- February 26, 2021

- by:

- in: Blog

This month, African e-commerce giant Jumia released its second full-year financials for Q4 and its fiscal year 2020. The results were mixed — active customers and gross profit increased, while orders and gross merchandise volume (GMV) fell. A particular feature that has troubled the company since its inception in 2012 was also present, namely persistent

This month, African e-commerce giant Jumia released its second full-year financials for Q4 and its fiscal year 2020. The results were mixed — active customers and gross profit increased, while orders and gross merchandise volume (GMV) fell.

A particular feature that has troubled the company since its inception in 2012 was also present, namely persistent adjusted EBITDA and operating losses. However, those metrics fell year over year, and the company, in a statement, said that it had demonstrated “meaningful progress on our path to profitability.”

The unevenness of Jumia’s business is also reflected in how its share price performed in the past year. In March 2020, the company hit rock bottom and traded at an all-time low of $2.15 after facing fraud allegations. But it hit an all-time high of $69.89 almost a year later this February.

With the release of its financials, two things were top of TechCrunch’s mind: What made Jumia’s value swell by more than 3,000 percent in the last year, and will the e-commerce player’s unending losses end anytime soon?

I spoke with Jumia co-CEO Jeremy Hodara to get his insights on these two questions and on issues that have faced the company in the past.

Talking profitability with Jumia

This interview has edited for length and clarity.

TechCrunch: This time last year, Jumia was trading between $2 and $4. Now it’s within $40 to $50. What do you think has been the driving factor behind this?

Jeremy Hodara: What I think is really important about the stock rise is two things. First, in general, the world realized that there was a big paradigm shift in e-commerce and that e-commerce was the way to go for the future. This is something you can look at for every e-commerce company in the past 12 to 18 months. The second thing that happened is that we at Jumia have been very clear about the opportunities e-commerce represents in Africa. E-commerce is a real problem of access to consumption and has a strong value proposition to those who necessarily don’t fancy brick-and-mortar stores in Africa.

What we never really have proven is that you can build a profitable e-commerce business. However, I think that will change soon because what we’ve done quarter after quarter is to be disciplined to bring clarity that we’re going after a profitable business model and profitable growth. And as people understood and saw what we were doing, it also gave them more confidence about how exciting this opportunity is. In my opinion, what happened in the last 12 months was the combination of people understanding how important e-commerce is worldwide. Secondly, Jumia brought proof points that it was building a sustainable and profitable business model.

Would you say Andrew Left’s reversal in October and his decision to take long positions at Jumia also affected the share price?

Not really. Like I said earlier, I think it had to do with the story of e-commerce change for the future. That didn’t start in October; it started months before. Also, we being disciplined quarter after quarter to build what’s right started months before, so I can’t really comment if his decision affected our share price or if an investor’s negative or positive comments would change market sentiment towards our stock.

You’ve talked about how Jumia is trying to build a profitable business. But how’s it going to do that if the company reports losses quarter after quarter and year after year?

I think we’re on the right path, considering that our EBITDA losses reduced by 47 percent last quarter, and we’ll be trying to do so every quarter. We want to go about it by improving the efficiency of the business and opening new avenues for growth.

The most exciting thing about e-commerce is that first, you build large assets for your own use, but it becomes relevant for other stakeholders over time. For us, we have an application and website with very engaged visitors, and we’re exploring having third-party advertisers who place ads on the platform.

Our logistics service is also another way. We’re building tools and technology to equip our logistics partners and help them become more productive. This drives our costs per delivery down and is the type of benefit that comes with scaling. So I think there’s a path to profitability by opening the assets we’ve built for ourselves to benefit our ecosystem.

Jumia’s expenses dropped last year, but revenue also dropped despite a little increase in customer base. Aren’t those worrying signs?

On the revenue side, here’s how we should look at it. When you’re a marketplace, your revenue is the commission that you make from a transaction. So if you’re a seller on Jumia and sell something that costs $100 and your commission is 10 percent, your revenue inside the P&L of Jumia will be $10. If I buy a product from you at $90 and sell it to my consumer for $100, I’ll record $100 as the revenue.

