release.. “Formlabs’ deep industry knowledge and broad expertise in developing scalable solutions enable us to deliver tangible innovations to our customers. In this case, we are working with Sennheiser’s Ambeo team to deliver a uniquely accessible, custom fit experience.”

The product is still very much in the prototype phase. And while such a partnership seems like a no-brainer for headphone makers going forward, there are some big questions here, including pricing and scalability. Clearly such a product would come at a premium over standard headphones, but not at so high a cost that supersedes such novelty.

The release calls it “an affordable and simple solution is now available to mass 3D print custom-fit earphones.” What, precisely, it means by affordable remains to be seen.