News: Berlin Brands Group commits $302M to acquire D2C and Amazon merchants

If the rise of direct-to-consumer businesses has been one of the big e-commerce trends of the last decade, then the growth of startups raising huge rounds to consolidate D2C players, to bring more economies of scale to the model, has definitely been a related theme of the past year. In the latest move, a startup

If the rise of direct-to-consumer businesses has been one of the big e-commerce trends of the last decade, then the growth of startups raising huge rounds to consolidate D2C players, to bring more economies of scale to the model, has definitely been a related theme of the past year.

In the latest move, a startup out of Germany called the Berlin Brands Group has announced that it plans to invest €250 million (about $302 million at today’s rates) to buy up smaller companies and bring them into its fold.

While a lot of the company’s would-be competitors in the consolidation race are focusing primarily on the Amazon Marketplace — leaning on fulfillment by Amazon (FBA) to carry out the distribution and logistics — Peter Chaljawski, the founder and CEO, tells us that it’s a different story in its existing target market of Europe.

“In the M&A market, one big difference between the U.S. and Europe is that the latter is more fragmented,” he said. “In the U.S., D2C sellers do a lot on Amazon. In Europe, there are still lots of alternatives. And in some markets like France, consumers don’t even like Amazon.” This is in addition, of course, to selling directly to consumers and bypassing marketplaces altogether, an area that Chaljawski said will continue to be a big focus for BBG. In all, BBG today says it uses some 100 channels to sell its products.

BBG is not your typical e-commerce startup, in that up to now it’s managed to build a big and profitable business largely on its own steam. And despite being a big e-commerce player in Berlin, BBC has no connection to Rocket Internet, the famous incubator of e-commerce businesses founded in the city.

The $302 million earmarked for acquisitions is coming off the startup’s own balance sheet. And from what we understand, it’s also coming ahead of BBG raising a significant round of outside funding to continue its growth. Although BBG has raised money (of an undisclosed amount, per PitchBook) in the past, this would be its first significant equity round when it closes.

BBG itself has built its own profitable direct-to-consumer business from the ground up. Founded in 2005 first focused on audio equipment (Chaljawski had ambitions to be a DJ in a past life) it has some 14 brands today, covering 2,500 items, that it has hatched and grown itself, which it sells in 28 markets.

The conglomerate model that BBG has taken covers a variety of categories, mostly in consumer electronics (including audio gear, fitness equipment and home appliances), and are sold under a range of different brands like auna, Klarstein and Capital Sports. To date, it says it has sold more than 10 million products, and it is profitable, making €300 million (around $363 million) in revenues in 2020.

Its focus for new acquisitions will include more brands and products in garden, home and living goods, sports, electronics and household appliances, with targets generating anything from €500,000 to €30 million in revenues.

While BBG has mostly been about organic growth, it started taking its first foray into inorganic expansion last December, with the acquisition of home goods brand Sleepwise, which Chaljawski describes as making “a very nice blanket.”

The comfort of a nice blanket might come in handy. Despite its success to date, a number of challenges lie ahead for BBG.

First of these are competitors. BBG’s strategy shift and acquisition plans come at a time when consolidators in the space are starting to emerge, armed with fistfuls of dollars to consolidate smaller brands that have emerged with success on marketplaces like Amazon’s (in fact, primarily the Amazon marketplace) but perhaps without obvious paths to scaling.

They include the likes of Thrasio (which most recently raised $500 million in debt to use to buy companies), SellerX, Heyday, Heroes, Perch and more.

This story from December in the FT (before that most recent debt round of Thrasio’s) estimated that there has been at least $1 billion raised collectively by these companies to build out new online consumer empires based on this model.

The vision for all of them is very clear: they want to create the next Unilever, P&G, or Sony, and they are leveraging new economic models and technology to bring in manufacturing, logistics, economies of scale, sales analytics and new innovations in marketing to do it.

Another challenge is how successful and efficient a company, which has up to now taken a very deliberate and organic path, will be in integrating lots of new brands, with the cultures and business partnerships relationships that exist with those, in tow.

The third is the sourcing of quality brands themselves. As we’ve pointed out before, taking just Amazon as one example, there is a ton of junk sold there, including a whole industry of those who buy off wholesale sites and resell on Amazon, which is one reason why so many merchants sell what look like identical products in specific categories. These marketplace sellers leverage things like SEO and armies of reviews to get their products sifting to the top of huge piles of search results, and they can often sell well, even if they are not great buys for you the consumer. That means misleading signals for a potential consolidator looking for hot companies to snap up.

The balance between how marketplaces are leveraged versus how much brands and their owners try to build these things on their own will be an interesting one to watch in the coming years. Amazon and its ilk have only continued to grow and become more efficient, although this sometimes means they are too powerful rather than more useful for third parties:

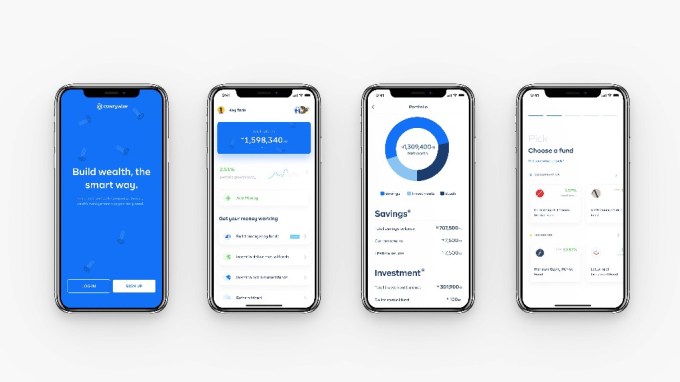

On the other hand, we’re seeing another persistent theme to help them: the presence of startups and bigger companies continuing to make tools to help the smaller players stay in the game on their own terms. They include biggies like Shopify, but also newer players like GoSite, Shogun and Xentral.