That’s the insurance from the financial pinpoint between what you call the third-party and the first-party model. At the first-party model, you record as the revenue the value of the product. At the marketplace, you only record the commission. Jumia has, give or take, 10 percent of its business as the first-party model and 90 percent as the marketplace model. But that percentage changed over time, and when it did, you can see how the revenue went down.

So we don’t base our profitability on revenue. What is the right KPI for us is the gross profit as it shows the monetization of Jumia. It has been growing quarter after quarter, this time by 12% percent. Our active consumers growing 12 percent from 6.1 million in Q4 2019 to 6.8 million in Q4 2020 shows a disciplined growth towards profitability.

If there’s indeed a path to profitability, why did Jumia investors — Rocket Internet and MTN — exit the company? And does that put pressure on the company?

Oh, not at all. The fact that Jumia was able to gain support from the companies was a blessing, and they’ve come a long way with us. But like any investor after six to nine years, I think it was time for them to decide to leave the company, and I’ll say the company was lucky to have had them along our side from the beginning. Well, I can’t say for them, but for myself, I don’t think one can say that their leaving after so many years is a sign of distrust in our ability to become profitable.

One of the positives of your financials was JumiaPay. Does it tie into Jumia’s journey to being profitable?

JumiaPay is an amazing opportunity for us. Once you have a great commerce platform, you have a fantastic opportunity to build a great payments solution for your consumers. We can see that consumers are adopting it very fast, and I think this is because the platform also gives them access to other digital services where they top up their phone, pay bills and get loans. Also, it is a great payment method for consumers who want to prepay for services. And when you prepay for products, you make logistics more efficient and have more sales.

Sales remind me of the fraud issues in 2019 when some J-Force team members engaged in improper sales practices. What is Jumia doing to avoid situations like that?

It’s a lesson we’ve learnt, and we have put in the right compliance, the right internal control team to resolve such situations. I’ll say one of the reasons why we’re becoming one of the most professional organizations in Africa is because we now have these systems in place.

As an African company, how is Jumia addressing concerns around diversity, especially at top positions?

I think what’s really African with Jumia is who we are serving, our African sellers, our African consumers and our African team. In Nigeria, Juliet Anammah, who was the CEO of Jumia Nigeria, is now the chairperson of Jumia Group. I don’t know what constitutes an African or a non-African company, but what I can tell you is that our team is African, our consumers are African, and we’re selling on the continent every day. I think that’s what should make sense to our ecosystem.

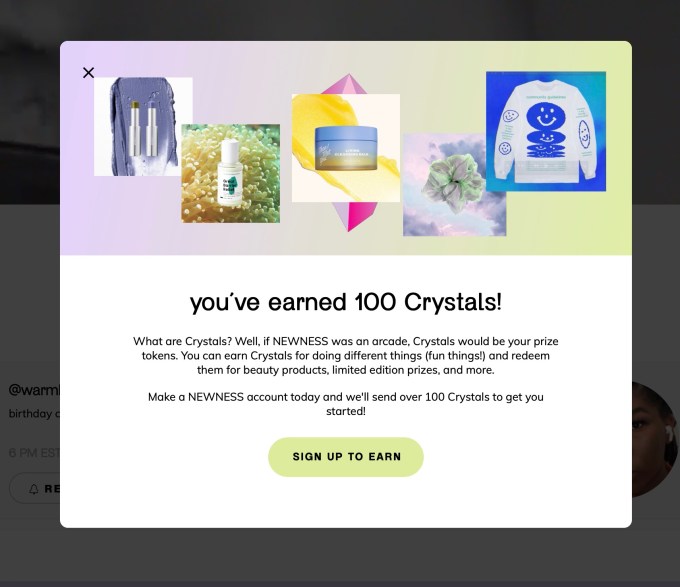

. It also plans to use the money to expand its team, increase its customer base and grow its platform to offer fee-free debit cards, financial education and on developing technology to help members automate their saving and wealth building goals.

. It also plans to use the money to expand its team, increase its customer base and grow its platform to offer fee-free debit cards, financial education and on developing technology to help members automate their saving and wealth building goals.